0001384195DEF 14AFALSE00013841952023-01-012023-12-310001384195rei:PaulDMcKinneyMember2023-01-012023-12-31iso4217:USD0001384195rei:KellyHoffmanMember2023-01-012023-12-31rei:pure0001384195rei:PaulDMcKinneyMember2022-01-012022-12-310001384195rei:KellyHoffmanMember2022-01-012022-12-3100013841952022-01-012022-12-310001384195rei:PaulDMcKinneyMember2021-01-012021-12-310001384195rei:KellyHoffmanMember2021-01-012021-12-3100013841952021-01-012021-12-310001384195rei:PaulDMcKinneyMember2020-01-012020-12-310001384195rei:KellyHoffmanMember2020-01-012020-12-3100013841952020-01-012020-12-3100013841952020-09-302020-12-3100013841952020-01-012020-09-290001384195ecd:PeoMemberrei:PaulDMcKinneyMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2023-01-012023-12-310001384195ecd:PeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberrei:PaulDMcKinneyMember2023-01-012023-12-310001384195ecd:PeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberrei:PaulDMcKinneyMember2023-01-012023-12-310001384195ecd:PeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberrei:PaulDMcKinneyMember2023-01-012023-12-310001384195ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberrei:PaulDMcKinneyMember2023-01-012023-12-310001384195ecd:PeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberrei:PaulDMcKinneyMember2023-01-012023-12-310001384195ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2023-01-012023-12-310001384195ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2023-01-012023-12-310001384195ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2023-01-012023-12-310001384195ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2023-01-012023-12-310001384195ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001384195ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2023-01-012023-12-31000138419522023-01-012023-12-31000138419512023-01-012023-12-31000138419532023-01-012023-12-31000138419542023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material under § 240.14a-12

RING ENERGY, INC.

________________________________________________________________________________________________________

(Name of Registrant as Specified in its Charter)

________________________________________________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

x No fee required.

o Fee paid previously with preliminary materials.

o Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

________________________________________________________________________________________________________

| | | | | | | | | | | | | | |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS The 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Ring Energy, Inc., a Nevada corporation (“Ring” or the “Company”), will be held on May 23, 2024, at 10:00 a.m., Central Daylight Time, in Ring’s offices, located at 1725 Hughes Landing Blvd., Suite 900, The Woodlands, TX 77380. You will be asked to consider and to approve the following proposals: | |

ANNUAL MEETING OF STOCKHOLDERS

DATE: May 23, 2024 DATE: May 23, 2024

TIME: 10:00 a.m. TIME: 10:00 a.m. Central Daylight Time

PLACE: PLACE:1725 Hughes Landing Blvd. Suite 900 The Woodlands, TX 77380

RECORD DATE FOR STOCKHOLDERS ENTITLED TO VOTE: March 28, 2024

|

| 1 | Elect Seven Nominated Directors Included in the Proxy Statement to Serve on our Board | |

| 2 | Approve on a Non-Binding, Advisory Basis, the Compensation of our Named Executive Officers | |

| 3 | Ratify the Appointment of Grant Thornton LLP as our Independent Registered Public Accounting Firm | |

| | |

This proxy statement and accompanying proxy card are being mailed to our stockholders on or about April 16, 2024. Our Annual Report on Form 10-K (the “Annual Report”) covering the year ended December 31, 2023 is enclosed, but does not form any part of the materials for solicitation of proxies. The Notice of Annual Meeting and Proxy Statement herein provide further information on the Company’s performance and corporate governance and describe the matters to be presented at the Annual Meeting. Only stockholders of record at the close of business on March 28, 2024 (the "Record Date") are entitled to notice of and to vote at the Annual Meeting. A list of stockholders entitled to vote at the Annual Meeting will be available for examination at our offices during normal business hours for a period of ten calendar days prior to the Annual Meeting and will also be available during the Annual Meeting for inspection by our stockholders. EVEN IF YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, SIGN, AND MAIL THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE IN THE ACCOMPANYING ENVELOPE, OR VOTE YOUR SHARES USING THE TELEPHONE OR INTERNET VOTING INSTRUCTIONS PROVIDED. We thank you for your continued support and look forward to seeing you at the Annual Meeting.

By Order of the Board of Directors,

/s/ Travis T. Thomas

Travis T. Thomas Executive Vice President, Chief Financial Officer, Corporate Secretary & Treasurer

The Woodlands, Texas, April 16, 2024

| |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON May 23, 2024 The Notice of Annual Meeting, Proxy Statement, and Annual Report to Stockholders for the year ended December 31, 2023, are available at www.proxyvote.com. |

| | | | |

| | | | |

TABLE OF CONTENTS

| | | | | | | | |

OVERVIEW | | |

| |

| |

| |

| |

| |

| |

|

PROPOSAL 1: ELECTION OF DIRECTORS | | |

| |

| |

|

CORPORATE GOVERNANCE AND OUR BOARD | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | |

EXECUTIVE OFFICERS | | |

| | |

COMPENSATION DISCUSSION & ANALYSIS | | |

| |

| |

| |

| |

| |

| |

| |

| | |

| EXECUTIVE COMPENSATION | | |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | |

| DIRECTOR COMPENSATION | | |

| | |

| OTHER COMPENSATION MATTERS | | |

| |

| | |

| RELATED PARTY TRANSACTIONS | | |

| | |

| BENEFICIAL OWNERSHIP | | |

| | |

PROPOSAL 2: NON-BINDING, ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION | | |

| |

|

PROPOSAL 3: RATIFICATION OF THE APPOINTMENT OF GRANT THORNTON LLP | | |

| |

| |

| |

|

STOCKHOLDER PROPOSALS AND DIRECTOR NOMINATIONS FOR THE 2025 ANNUAL MEETING AND OTHER ITEMS | | |

| |

| |

| | |

| APPENDIX A | | |

DEAR FELLOW STOCKHOLDERS,

On behalf of the Board of Directors of Ring Energy, Inc., we are pleased to

invite you to our 2024 Annual Meeting of Stockholders, which will take place on May 23, 2024 at 10:00 a.m. Central Daylight Time in our offices located at 1725 Hughes Landing Blvd., Suite 900, The Woodlands, Texas 77380.

As you may know, we ended 2023 with record operational and financial results on multiple fronts. Year-over-year, we achieved a 47% increase in sales volumes, a 21% increase in Adjusted EBITDA1, and a 30% increase in Adjusted Free Cash Flow1. We also ended 2023 with $175 million of liquidity and a leverage ratio1 of 1.62 times. Our financial flexibility and capital efficiency are critical as we continue to execute our value focused proven strategy. Of course, none of our success in 2023 would have been possible without our talented workforce and business partners, and we want to thank everyone for their hard work and dedication.

Substantially driving our record-setting results in 2023 was the successful execution and integration of the two acquisitions we made over the last two years. As you may remember, we acquired the Permian Basin assets of Stronghold Energy II Operating, LLC and Stronghold Energy II Royalties, LP (collectively, “Stronghold”) closing the transaction on August 31, 2022 (the ”Stronghold Acquisition”). Since that time, and further enhancing and consolidating our core position in the Central Basin Platform, on August 15, 2023 we completed the asset acquisition of privately held Founders Oil & Gas IV, LLC ("Founders").

These two immediately accretive asset acquisitions substantially increased our size and scale, lowered our overall cost structure, materially increased the inventory and capital efficiency of our undeveloped investment opportunities, and increased our adjusted free cash flow generation.

Additionally, during full year 2023, we benefited from the success of our high-return drilling and recompletion programs, including the drilling and completion of 20 horizontal wells and 11 vertical wells, as well as the recompletion of nine wells. We also made progress regarding our ongoing focus on reducing the cost structure of our business on a per barrel basis.

Our success in 2023 was also reflected in our year end SEC proved reserves of 129.8 million barrels of oil equivalent, which was only 6% lower than the end of 2022. We achieved this despite a 17% reduction in SEC oil prices and the sale of non-core legacy assets by adding the reserves associated with the Founders assets and our continuing efforts to improve existing field developments.

The last thing we would like to share about 2023 is regarding our efforts to help ensure long-term sustainability of the Company. During 2023 we made substantial progress enhancing our sustainability through an internal initiative we refer to as our TARGET ZERO-365 program. This program is focused on further building on our philosophy of ongoing improvement to ensure our operations continue to be conducted safely and efficiently, while minimizing environmental impact. We believe that working in a safe and environmentally conscientious manner is essential to protecting our employees and the communities in which we operate and where our employees reside. We also believe it is a key aspect of our strategy to ensure the financial sustainability of the Company.

Regarding our efforts in 2024, we expect them to be very similar to the past — we will continue a disciplined capital spending program designed to organically maintain or slightly grow our oil production with the flexibility to respond as necessary to changing oil and natural gas prices. We intend to allocate our excess cash from operations to reducing debt and improving our balance sheet. We plan to continue seeking to grow through our pursuit of accretive, balance sheet enhancing acquisitions. These efforts should lead us to our ultimate goal, which is to further position our balance sheet and achieve the size and scale necessary to sustainably return meaningful capital to our stockholders. In short, we believe our value focused proven strategy retains the discipline and flexibility necessary to manage the risks associated with ongoing price volatility and better positions the Company for long term success.

Finally, we believe purposeful and regular engagement with our various stockholders is critical as we discuss the issues important to them and us. We have had and continue to have engagement sessions with a number of our largest stockholders concerning Say-On-Pay and other governance matters. During these conversations we answer their questions and get their feedback concerning these and other ESG-related topics. We value the opinions of our stockholders and take these conversations very seriously.

On behalf of Ring’s Board of Directors, executive management and employee teams, we want to thank all of our stockholders for their continued support. Your vote is very important to us, and we encourage you to review the enclosed proxy statement and to promptly vote so your shares are represented at the Annual Meeting.

Best regards,

Paul D. McKinney

Chairman of the Board of Directors & Chief Executive Officer

Anthony B. Petrelli

Lead Independent Director

(1) Adjusted EBITDA, Adjusted Free Cash Flow and leverage ratio are non-GAAP financial measures. See Appendix A for a reconciliation of these financial measures to our most directly comparable financial measure calculated in accordance with GAAP.

OUR COMPANY

Ring Energy, Inc. is a growth oriented independent energy company engaged in oil and natural gas development, production, acquisition and exploration of high-quality, oil and liquids rich assets in the Permian Basin.

OUR MISSION & VISION

Ring’s mission is to deliver competitive and sustainable returns to its stockholders by developing, acquiring, exploring for, and commercializing oil and natural gas resources vital to the world’s health and welfare. Successfully achieving Ring’s mission requires a firm commitment to operating safely in a socially responsible and environmentally friendly manner, while ensuring the Company conducts its business with honesty and integrity.

The key principles supporting Ring’s strategic vision are:

■Ensuring health, safety, and environmental excellence and a strong commitment to our employees and the communities in which we work and operate;

■Continuing to generate free cash flow to improve and build a sustainable financial foundation;

■Pursuing rigorous capital discipline focused on our highest returning opportunities;

■Improving margins and driving value by continuously targeting additional operating cost reductions and capital efficiencies; and

■Strengthening the balance sheet by steadily paying down debt, divesting of non-core assets and becoming a peer leader in Debt/EBITDA metrics.

OUR STRATEGIC PRIORITIES

Ring has historically capitalized on its low-risk, high-return asset base that is focused on the conventional San Andres reservoir in the Permian Basin, which is one of the most prolific hydrocarbon producing regions in the U.S. As compared to unconventional plays, the San Andres offers much lower initial year and subsequent decline rates for production, which helps generate high rates of return and low breakeven economics. Subsequent to recent asset acquisitions also in the Permian Basin, Ring's focus has now expanded to additional low-risk, high-return assets, being the vertical section between the Glorieta and Devonian Formations.

The collective efforts of your management team are focused on creating stockholder value with Ring’s proven strategy. We are targeting a number of strategic initiatives that we believe will uniquely position Ring for continued operating and financial success, thereby enhancing long-term value for our stockholders.

To accomplish these goals, we are committed to pursuing the following strategic priorities:

| | | | | | | | | | | | | | |

| | | | |

Attract and retain high-quality people because achieving our mission will only be possible through our employees. It is critical to have compensation, development, and human resource programs that attract, retain and motivate the people we need to succeed. |

Pursue operational excellence with a sense of urgency, as we plan to deliver low cost, consistent, timely and efficient execution of our drilling campaigns, work programs and operations. This includes executing our operations in a safe and environmentally responsible manner, focusing on reducing our emissions, applying advanced technologies, and continuously seeking ways to reduce our operating cash costs on a per barrel basis. This objective is a foundational aspect of our culture and future success. |

Invest in high margin, high rate-of-return projects. This will allow us to profitably grow our production and reserve levels and maximize free cash flow generation. |

Focus on generating free cash flow and strengthening our balance sheet by reducing debt through the use of excess cash from operations and potentially through proceeds from the sale of non-core assets. We believe remaining focused and disciplined in this regard will lead to meaningful returns for our stockholders and provide additional financial flexibility to manage potential future swings in the business cycle. |

Pursue strategic acquisitions that maintain or reduce our break-even costs, as well as improve our margins and operating costs. Financial strategies associated with these efforts will focus on delivering competitive debt-adjusted per share returns. This objective is key to delivering competitive returns to our stockholders on a sustainable basis. |

QUESTIONS AND ANSWERS ABOUT

THE 2024 ANNUAL MEETING AND VOTING

WHAT IS THE PURPOSE OF THE ANNUAL MEETING?

At the Annual Meeting, our stockholders will act upon the matters outlined in the Notice, including (1) the election of seven directors named in this proxy statement to our Board, each for a term ending on the date of the 2025 annual meeting of stockholders or until their successors are duly elected and qualified (this proposal is referred to as the “Election of Directors”); (2) a non-binding, advisory vote to approve named executive officer ("NEO") compensation (this proposal is referred to as the “Advisory Vote on Executive Compensation”); (3) the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024 (this proposal is referred to as the “Ratification of Grant Thornton”); and (4) the transaction of such other business as may arise that can properly be conducted at the Annual Meeting or any adjournment or postponement thereof. Additionally, management will report on our performance during the last fiscal year and respond to appropriate questions from our stockholders.

WHAT IS A PROXY?

A proxy is another person that you legally designate to vote your stock. If you designate a person or entity as your proxy in a written document, such document is also called a proxy or a proxy card. All duly executed proxies received prior to the Annual Meeting will be voted in accordance with the choices specified thereon and, in connection with any other business that may properly come before the Annual Meeting, in the discretion of the persons named in the proxy.

WHAT IS A PROXY STATEMENT?

A proxy statement is a document that regulations of the United States Securities and Exchange Commission (the “SEC”) require that we make available to you when we ask you to sign a proxy card to vote your stock at the Annual Meeting. This proxy statement describes matters on which we would like you, as a stockholder, to vote and provides you with information on such matters so that you can make an informed decision.

WHAT IS “HOUSEHOLDING”?

One copy of the Notice, this proxy statement, and the Annual Report (collectively, the “Proxy Materials”) will be sent to stockholders who share an address, unless they have notified us that they want to continue receiving multiple packages. This practice, known as “householding,” is designed to reduce duplicate mailings and save significant printing and postage costs. If you received a householded mailing this year and you would like to have additional copies of the Proxy Materials mailed to you or you would like to opt out of this practice for future mailings, we will promptly deliver such additional copies to you if you submit your request in writing to Ring Energy, Inc., Attention: Travis T. Thomas, Corporate Secretary, Executive Vice President and Chief Financial Officer, 1725 Hughes Landing Blvd., Suite 900, The Woodlands, TX 77380, or by telephone by calling (281) 397-3699. You may also contact us in the same manner if you received multiple copies of the Proxy Materials and would prefer to receive a single copy in the future. The Proxy Materials are also available at: www.proxyvote.com.

WHAT SHOULD I DO IF I RECEIVE MORE THAN ONE SET OF VOTING MATERIALS?

Despite our efforts related to householding, you may receive more than one set of Proxy Materials, including multiple copies of the proxy statement and multiple proxy cards or voting instruction cards. For example, if you hold your

shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. Similarly, if you are a stockholder of record and hold shares in a brokerage account, you will receive a proxy card and a voting instruction card. Please complete, sign, date, and return each proxy card and voting instruction card that you receive to ensure that all your shares are voted at the Annual Meeting. You can also vote your shares over the phone or internet. Please see “How Do I Vote My Shares?” below for more information.

WHO IS ENTITLED TO NOTICE OF THE ANNUAL MEETING?

Governing laws as well as our governance documents require our Board to establish a record date in order to determine who is entitled to receive notice of, attend, and vote at the Annual Meeting, and any continuations, adjournments, or postponements thereof.

The record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting is the close of business on March 28, 2024 (the “Record Date”).

As of the Record Date, we had 197,934,202 shares of Common Stock outstanding. A list of all stockholders of record entitled to vote at our Annual Meeting is on file at our principal office located at 1725 Hughes Landing Blvd., Suite 900, The Woodlands, TX 77380, and will be available for inspection at the Annual Meeting.

WHO IS ENTITLED TO VOTE AT THE ANNUAL MEETING?

Subject to the limitations set forth below, stockholders at the close of business on the Record Date may vote at the Annual Meeting. If you are a beneficial owner of shares of Common Stock, you must have a legal proxy from the stockholder of record to vote your shares at the Annual Meeting.

WHAT IS A QUORUM?

A quorum is the presence at the Annual Meeting, in person or by proxy, of the holders of at least one-third of the shares of our Common Stock outstanding and entitled to vote as of the Record Date. There must be a quorum for the Annual Meeting to be held. If a quorum is not present, the Annual Meeting may be adjourned until a quorum is reached. Proxies received but marked as abstentions or broker non-votes will be included in the calculation of votes considered to be present at the Annual Meeting.

WHAT ARE THE VOTING RIGHTS OF OUR STOCKHOLDERS?

Each holder of Common Stock is entitled to one vote per share of Common Stock on all matters to be acted upon at the Annual Meeting. Neither our Articles of Incorporation, nor our Bylaws (as amended, the “Bylaws”), allow for cumulative voting rights in the election of directors.

WHAT IS THE DIFFERENCE BETWEEN A STOCKHOLDER OF RECORD AND A “STREET NAME” HOLDER?

Most stockholders hold their shares through a broker, bank, or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned in street name.

■Stockholder of Record. If your shares are registered directly in your name with Standard Registrar & Transfer Company, Inc., our transfer agent, you are considered the stockholder of record with respect to those shares. As the stockholder of record, you have the right to grant your voting proxy directly or to vote in person at the Annual Meeting.

■Street Name Stockholder. If your shares are held in a stock brokerage account or by a bank, fiduciary, or other nominee, you are considered the beneficial owner of shares held in “street name.” In this case, such broker, fiduciary, or other nominee is considered the stockholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to direct your broker, bank, or nominee how to vote and are also invited to attend the Annual Meeting. If you hold your shares through a broker, bank, or other nominee, follow the voting directions provided by your broker, bank, or other nominee to vote your shares. Since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you obtain a signed proxy from the record holder giving you the right to vote the shares.

HOW DO I VOTE MY SHARES?

Stockholders of Record: Stockholders of record may vote their shares or submit a proxy to have their shares voted by one of the following methods:

■By Written Proxy. You may indicate your vote by completing, signing, and dating your proxy card and returning it in the enclosed reply envelope.

■In Person. You may vote in person at the Annual Meeting by completing a ballot; however, attending the Annual Meeting without completing a ballot will not count as a vote.

■By Phone. Use any touch-tone telephone to call 1-800-690-6903 to transmit your voting instructions up until 11:59 P.M. Eastern Time the day before the cut-off date or the meeting date. Have your proxy card in hand when you call and then follow the instructions.

■By Internet. Use the internet to access www.proxyvote.com to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time the day before the cut-off date or the meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form.

Street Name Stockholders: Street name stockholders may generally vote their shares or submit a proxy to have their shares voted by one of the following methods:

■By Voting Instruction Card. If you hold your shares in street name, your broker, bank, or other nominee will explain how you can access a voting instruction card for you to use in directing the broker, bank, or other nominee how to vote your shares.

■In Person with a Proxy from the Record Holder. You may vote in person at the Annual Meeting if you obtain a legal proxy from your broker, bank, or other nominee. Please consult the instruction card or other information sent to you by your broker, bank, or other nominee to determine how to obtain a legal proxy in order to vote in person at the Annual Meeting.

If you are a stockholder of record, your shares will be voted by the management proxy holder in accordance with the instructions on the proxy card you submit. For stockholders who have their shares voted by submitting a proxy, the management proxy holder will vote all shares represented by such valid proxies as our Board recommends, unless a stockholder appropriately specifies otherwise.

CAN I REVOKE MY PROXY OR CHANGE MY VOTE?

Yes. If you are a stockholder of record, you can revoke your proxy at any time before it is voted at the Annual Meeting by doing one of the following:

■Submitting written notice of revocation stating that you would like to revoke your proxy to Ring Energy, Inc., Attention: Travis T. Thomas, Corporate Secretary, Executive Vice President and Chief Financial Officer, 1725 Hughes Landing Blvd., Suite 900, The Woodlands, TX 77380, which must be received prior to the Annual Meeting;

■Completing, signing, and dating another proxy card with new voting instructions and returning it by mail to Ring Energy, Inc., Attention: Travis T. Thomas, Corporate Secretary, Executive Vice President and Chief Financial Officer, 1725 Hughes Landing Blvd., Suite 900, The Woodlands, TX 77380 in time to be received, in which case the later submitted proxy will be recorded and earlier proxy revoked; or

■Attending the Annual Meeting, notifying the inspector of elections that you wish to revoke your proxy, and voting your shares in person at the Annual Meeting. Attendance at the Annual Meeting without submitting a ballot to vote your shares will not revoke or change your vote.

If you are a beneficial or street name stockholder, you should follow the directions provided by your broker, bank, or other nominee to revoke your voting instructions or otherwise change your vote before the applicable deadline. You may also vote in person at the Annual Meeting if you obtain a legal proxy from your broker, bank, or other nominee as described in “How Do I Vote My Shares?” above.

WHAT ARE ABSTENTIONS AND BROKER NON-VOTES?

An abstention occurs when the beneficial owner of shares, or a broker, bank, or other nominee holding shares for a beneficial owner, is present, in person or by proxy, and entitled to vote at a stockholder meeting, but fails to vote or voluntarily withholds its vote for any of the matters upon which the stockholders are voting.

If you are a beneficial owner and hold your shares in “street name,” you will receive instructions from your broker, bank, or other nominee describing how to vote your shares. If you do not instruct your broker or nominee how to vote your shares, they may vote your shares as they decide as to each matter for which they have discretionary authority under the rules of the NYSE American LLC (the “NYSE American”). There are non-discretionary matters for which brokers, banks, and other nominees do not have discretionary authority to vote unless they receive timely instructions from you. If a broker, bank, or other nominee does not have discretion to vote on a particular matter and you have not given timely instructions on how the broker, banker, or other nominee should vote your shares, then the broker, bank, or other nominee indicates it does not have authority to vote such shares on its proxy and a “broker non-vote” results. Although any broker non-vote would be counted as present at the Annual Meeting for purposes of determining a quorum, it would be treated as not entitled to vote with respect to non-discretionary matters.

If your shares are held in street name and you do not give voting instructions, the record holder will not be permitted to vote your shares with respect to Proposal 1 (Election of Directors) and Proposal 2 (Advisory Vote on Executive Compensation), and your shares will be considered broker non-votes with respect to these proposals. If

your shares are held in street name and you do not give voting instructions, the record holder will have discretionary authority to vote your shares with respect to Proposal 3 (Ratification of Grant Thornton).

WHAT VOTE IS REQUIRED FOR THE PROPOSALS TO BE APPROVED?

■Proposal 1 (Election of Directors): To be elected, each nominee for election as a director must receive the affirmative vote of a plurality of the votes cast by the holders of our Common Stock, present in person or represented by proxy at the Annual Meeting and entitled to vote on the proposal. The director nominees who receive the most votes will be elected. Votes may be cast in favor of or withheld from the election of each nominee. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

■Proposal 2 (Executive Compensation): To consider and vote upon, on a non-binding, advisory basis, a resolution to approve the compensation of our named executive officers as disclosed pursuant to the compensation disclosure rules of the SEC. This advisory vote will be approved if it receives the affirmative vote of the holders of a majority of the votes cast by the holders of our Common Stock present in person or represented by proxy at the Annual Meeting and entitled to vote thereon. Broker non-votes and abstentions will not affect the outcome of this proposal.

■Proposal 3 (Ratification of Grant Thornton): Ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024, requires the affirmative vote of the holders of a majority of the votes cast by the holders of our Common Stock present in person or represented by proxy at the Annual Meeting and entitled to vote thereon. Brokers will have discretionary authority to vote on Proposal 3 and, accordingly, there will be no broker non-votes for this proposal. Abstentions will not affect the outcome of this proposal.

HOW DOES THE BOARD RECOMMEND THAT I VOTE?

Our Board unanimously recommends a vote:

■FOR each of the nominees for director;

■FOR non-binding, advisory approval of named executive officer compensation; and

■FOR the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024.

WHAT HAPPENS IF I PROVIDE MY SIGNED PROXY BUT DO NOT SPECIFY HOW I WANT MAY SHARES TO BE VOTED, OR IF ADDITIONAL PROPOSALS ARE PRESENTED AT THE ANNUAL MEETING?

If you provide us your signed and dated proxy but do not specify how to vote, we will vote your shares as follows:

Proposal 1. FOR the election of each director nominee;

Proposal 2. FOR the approval, on an advisory basis, of the compensation of our named executive officers; and

Proposal 3. FOR the ratification of the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2024.

As of the date of this proxy statement, we do not expect any additional matters to be presented for a vote at the Annual Meeting. If you grant a proxy, the proxy holder will have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting.

WHO WILL BEAR THE COST OF SOLICITING VOTES FOR THE ANNUAL MEETING?

The Board is providing these Proxy Materials to you in connection with the solicitation by the Board of proxies to be voted at the Annual Meeting. We will bear all expenses of soliciting proxies. We have engaged Broadridge Financial Solutions, Inc. to aid in the distribution of proxy materials and to provide voting and tabulation services for the Annual Meeting. Directors, officers, and employees will not be additionally compensated but may be reimbursed for reasonable out-of-pocket expenses in connection with any solicitation. In addition, we may reimburse brokerage firms, custodians, nominees, fiduciaries, and other persons representing beneficial owners of our Common Stock for their reasonable expenses in forwarding solicitation material to such beneficial owners.

MAY I PROPOSE ACTIONS FOR CONSIDERATION AT THE 2025 ANNUAL MEETING OF STOCKHOLDERS OR NOMINATE INDIVIDUALS TO SERVE AS DIRECTORS?

You may submit proposals for consideration at future stockholder meetings, including director nominations. Please read “Stockholder Proposals and Director Nominations for the 2025 Annual Meeting” for information regarding the submission of stockholder proposals and director nominations for consideration at next year’s annual meeting.

OUR 2023 PERFORMANCE HIGHLIGHTS

Our multi-faceted initiatives throughout 2023 significantly contributed to our financial performance for the year. Key highlights included:

| | | | | | | | |

$104.9 MM | | $236.0 MM |

| Net income | | Adjusted EBITDA1 |

| | |

$45.3 MM | | $198.2 MM |

Adjusted Free Cash Flow1 | | Net Cash Provided by Operating Activities |

| | |

18,119 Boe/D | | $10.61 |

| Net Sales per day | | Lease Operating Expenses per BOE2 |

(1) A non-GAAP financial measure; see Appendix A for reconciliations to the most comparable GAAP financial measures.

(2) Calculated as lease operating expenses divided by total barrels of oil equivalent sold during the same period.

Through our strategic efforts designed to drive financial stability and improve the balance sheet, we:

| | | | | | | | |

| | |

Increased production by 47% from 2022 levels | Grew adjusted EBIDTA1 to $236.0 million – a 21% increase year-over-year | Successfully drilled and completed 31 wells |

| | | | | |

| |

Generated adjusted free cash flow1 of $45.3 million (including generating free cash flow every quarter during 2023) | Paid down $30 million of borrowings on our bank credit facility since the closing of the Founders Acquisition on August 15, 2023 |

We ended 2023 with proved reserves of 129.8 million barrels of oil equivalent (“MMBoe”) and a present value discounted at 10% ("PV-10")1 of $1.6 billion, using Securities and Exchange Commission (“SEC”) pricing. Proved developed reserves were 88.1 MMBoe with a PV-10 of $1.3 billion.

(1) A non-GAAP financial measure; see the end of this document for a reconciliation to the most comparable GAAP financial measure.

OUR COMMITMENT TO ENVIRONMENTAL, SOCIAL AND GOVERNANCE (“ESG”)

We are focused on creating long-term value for our stockholders and fostering a culture that is steadfast on environmental sustainability, operational safety, social responsibility and sound corporate governance.

In 2021, we created an ESG Task Force that is comprised of management representatives from Health, Safety & Environmental (“HSE”), Operations, Legal, Human Resources, Investor Relations and Finance. The task force is charged with the responsibility to monitor the Company’s adherence to our ESG standards and formally communicate their findings on an ongoing basis to our CEO and the Board. We published our detailed inaugural ESG sustainability report in 2021 and published follow-up sustainability reports in 2022 and 2023 (the "2023 ESG Sustainability Report"). Included in our sustainability reports is a discussion of our steadfast efforts to disclose our ESG performance record, as applicable, and discuss our plans to drive further alignment in the future with the various reporting frameworks as we continue our ESG reporting journey. Our 2023 ESG Sustainability Report may be found on our website at https://ringenergy.com/sustainability. The information on, or that can be accessed through our website, is not incorporated by reference into this proxy statement and should not be considered part of this proxy statement.

In the creation of our ESG sustainability reports to date, we have reviewed the Sustainability Accounting Standards Board’s (“SASB”) Oil and Gas Exploration and Production Sustainability Accounting Standard, the recommendations of the Task Force on Climate-related Financial Disclosures (“TCFD”), the Sustainable Development Goals (“SDGs”) promulgated by the United Nations, and other reporting guidance from industry frameworks and standards.

| | | | | |

| ENVIRONMENTAL We are committed to protecting and preserving the environment in all aspects of our business, including production operations, well work programs, and decommissioning activities. Our policies and procedures are designed to meet or exceed adherence with all federal, state and local regulations, and we expect our contractors to have similar programs in place. Our efforts to minimize our operational impact are multi-faceted, including reducing greenhouse gas (“GHG”) and air emissions, minimizing the use of freshwater, preventing spills, safeguarding local water supplies and minimizing waste. Our ongoing environmental programs are designed to not only reduce our operational impacts but also improve efficiency, lower costs and reduce risk, which promotes the long-term sustainability of our business, while enhancing our relationships with the communities in which we operate. |

| | | | | |

| SOCIAL We strive to attract, develop and retain a highly qualified workforce in the industry as we recognize our future success is a direct result of their efforts. As such, we provide a competitive compensation and comprehensive benefits program, as well as a positive work environment designed to drive a culture of safety and innovation. We are also committed to continuously providing an inclusive, safe and secure work environment where all of our employees can be respected, valued, and successful in pursuing their goals, all while contributing to the Company’s success. We will continue to promote honesty and integrity in all interactions with our employees and actively support the communities in which we operate with both our time and resources. We recognize and appreciate the ongoing efforts of our employees in their personal commitments from both a time and financial perspective in enhancing the quality of life in our local communities. As of December 31, 2023, we had 108 full-time employees as well as a diverse group of independent contractors who assist our full-time staff in a range of areas including geology, engineering, land, accounting, and field operations, as needed. None are represented by labor unions or covered by any collective bargaining agreements.

|

Diversity and Inclusion

The unique backgrounds and experiences of our employees help to develop a wide range of perspectives that lead to better solutions. Our staff’s diversity is reflected in our full-time employees where 23% are women and approximately 50% represent minorities, as of December 31, 2023.

The majority of our employees are citizens of the United States, with a few retaining dual citizenships in other countries. The employees who are not U.S. citizens are legally registered to live and work here and the Company is committed to helping those employees retain their ability to remain in the U.S. and continue their employment.

| | | | | |

| GOVERNANCE We leverage sound corporate governance practices that promote accountability and good decision making, which is a key tenet to our long-term success and sustainability. Our Board and its committees are responsible for our strategy and governance and these practices depend on our guiding principle to conduct our business in accordance with appropriate legal and ethical standards, and with honesty and integrity. We expect all employees across the organization to exemplify these principles as they conduct their work activities and appreciate their collective efforts in this regard. |

BOARD COMPOSITION AND EXPERIENCE

| | | | | |

8 MEN 1 WOMAN DIVERSITY BY GENDER | |

| |

7 INDEPENDENT 2 NOT INDEPENDENT DIVERSITY BY INDEPENDENCE | |

| |

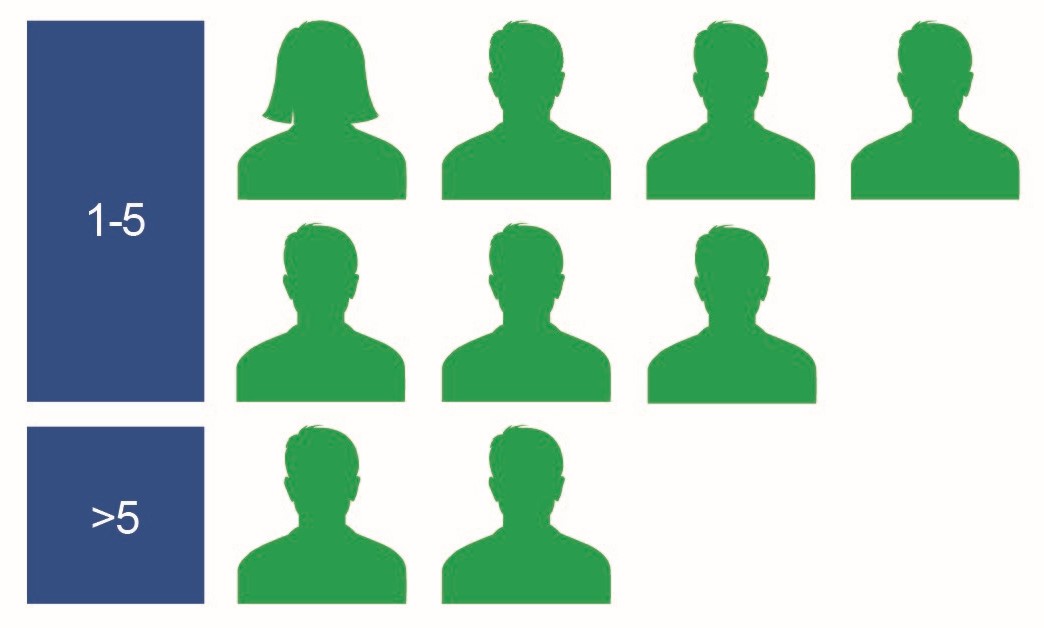

DIVERSITY BY TENURE Years | |

| |

DIVERSITY BY AGE Average Age: 64 | |

PROPOSAL 1:

ELECTION OF DIRECTORS

At the Annual Meeting, the stockholders will elect seven directors to serve on our Board until the 2025 annual meeting or until their successors are duly elected and qualified. Each of Roy Ben-Dor’s and Clayton Woodrum’s current term as a director expires at the Annual Meeting, and each of them has informed the Board that he is retiring from the Board and will not stand for re-election at the Annual Meeting. After careful consideration, the Nominating, Environmental, Social and Governance Committee (“NESG Committee”) and the Board as a whole have determined not to nominate a replacement for Messrs. Ben-Dor and Woodrum and instead to reduce the size of the Board from nine members to seven. As a result, the size of the Board will be seven members following the Annual Meeting. Messrs. Ben-Dor and Woodrum intend to serve on the Board through the date of the Annual Meeting. Upon the recommendation of the NESG Committee, our Board has nominated as directors the following individuals, other than Messrs. Ben-Dor and Woodrum, each of whom is presently serving as a director.

DIRECTORS

The following table sets forth the names, ages, and titles, as of April 16, 2024, of each of our directors:

| | | | | | | | |

| NAME | AGE | POSITION |

Management Director |

Paul D. McKinney | 65 | Chairman of the Board of Directors and Chief Executive Officer |

Non-Independent Director |

Roy I. Ben-Dor (1) | 41 | Director |

Independent Directors |

Anthony B. Petrelli | 71 | Lead Director |

John A. Crum | 72 | Director |

| David S. Habachy | 48 | Director |

Richard E. Harris | 71 | Director |

Thomas L. Mitchell | 64 | Director |

Regina Roesener | 64 | Director |

Clayton E. Woodrum (1) | 84 | Director |

(1) Messrs. Ben-Dor and Woodrum have notified the Board of their decision to not stand for re-election at the Annual Meeting.

We did not pay any third-party fees to assist in the process of identifying or evaluating candidates. Each nominee is currently a director on our Board. Mr. Petrelli joined the Board in January 2013. Ms. Roesener joined the Board in September 2019. Messrs. McKinney, Mitchell, Crum and Harris joined the Board in October 2020. Mr. Habachy joined the Board in September 2022.

Each nominee has consented to being named as a nominee in this proxy statement and has indicated a willingness to serve on our Board if elected. Stockholders may not cumulate their votes in the election of our directors. We have no reason to believe that the nominees will be unable or unwilling to serve if elected; however, if a nominee

should become unable or unwilling to serve for any reason, proxies may be voted for another person nominated as a substitute by our Board.

| | | | | | | | | | | | | | |

BOARD COMMITTEES |

| | | | |

Audit Committee | Compensation Committee | Nominating, Environmental, Social, and Governance Committee | Committee Chairperson | Lead Independent Director |

| | | | | |

| Paul D. McKinney joined Ring on October 1, 2020 and his most recent role prior to joining the Company was President, CEO & Director of SandRidge Energy (NYSE:SD)(“SandRidge”). He accepted the post in January 2019 and continued there eleven months before resigning in December 2019. Prior to SandRidge, Mr. McKinney was President & Chief Operating Officer for Yuma Energy, Inc. (NYSE American:YUMA)(“Yuma”) since April 2017 after serving as Yuma’s Executive Vice President and Chief Operating Officer since October 2014. Mr. McKinney served as a petroleum engineering consultant for Yuma’s predecessor from June 2014 to September 2014 and for Yuma from September 2014 to October 2014. Yuma filed for protection under federal bankruptcy laws in April 2020. Mr. McKinney served as Region Vice President, Gulf Coast Onshore, for Apache Corporation (NYSE:APA)(“Apache”) from 2010 through 2013, where he was responsible for the development and all operational aspects of the Gulf Coast region for Apache. Prior to his role as Region Vice President, Mr. McKinney was Manager, Corporate Reservoir Engineering, for Apache from 2007 through 2010. From 2006 through 2007, Mr. McKinney was Vice President and Director, Acquisitions & Divestitures for Tristone Capital, Inc. Mr. McKinney commenced his career with Anadarko Petroleum Corporation (NYSE:APC)(“Anadarko”) and held various positions with Anadarko over a 23 year period from 1983 to 2006, including his last title as Vice President of Reservoir Engineering, Anadarko Canada Corporation. From July 2017 to December 2021, Mr. McKinney was a member of the board of directors for Pro-Ject Holdings, LLC a privately owned oil field chemical services company. He co-authored Advanced Reservoir Engineering, Gulf Professional Publishing, Elsevier, and Society of Petroleum Engineers paper number SPE-75708-MS: Applied Reservoir Characterization for Maximizing Reserve Growth and Profitability in Tight Gas Sands: A Paradigm Shift in Development Strategies for Low-Permeability Gas Reservoirs. Mr. McKinney entered the United States Air Force upon graduating from high school and continued in the United States Air Force Reserves while attending college. Mr. McKinney attended Louisiana Tech University and graduated with a Bachelor of Science degree in Petroleum Engineering in 1983.

Effective October 1, 2020, Mr. McKinney was appointed to the Board to fill a vacancy created from the resignation of prior directors. At that time, Mr. McKinney was appointed as Chairman of the Board and as Chief Executive Officer.

The particular experience, qualifications, attributes, and skills that led our Board to conclude that Mr. McKinney should serve as director include his 40 years of experience in the oil and gas industry; his extensive experience in advanced reservoir engineering and economic evaluations, strategic planning, and pursuing strategic transactions; his corporate governance, compliance, and risk management experience; and his experience as a director of public and private companies. |

Paul D. McKinney Chairman of the Board of Directors and Chief Executive Officer

Age: 65 Director Since: 2020 |

| | | | | | | | | | | | | | | | | | | | |

|

Anthony B. Petrelli served from 2010 to 2022 as President, Chairman and Director of Investment Banking Services of NTB Financial Corporation, a Denver, Colorado based financial services firm founded in 1977. Since the beginning of 2023, Mr. Petrelli has served as a registered representative and financial consultant with Momentum Independent Network, a FINRA member firm. Beginning his career in 1972 in the investment industry, Mr. Petrelli has extensive experience in the areas of corporate finance, underwriting, management, operations, sales, and trading. He has served on numerous regulatory and industry committees including service on the FINRA (previously “NASD”) Corporate Finance Committee, FINRA National Adjudicatory Council (Vice Chairman), FINRA Small Firm Advisory Board, and Chairman of the FINRA District Business Conduct Committee for District 3. Mr. Petrelli has also served as an Arbitrator for FINRA dispute resolution. Additionally, since 2016 Mr. Petrelli has served as a director and member of the audit committee for Sensus Healthcare, Inc. (NASDAQ:SRTS), a medical device company. He has also served on several other public company boards including director and member of the audit committee of Arena Resources Inc. (NYSE:ARD), an oil and gas exploration, development and production company, and director of Natural Gas Services Group (NYSE:NGS), a provider of natural gas compression equipment and services to the energy industry. Mr. Petrelli has also served as an advisory director on several other public company boards. In addition to his career in the investment industry, Mr. Petrelli served on the board of directors of Southwest Counseling Associates, a Denver, Colorado based professional counseling firm. Mr. Petrelli established Equinox Counseling LLC in 2012, and is a Licensed Professional Counselor (LPC), a National Certified Counselor (NCC) and an Approved Clinical Supervisor (ACS). Mr. Petrelli received his Bachelor of Science degree in Business (Finance) and his Master of Business Administration (MBA) degree from the University of Colorado. In addition, he received his Master of Arts degree in Counseling from Denver Seminary. The particular experience, qualifications, attributes, and skills that led our Board to conclude that Mr. Petrelli should serve as director include his experience and expertise in financial and business matters with significant involvement in corporate governance and financial matters; his service on the FINRA Corporate Finance Committee, the NASD Small Firm Advisory Board and as Chairman of the FINRA District Business Conduct Committee; and his board experience. |

Anthony B. Petrelli Lead Independent Director

Age: 71 Director Since: 2013 |

| Board Committees: | | | | | |

| | | | | | | | | | | | | | | | | | | | |

|

John A. Crum is managing partner of JAC Energy Partners, LLC, formed to provide advice to companies and individual investors in oil and gas exploration and production. He has been involved with worldwide oil and gas development for more than 40 years. Mr. Crum currently serves as a director for: Forty Acres Energy, LLC, an oil company developing Permian Basin waterflood assets. He served as chief executive officer and director of Midstates Petroleum Company Inc. (NYSE:MPO), from 2011 to 2014. From 1995 to 2011, Mr. Crum served in a variety of executive roles for Apache Corporation (NYSE:APA), including co-chief operating officer and president, North America, president Apache Canada Ltd., managing director Apache North Sea (UK), managing Director Apache Energy Ltd. (Australia), and executive vice president for Eurasia and worldwide new ventures. Earlier in his career, Mr. Crum held positions of responsibility at Aquila Energy Corporation, Pacific Enterprises Oil Company, and Southland Royalty Company. He began his career with Conoco in 1975. He has previously served as a director of several public and private companies including the midstream MLP, Midcoast Energy Partners, LP; exploration and production company, Crestone Peak Resources; rotorcraft services supplier, CHC Helicopter; and for the biofuels technology company, Coskata Inc. Mr. Crum has been active with industry groups serving on the boards of the Australian Petroleum Production and Exploration Association (APPEA), UK Offshore Operators Association (UKOOA), and Canadian Association of Petroleum Producers (CAPP) during assignments in those countries. He holds a Bachelor of Science degree in petroleum engineering from the New Mexico Institute of Mining and Technology. The particular experience, qualifications, attributes, and skills that led our Board to conclude that Mr. Crum should serve as a director include his significant worldwide oil and gas experience; and his prior executive and Board experience. |

John A. Crum Independent Director

Age: 72 Director Since: 2020 |

| Board Committees: | | | | | |

| | | | | | | | | | | | | | | | | | | | |

|

David S. Habachy served as a Managing Director on the energy team of Warburg Pincus from 2017 until July 2022. Previously, Mr. Habachy served as Managing Director and member of the Investment Committee of the Kayne Anderson Energy Funds. Additionally, Mr. Habachy served on numerous boards of oil and gas E&P domestic and international companies during his tenure in private equity. Prior to entering into private equity in 2008, Mr. Habachy spent 10 years in asset management, operations and consulting in the upstream E&P business. He started his petroleum engineering career at Arco/Vastar in 1998. Mr. Habachy previously served on the Board of Directors of Earthstone Energy, Inc. Additionally, Mr. Habachy currently serves on the Investment Committee Board for Memorial Hermann Health System and is a board member of the Houston Producers’ Forum. Mr. Habachy holds a B.S. in Chemical Engineering and an MBA degree with George Kozmetsky highest honors distinction from The University of Texas at Austin.

The particular experience, qualifications, attributes, and skills that led our Board to conclude that Mr. Habachy should serve as a director include his extensive experience in the oil and gas industry, including serving on the boards of private oil and gas exploration and production companies, and his serving as a managing director at Warburg makes him uniquely positioned to provide the Board with insight and advice on a full range of strategic, financial and governance matters.

|

David S. Habachy Independent Director

Age: 48 Director Since: 2022 |

| Board Committees: | | | | | |

| | | | | | | | | | | | | | | | | | | | |

|

Richard E. Harris began his corporate career in 1981, joining The Standard Oil Company of Ohio (“SOHIO”) in the Treasury Department. SOHIO was acquired by British Petroleum plc (“BP”) in 1987. Mr. Harris continued to be assigned challenging positions with increasing responsibility within BP Finance and BP America Finance. Mr. Harris’ achievements earned him a two year assignment in Belgium as a member of a team charged with integrating finance functions across Europe into BP Oil Europe in Brussels. In 1995, Mr. Harris left BP to join Compaq Computer Corporation in a newly created position where Mr. Harris developed and enhanced the company’s global capabilities in corporate finance, financial planning, M&A pre-close analysis and post close evaluation as well as global treasury management. Compaq promoted Mr. Harris to Assistant Treasurer, Global Treasury in 1999. In 2003, Mr. Harris joined Cummins Inc.’s executive team as Vice President, Treasurer and led initiatives to develop best in class global treasury processes and procedures. Mr. Harris was also secretary of the Finance Committee of the Cummins Board of Directors and collaborated with the Board members on a frequent basis. Mr. Harris established a world class global treasury organization which supported the Cummins’ businesses in 198 countries worldwide. Mr. Harris was promoted to Vice President, Chief Investment Officer in 2008. Mr. Harris’ team successfully developed, implemented and provided oversight for processes to source, evaluate, and execute the company’s strategic acquisitions, investments, and joint ventures. In 2015, Mr. Harris retired to Austin, Texas. In February, 2022, Mr. Harris joined the Board of Directors of Longhorn Village, a private senior living facility in Austin, TX. Mr. Harris received a Bachelor of Science in Mathematics and Master of Business Administration from John Carroll University. Subsequent to Mr. Harris’ appointment to the Board in 2020, he joined the board of directors of BPH Holding Co. Inc. (“BPH”) and its Austin, Texas subsidiary, Longhorn Village. BPH is a not-for-profit company that focuses on the development and management of senior living communities in Texas. Mr. Harris currently serves on the strategic planning committee of the BPH Board. The particular experience, qualifications, attributes, and skills that led our Board to conclude that Mr. Harris should serve as a director include his significant worldwide business experience; and his prior executive and Board experience. |

Richard E. Harris Independent Director

Age: 71 Director Since: 2020 |

| Board Committees: | | | | | |

| | | | | | | | | | | | | | | | | | | | |

|

Thomas L. Mitchell is a strategic finance leader with a record of driving growth in energy business models as the chief financial officer of both large and small companies in the oil and gas industry. He has had a career of strong Fortune 500 experience with exploration and production companies, and broad energy exposure with offshore drilling and midstream gathering and marketing companies. In his last position as EVP and Chief Financial Officer of Devon Energy Corporation (NYSE:DVN) from 2014 to 2017, Mr. Mitchell led the finance and business development organizations, and also helped the company successfully strengthen its asset quality through strategic acquisitions. Previously, Mr. Mitchell served as EVP and Chief Financial Officer and a member of the board of directors of Midstates Petroleum Company (now NYSE:AMPY), a private equity-funded exploration and production company. While there, Mr. Mitchell helped lead the initial public offering listing of the company on the New York Stock Exchange in 2012. From November 2006 to September 2011, Mr. Mitchell was the Senior Vice President, Chief Financial Officer of Noble Corporation (NASDAQ:NEBLQ), a publicly-held offshore drilling contractor for the oil and gas industry. Following his formal education, Mr. Mitchell began his career in public accounting with Arthur Andersen & Co. where he practiced as a CPA (currently inactive), then, in 1989 entered the oil and gas industry at Apache Corporation (NYSE:APA) where he spent eighteen years in various finance and commercial roles, the last being Vice President and Controller. Mr. Mitchell currently serves on the board of EPIC Midstream Holdings GP, LLC, a private midstream crude and NGL infrastructure company. He previously served on the board of directors of Hines Global REIT, Inc., a public real estate investment trust, Sundance Energy, Inc. (OTC MKTS:SNDEQ), a public exploration and production company, and EnLink Midstream Partners, LP and EnLink Midstream, LLC (NYSE:ENLC). Mr. Mitchell graduated from Bob Jones University with a B.S. in Accounting. The particular experience, qualifications, attributes, and skills that led our Board to conclude that Mr. Mitchell should serve as a director include his significant financial background; his public accounting experience; his prior performance of chief financial officer functions for both public and private companies; and his board experience. |

Thomas L. Mitchell Independent Director

Age: 64 Director Since: 2020 |

| Board Committees: | | | | | |

| | | | | | | | | | | | | | | | | | | | |

|

Regina Roesener served as the Chief Operating Officer, Director of Corporate Finance and a member of the board of directors of NTB Financial Corporation (“NTB”), a member firm of FINRA and also a Registered Investment Advisor with the SEC from 1990 to 2022. During her more than 30-year tenure at NTB, Ms. Roesener was involved in the capital raising efforts for numerous public and private companies, many of which were in the energy sector, collectively raising more than $300 million. This involved working closely with executive management of the issuing company to develop and deliver their investor presentations and road shows, utilizing longstanding strategic relationships with participating FINRA member firms. In addition, in her position at NTB, Ms. Roesener was responsible for the management of an internal market broker for a large, SEC registered public company, where she facilitated more than $500 million in transactions over 15 years. She has served as a board member of the National Investment Bankers Association and as a member of Women in Syndicate Association and has served as a board member for the Denver chapter of the March of Dimes. She is a member of the National Association of Corporate Directors and the Institute for Excellence in Corporate Governance. Ms. Roesener received her Bachelor of Science degree in Education from the University of Colorado in 1982. Ms. Roesener completed the Wharton Executive Education-Corporate Governance Certificate Program in 2022. The particular experience, qualifications, attributes, and skills that led our Board to conclude that Ms. Roesener should serve as director include her experience and knowledge in the areas of corporate governance, corporate finance and capital markets, which the Board believes will provide valuable insight and assistance in the future growth of the Company. |

Regina Roesener Independent Director

Age: 64 Director Since: 2019 |

| Board Committees: | | | | | |

BOARD RECOMMENDATION ON PROPOSAL

The Board unanimously recommends a vote FOR the election of each of the director nominees named above. The management proxy holder will vote all properly submitted proxies FOR election of each director unless properly instructed otherwise.

CORPORATE GOVERNANCE AND OUR BOARD

CORPORATE GOVERNANCE HIGHLIGHTS

| | | | | |

RELATING TO THE BOARD |

a Annual elections of the entire Board | a Dedication to continuing director education |

a Majority independent directors | a Dedication to diversity on the Board |

a Annual evaluations of the Board, each committee, and each director | a Designated Lead Independent Director

|

a Insider trading policy that prohibits hedging, pledging, and margin transactions in Company securities | a Board committees comprised entirely of independent directors |

a Maintains corporate governance guidelines

| a Board oversees environmental, social, and governance practices |

a Annual say-on-pay vote

| a Board oversees succession planning for the CEO and executive officer positions |

a Director overboarding policy | a Adopted stock ownership guidelines for officers and directors |

| | | | | |

RELATING TO STOCKHOLDER RIGHTS |

a Equal voting rights among all stockholders | a All stockholders entitled to vote on all director nominees |

a Ability of stockholders to call a special meeting (at a 10% threshold) | a No poison pill or similar plan

|

a Ability of stockholders to act by written consent | a No supermajority voting requirements |

We maintain a corporate governance section on our website that contains copies of the charters for the committees of our Board. The corporate governance section may be found at https://ringenergy.com/investors/corporate-governance. The charters for each of the Board’s committees will be provided to any person without charge, upon request. Requests may be directed to Ring Energy, Inc., Attention: Travis T. Thomas, Corporate Secretary, Executive Vice President and Chief Financial Officer, 1725 Hughes Landing Blvd., Suite 900, The Woodlands, TX 77380, or by calling (281) 397-3699.

Also available on our website under the corporate governance section or the sustainability section are copies of our Corporate Governance Guidelines, Code of Ethics, Code of Business Conduct and our 2023 ESG Sustainability Report. We have adopted a Code of Ethics that applies to our Chief Executive Officer, Executive Vice Presidents, and Chief Financial Officer, as well as the principal accounting officer or controller, or persons performing similar functions, to ensure high standards of ethical conduct and fair dealing. Our 2023 ESG Sustainability Report discusses a wide range of our business practices and procedures designed to help promote workplace safety, health of our stakeholders, sound environmental practices, protection of human rights, and honest and ethical conduct. The Code of Business Conduct covers standards for professional conduct, including, among others, conflicts of interest, insider trading, protection, proper use of confidential

information and Company assets, and compliance with the laws and regulations applicable to the Company’s business. Finally, we have adopted Corporate Governance Guidelines to assist the Board in the exercise of its responsibilities.

The information on, or that can be accessed through our website, is not incorporated by reference into this proxy statement and should not be considered part of this proxy statement.

OUR BOARD

Our Board currently consists of nine members and will be reduced to seven directors effective at the conclusion of the Annual Meeting. Our Articles of Incorporation and Bylaws provide for the annual election of directors. At each annual meeting of stockholders, our directors will be elected for a one-year term and serve until their respective successors have been elected and qualified.

Our Board held eight meetings during the fiscal year ended December 31, 2023. During the fiscal year ended December 31, 2023, no directors attended fewer than 75% of the total number of meetings of our Board and committees on which that director served.

We encourage, but do not require, our directors to attend our annual meetings of stockholders. At our last annual meeting of stockholders, eight members of our Board attended either in person or by video conference participation.

BOARD LEADERSHIP STRUCTURE

The Chairman of the Board is selected by the members of the Board. Our Board does not have a policy as to whether the roles of Chairman of the Board and Chief Executive Officer should be separate or combined. Currently, the positions of Chairman of the Board and Chief Executive Officer are held by Paul D. McKinney. The Board has determined that the current structure is effective in allowing Mr. McKinney to draw on his knowledge of the operations of our business and industry developments to provide leadership on the broad strategic issues considered by the Board. At the same time, the appointment of a Lead Independent Director with clearly defined responsibilities and authority, along with the Board’s fully independent committees and substantial majority of independent directors, establishes an effective balance between management leadership and appropriate oversight by independent directors. Anthony B. Petrelli currently serves as the Lead Independent Director. Periodically, our NESG Committee assesses these roles and the board leadership structure to ensure the interests of Ring and its stockholders are best served.

LEAD INDEPENDENT DIRECTOR

In 2021, we amended our Bylaws to provide for the election of a Lead Independent Director.

Duties of the Lead Independent Director

■Presides at all meetings of the Board at which the Chairman is not present and all executive sessions of the independent directors;

■Acts as advisor to CEO and direct liaison between CEO and non-employee directors;

■Plans, reviews, and approves Board meeting agendas and information presented to the Board;

■Calls meetings of the independent directors as appropriate;

■Contributes to annual CEO performance review and assists with succession planning;

■Consults the NESG Committee on the Board’s evaluation process;

■Consults with the Audit Committee regarding internal controls and audit matters;

■Consults with the Compensation Committee regarding CEO, executive and employee compensation;

■Participates in consultations and direct communication with major stockholders and their representatives when appropriate; and

■Performs such other duties as the Board may determine from time to time.

Key Attributes of the Lead Independent Director

The Lead Independent Director is selected from among the independent directors. The NESG Committee and management discuss candidates for the Lead Independent Director position, and consider many of the same types of criteria as candidates for the chair of other Board committees including:

■Tenure;

■Previous service as a Board committee chair;

■Diverse experience;

■Participation in and contributions to activities of the Board; and

■Ability and willingness to commit adequate time to the role.

ANNUAL BOARD EVALUATION

The NESG Committee is responsible for the Board evaluation process. In each fiscal year, the NESG Committee requests that the chairman of each committee report to the full Board about such committee’s annual evaluation of its performance and evaluation of its charter. In addition, the NESG Committee receives comments from all directors and reports to the full Board with an assessment of the Board’s and management’s performance each fiscal year. In conducting its annual evaluation, our Board has utilized written questionnaires to solicit feedback on committee and board effectiveness, agenda topics and materials, appropriate delegation of issues to committees, and the appropriateness of board and committee materials. The NESG Committee’s review process also includes an annual director self-evaluation that prompts each director to reflect and comment on his or her own individual performance and contributions to the Board and the Company.

DIRECTOR ORIENTATION AND CONTINUING EDUCATION

Our Board takes measures as it deems appropriate to ensure that its members may act on a fully informed basis. The NESG Committee reviews general education and orientation for our directors. Newly appointed directors are required to become knowledgeable about the responsibilities of directors for publicly traded companies. In addition, we provide our directors with information regarding changes in our business and industry as well as the responsibilities of the directors in fulfilling their duties. The Board frequently invites consultants and counsel to provide updates on developments in Board meetings throughout the year.

BOARD INDEPENDENCE

As required under the listing standards of the NYSE American, a majority of the members of our Board must qualify as independent, as affirmatively determined by our Board. The standards relied upon by the Board in determining whether a director is “independent” are those set forth in the rules of the NYSE American. The NYSE American generally defines the term “independent director” as a person other than an executive officer or employee of a company, who does not have a relationship with the company that would interfere with the director’s exercise of independent judgment in carrying out the responsibilities of a director. Because the Board believes it is not possible to anticipate or provide for all circumstances that might give rise to conflicts of interest or that might bear on the materiality of a relationship between a director and the Company, the Board has not established specific objective criteria, apart from the criteria set forth in the NYSE American rules, to determine “independence.” In addition to the NYSE American criteria, in making the determination of “independence”, the Board considers such other matters including, without limitation, (i) the business and non-business relationships that each director has or may have had with the Company and its other directors and executive officers, (ii) the stock ownership in the Company held by each such director, (iii) the existence of any familial relationships with any executive officer or director of the Company, and (iv) any other relevant factors which could cause any such director to not exercise his independent judgment. Our NESG Committee evaluated all relevant transactions and relationships between each director then on the Board, and any of his or her family members, and the Company, senior management, and independent registered accounting firm. Based on this evaluation and the recommendation of our NESG Committee, our Board determined that Clayton E. Woodrum, Anthony B. Petrelli, Regina Roesener, Richard A. Harris, John A. Crum, Thomas L. Mitchell and David S. Habachy were independent directors, as that term is defined in the listing standards of the NYSE American and that Paul D. McKinney and Roy I. Ben-Dor are not independent.

Family Relationships and Involvement in Legal Proceedings

All directors and nominees for director of the Company are United States citizens. There are no family relationships between any of our directors or nominees for director and our executive officers. In addition, there are no other arrangements or understandings between any of our directors or nominees for director and any other person pursuant to which any person was selected as a director or nominee for director.

BOARD RISK ASSESSMENT AND CONTROL

The Board considers risk oversight and management to be an integral part of its role. Our risk management program is overseen by our Board and its committees, with support from our management. Our Board utilizes an enterprise-wide approach to oil and gas industry risk management, designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and enhance stockholder value. A fundamental part of risk management is a thorough understanding of the risks the Company faces, understanding of the level of risk appropriate for our Company, and the steps needed to manage those risks effectively. The involvement of all members of the Board in setting our business strategy is a key part of their overall responsibilities and, together with management, determines what constitutes an appropriate level of risk for our Company. Our Board believes that its practice of including all members of our management team in our risk assessments allows the Board to more directly and effectively evaluate management capabilities and performance, more effectively and efficiently communicate its concerns and wishes to the entire management team and provides all members of management with a direct communication avenue to the Board.

While our Board has the ultimate oversight responsibility for the risk management process, the committees of our Board also have responsibility for specific risk management activities. In particular, the Audit Committee focuses on financial risk management, including internal controls, and oversees compliance with regulatory requirements. In setting compensation, the Compensation Committee approves compensation programs for the officers and other key employees to encourage an appropriate level of risk-taking behavior consistent with our business strategy and performance. Our Board has delegated oversight of matters related to cybersecurity and the security of information technology systems to the Audit Committee.

INSIDER TRADING POLICY

Our Board has adopted an Insider Trading Policy for employees and directors to promote compliance with federal and state securities laws. The policy prohibits certain persons who are aware of material non-public information about the Company from: (i) trading in securities of the Company; or (ii) providing material non-public information to other persons who may trade on the basis of that information. When material non-public information about us may exist and may have an influence on the marketplace, a trading blackout period is placed in effect by management. In addition, our Insider Trading Policy also applies to family members, other members of a person’s household, and entities controlled by a person covered by this Insider Trading Policy. Officers, directors, and designated employees, as well as the family members and controlled entities of such persons, may not engage in any transaction in Company securities without first obtaining pre-clearance of the transaction.

Under the Insider Trading Policy, directors, executive officers and other employees are prohibited from entering into any hedging or monetization transactions relating to our securities or otherwise trading in any instrument relating to the future securities’ price. Our Insider Trading Policy also prevents directors and executive officers from pledging our securities as collateral for loans or holding our securities in a margin account.

BOARD COMMITTEES

Our Board has established three standing committees, the composition and responsibilities of which are briefly described below. Our Board may establish other committees from time to time to facilitate our management.

| | | | | | | | |

| | |

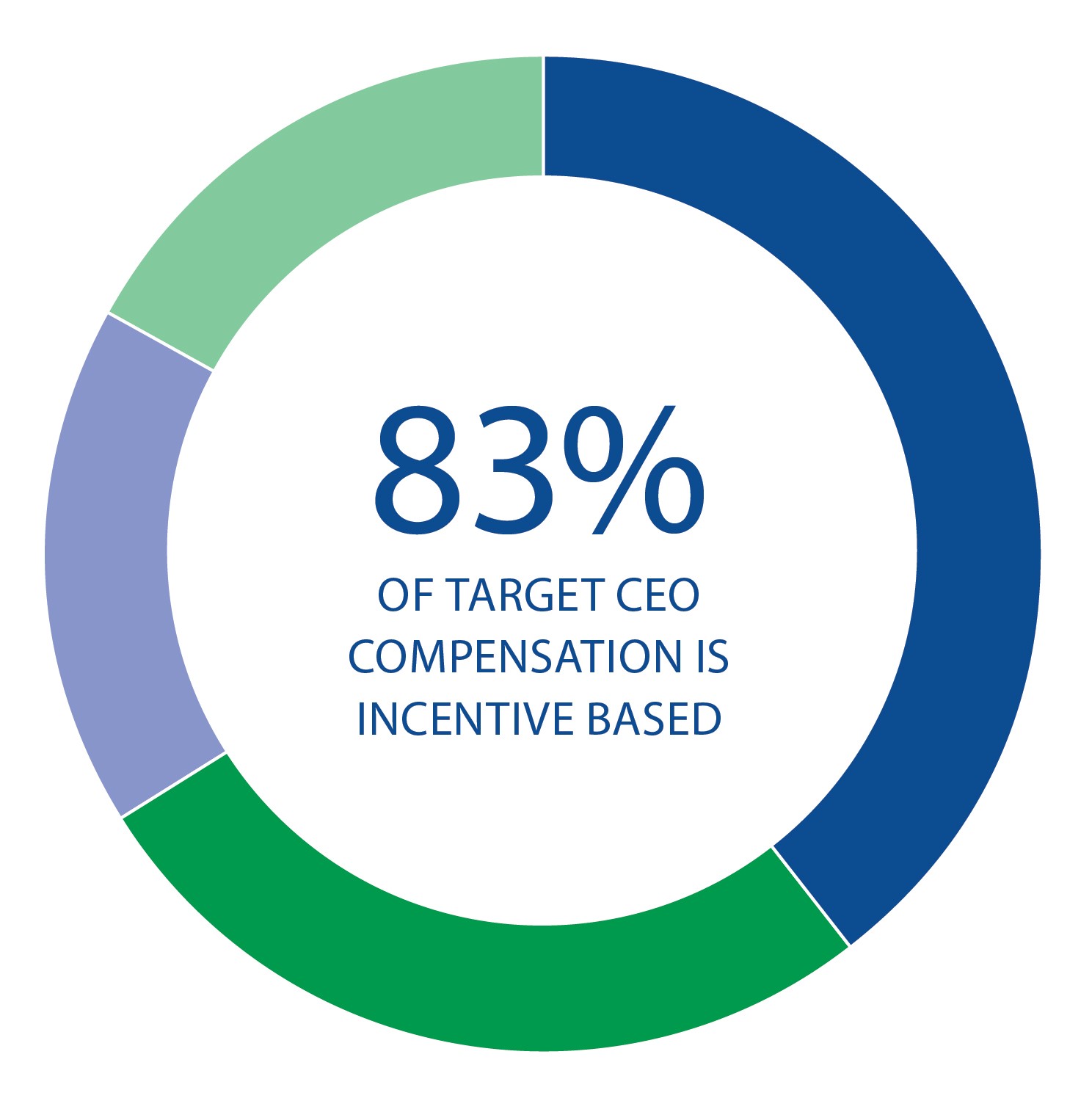

Audit Committee | Compensation Committee | Nominating, Environmental, Social, and Governance Committee |