FOUNDERS OIL & GAS IV, LLC and AFFILIATE CONSOLIDATED FINANCIAL STATEMENTS Years ended September 30, 2022 and 2021 with Report of Independent Auditors

FOUNDERS OIL & GAS IV, LLC and AFFILIATE CONSOLIDATED FINANCIAL STATEMENTS Years ended September 30, 2022 and 2021 Table of Contents Report of Independent Registered Public Accounting Firm ...................................................... 1 Consolidated Financial Statements: Consolidated Balance Sheets ................................................................................................ 3 Consolidated Statements of Income ..................................................................................... 4 Consolidated Statements of Changes in Member’s Equity ................................................... 5 Consolidated Statements of Cash Flows ............................................................................... 6 Notes to Consolidated Financial Statements ............................................................................... 7

Fort Worth Office 640 Taylor Street Suite 2200 Fort Worth, Texas 76102 817.259.9100 Main whitleypenn.com REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Member of Founders Oil & Gas IV, LLC and its affiliate Opinion on the Financial Statements We have audited the accompanying consolidated balance sheets of Founders Oil & Gas IV, LLC and its affiliate (collectively referred to as the “Company”) as of September 30, 2022 and 2021, and the related consolidated statements of income, changes in member’s equity, and cash flows for the years then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of September 30, 2022 and 2021 and the results of their operations and their cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States of America. Basis for Opinion These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control over financial reporting. Accordingly, we express no such opinion. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Critical Audit Matters Critical audit matters are matters arising from the current period audit of the financial statements that were communicated or required to be communicated to the audit committee and that: (1) relate to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective, or complex judgments. We determined that there are no critical audit matters. We have served as the Company’s auditor since 2022. Fort Worth, Texas February 15, 2023

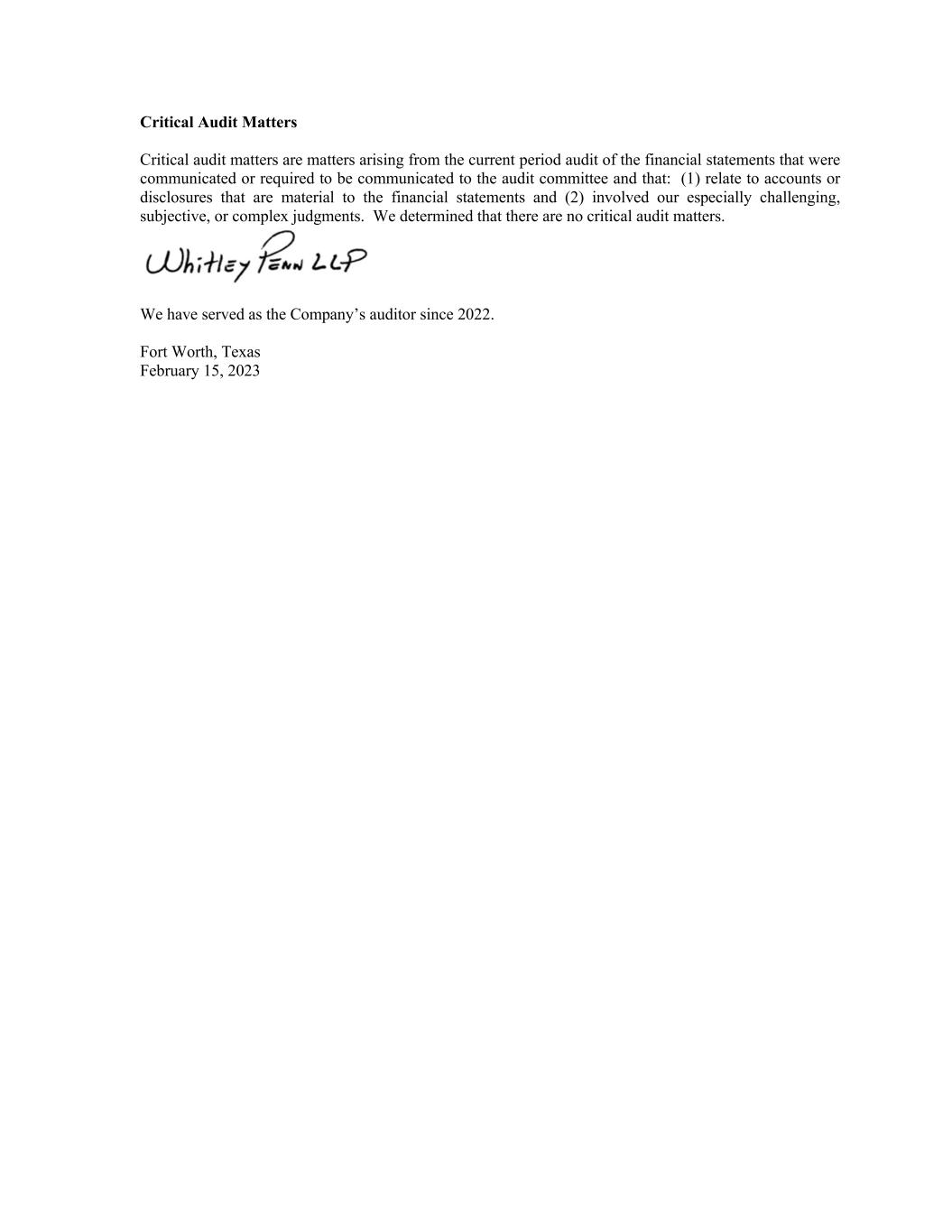

FOUNDERS OIL & GAS IV, LLC and AFFILIATE Consolidated Balance Sheets September 30, 2022 September 30, 2021 ASSETS Current Assets Cash and Cash Equivalents 8,816,718$ 6,610,218$ Crude Oil and Natural Gas Receivable 5,813,385 2,502,411 Other Receivables 75,297 94,620 Prepaid Expenses and Other Current Assets 338,245 412,912 Inventory 2,309,550 - Total Current Assets 17,353,195 9,620,161 Property and Equipment Oil and Gas Properties (Successful Efforts Method) 103,639,011 78,560,126 Other Property and Equipment 413,458 407,819 Total Property and Equipment 104,052,469 78,967,945 Less: Accumulated Depreciation, Depletion and Amortization (29,166,594) (16,288,781) Total Property and Equipment, Net 74,885,875 62,679,164 Total Assets 92,239,070$ 72,299,325$ LIABILITIES AND MEMBER'S EQUITY Current Liabilities Accounts Payable $ 112,123 $ 13,891 Accrued Capital Costs 194,914 2,875,856 Other Accrued Liabilities 2,371,976 1,821,292 Revenue Payable 973,291 515,372 Total Current Liabilities 3,652,304 5,226,411 Long-Term Liabilities Asset Retirement Obligations 3,081,007 2,829,303 Total Liabilities 6,733,311 8,055,714 Commitments and Contingencies Member's Equity Member's Equity 83,305,884 66,212,212 Non-Controlling Interest 2,199,875 (1,968,601) Total Member's Equity 85,505,759 64,243,611 Total Liabilities and Member's Equity 92,239,070$ 72,299,325$ See Accompanying Notes to Consolidated Financial Statements 3

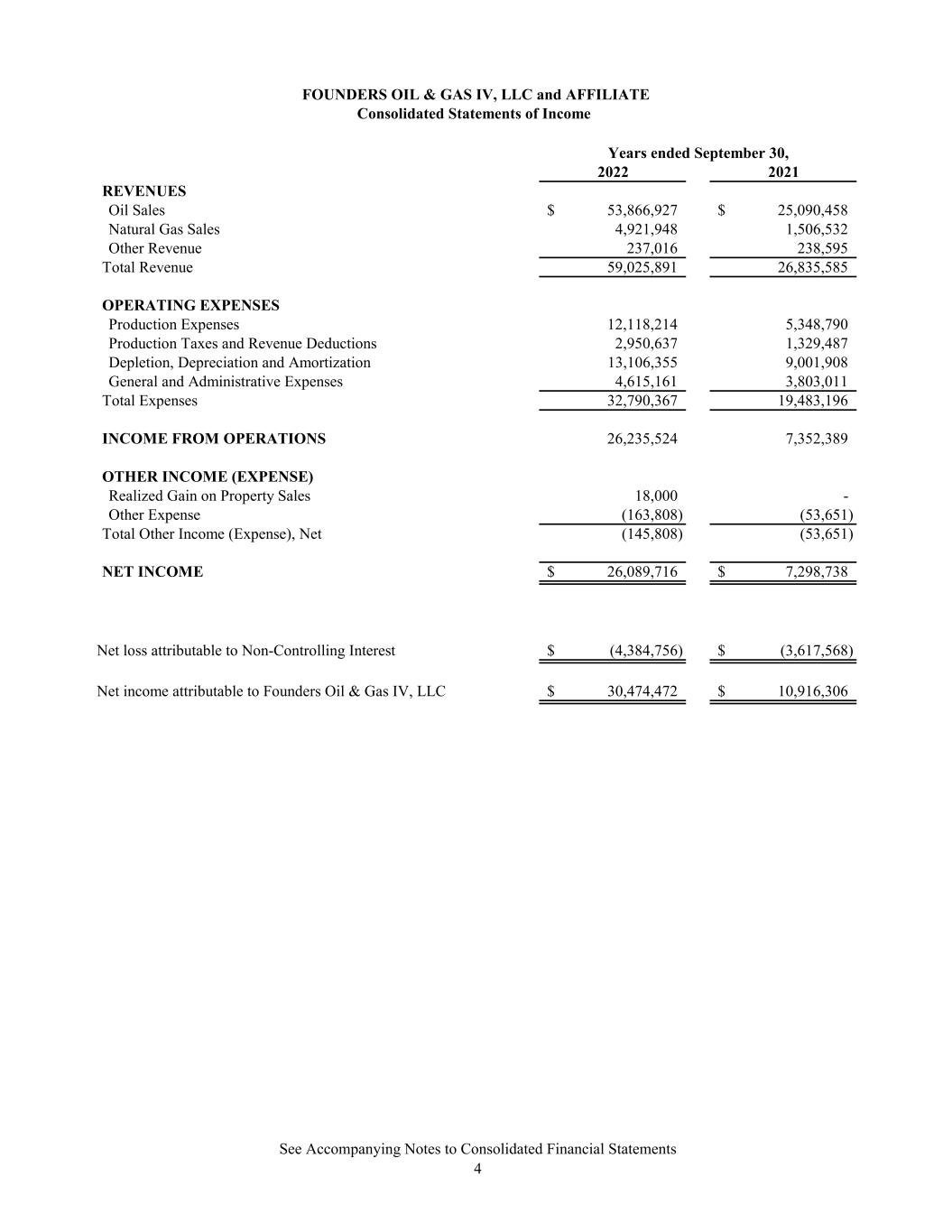

2022 2021 REVENUES Oil Sales 53,866,927$ 25,090,458$ Natural Gas Sales 4,921,948 1,506,532 Other Revenue 237,016 238,595 Total Revenue 59,025,891 26,835,585 OPERATING EXPENSES Production Expenses 12,118,214 5,348,790 Production Taxes and Revenue Deductions 2,950,637 1,329,487 Depletion, Depreciation and Amortization 13,106,355 9,001,908 General and Administrative Expenses 4,615,161 3,803,011 Total Expenses 32,790,367 19,483,196 INCOME FROM OPERATIONS 26,235,524 7,352,389 OTHER INCOME (EXPENSE) Realized Gain on Property Sales 18,000 - Other Expense (163,808) (53,651) Total Other Income (Expense), Net (145,808) (53,651) NET INCOME 26,089,716$ 7,298,738$ Net loss attributable to Non-Controlling Interest (4,384,756)$ (3,617,568)$ Net income attributable to Founders Oil & Gas IV, LLC 30,474,472$ 10,916,306$ FOUNDERS OIL & GAS IV, LLC and AFFILIATE Consolidated Statements of Income Years ended September 30, See Accompanying Notes to Consolidated Financial Statements 4

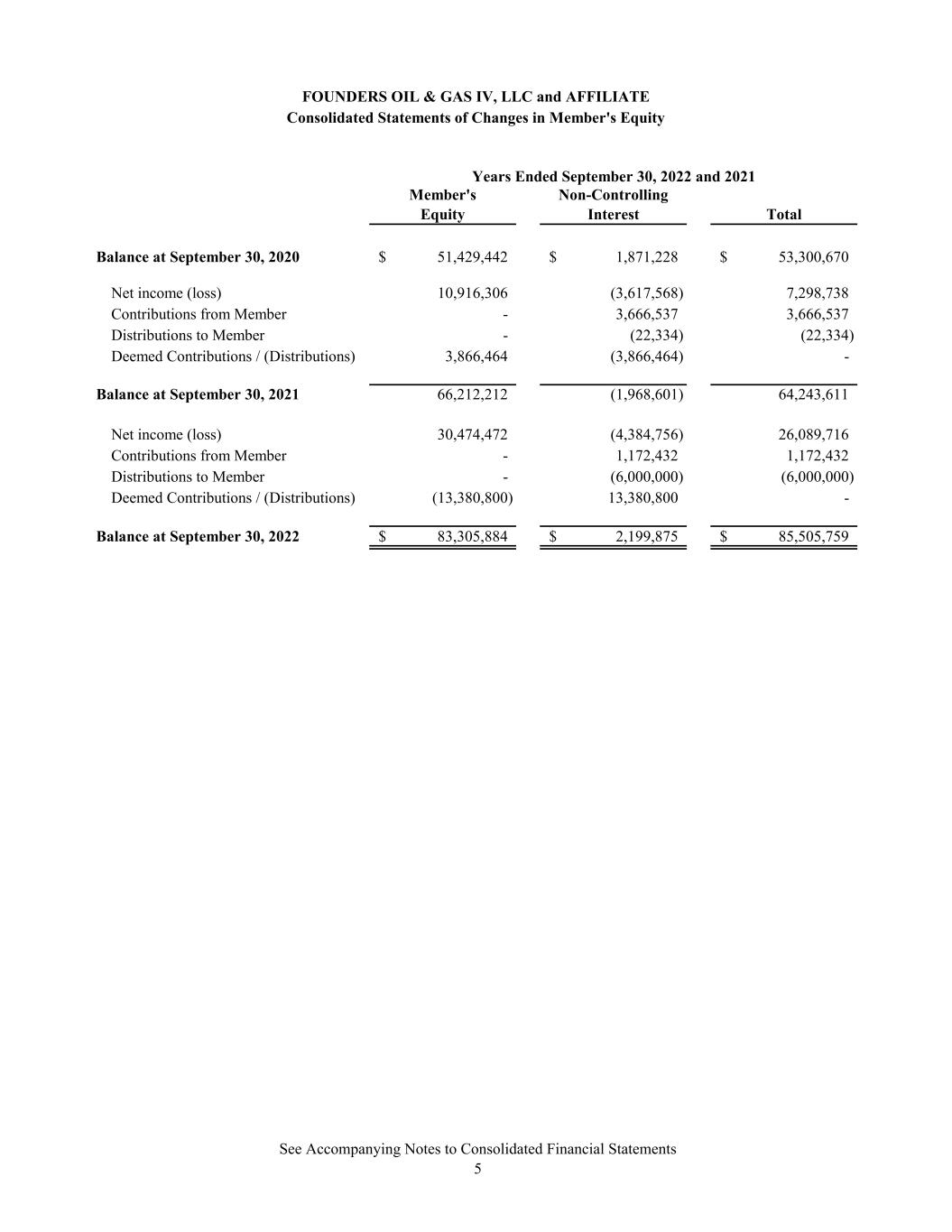

FOUNDERS OIL & GAS IV, LLC and AFFILIATE Consolidated Statements of Changes in Member's Equity Years Ended September 30, 2022 and 2021 Member's Equity Non-Controlling Interest Total Balance at September 30, 2020 51,429,442$ 1,871,228$ 53,300,670$ Net income (loss) 10,916,306 (3,617,568) 7,298,738 Contributions from Member - 3,666,537 3,666,537 Distributions to Member - (22,334) (22,334) Deemed Contributions / (Distributions) 3,866,464 (3,866,464) - Balance at September 30, 2021 66,212,212 (1,968,601) 64,243,611 Net income (loss) 30,474,472 (4,384,756) 26,089,716 Contributions from Member - 1,172,432 1,172,432 Distributions to Member - (6,000,000) (6,000,000) Deemed Contributions / (Distributions) (13,380,800) 13,380,800 - Balance at September 30, 2022 83,305,884$ 2,199,875$ 85,505,759$ See Accompanying Notes to Consolidated Financial Statements 5

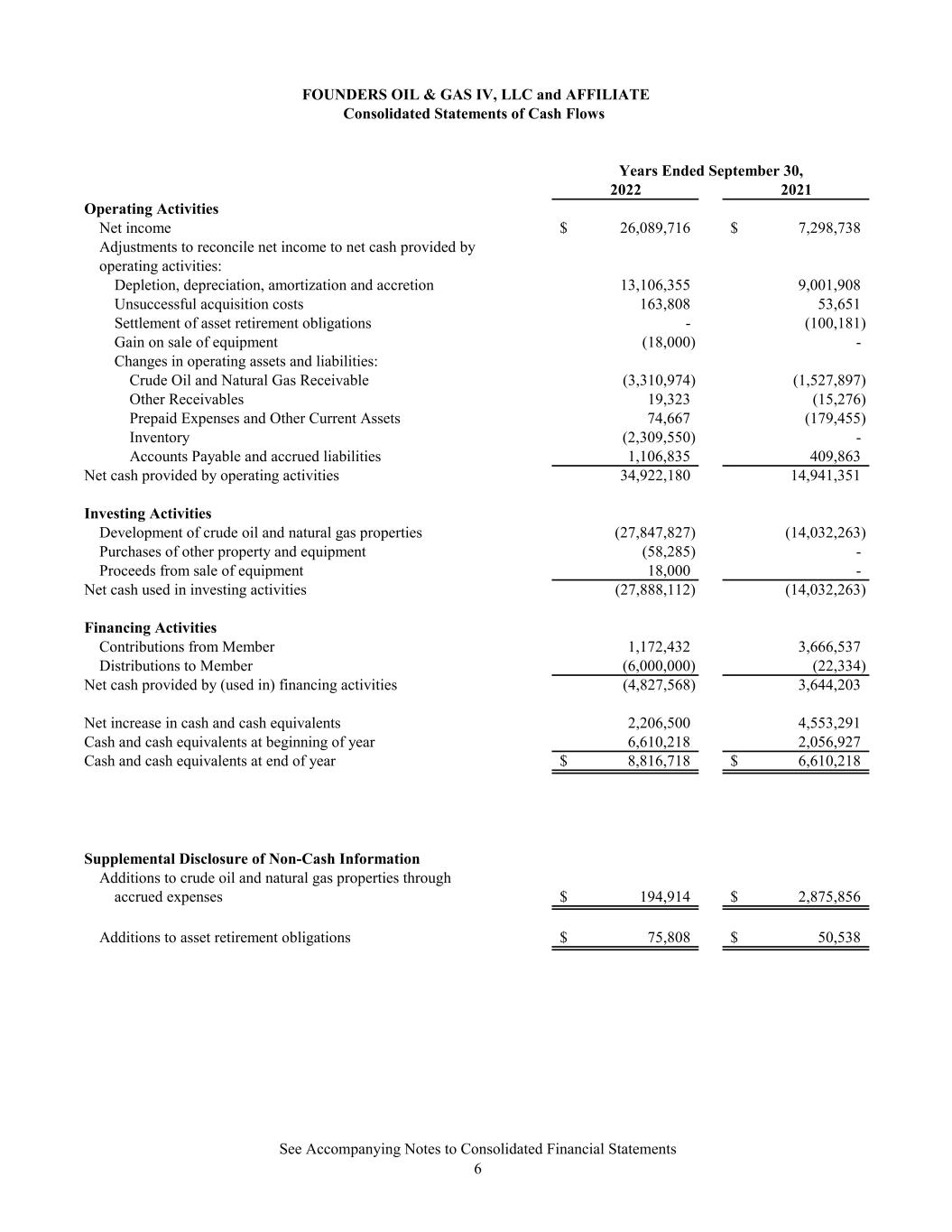

FOUNDERS OIL & GAS IV, LLC and AFFILIATE Consolidated Statements of Cash Flows 2022 2021 Operating Activities Net income 26,089,716$ 7,298,738$ Adjustments to reconcile net income to net cash provided by operating activities: Depletion, depreciation, amortization and accretion 13,106,355 9,001,908 Unsuccessful acquisition costs 163,808 53,651 Settlement of asset retirement obligations - (100,181) Gain on sale of equipment (18,000) - Changes in operating assets and liabilities: Crude Oil and Natural Gas Receivable (3,310,974) (1,527,897) Other Receivables 19,323 (15,276) Prepaid Expenses and Other Current Assets 74,667 (179,455) Inventory (2,309,550) - Accounts Payable and accrued liabilities 1,106,835 409,863 Net cash provided by operating activities 34,922,180 14,941,351 Investing Activities Development of crude oil and natural gas properties (27,847,827) (14,032,263) Purchases of other property and equipment (58,285) - Proceeds from sale of equipment 18,000 - Net cash used in investing activities (27,888,112) (14,032,263) Financing Activities Contributions from Member 1,172,432 3,666,537 Distributions to Member (6,000,000) (22,334) Net cash provided by (used in) financing activities (4,827,568) 3,644,203 Net increase in cash and cash equivalents 2,206,500 4,553,291 Cash and cash equivalents at beginning of year 6,610,218 2,056,927 Cash and cash equivalents at end of year 8,816,718$ 6,610,218$ Supplemental Disclosure of Non-Cash Information Additions to crude oil and natural gas properties through accrued expenses 194,914$ 2,875,856$ Additions to asset retirement obligations 75,808$ 50,538$ Years Ended September 30, See Accompanying Notes to Consolidated Financial Statements 6

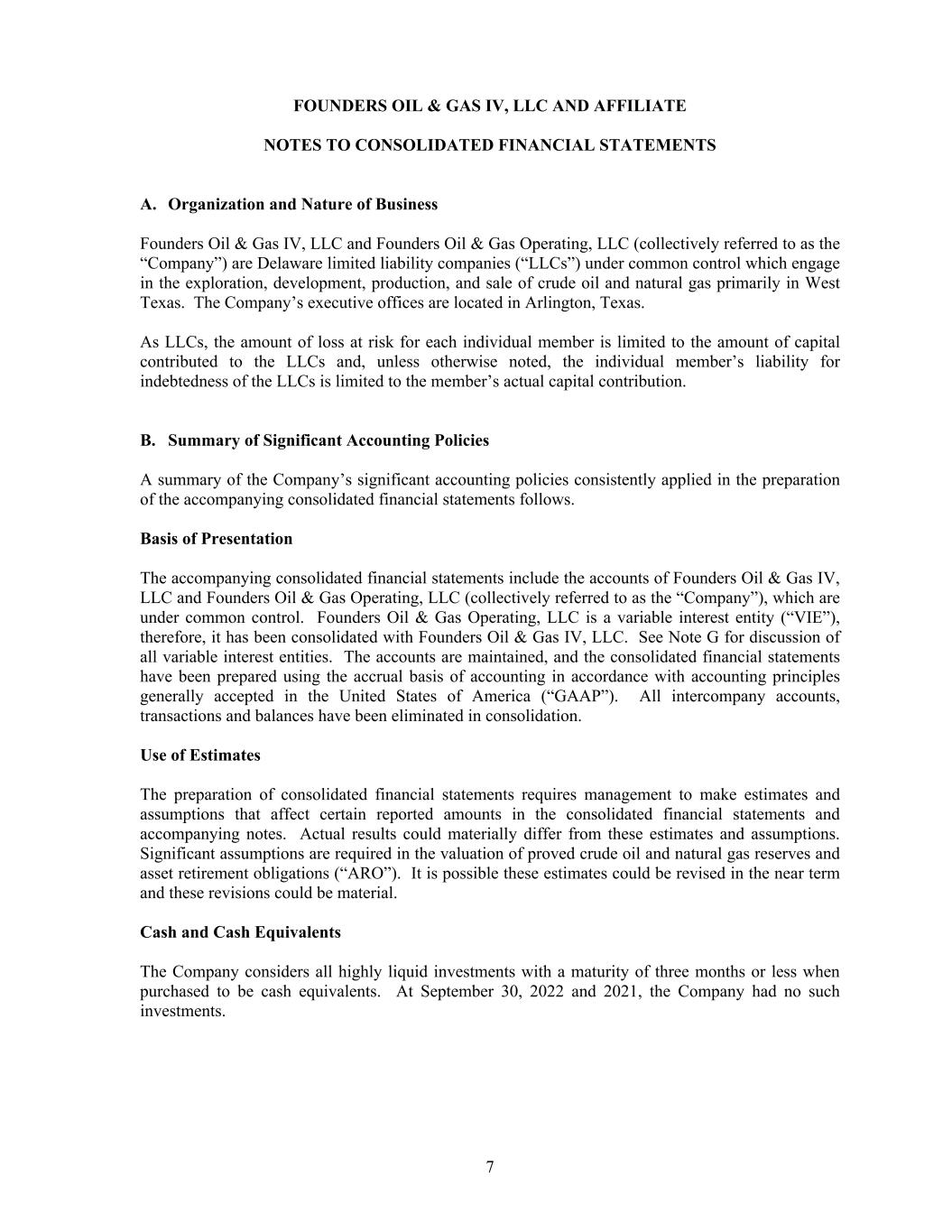

FOUNDERS OIL & GAS IV, LLC AND AFFILIATE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS 7 A. Organization and Nature of Business Founders Oil & Gas IV, LLC and Founders Oil & Gas Operating, LLC (collectively referred to as the “Company”) are Delaware limited liability companies (“LLCs”) under common control which engage in the exploration, development, production, and sale of crude oil and natural gas primarily in West Texas. The Company’s executive offices are located in Arlington, Texas. As LLCs, the amount of loss at risk for each individual member is limited to the amount of capital contributed to the LLCs and, unless otherwise noted, the individual member’s liability for indebtedness of the LLCs is limited to the member’s actual capital contribution. B. Summary of Significant Accounting Policies A summary of the Company’s significant accounting policies consistently applied in the preparation of the accompanying consolidated financial statements follows. Basis of Presentation The accompanying consolidated financial statements include the accounts of Founders Oil & Gas IV, LLC and Founders Oil & Gas Operating, LLC (collectively referred to as the “Company”), which are under common control. Founders Oil & Gas Operating, LLC is a variable interest entity (“VIE”), therefore, it has been consolidated with Founders Oil & Gas IV, LLC. See Note G for discussion of all variable interest entities. The accounts are maintained, and the consolidated financial statements have been prepared using the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America (“GAAP”). All intercompany accounts, transactions and balances have been eliminated in consolidation. Use of Estimates The preparation of consolidated financial statements requires management to make estimates and assumptions that affect certain reported amounts in the consolidated financial statements and accompanying notes. Actual results could materially differ from these estimates and assumptions. Significant assumptions are required in the valuation of proved crude oil and natural gas reserves and asset retirement obligations (“ARO”). It is possible these estimates could be revised in the near term and these revisions could be material. Cash and Cash Equivalents The Company considers all highly liquid investments with a maturity of three months or less when purchased to be cash equivalents. At September 30, 2022 and 2021, the Company had no such investments.

FOUNDERS OIL & GAS IV, LLC AND AFFILIATE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued) 8 B. Summary of Significant Accounting Policies – continued Crude Oil and Natural Gas Receivable Crude oil and natural gas accounts receivable are stated at amounts management expects to collect from outstanding balances. The Company’s crude oil and natural gas accounts receivable are due from purchasers of crude oil and natural gas. Crude oil and natural gas revenue receivables are generally unsecured. Receivables are considered past due if full payment is not received by the contractual due date. Past due accounts are generally written off against the allowance for doubtful accounts only after all collection attempts have been exhausted. As of September 30, 2022, and 2021, credit losses had not occurred and an allowance for doubtful accounts was not recorded. Concentrations of Credit Risk Financial instruments that potentially subject the Company to a concentration of credit risk consist principally of cash and accounts receivable. The Company maintains deposits primarily in one financial institution, which may at times exceed amounts covered by insurance provided by the U.S. Federal Deposit Insurance Corporation (“FDIC”). The Company has not experienced any losses related to amounts in excess of FDIC limits. The Company’s accounts receivable is due from either the purchasers of crude oil and natural gas or participants in crude oil and natural gas wells which the Company serves as the operator. Generally, operators of crude oil and natural gas properties have the right to offset future revenues against unpaid charges related to operated wells. The Company’s receivables from purchasers are generally unsecured; however, there have been no credit losses incurred to date. Crude oil and natural gas sales to two purchasers totaled approximately 99.9% of crude oil and natural gas revenues for 2022 and 2021. These significant customers’ accounts receivable balances totaled 100.0% of the total crude oil and natural gas receivable as of September 30, 2022 and September 30, 2021. Due to the nature of the markets for crude oil and natural gas, the Company does not believe the loss of any one purchaser would have a material adverse impact on the Company’s financial position, results of operations, or cash flows for any significant period of time. Inventory Inventory generally consists of finished goods purchased for the development of the crude oil and natural gas properties and are stated at the lower of cost or net realizable value.

FOUNDERS OIL & GAS IV, LLC AND AFFILIATE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued) 9 B. Summary of Significant Accounting Policies – continued Crude Oil and Natural Gas Properties The Company uses the successful efforts method of accounting to account for its crude oil and natural gas properties. Under this method, costs of acquiring properties, costs of drilling successful exploration wells, and development costs are capitalized. The costs of exploratory wells are initially capitalized pending a determination of whether proved reserves have been found. At the completion of drilling activities, the costs of exploratory wells remain capitalized if a determination is made that proved reserves have been found. If no proved reserves have been found, the costs of each of the related exploratory wells are charged to expense. In some cases, a determination of proved reserves cannot be made at the completion of drilling, requiring additional testing and evaluation of the wells. The timing of any write downs of these unproven properties, if warranted, depends upon the nature, timing, and extent of future exploration and development activities and their results. Exploration costs such as geological, geophysical, and seismic costs are expensed as incurred, unless such costs relate to seismic surveys to further develop a proven area and then, those costs are capitalized. As exploration and development work progresses and the reserves on these properties are proven, capitalized costs attributed to the properties are subject to depreciation and depletion. Depletion of capitalized costs is provided using the units-of-production method based on proved crude oil and natural gas reserves related to the specific crude oil and natural gas property. At September 30, 2022 and 2021, the Company’s crude oil and natural gas revenues come from wells with proven reserve estimates that were prepared by an independent engineering firm. On the sale or retirement of a complete or partial unit of a proved property and related facilities, the cost and related accumulated depreciation, depletion, and amortization are eliminated from the property accounts, and any gain or loss is recognized. Other Property and Equipment Other property and equipment are carried at cost. Major renewals and improvements are capitalized while expenditures for maintenance and repairs are expensed as incurred. Upon sale or abandonment, the cost of the equipment and related accumulated depreciation are removed from the accounts and any gain or loss is recognized. Depreciation is calculated using the straight-line method over the estimated useful lives of the various assets as follows: Buildings 20 years Equipment 3 to 5 years Vehicles 2 to 4 years

FOUNDERS OIL & GAS IV, LLC AND AFFILIATE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued) 10 B. Summary of Significant Accounting Policies – continued Long-Lived Assets The carrying value of the crude oil and natural gas properties, related facilities, and other property and equipment is periodically evaluated for impairment. GAAP requires long-lived assets and certain identifiable intangibles to be reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. When it is determined that the estimated future net cash flows of an asset will not be sufficient to recover its carrying amount, an impairment loss must be recorded to reduce the carrying amount to its estimated fair value. The Company evaluates impairment of proven and unproven crude oil and natural gas properties on a field-by-field basis. On this basis, certain fields may be impaired because they are not expected to recover their entire carrying value from future net cash flows. At September 30, 2022 and 2021, the Company owned just one single field and no associated impairment was identified. Asset Retirement Obligations The Company recognizes an asset retirement obligation for legal obligations associated with the retirement of the Company’s long-lived assets. Crude oil and natural gas producing companies incur such a liability upon acquiring or drilling a well. An asset retirement obligation is recorded as a liability at its estimated present value at the asset’s inception, with an offsetting increase to producing properties in the accompanying consolidated balance sheet which is allocated to expense over the useful life of the asset. Periodic accretion of the discount on asset retirement obligations is recorded as an expense in the accompanying consolidated statement of operations. See Note E. Revenue Recognition The Company recognizes revenue when control of the promised goods or services is transferred to customers at an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. Crude Oil Sales Sales under the Company’s oil contracts are generally considered performed when the Company sells oil production at the wellhead and receives an agreed-upon index price, net of any price differentials. The Company recognizes revenue when control transfers to the purchaser at the wellhead based on the price received.

FOUNDERS OIL & GAS IV, LLC AND AFFILIATE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued) 11 B. Summary of Significant Accounting Policies – continued Revenue Recognition - continued Natural Gas and Natural Gas Liquid (“NGL”) Sales The Company evaluated whether it was the principal or the agent in natural gas processing transactions and concluded that it is the principal when it has the ability to take-in-kind, which is the case in the majority of the Company’s gas processing and transportation contracts. Therefore, the Company recognizes natural gas and NGL revenue on a gross basis, and the related natural gas gathering, processing, and transportation costs associated with its take-in-kind arrangements are recorded as production costs in the consolidated statements of operations. Performance Obligations and Contract Balances The majority of the Company’s product sale commitments are short-term in nature with a contract term of one year or less. The Company typically satisfies its performance obligations upon transfer of control as described above and records the related revenue in the month production is delivered to the purchaser. Settlement statements for sales of oil, NGL, and natural gas may not be received for 30 to 60 days after the date the volumes are delivered and, as a result, the Company is required to estimate the amount of volumes delivered to the purchaser and the price that will be received for the sale of the product. The Company records the differences between estimates and the actual amounts received for product sales in the month that payment is received from the purchaser. Historically, differences between the Company’s revenue estimates and actual revenue received have not been significant. The crude oil and natural gas receivable balance as of September 30, 2020 was $974,514. Fair Value Measurement GAAP defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date and establishes a three-tier hierarchy that is used to identify assets and liabilities measured at fair value. The hierarchy focuses on the inputs used to measure fair value and requires that the lowest level input be used. The three levels defined are as follows: Level 1 — observable inputs that are based upon quoted market prices for identical assets or liabilities within active markets. Level 2 — observable inputs other than Level 1 that are based upon quoted market prices for similar assets or liabilities, based upon quoted prices within inactive markets, or inputs other than quoted market prices that are observable through market data for substantially the full term of the asset or liability. Level 3 — inputs that are unobservable for the particular asset or liability due to little or no market activity and are significant to the fair value of the asset or liability. These inputs reflect assumptions that market participants would use when valuing the particular asset or liability.

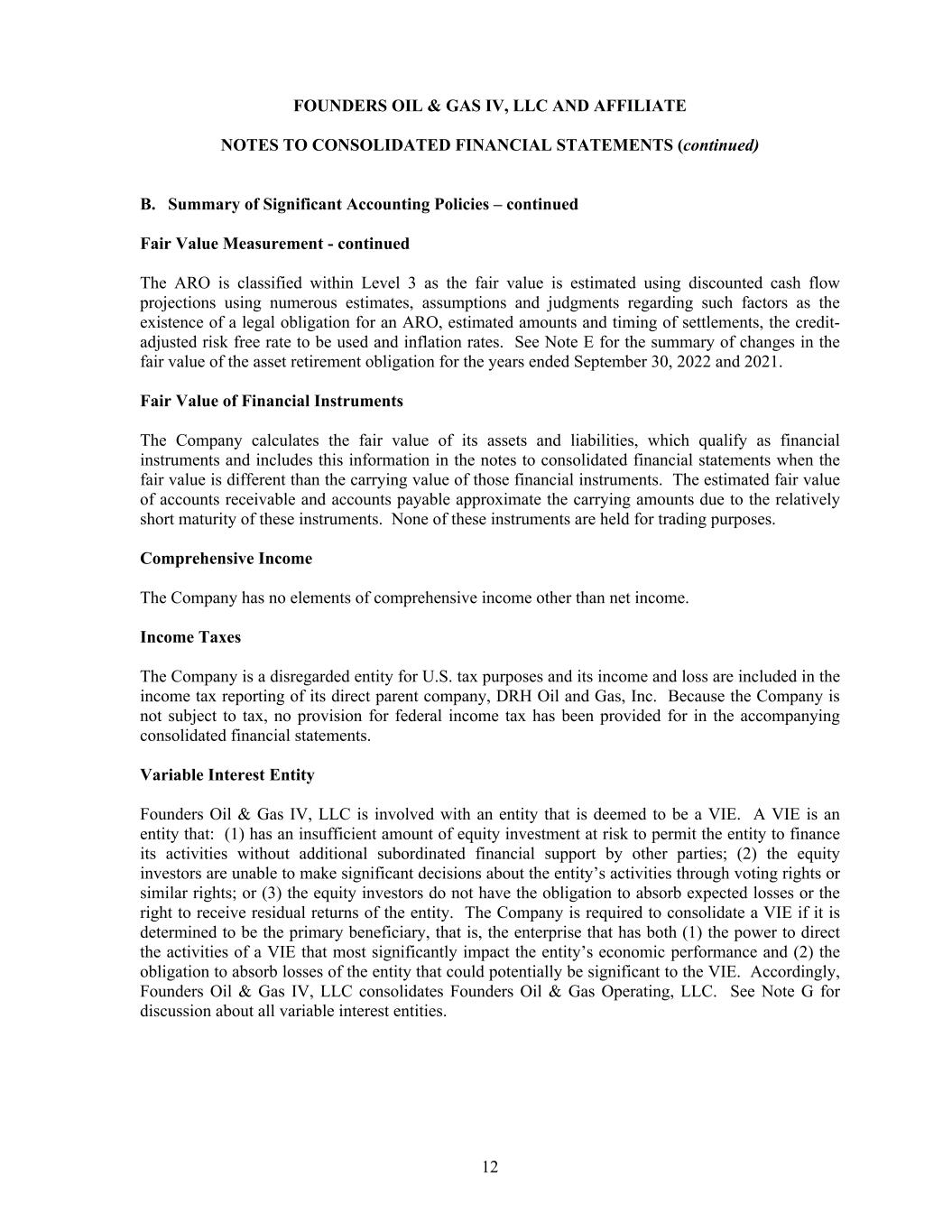

FOUNDERS OIL & GAS IV, LLC AND AFFILIATE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued) 12 B. Summary of Significant Accounting Policies – continued Fair Value Measurement - continued The ARO is classified within Level 3 as the fair value is estimated using discounted cash flow projections using numerous estimates, assumptions and judgments regarding such factors as the existence of a legal obligation for an ARO, estimated amounts and timing of settlements, the credit- adjusted risk free rate to be used and inflation rates. See Note E for the summary of changes in the fair value of the asset retirement obligation for the years ended September 30, 2022 and 2021. Fair Value of Financial Instruments The Company calculates the fair value of its assets and liabilities, which qualify as financial instruments and includes this information in the notes to consolidated financial statements when the fair value is different than the carrying value of those financial instruments. The estimated fair value of accounts receivable and accounts payable approximate the carrying amounts due to the relatively short maturity of these instruments. None of these instruments are held for trading purposes. Comprehensive Income The Company has no elements of comprehensive income other than net income. Income Taxes The Company is a disregarded entity for U.S. tax purposes and its income and loss are included in the income tax reporting of its direct parent company, DRH Oil and Gas, Inc. Because the Company is not subject to tax, no provision for federal income tax has been provided for in the accompanying consolidated financial statements. Variable Interest Entity Founders Oil & Gas IV, LLC is involved with an entity that is deemed to be a VIE. A VIE is an entity that: (1) has an insufficient amount of equity investment at risk to permit the entity to finance its activities without additional subordinated financial support by other parties; (2) the equity investors are unable to make significant decisions about the entity’s activities through voting rights or similar rights; or (3) the equity investors do not have the obligation to absorb expected losses or the right to receive residual returns of the entity. The Company is required to consolidate a VIE if it is determined to be the primary beneficiary, that is, the enterprise that has both (1) the power to direct the activities of a VIE that most significantly impact the entity’s economic performance and (2) the obligation to absorb losses of the entity that could potentially be significant to the VIE. Accordingly, Founders Oil & Gas IV, LLC consolidates Founders Oil & Gas Operating, LLC. See Note G for discussion about all variable interest entities.

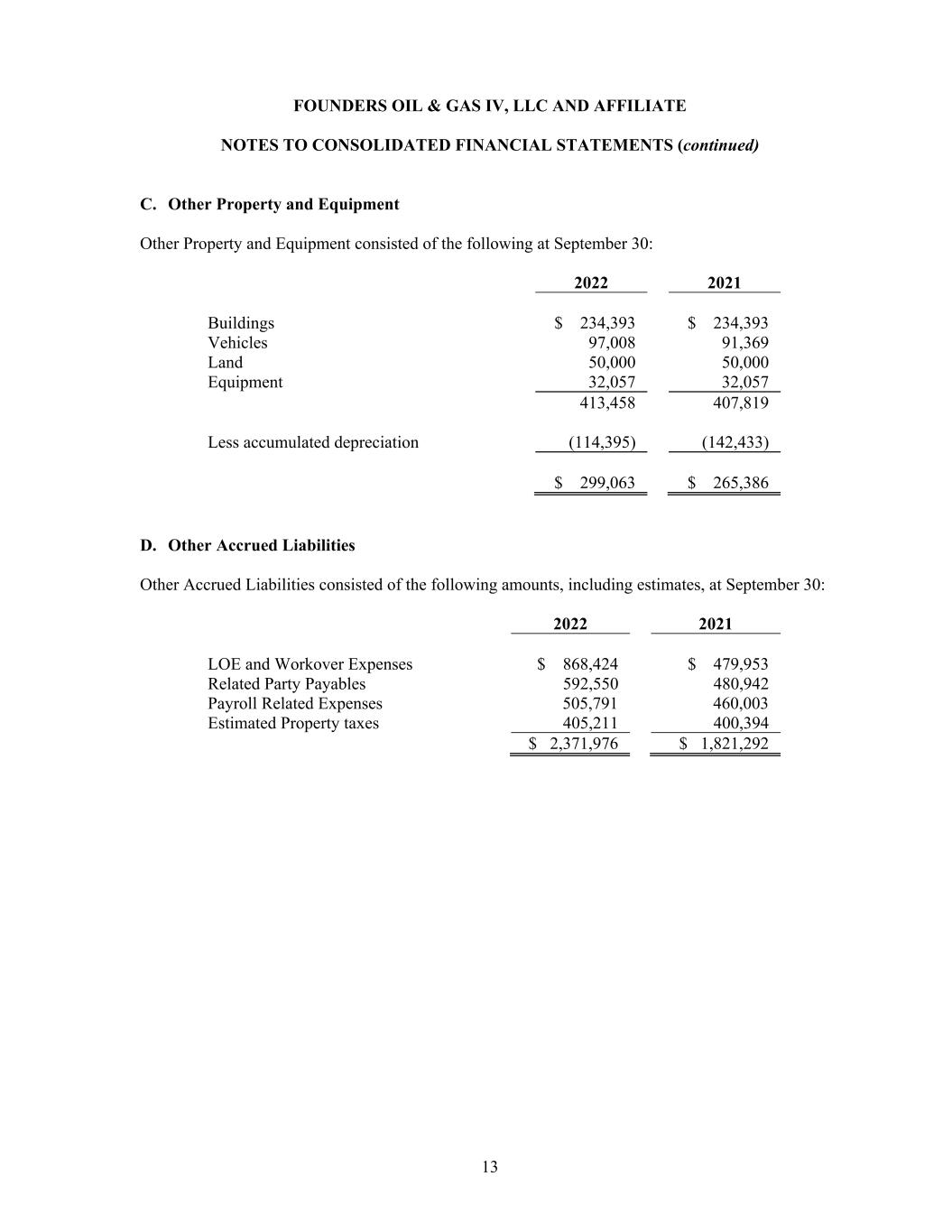

FOUNDERS OIL & GAS IV, LLC AND AFFILIATE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued) 13 C. Other Property and Equipment Other Property and Equipment consisted of the following at September 30: 2022 2021 Buildings $ 234,393 $ 234,393 Vehicles 97,008 91,369 Land 50,000 50,000 Equipment 32,057 32,057 413,458 407,819 Less accumulated depreciation (114,395) (142,433) $ 299,063 $ 265,386 D. Other Accrued Liabilities Other Accrued Liabilities consisted of the following amounts, including estimates, at September 30: 2022 2021 LOE and Workover Expenses $ 868,424 $ 479,953 Related Party Payables 592,550 480,942 Payroll Related Expenses 505,791 460,003 Estimated Property taxes 405,211 400,394 $ 2,371,976 $ 1,821,292

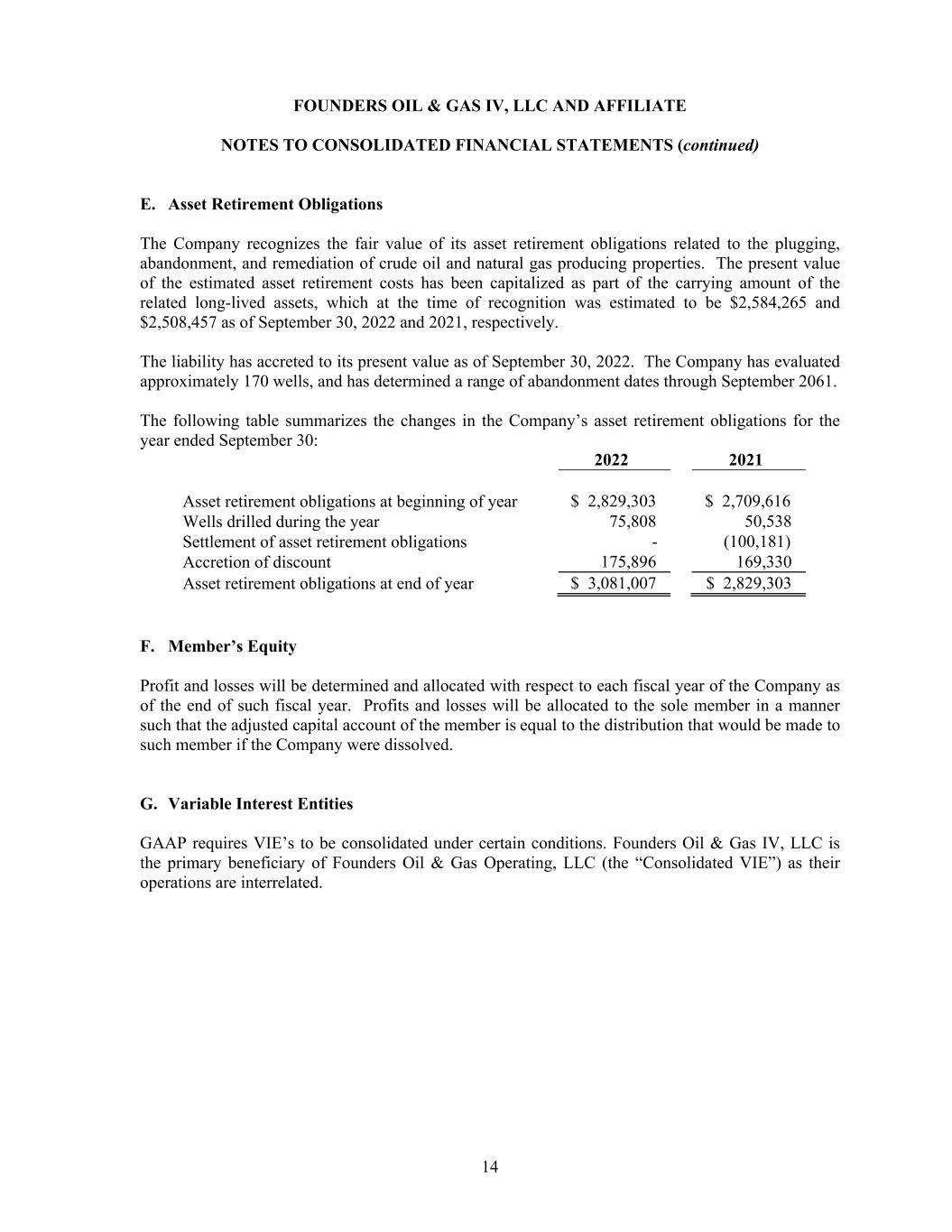

FOUNDERS OIL & GAS IV, LLC AND AFFILIATE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued) 14 E. Asset Retirement Obligations The Company recognizes the fair value of its asset retirement obligations related to the plugging, abandonment, and remediation of crude oil and natural gas producing properties. The present value of the estimated asset retirement costs has been capitalized as part of the carrying amount of the related long-lived assets, which at the time of recognition was estimated to be $2,584,265 and $2,508,457 as of September 30, 2022 and 2021, respectively. The liability has accreted to its present value as of September 30, 2022. The Company has evaluated approximately 170 wells, and has determined a range of abandonment dates through September 2061. The following table summarizes the changes in the Company’s asset retirement obligations for the year ended September 30: 2022 2021 Asset retirement obligations at beginning of year $ 2,829,303 $ 2,709,616 Wells drilled during the year 75,808 50,538 Settlement of asset retirement obligations - (100,181) Accretion of discount 175,896 169,330 Asset retirement obligations at end of year $ 3,081,007 $ 2,829,303 F. Member’s Equity Profit and losses will be determined and allocated with respect to each fiscal year of the Company as of the end of such fiscal year. Profits and losses will be allocated to the sole member in a manner such that the adjusted capital account of the member is equal to the distribution that would be made to such member if the Company were dissolved. G. Variable Interest Entities GAAP requires VIE’s to be consolidated under certain conditions. Founders Oil & Gas IV, LLC is the primary beneficiary of Founders Oil & Gas Operating, LLC (the “Consolidated VIE”) as their operations are interrelated.

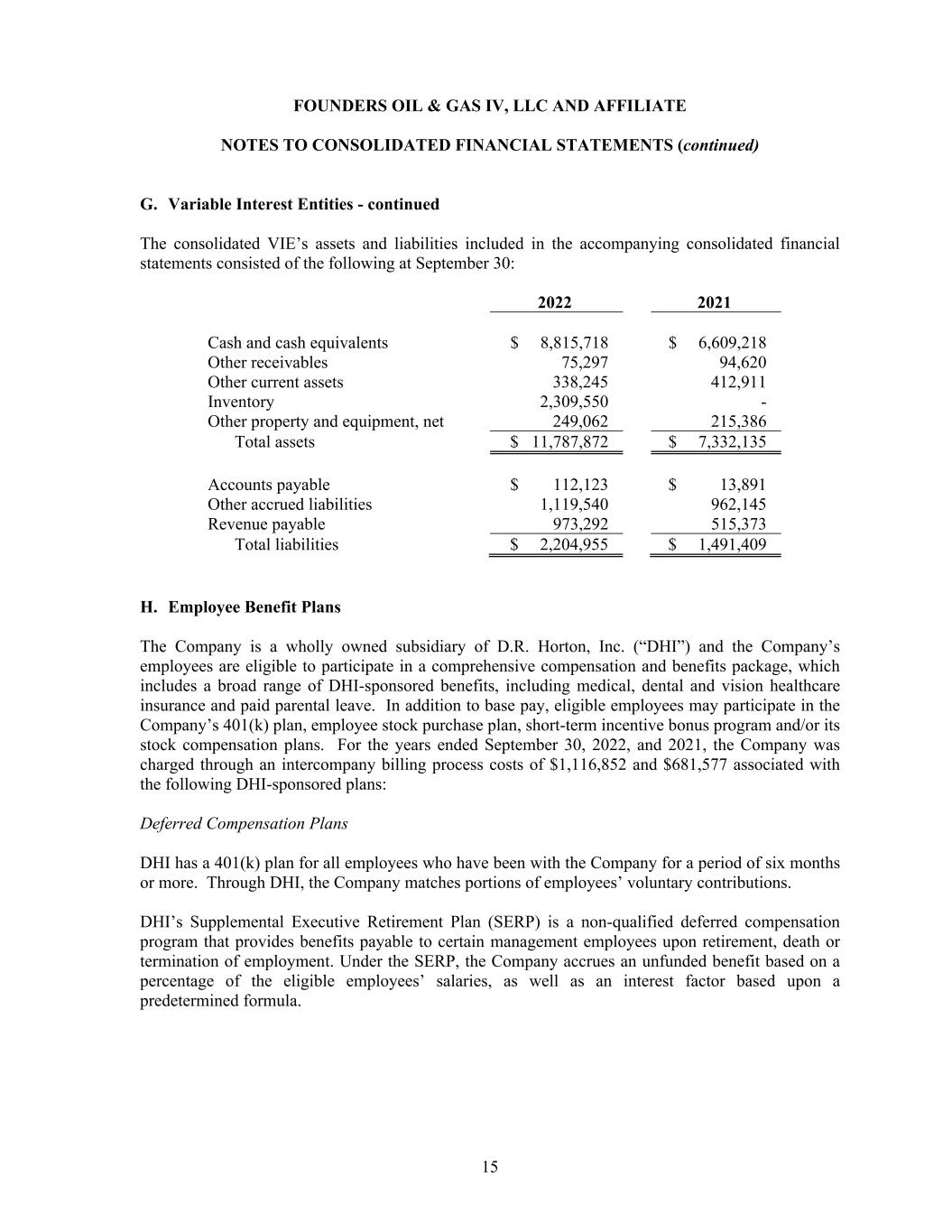

FOUNDERS OIL & GAS IV, LLC AND AFFILIATE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued) 15 G. Variable Interest Entities - continued The consolidated VIE’s assets and liabilities included in the accompanying consolidated financial statements consisted of the following at September 30: 2022 2021 Cash and cash equivalents $ 8,815,718 $ 6,609,218 Other receivables 75,297 94,620 Other current assets 338,245 412,911 Inventory 2,309,550 - Other property and equipment, net 249,062 215,386 Total assets $ 11,787,872 $ 7,332,135 Accounts payable $ 112,123 $ 13,891 Other accrued liabilities 1,119,540 962,145 Revenue payable 973,292 515,373 Total liabilities $ 2,204,955 $ 1,491,409 H. Employee Benefit Plans The Company is a wholly owned subsidiary of D.R. Horton, Inc. (“DHI”) and the Company’s employees are eligible to participate in a comprehensive compensation and benefits package, which includes a broad range of DHI-sponsored benefits, including medical, dental and vision healthcare insurance and paid parental leave. In addition to base pay, eligible employees may participate in the Company’s 401(k) plan, employee stock purchase plan, short-term incentive bonus program and/or its stock compensation plans. For the years ended September 30, 2022, and 2021, the Company was charged through an intercompany billing process costs of $1,116,852 and $681,577 associated with the following DHI-sponsored plans: Deferred Compensation Plans DHI has a 401(k) plan for all employees who have been with the Company for a period of six months or more. Through DHI, the Company matches portions of employees’ voluntary contributions. DHI’s Supplemental Executive Retirement Plan (SERP) is a non-qualified deferred compensation program that provides benefits payable to certain management employees upon retirement, death or termination of employment. Under the SERP, the Company accrues an unfunded benefit based on a percentage of the eligible employees’ salaries, as well as an interest factor based upon a predetermined formula.

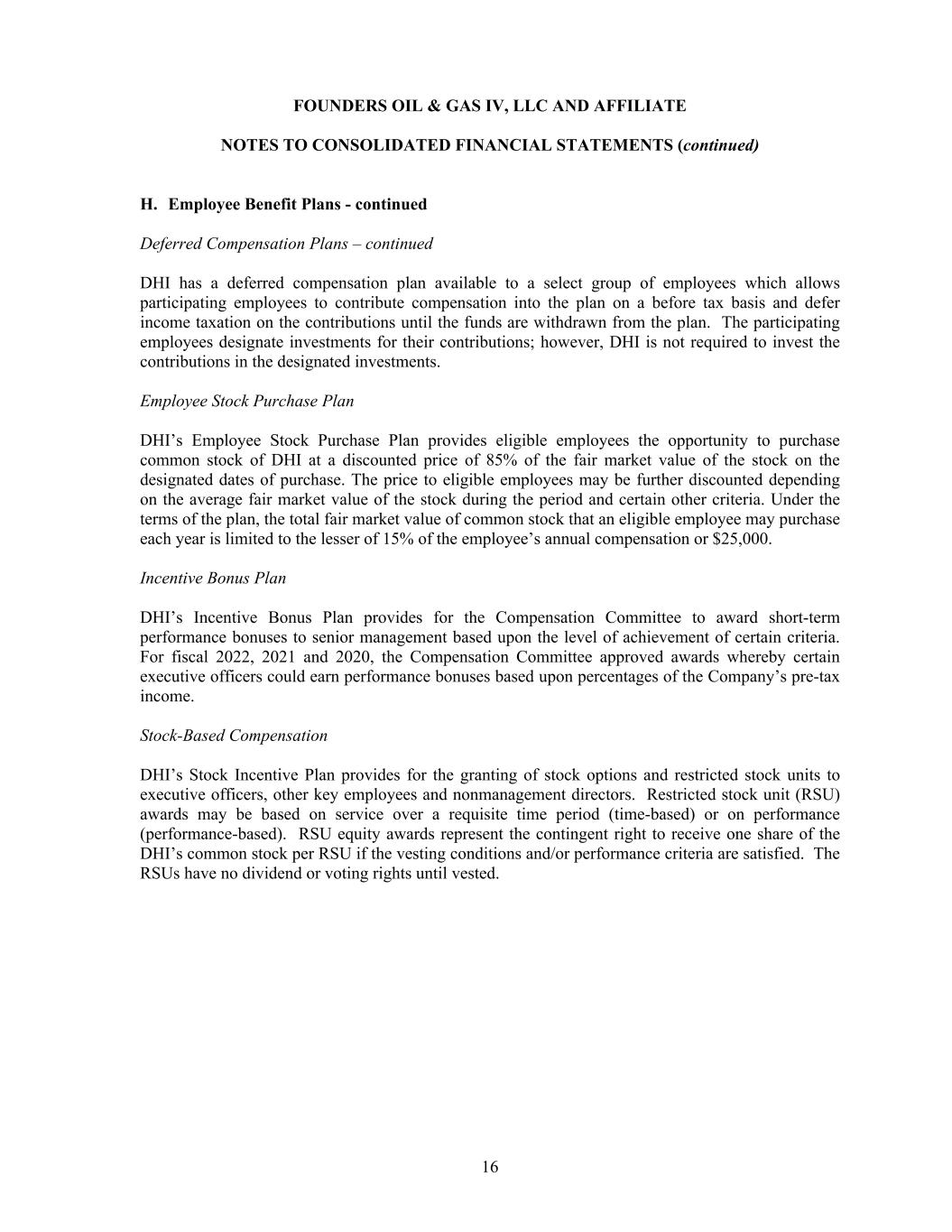

FOUNDERS OIL & GAS IV, LLC AND AFFILIATE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued) 16 H. Employee Benefit Plans - continued Deferred Compensation Plans – continued DHI has a deferred compensation plan available to a select group of employees which allows participating employees to contribute compensation into the plan on a before tax basis and defer income taxation on the contributions until the funds are withdrawn from the plan. The participating employees designate investments for their contributions; however, DHI is not required to invest the contributions in the designated investments. Employee Stock Purchase Plan DHI’s Employee Stock Purchase Plan provides eligible employees the opportunity to purchase common stock of DHI at a discounted price of 85% of the fair market value of the stock on the designated dates of purchase. The price to eligible employees may be further discounted depending on the average fair market value of the stock during the period and certain other criteria. Under the terms of the plan, the total fair market value of common stock that an eligible employee may purchase each year is limited to the lesser of 15% of the employee’s annual compensation or $25,000. Incentive Bonus Plan DHI’s Incentive Bonus Plan provides for the Compensation Committee to award short-term performance bonuses to senior management based upon the level of achievement of certain criteria. For fiscal 2022, 2021 and 2020, the Compensation Committee approved awards whereby certain executive officers could earn performance bonuses based upon percentages of the Company’s pre-tax income. Stock-Based Compensation DHI’s Stock Incentive Plan provides for the granting of stock options and restricted stock units to executive officers, other key employees and nonmanagement directors. Restricted stock unit (RSU) awards may be based on service over a requisite time period (time-based) or on performance (performance-based). RSU equity awards represent the contingent right to receive one share of the DHI’s common stock per RSU if the vesting conditions and/or performance criteria are satisfied. The RSUs have no dividend or voting rights until vested.

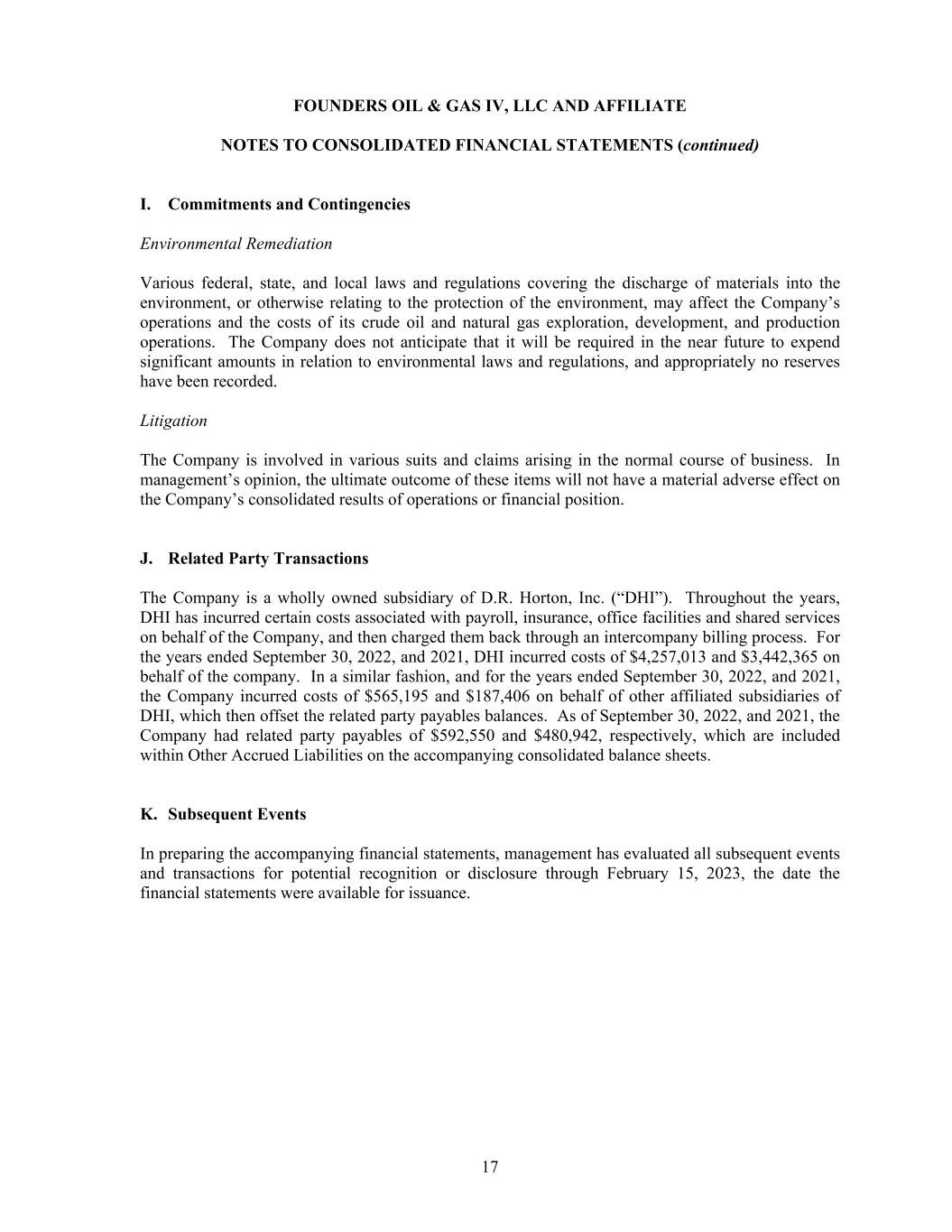

FOUNDERS OIL & GAS IV, LLC AND AFFILIATE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued) 17 I. Commitments and Contingencies Environmental Remediation Various federal, state, and local laws and regulations covering the discharge of materials into the environment, or otherwise relating to the protection of the environment, may affect the Company’s operations and the costs of its crude oil and natural gas exploration, development, and production operations. The Company does not anticipate that it will be required in the near future to expend significant amounts in relation to environmental laws and regulations, and appropriately no reserves have been recorded. Litigation The Company is involved in various suits and claims arising in the normal course of business. In management’s opinion, the ultimate outcome of these items will not have a material adverse effect on the Company’s consolidated results of operations or financial position. J. Related Party Transactions The Company is a wholly owned subsidiary of D.R. Horton, Inc. (“DHI”). Throughout the years, DHI has incurred certain costs associated with payroll, insurance, office facilities and shared services on behalf of the Company, and then charged them back through an intercompany billing process. For the years ended September 30, 2022, and 2021, DHI incurred costs of $4,257,013 and $3,442,365 on behalf of the company. In a similar fashion, and for the years ended September 30, 2022, and 2021, the Company incurred costs of $565,195 and $187,406 on behalf of other affiliated subsidiaries of DHI, which then offset the related party payables balances. As of September 30, 2022, and 2021, the Company had related party payables of $592,550 and $480,942, respectively, which are included within Other Accrued Liabilities on the accompanying consolidated balance sheets. K. Subsequent Events In preparing the accompanying financial statements, management has evaluated all subsequent events and transactions for potential recognition or disclosure through February 15, 2023, the date the financial statements were available for issuance.

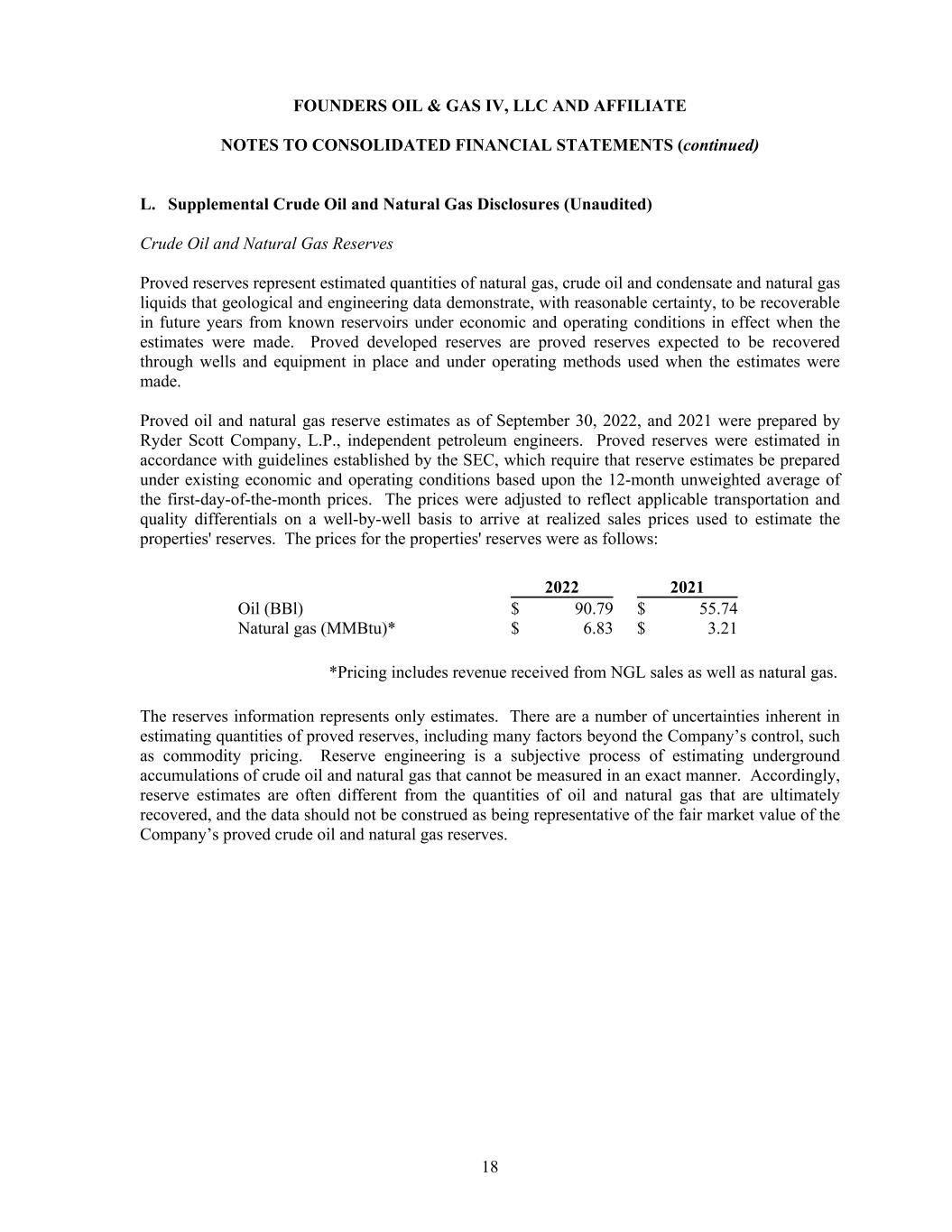

FOUNDERS OIL & GAS IV, LLC AND AFFILIATE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued) 18 L. Supplemental Crude Oil and Natural Gas Disclosures (Unaudited) Crude Oil and Natural Gas Reserves Proved reserves represent estimated quantities of natural gas, crude oil and condensate and natural gas liquids that geological and engineering data demonstrate, with reasonable certainty, to be recoverable in future years from known reservoirs under economic and operating conditions in effect when the estimates were made. Proved developed reserves are proved reserves expected to be recovered through wells and equipment in place and under operating methods used when the estimates were made. Proved oil and natural gas reserve estimates as of September 30, 2022, and 2021 were prepared by Ryder Scott Company, L.P., independent petroleum engineers. Proved reserves were estimated in accordance with guidelines established by the SEC, which require that reserve estimates be prepared under existing economic and operating conditions based upon the 12-month unweighted average of the first-day-of-the-month prices. The prices were adjusted to reflect applicable transportation and quality differentials on a well-by-well basis to arrive at realized sales prices used to estimate the properties' reserves. The prices for the properties' reserves were as follows: 2022 2021 Oil (BBl) $ 90.79 $ 55.74 Natural gas (MMBtu)* $ 6.83 $ 3.21 *Pricing includes revenue received from NGL sales as well as natural gas. The reserves information represents only estimates. There are a number of uncertainties inherent in estimating quantities of proved reserves, including many factors beyond the Company’s control, such as commodity pricing. Reserve engineering is a subjective process of estimating underground accumulations of crude oil and natural gas that cannot be measured in an exact manner. Accordingly, reserve estimates are often different from the quantities of oil and natural gas that are ultimately recovered, and the data should not be construed as being representative of the fair market value of the Company’s proved crude oil and natural gas reserves.

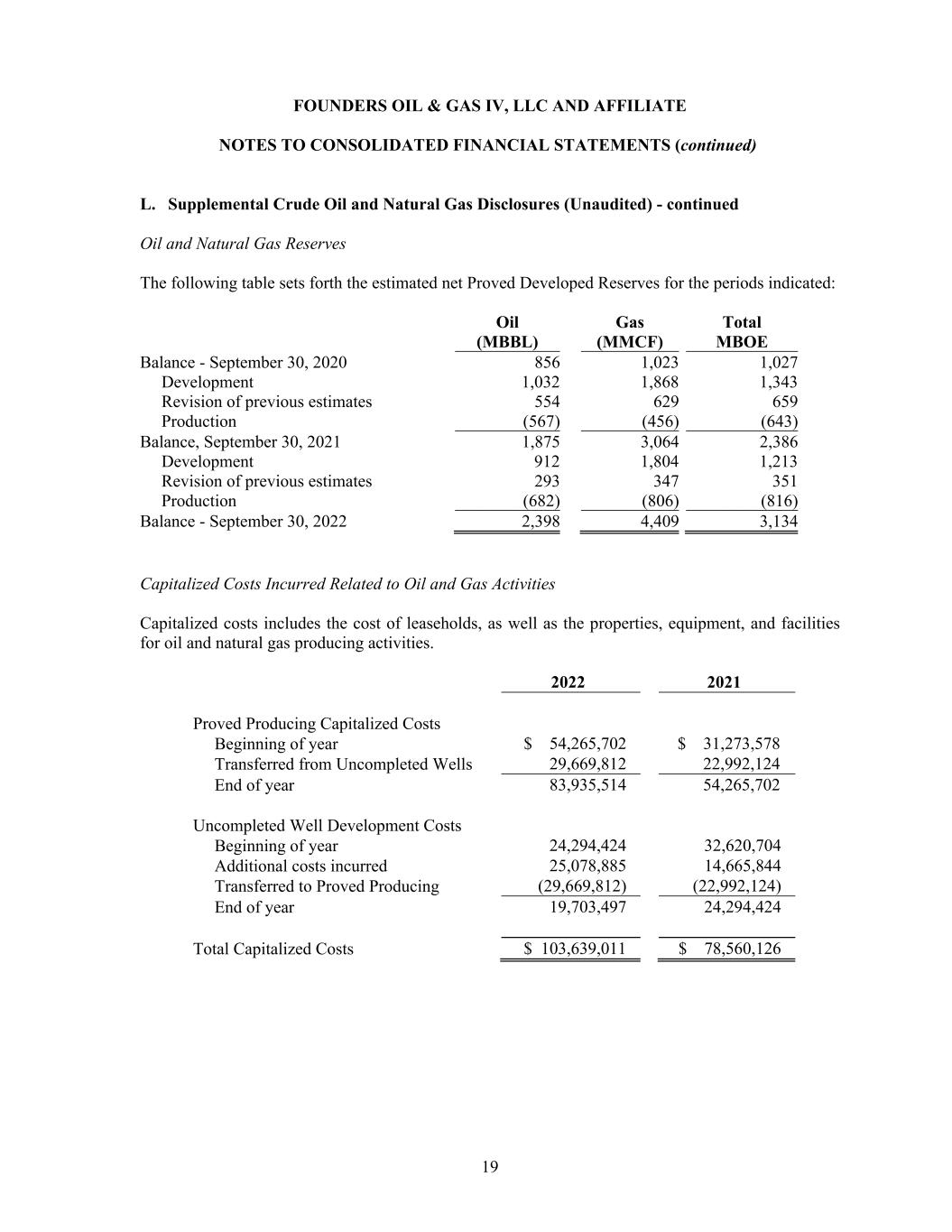

19 FOUNDERS OIL & GAS IV, LLC AND AFFILIATE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued) L. Supplemental Crude Oil and Natural Gas Disclosures (Unaudited) - continued Oil and Natural Gas Reserves The following table sets forth the estimated net Proved Developed Reserves for the periods indicated: Oil (MBBL) Gas (MMCF) Total MBOE Balance - September 30, 2020 856 1,023 1,027 Development 1,032 1,868 1,343 Revision of previous estimates 554 629 659 Production (567) (456) (643) Balance, September 30, 2021 1,875 3,064 2,386 Development 912 1,804 1,213 Revision of previous estimates 293 347 351 Production (682) (806) (816) Balance - September 30, 2022 2,398 4,409 3,134 Capitalized Costs Incurred Related to Oil and Gas Activities Capitalized costs includes the cost of leaseholds, as well as the properties, equipment, and facilities for oil and natural gas producing activities. 2022 2021 Proved Producing Capitalized Costs Beginning of year $ 54,265,702 $ 31,273,578 Transferred from Uncompleted Wells 29,669,812 22,992,124 End of year 83,935,514 54,265,702 Uncompleted Well Development Costs Beginning of year 24,294,424 32,620,704 Additional costs incurred 25,078,885 14,665,844 Transferred to Proved Producing (29,669,812) (22,992,124) End of year 19,703,497 24,294,424 Total Capitalized Costs $ 103,639,011 $ 78,560,126

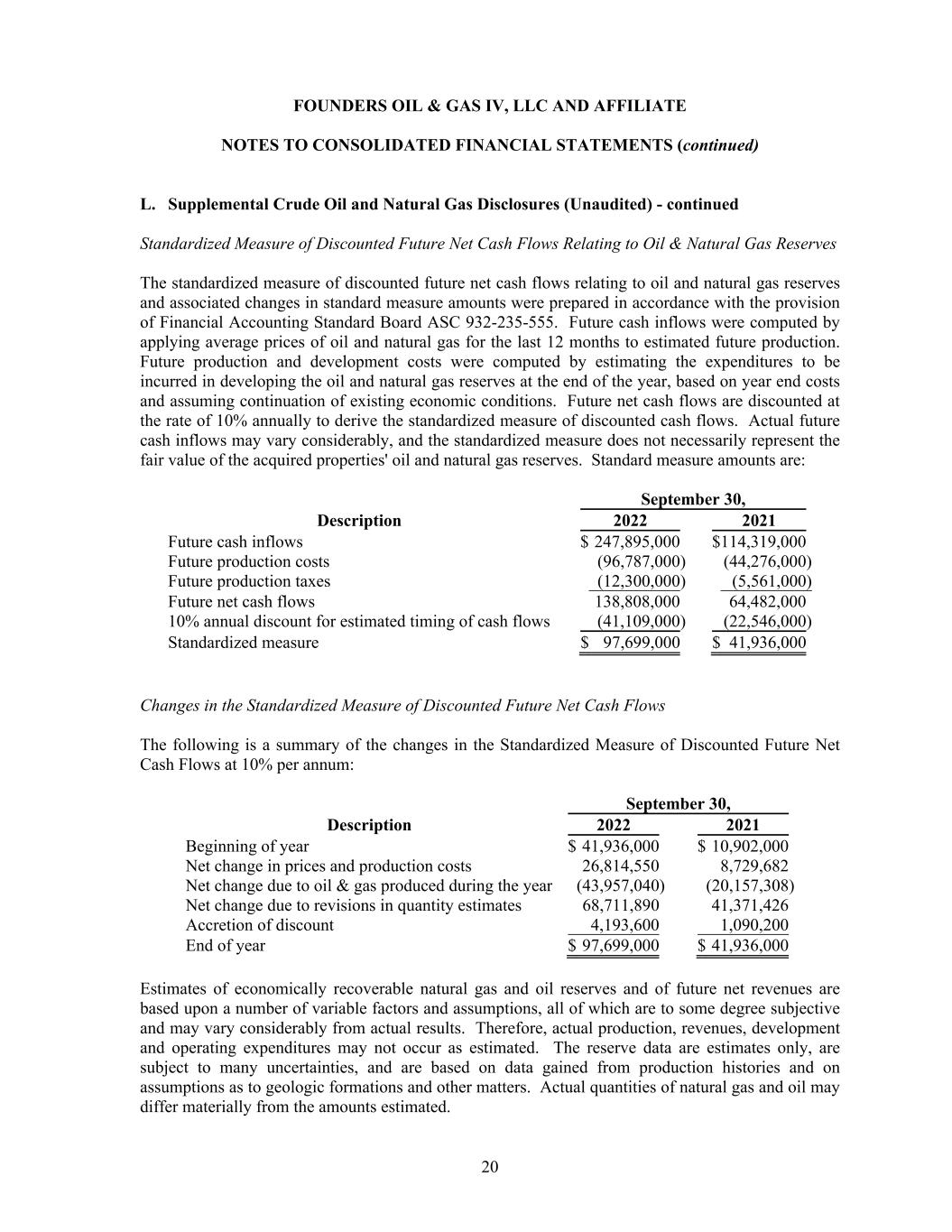

20 FOUNDERS OIL & GAS IV, LLC AND AFFILIATE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued) L. Supplemental Crude Oil and Natural Gas Disclosures (Unaudited) - continued Standardized Measure of Discounted Future Net Cash Flows Relating to Oil & Natural Gas Reserves The standardized measure of discounted future net cash flows relating to oil and natural gas reserves and associated changes in standard measure amounts were prepared in accordance with the provision of Financial Accounting Standard Board ASC 932-235-555. Future cash inflows were computed by applying average prices of oil and natural gas for the last 12 months to estimated future production. Future production and development costs were computed by estimating the expenditures to be incurred in developing the oil and natural gas reserves at the end of the year, based on year end costs and assuming continuation of existing economic conditions. Future net cash flows are discounted at the rate of 10% annually to derive the standardized measure of discounted cash flows. Actual future cash inflows may vary considerably, and the standardized measure does not necessarily represent the fair value of the acquired properties' oil and natural gas reserves. Standard measure amounts are: September 30, Description 2022 2021 Future cash inflows $ 247,895,000 $114,319,000 Future production costs (96,787,000 ) (44,276,000) Future production taxes (12,300,000 ) (5,561,000) Future net cash flows 138,808,000 64,482,000 10% annual discount for estimated timing of cash flows (41,109,000 ) (22,546,000) Standardized measure $ 97,699,000 $ 41,936,000 Changes in the Standardized Measure of Discounted Future Net Cash Flows The following is a summary of the changes in the Standardized Measure of Discounted Future Net Cash Flows at 10% per annum: September 30, Description 2022 2021 Beginning of year $ 41,936,000 $ 10,902,000 Net change in prices and production costs 26,814,550 8,729,682 Net change due to oil & gas produced during the year (43,957,040) (20,157,308) Net change due to revisions in quantity estimates 68,711,890 41,371,426 Accretion of discount 4,193,600 1,090,200 End of year $ 97,699,000 $ 41,936,000 Estimates of economically recoverable natural gas and oil reserves and of future net revenues are based upon a number of variable factors and assumptions, all of which are to some degree subjective and may vary considerably from actual results. Therefore, actual production, revenues, development and operating expenditures may not occur as estimated. The reserve data are estimates only, are subject to many uncertainties, and are based on data gained from production histories and on assumptions as to geologic formations and other matters. Actual quantities of natural gas and oil may differ materially from the amounts estimated.