Combined Statement of Revenues and Direct Operating Expenses of Interests in Oil and Gas Leases and Related Property of Lime Rock Located in Andrews County, Texas December 31, 2024

Index to the Combined Statement of Revenues and Direct Operating Expenses of Interests in Oil and Gas Leases and Related Property of Lime Rock Located in Andrews County, Texas Report of Independent Auditors 1 Combined Statement of Revenues and Direct Operating Expenses 3 Notes to the Combined Statement of Revenues and Direct Operating Expenses 4 Supplemental Oil and Gas Reserve Information (Unaudited) 6

Report of Independent Auditors To the Management of Lime Rock Resources Opinion We have audited the accompanying combined statement of revenues and direct operating expenses of interests in oil and gas leases and related property of Lime Rock Located in Andrews County, Texas (the “Properties”), for the year ended December 31, 2024, including the related notes (collectively referred to as the “Statement”). In our opinion, the accompanying Statement presents fairly, in all material respects, the revenues and direct operating expenses of the Properties as described in Note 1 of the Statement for the year ended December 31, 2024, in accordance with accounting principles generally accepted in the United States of America. Basis for Opinion We conducted our audit in accordance with auditing standards generally accepted in the United States of America (US GAAS). Our responsibilities under those standards are further described in the Auditors’ Responsibilities for the Audit of the Statement section of our report. We are required to be independent of the Properties and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Emphasis of Matter The accompanying special purpose combined statement was prepared in connection with the acquisition of the Properties by Ring Energy, Inc., and as described in Note 1, was prepared for the purpose of complying with the rules and regulations of the Securities and Exchange Commission. The special purpose combined statement is not intended to be a complete presentation of the financial position, results of operations or cash flows of the Properties. Our opinion is not modified with respect to this matter. Responsibilities of Management for the Statement Management is responsible for the preparation and fair presentation of the Statement in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of the Statement that is free from material misstatement, whether due to fraud or error. In preparing the Statement, management is responsible for the evaluation of whether there are conditions or events, considered in the aggregate, that raise substantial doubt about Properties’ ability to continue as a going concern for one year after the date the Statement is available to be issued. Auditors’ Responsibilities for the Audit of the Statement Our objectives are to obtain reasonable assurance about whether the Statement as a whole is free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with US GAAS will always detect a material PricewaterhouseCoopers LLP, 1000 Louisiana St., Suite 5800, Houston, TX 77002 T: (713) 356 4000, www.pwc.com/us

PricewaterhouseCoopers LLP, 1000 Louisiana St., Suite 5800, Houston, TX 77002 T: (713) 356 4000, www.pwc.com/us misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the Statement. In performing an audit in accordance with US GAAS, we: • Exercise professional judgment and maintain professional skepticism throughout the audit. • Identify and assess the risks of material misstatement of the Statement, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the Statement. • Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Properties’ internal control. Accordingly, no such opinion is expressed. • Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the Statement. • Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about Properties’ ability to continue as a going concern for a reasonable period of time. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit. April 21, 2025

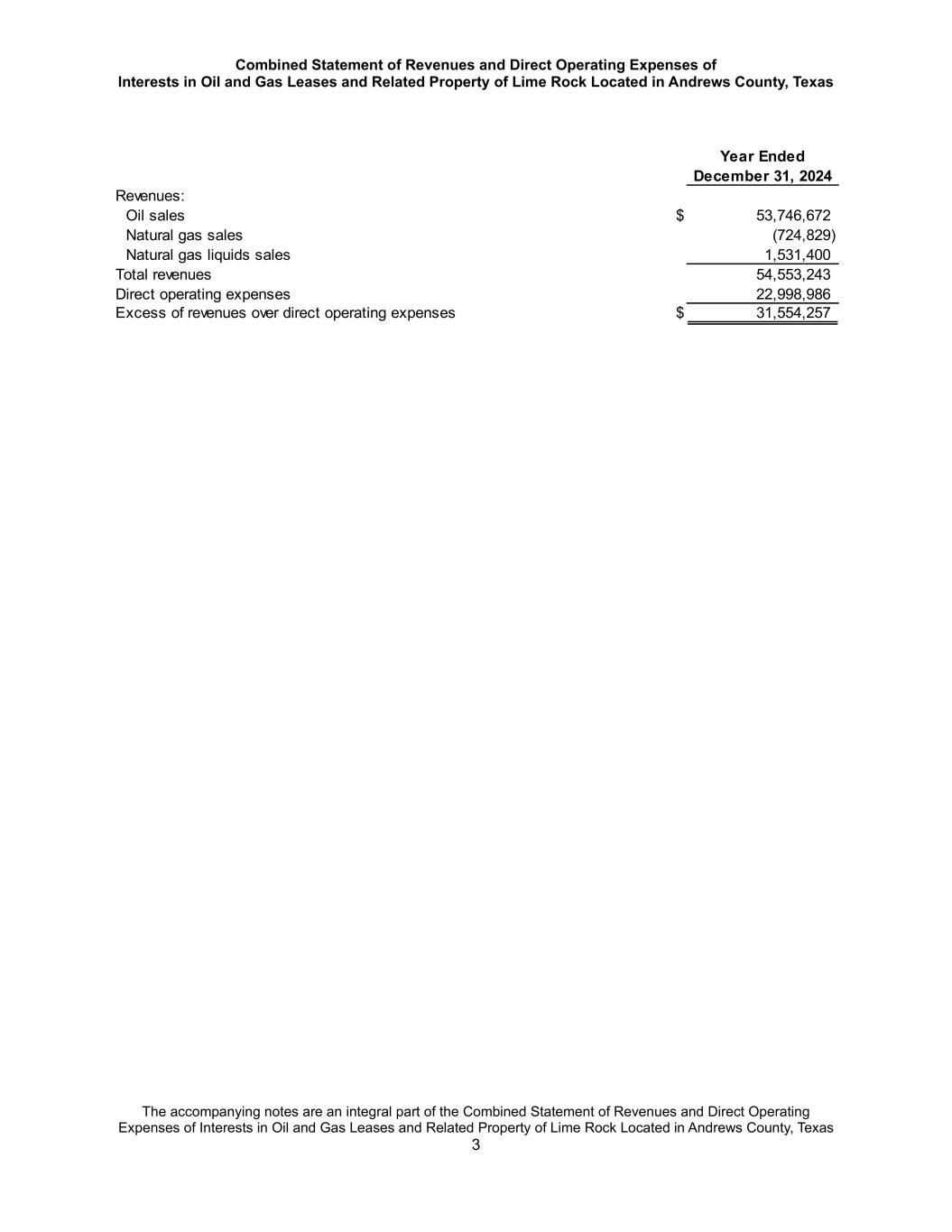

Combined Statement of Revenues and Direct Operating Expenses of Interests in Oil and Gas Leases and Related Property of Lime Rock Located in Andrews County, Texas The accompanying notes are an integral part of the Combined Statement of Revenues and Direct Operating Expenses of Interests in Oil and Gas Leases and Related Property of Lime Rock Located in Andrews County, Texas 3 Year Ended December 31, 2024 Revenues: Oil sales $ 53,746,672 Natural gas sales (724,829) Natural gas liquids sales 1,531,400 Total revenues 54,553,243 Direct operating expenses 22,998,986 Excess of revenues over direct operating expenses $ 31,554,257

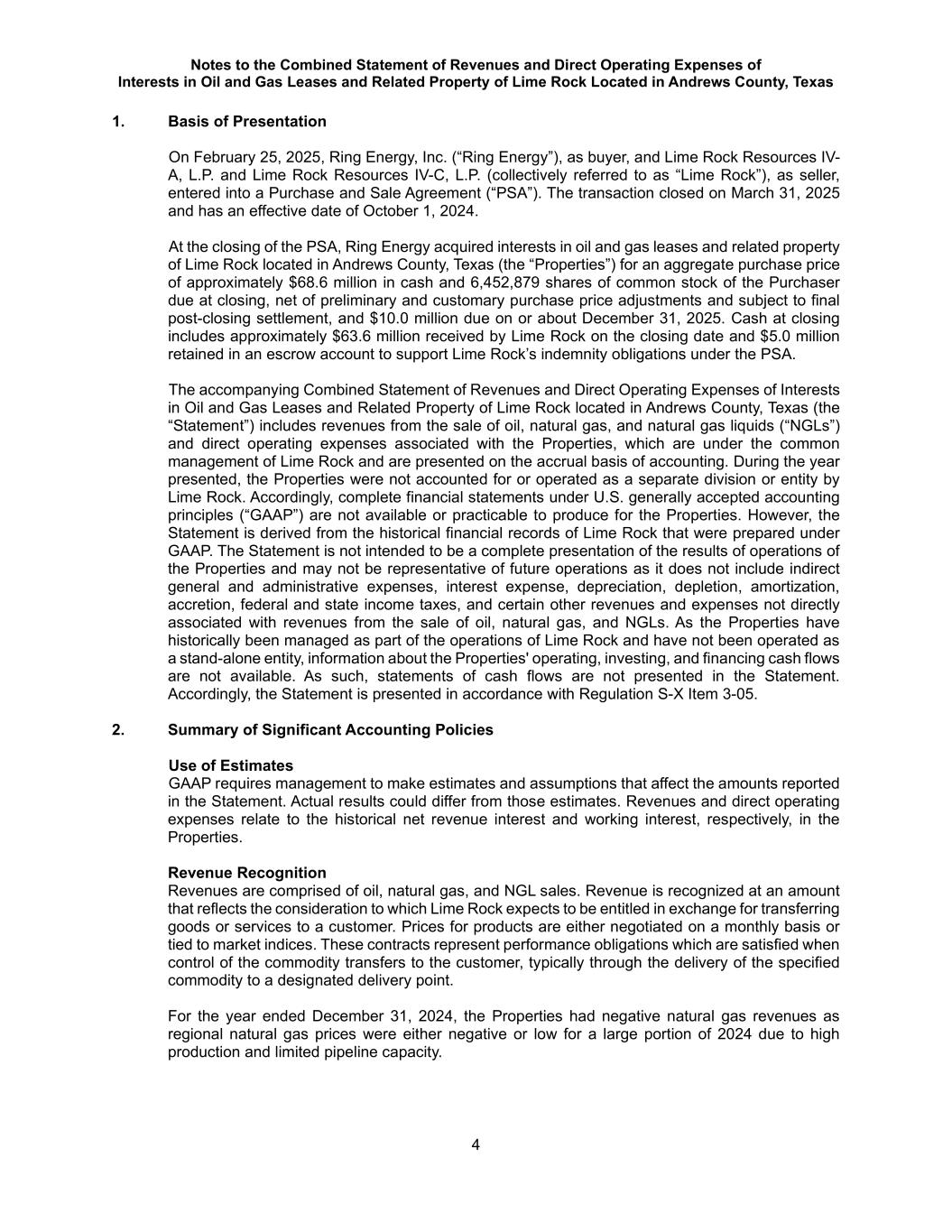

Notes to the Combined Statement of Revenues and Direct Operating Expenses of Interests in Oil and Gas Leases and Related Property of Lime Rock Located in Andrews County, Texas 4 1. Basis of Presentation On February 25, 2025, Ring Energy, Inc. (“Ring Energy”), as buyer, and Lime Rock Resources IV- A, L.P. and Lime Rock Resources IV-C, L.P. (collectively referred to as “Lime Rock”), as seller, entered into a Purchase and Sale Agreement (“PSA”). The transaction closed on March 31, 2025 and has an effective date of October 1, 2024. At the closing of the PSA, Ring Energy acquired interests in oil and gas leases and related property of Lime Rock located in Andrews County, Texas (the “Properties”) for an aggregate purchase price of approximately $68.6 million in cash and 6,452,879 shares of common stock of the Purchaser due at closing, net of preliminary and customary purchase price adjustments and subject to final post-closing settlement, and $10.0 million due on or about December 31, 2025. Cash at closing includes approximately $63.6 million received by Lime Rock on the closing date and $5.0 million retained in an escrow account to support Lime Rock’s indemnity obligations under the PSA. The accompanying Combined Statement of Revenues and Direct Operating Expenses of Interests in Oil and Gas Leases and Related Property of Lime Rock located in Andrews County, Texas (the “Statement”) includes revenues from the sale of oil, natural gas, and natural gas liquids (“NGLs”) and direct operating expenses associated with the Properties, which are under the common management of Lime Rock and are presented on the accrual basis of accounting. During the year presented, the Properties were not accounted for or operated as a separate division or entity by Lime Rock. Accordingly, complete financial statements under U.S. generally accepted accounting principles (“GAAP”) are not available or practicable to produce for the Properties. However, the Statement is derived from the historical financial records of Lime Rock that were prepared under GAAP. The Statement is not intended to be a complete presentation of the results of operations of the Properties and may not be representative of future operations as it does not include indirect general and administrative expenses, interest expense, depreciation, depletion, amortization, accretion, federal and state income taxes, and certain other revenues and expenses not directly associated with revenues from the sale of oil, natural gas, and NGLs. As the Properties have historically been managed as part of the operations of Lime Rock and have not been operated as a stand-alone entity, information about the Properties' operating, investing, and financing cash flows are not available. As such, statements of cash flows are not presented in the Statement. Accordingly, the Statement is presented in accordance with Regulation S-X Item 3-05. 2. Summary of Significant Accounting Policies Use of Estimates GAAP requires management to make estimates and assumptions that affect the amounts reported in the Statement. Actual results could differ from those estimates. Revenues and direct operating expenses relate to the historical net revenue interest and working interest, respectively, in the Properties. Revenue Recognition Revenues are comprised of oil, natural gas, and NGL sales. Revenue is recognized at an amount that reflects the consideration to which Lime Rock expects to be entitled in exchange for transferring goods or services to a customer. Prices for products are either negotiated on a monthly basis or tied to market indices. These contracts represent performance obligations which are satisfied when control of the commodity transfers to the customer, typically through the delivery of the specified commodity to a designated delivery point. For the year ended December 31, 2024, the Properties had negative natural gas revenues as regional natural gas prices were either negative or low for a large portion of 2024 due to high production and limited pipeline capacity.

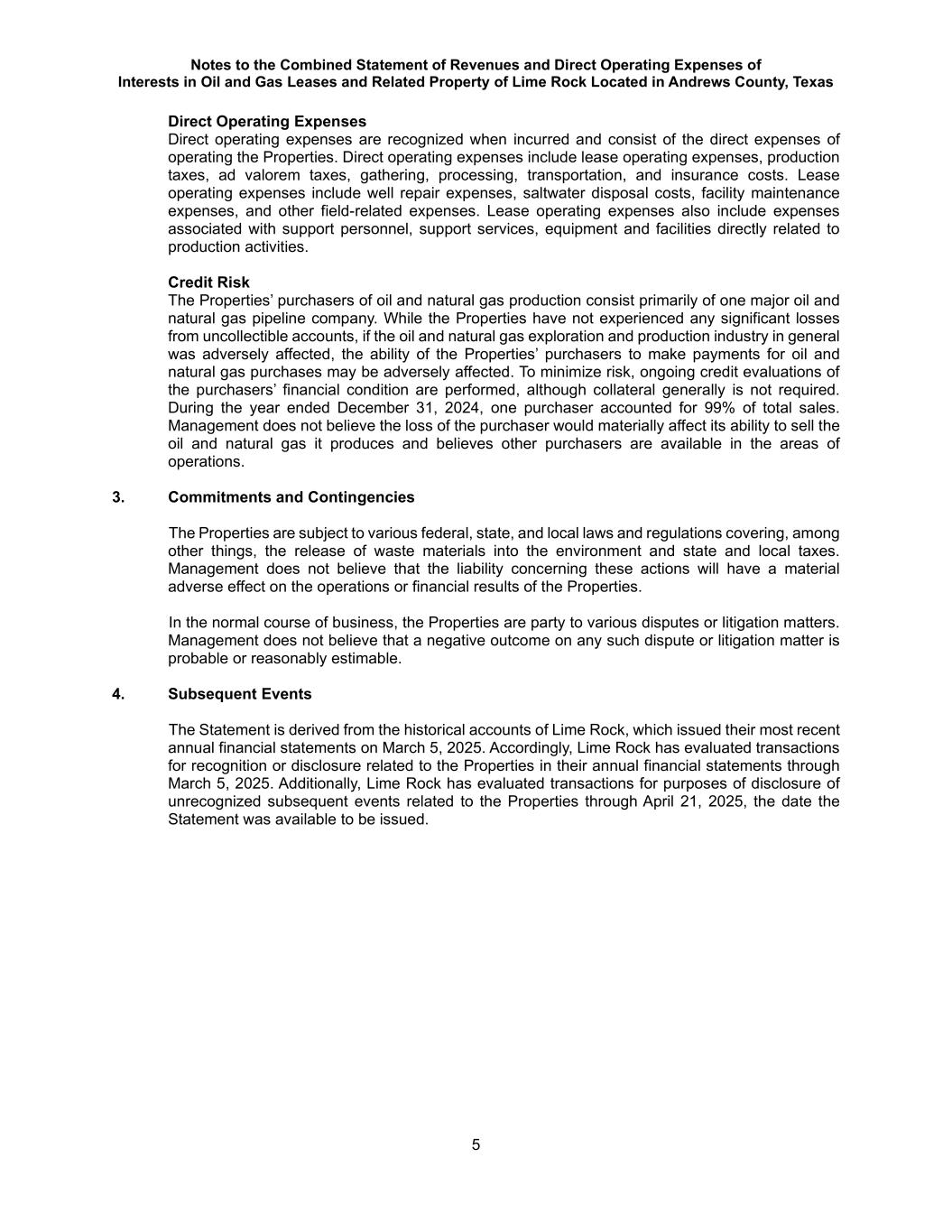

Notes to the Combined Statement of Revenues and Direct Operating Expenses of Interests in Oil and Gas Leases and Related Property of Lime Rock Located in Andrews County, Texas 5 Direct Operating Expenses Direct operating expenses are recognized when incurred and consist of the direct expenses of operating the Properties. Direct operating expenses include lease operating expenses, production taxes, ad valorem taxes, gathering, processing, transportation, and insurance costs. Lease operating expenses include well repair expenses, saltwater disposal costs, facility maintenance expenses, and other field-related expenses. Lease operating expenses also include expenses associated with support personnel, support services, equipment and facilities directly related to production activities. Credit Risk The Properties’ purchasers of oil and natural gas production consist primarily of one major oil and natural gas pipeline company. While the Properties have not experienced any significant losses from uncollectible accounts, if the oil and natural gas exploration and production industry in general was adversely affected, the ability of the Properties’ purchasers to make payments for oil and natural gas purchases may be adversely affected. To minimize risk, ongoing credit evaluations of the purchasers’ financial condition are performed, although collateral generally is not required. During the year ended December 31, 2024, one purchaser accounted for 99% of total sales. Management does not believe the loss of the purchaser would materially affect its ability to sell the oil and natural gas it produces and believes other purchasers are available in the areas of operations. 3. Commitments and Contingencies The Properties are subject to various federal, state, and local laws and regulations covering, among other things, the release of waste materials into the environment and state and local taxes. Management does not believe that the liability concerning these actions will have a material adverse effect on the operations or financial results of the Properties. In the normal course of business, the Properties are party to various disputes or litigation matters. Management does not believe that a negative outcome on any such dispute or litigation matter is probable or reasonably estimable. 4. Subsequent Events The Statement is derived from the historical accounts of Lime Rock, which issued their most recent annual financial statements on March 5, 2025. Accordingly, Lime Rock has evaluated transactions for recognition or disclosure related to the Properties in their annual financial statements through March 5, 2025. Additionally, Lime Rock has evaluated transactions for purposes of disclosure of unrecognized subsequent events related to the Properties through April 21, 2025, the date the Statement was available to be issued.

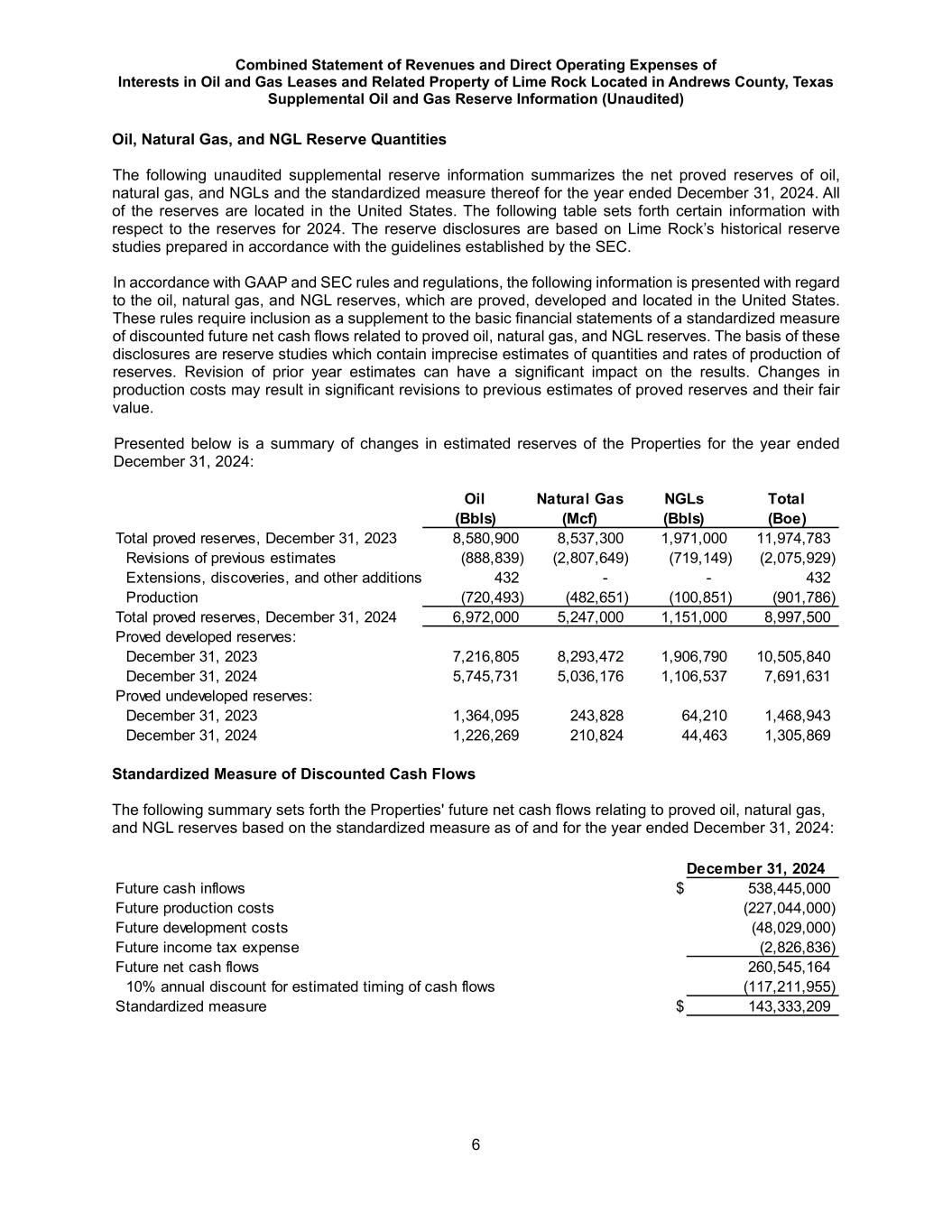

Combined Statement of Revenues and Direct Operating Expenses of Interests in Oil and Gas Leases and Related Property of Lime Rock Located in Andrews County, Texas Supplemental Oil and Gas Reserve Information (Unaudited) 6 Oil, Natural Gas, and NGL Reserve Quantities The following unaudited supplemental reserve information summarizes the net proved reserves of oil, natural gas, and NGLs and the standardized measure thereof for the year ended December 31, 2024. All of the reserves are located in the United States. The following table sets forth certain information with respect to the reserves for 2024. The reserve disclosures are based on Lime Rock’s historical reserve studies prepared in accordance with the guidelines established by the SEC. In accordance with GAAP and SEC rules and regulations, the following information is presented with regard to the oil, natural gas, and NGL reserves, which are proved, developed and located in the United States. These rules require inclusion as a supplement to the basic financial statements of a standardized measure of discounted future net cash flows related to proved oil, natural gas, and NGL reserves. The basis of these disclosures are reserve studies which contain imprecise estimates of quantities and rates of production of reserves. Revision of prior year estimates can have a significant impact on the results. Changes in production costs may result in significant revisions to previous estimates of proved reserves and their fair value. Presented below is a summary of changes in estimated reserves of the Properties for the year ended December 31, 2024: Standardized Measure of Discounted Cash Flows The following summary sets forth the Properties' future net cash flows relating to proved oil, natural gas, and NGL reserves based on the standardized measure as of and for the year ended December 31, 2024: Oil Natural Gas NGLs Total (Bbls) (Mcf) (Bbls) (Boe) Total proved reserves, December 31, 2023 8,580,900 8,537,300 1,971,000 11,974,783 Revisions of previous estimates (888,839) (2,807,649) (719,149) (2,075,929) Extensions, discoveries, and other additions 432 - - 432 Production (720,493) (482,651) (100,851) (901,786) Total proved reserves, December 31, 2024 6,972,000 5,247,000 1,151,000 8,997,500 Proved developed reserves: December 31, 2023 7,216,805 8,293,472 1,906,790 10,505,840 December 31, 2024 5,745,731 5,036,176 1,106,537 7,691,631 Proved undeveloped reserves: December 31, 2023 1,364,095 243,828 64,210 1,468,943 December 31, 2024 1,226,269 210,824 44,463 1,305,869 Future cash inflows $ 538,445,000 Future production costs (227,044,000) Future development costs (48,029,000) Future income tax expense (2,826,836) Future net cash flows 260,545,164 10% annual discount for estimated timing of cash flows (117,211,955) Standardized measure $ 143,333,209 December 31, 2024

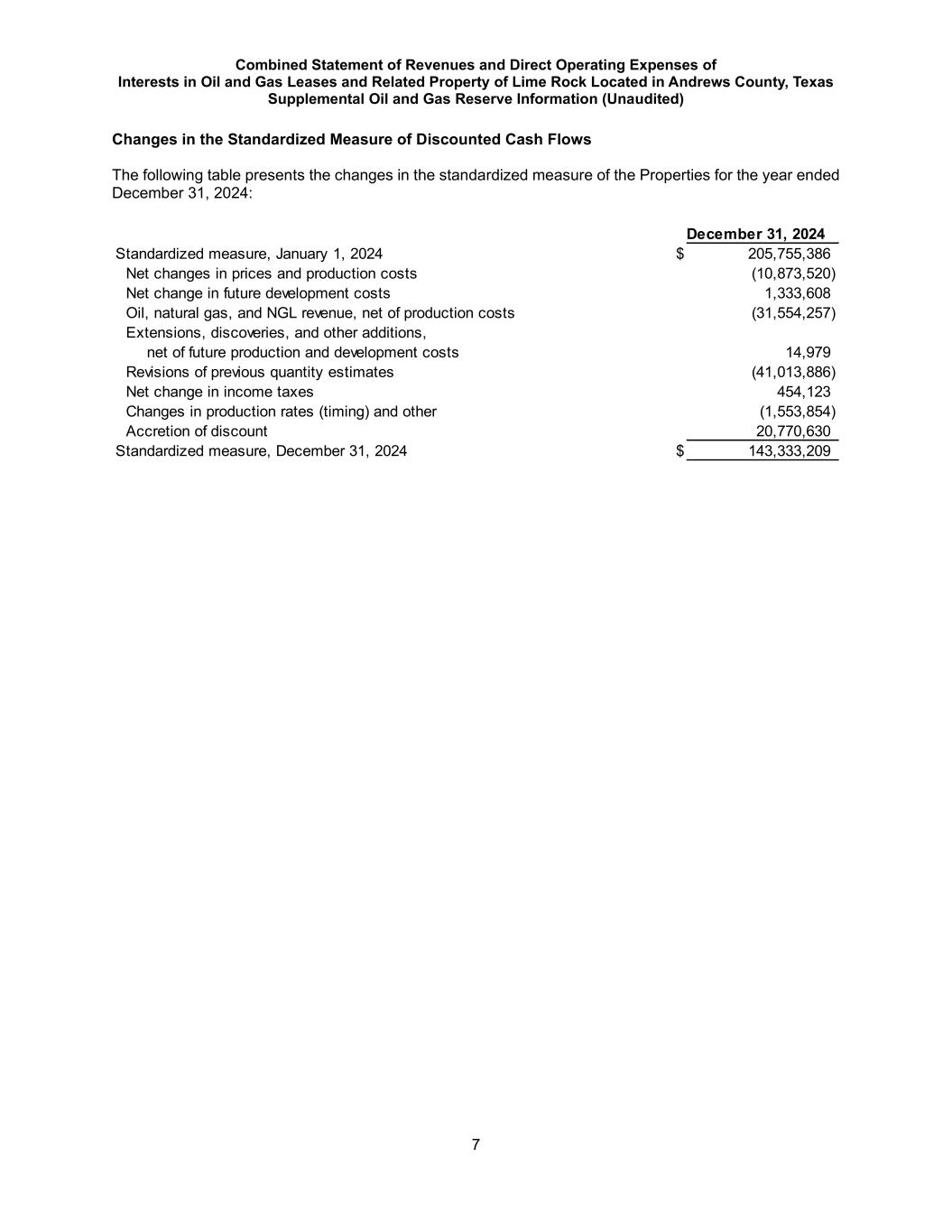

Combined Statement of Revenues and Direct Operating Expenses of Interests in Oil and Gas Leases and Related Property of Lime Rock Located in Andrews County, Texas Supplemental Oil and Gas Reserve Information (Unaudited) 7 Changes in the Standardized Measure of Discounted Cash Flows The following table presents the changes in the standardized measure of the Properties for the year ended December 31, 2024: Standardized measure, January 1, 2024 $ 205,755,386 Net changes in prices and production costs (10,873,520) Net change in future development costs 1,333,608 Oil, natural gas, and NGL revenue, net of production costs (31,554,257) Extensions, discoveries, and other additions, net of future production and development costs 14,979 Revisions of previous quantity estimates (41,013,886) Net change in income taxes 454,123 Changes in production rates (timing) and other (1,553,854) Accretion of discount 20,770,630 Standardized measure, December 31, 2024 $ 143,333,209 December 31, 2024