Target Reservoir

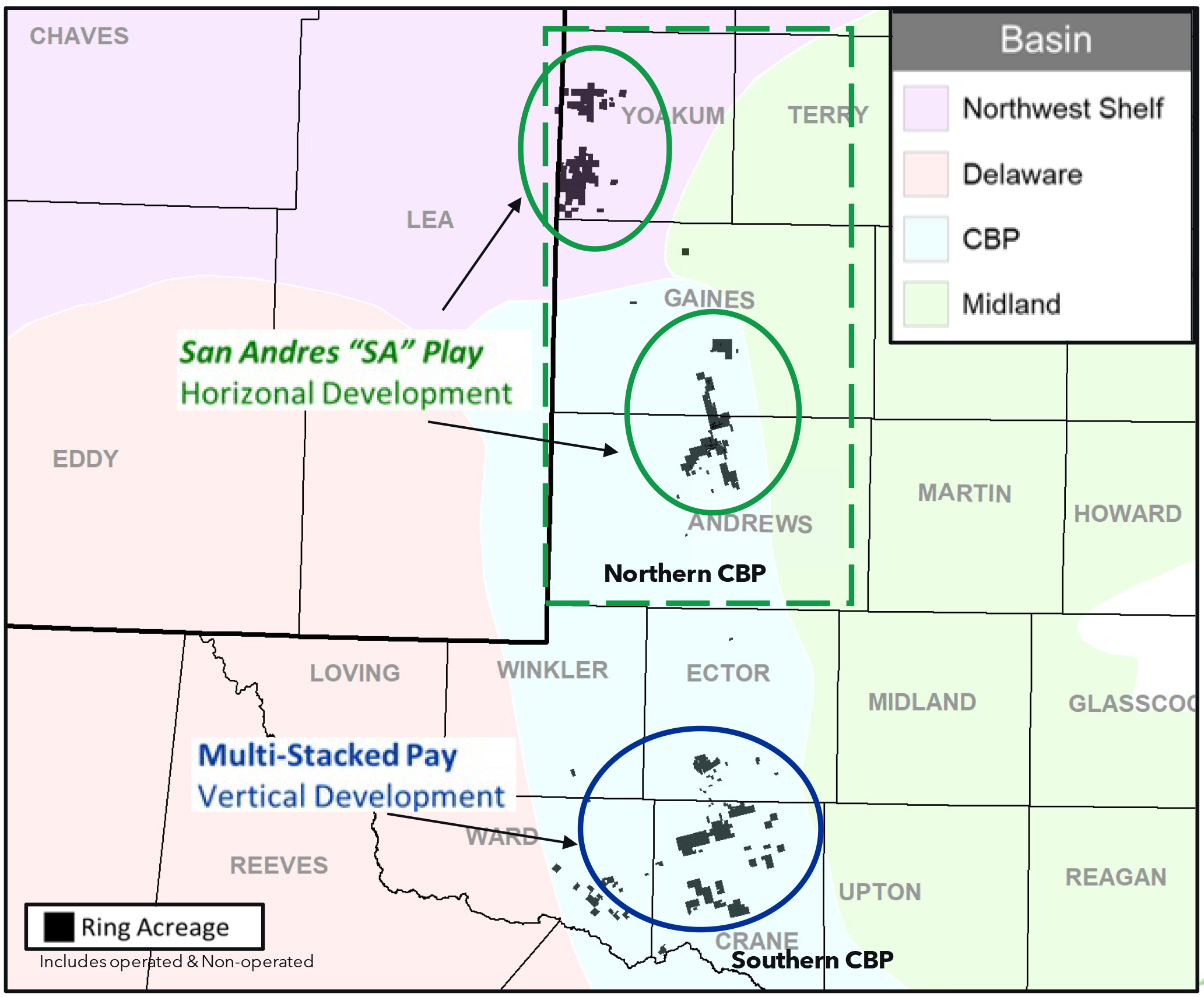

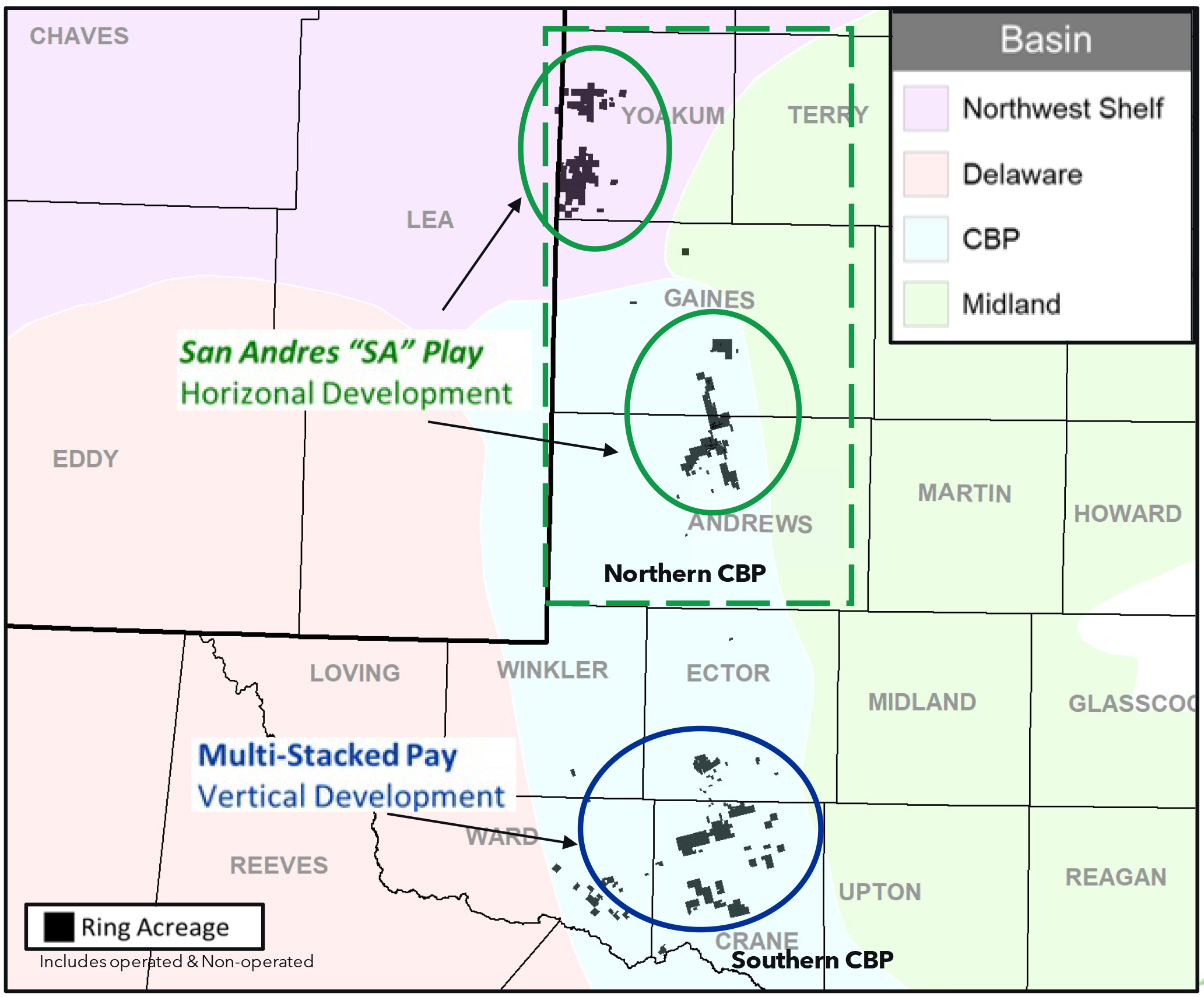

Ring Energy, Inc. (REI) acquired its Northwest Shelf (NWS) assets in April 2019. The NWS is targeting the San Andres formation, a conventional shallow carbonate reservoir at approximately 5,000 feet (approximately 86% oil.)

Ring Energy, Inc. (REI) acquired its Northwest Shelf (NWS) assets in April 2019. The NWS is targeting the San Andres formation, a conventional shallow carbonate reservoir at approximately 5,000 feet (approximately 86% oil.)