www.ringenergy.com NYSE American: REI VALUE FOCUSED PROVEN STRATEGY

www.ringenergy.com NYSE American: REI Forward-Looking Statements and Cautionary Note Regarding Hydrocarbon Disclosures Forward –Looking Statements This Presentation includes "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of strictly historical facts included in this Presentation constitute forward-looking statements and may often, but not always, be identified by the use of such words as “may,” “will,” “should,” “could,” “intends,” “estimates,” “expects,” “anticipates,” “plans,” “project,” “guidance,” “target,” “potential,” “possible,” “probably,” and “believes” or the negative variations thereof or comparable terminology. These forward-looking statements include statements regarding the expected benefits to the Company and its stockholders from the acquisition of oil and gas properties (the “Stronghold Acquisition”) from Stronghold Energy II Operating, LLC and its affiliates; and the Company's financial position, future revenues, net income, potential evaluations, business strategy and plans and objectives for future operations. Forward-looking statements are subject to numerous assumptions, risks and uncertainties that may cause actual results to be materially different than any future results expressed or implied in those statements. However, whether actual results and developments will conform to expectations is subject to a number of material risks and uncertainties, including but not limited to: the Company’s ability to successfully integrate the oil and gas properties acquired in the Stronghold Acquisition; declines in oil, natural gas liquids or natural gas prices; the level of success in exploration, development and production activities; the timing of exploration and development expenditures; inaccuracies of reserve estimates or assumptions underlying them; revisions to reserve estimates as a result of changes in commodity prices or production history; impacts to financial statements as a result of impairment write-downs; risks related to the level of indebtedness and periodic redeterminations of the borrowing base under the Company’s credit facility; the impacts of hedging on results of operations; the Company’s ability to replace oil and natural gas reserves; any loss of senior management or technical personnel; and the direct and indirect impact on most or all of the foregoing due to the COVID-19 pandemic or future variants. Some of the factors that could cause actual results to differ materially from expected results are described under “Risk Factors” in our 2022 annual report on Form 10-K filed with the U.S. Securities and Exchange Commission (“SEC”) on March 9, 2023 and the Company’s other SEC filings. Although the Company believes that the assumptions upon which such forward-looking statements are based are reasonable, it can give no assurance that such assumptions will prove to be correct. All forward-looking statements in this Presentation are expressly qualified by the cautionary statements and by reference to the underlying assumptions that may prove to be incorrect. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date hereof, except as required by applicable law. The financial and operating estimates contained in this Presentation represent our reasonable estimates as of the date of this Presentation. Neither our independent auditors nor any other third party has examined, reviewed or compiled the projections and, accordingly, none of the foregoing expresses an opinion or other form of assurance with respect thereto. The assumptions upon which the projections are based are described in more detail herein. Some of these assumptions inevitably will not materialize, and unanticipated events may occur that could affect our results. Therefore, our actual results achieved during the periods covered by the estimates will vary from the projected results. Prospective investors are cautioned not to place undue reliance on the estimates included herein. Supplemental Non-GAAP Financial Measures This Presentation includes financial measures that are not in accordance with accounting principles generally accepted in the United States (“GAAP”), such as “Adjusted Net Income,” “Adjusted EBITDA,” “PV-10,” “Free Cash Flow,” or “FCF,” “Cash Flow from Operations,” “Return on Capital Employed” or “ROCE”, “Liquidity” and “Leverage Ratio.” While management believes that such measures are useful for investors, they should not be used as a replacement for financial measures that are in accordance with GAAP. For definitions of such non-GAAP financial measures and their reconciliations to GAAP measures, please see the Appendix. 2

www.ringenergy.com NYSE American: REI Value Focused Proven Strategy Supporting Sustainable Returns KEY TAKEAWAYS Added Size & Scale - accretive acquisition of Stronghold assets Two full quarters with new assets under management which have led to record Net sales production of over 18,000 Boepd Continue to Deliver Record Results1 - cash flow from operations and Adj. EBITDA Q1 2023 increased 53% & 65% respectively over Q1 2022 Consistently Generating Free Cash Flow1 - for more than 3 years Company has generated FCF for 14 consecutive quarters, 2022 year-over-year increase of 70% Focused on Improving Balance Sheet - reduced leverage ratio2 and maintained strong liquidity Q1 2023 leverage ratio decreased over 1 full turn to ~1.65x as compared to Q1 2022. Maintained strong liquidity of $179.0 million Increased Proved Reserves3 to 138.1 million barrels of oil equivalent 2022 year-over-year increase of 78% Continue Value Focused Proven Strategy…creating sustainable returns to shareholders Goal and strategy to position Company to return capital to shareholders Focused On Delivering Competitive And Sustainable Returns By Developing, Acquiring, Exploring For, And Commercializing Oil And Natural Gas Resources Vital To The World’s Health And Welfare 1. Adjusted EBITDA, Free Cash Flow and Cash Flow from Operations are Non-GAAP financial measures. See Appendix for reconciliation to GAAP measures 2. Leverage ratio based on annualized third and fourth quarter 2022 and first quarter 2023 EBITDA adjusted for the pro-forma effects of the Stronghold Transaction, as per our credit agreement 3. Reserves as of 1/1/23 utilizing SEC prices, YE 2022 SEC Pricing Oil $90.15 per bbl and Gas $6.358 per Mcf 3

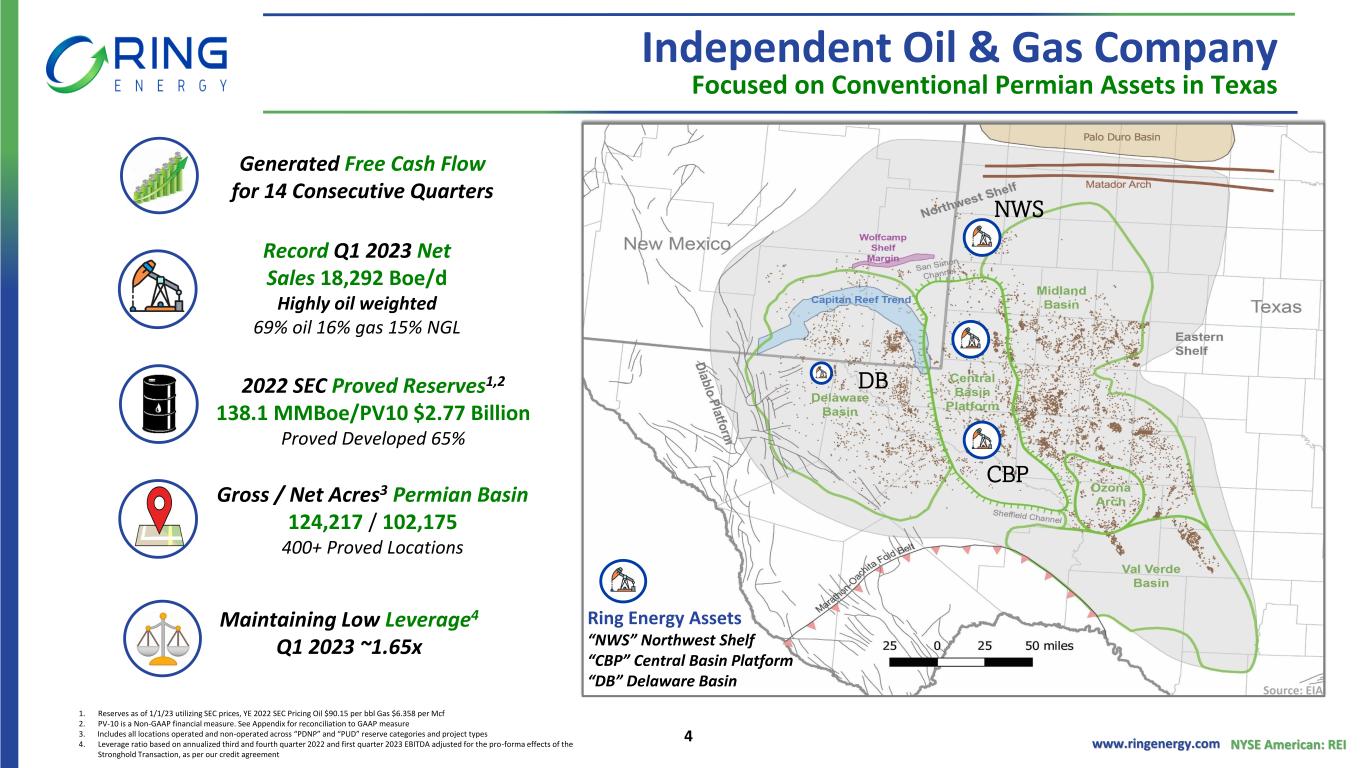

www.ringenergy.com NYSE American: REI Independent Oil & Gas Company Focused on Conventional Permian Assets in Texas 2022 SEC Proved Reserves1,2 138.1 MMBoe/PV10 $2.77 Billion Proved Developed 65% Gross / Net Acres3 Permian Basin 124,217 / 102,175 400+ Proved Locations Generated Free Cash Flow for 14 Consecutive Quarters Record Q1 2023 Net Sales 18,292 Boe/d Highly oil weighted 69% oil 16% gas 15% NGL Maintaining Low Leverage4 Q1 2023 ~1.65x 1. Reserves as of 1/1/23 utilizing SEC prices, YE 2022 SEC Pricing Oil $90.15 per bbl Gas $6.358 per Mcf 2. PV-10 is a Non-GAAP financial measure. See Appendix for reconciliation to GAAP measure 3. Includes all locations operated and non-operated across “PDNP” and “PUD” reserve categories and project types 4. Leverage ratio based on annualized third and fourth quarter 2022 and first quarter 2023 EBITDA adjusted for the pro-forma effects of the Stronghold Transaction, as per our credit agreement Source: EIA CBP NWS DB Ring Energy Assets “NWS” Northwest Shelf “CBP” Central Basin Platform “DB” Delaware Basin 4

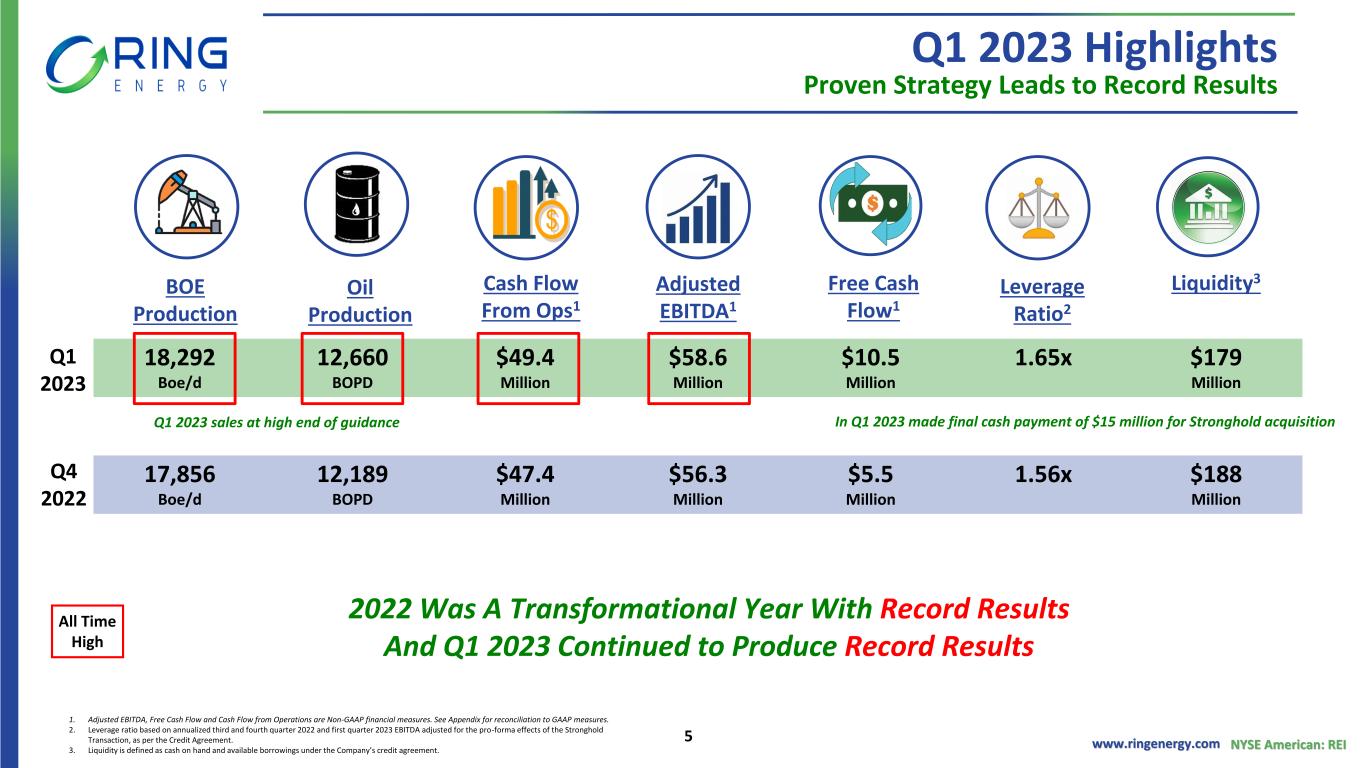

www.ringenergy.com NYSE American: REI 1. Adjusted EBITDA, Free Cash Flow and Cash Flow from Operations are Non-GAAP financial measures. See Appendix for reconciliation to GAAP measures. 2. Leverage ratio based on annualized third and fourth quarter 2022 and first quarter 2023 EBITDA adjusted for the pro-forma effects of the Stronghold Transaction, as per the Credit Agreement. 3. Liquidity is defined as cash on hand and available borrowings under the Company’s credit agreement. Q1 2023 Highlights Proven Strategy Leads to Record Results 18,292 Boe/d 12,660 BOPD $49.4 Million $58.6 Million $10.5 Million 1.65x $179 Million 17,856 Boe/d 12,189 BOPD $47.4 Million $56.3 Million $5.5 Million 1.56x $188 Million Oil Production BOE Production Cash Flow From Ops1 Adjusted EBITDA1 Free Cash Flow1 Leverage Ratio2 Liquidity3 Q1 2023 Q4 2022 All Time High 2022 Was A Transformational Year With Record Results And Q1 2023 Continued to Produce Record Results In Q1 2023 made final cash payment of $15 million for Stronghold acquisitionQ1 2023 sales at high end of guidance 5

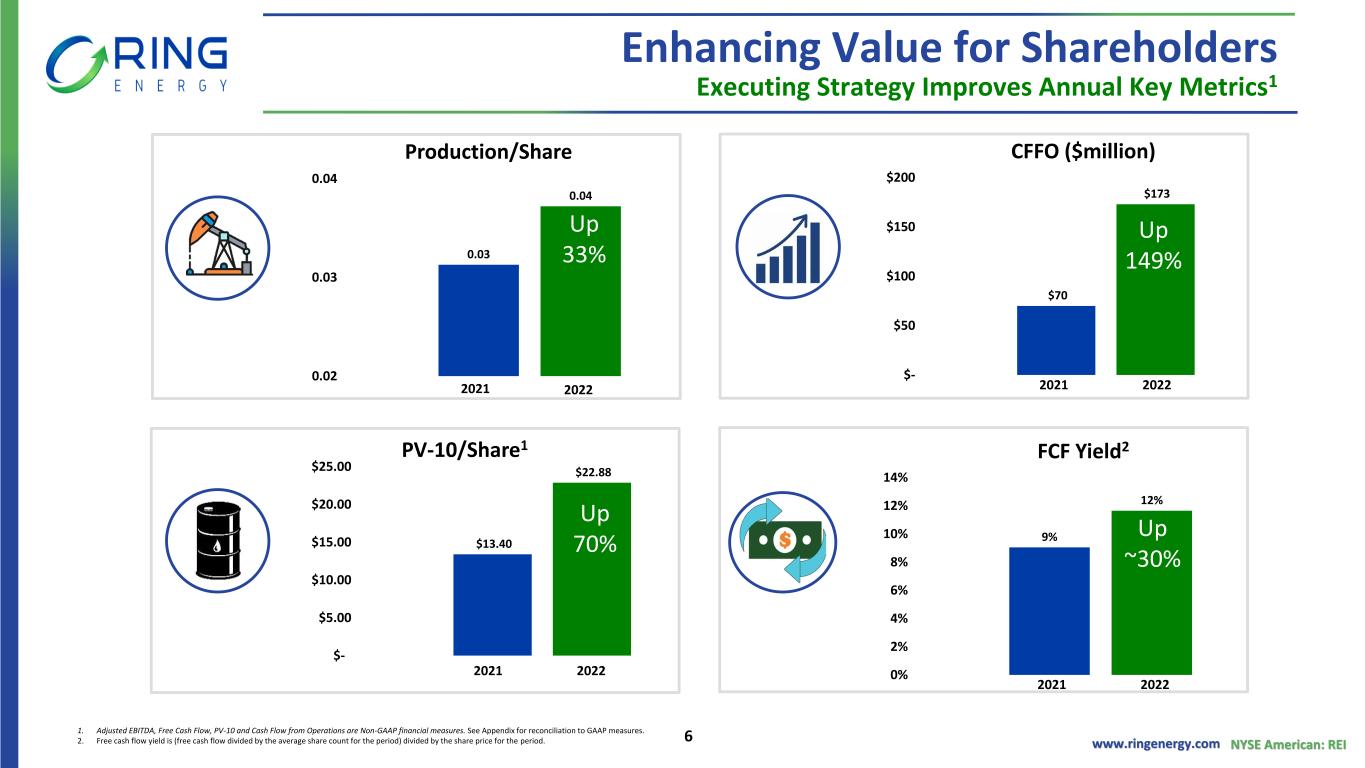

www.ringenergy.com NYSE American: REI Enhancing Value for Shareholders Executing Strategy Improves Annual Key Metrics1 1. Adjusted EBITDA, Free Cash Flow, PV-10 and Cash Flow from Operations are Non-GAAP financial measures. See Appendix for reconciliation to GAAP measures. 2. Free cash flow yield is (free cash flow divided by the average share count for the period) divided by the share price for the period. 9% 12% 0% 2% 4% 6% 8% 10% 12% 14% FCF Yield2 $13.40 $22.88 $- $5.00 $10.00 $15.00 $20.00 $25.00 PV-10/Share1 $70 $173 $- $50 $100 $150 $200 CFFO ($million) Up 33% Up 70% Up 149% Up ~30% 0.03 0.04 0.02 0.03 0.04 Production/Share Up 33% 2021 2022 2021 2022 2021 2022 2021 2022 6

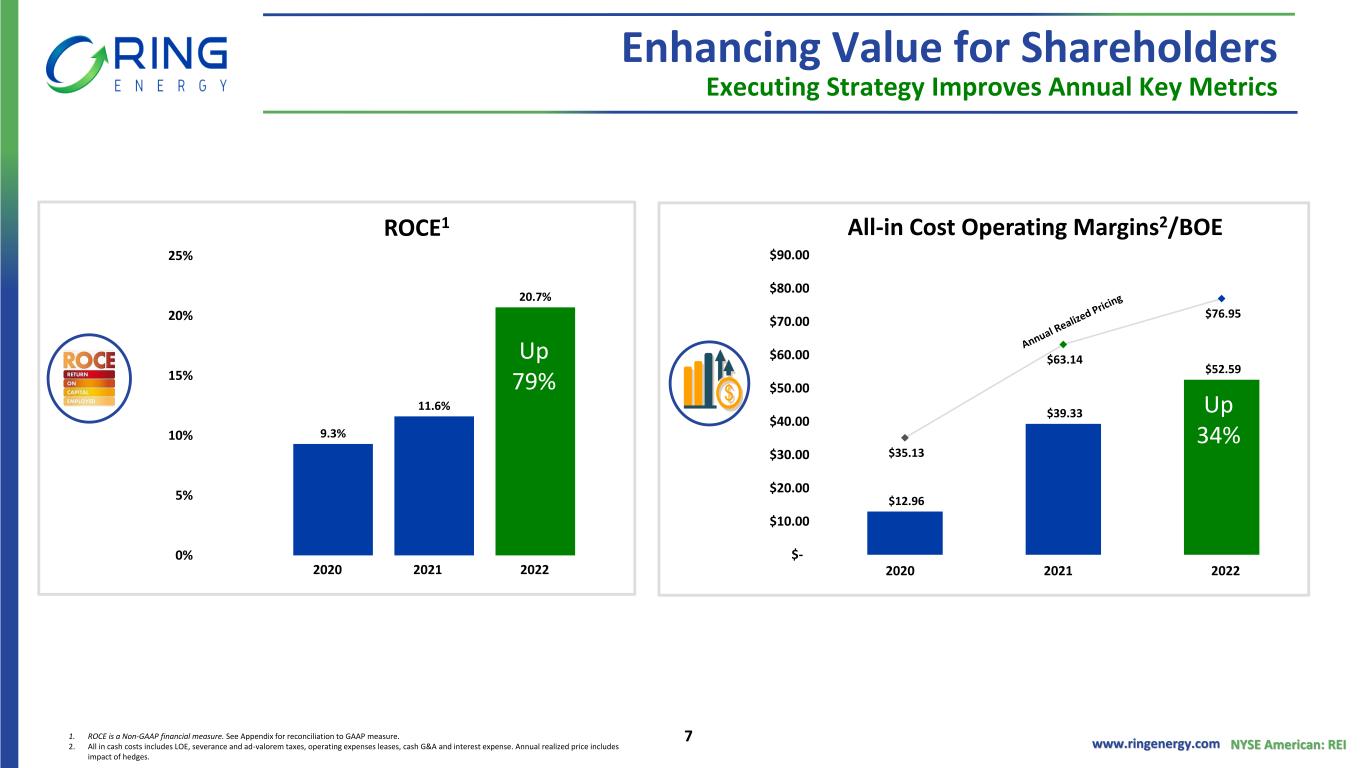

www.ringenergy.com NYSE American: REI Enhancing Value for Shareholders Executing Strategy Improves Annual Key Metrics 1. ROCE is a Non-GAAP financial measure. See Appendix for reconciliation to GAAP measure. 2. All in cash costs includes LOE, severance and ad-valorem taxes, operating expenses leases, cash G&A and interest expense. Annual realized price includes impact of hedges. 9.3% 11.6% 20.7% 0% 5% 10% 15% 20% 25% ROCE1 Up 79% $12.96 $39.33 $52.59 $35.13 $63.14 $76.95 $- $10.00 $20.00 $30.00 $40.00 $50.00 $60.00 $70.00 $80.00 $90.00 All-in Cost Operating Margins2/BOE Up 34% 2020 2021 2022 2020 2021 2022 7

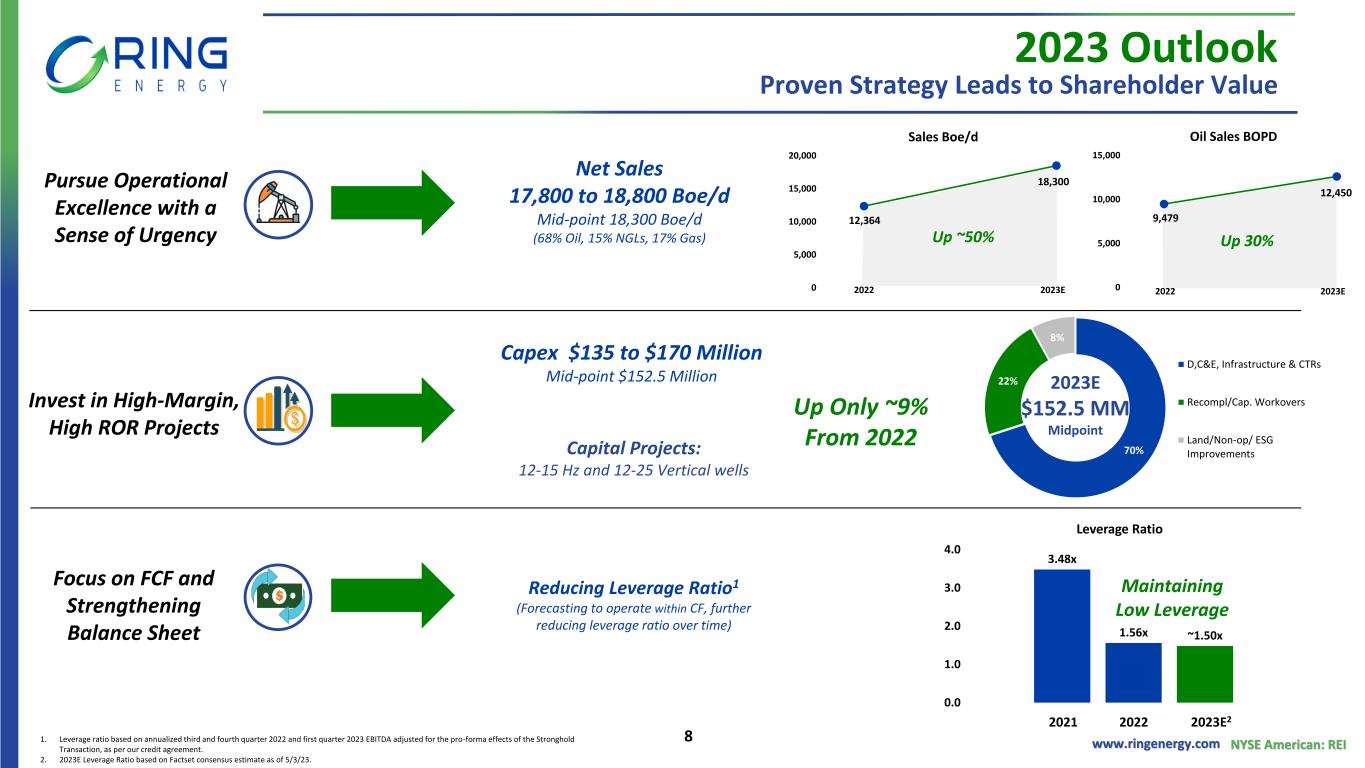

www.ringenergy.com NYSE American: REI 0 5,000 10,000 15,000 Oil Sales BOPD Focus on FCF and Strengthening Balance Sheet Pursue Operational Excellence with a Sense of Urgency Invest in High-Margin, High ROR Projects Capex $135 to $170 Million Mid-point $152.5 Million Net Sales 17,800 to 18,800 Boe/d Mid-point 18,300 Boe/d (68% Oil, 15% NGLs, 17% Gas) Reducing Leverage Ratio1 (Forecasting to operate within CF, further reducing leverage ratio over time) Capital Projects: 12-15 Hz and 12-25 Vertical wells 2023 Outlook Proven Strategy Leads to Shareholder Value 1. Leverage ratio based on annualized third and fourth quarter 2022 and first quarter 2023 EBITDA adjusted for the pro-forma effects of the Stronghold Transaction, as per our credit agreement. 2. 2023E Leverage Ratio based on Factset consensus estimate as of 5/3/23. 70% 22% 8% D,C&E, Infrastructure & CTRs Recompl/Cap. Workovers Land/Non-op/ ESG Improvements 3.48x 1.56x ~1.50x 0.0 1.0 2.0 3.0 4.0 Leverage Ratio 2023E $152.5 MM Midpoint 0 5,000 10,000 15,000 20,000 Sales Boe/d 2022 2023E 12,364 18,300 9,479 2023E 12,450 2022 Up Only ~9% From 2022 Up ~50% Up 30% Maintaining Low Leverage 2021 2022 2023E2 8

www.ringenergy.com NYSE American: REI Simplifying and Enhancing the Capital Structure Accelerated Exercise of Warrants ▪ Common warrants were issued in October 2020 as part of a public offering that raised $20.8 million in gross proceeds to restart a capital drilling program ▪ Common warrants gave the right, but not the obligation, to buy common shares at $0.80/share at a time when REI was trading below $0.60/share ▪ Shares issued pursuant to the exercise of the warrants were previously included in shares authorized and in fully diluted shares calculated using the treasury stock method ▪ Exercising the warrants increased shares outstanding, but did not impact shares available for use ▪ Accelerated ~$9 MM in warrant proceeds accelerates debt paydown ▪ Increased Ring’s public float We believe there are additional intangible benefits ▪ Should improve trading liquidity ▪ Potentially removes perceived warrant overhang impacting stock price ▪ Simplifies capital structure for current and prospective equity investors Preparing to Pursue Balance Sheet Enhancing & Accretive Acquisitions 9

www.ringenergy.com NYSE American: REI Committed to ESG Critical to Sustainable Success Progressing our ESG Journey ▪ Created ESG Task Force to monitor Company’s adherence to ESG standards and formally communicate to CEO and the Board on ongoing basis. ▪ Established Target Zero 365 (TZ-365) Safety & Environmental Initiative to further build culture for employees to work safely, openly communicate incidents, near misses, and strive for continuous improvement. • Designed to protect workforce, environment, communities and financial sustainability. • Focused on Safety-first environment and achieving high percentage of Target Zero Days. ▪ 2023 Capital Program includes Fugitive Emission Reduction plans with: • Installation of Vapor Recovery Units. • Installation of Air Compression Equipment to operate Pneumatic Actuators. • Establishing Leak Detection and Repair program. ▪ Refreshed all charters, guidelines and bylaws. ▪ Increased charitable giving and employee outreach within the communities in which we live and work. A Target Zero Day is a Day that Results in: • Zero Company or Contractor OSHA Recordable Injury, and • Zero Agency Reportable Spill or Release as Defined by TRRC, EPA, TCEQ, etc., and • Zero Preventable Vehicle Incidents, and • Zero Unintentional Natural Gas Releases 10

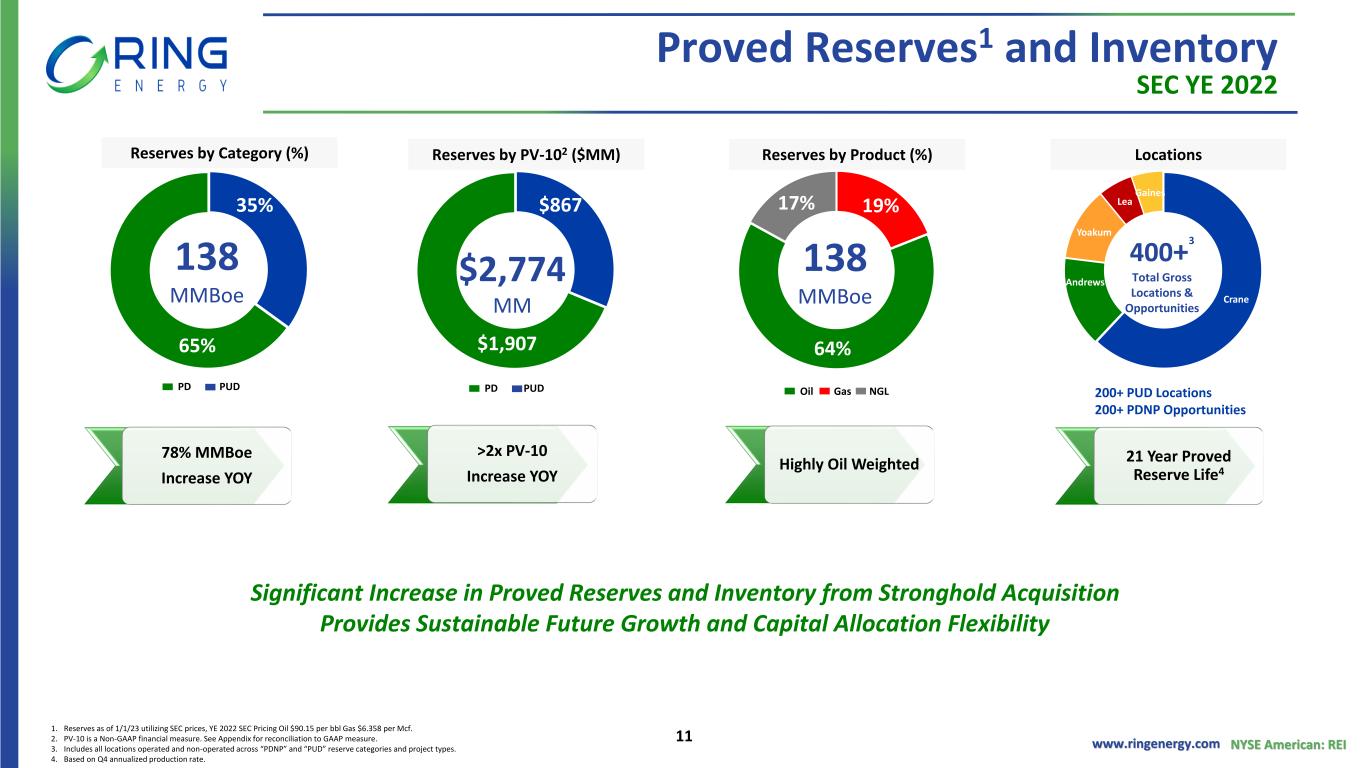

www.ringenergy.com NYSE American: REI Proved Reserves1 and Inventory SEC YE 2022 1. Reserves as of 1/1/23 utilizing SEC prices, YE 2022 SEC Pricing Oil $90.15 per bbl Gas $6.358 per Mcf. 2. PV-10 is a Non-GAAP financial measure. See Appendix for reconciliation to GAAP measure. 3. Includes all locations operated and non-operated across “PDNP” and “PUD” reserve categories and project types. 4. Based on Q4 annualized production rate. 35% 65% 138 MMBoe PD PUD Reserves by Category (%) $867 $1,907 $2,774 MM PD PUD Reserves by PV-102 ($MM) 19% 64% 17% Oil Gas NGL Reserves by Product (%) Crane Andrews Yoakum Lea Gaines Locations 138 MMBoe 400+ 3 Total Gross Locations & Opportunities 78% MMBoe Increase YOY >2x PV-10 Increase YOY Highly Oil Weighted 21 Year Proved Reserve Life4 200+ PUD Locations 200+ PDNP Opportunities Significant Increase in Proved Reserves and Inventory from Stronghold Acquisition Provides Sustainable Future Growth and Capital Allocation Flexibility 11

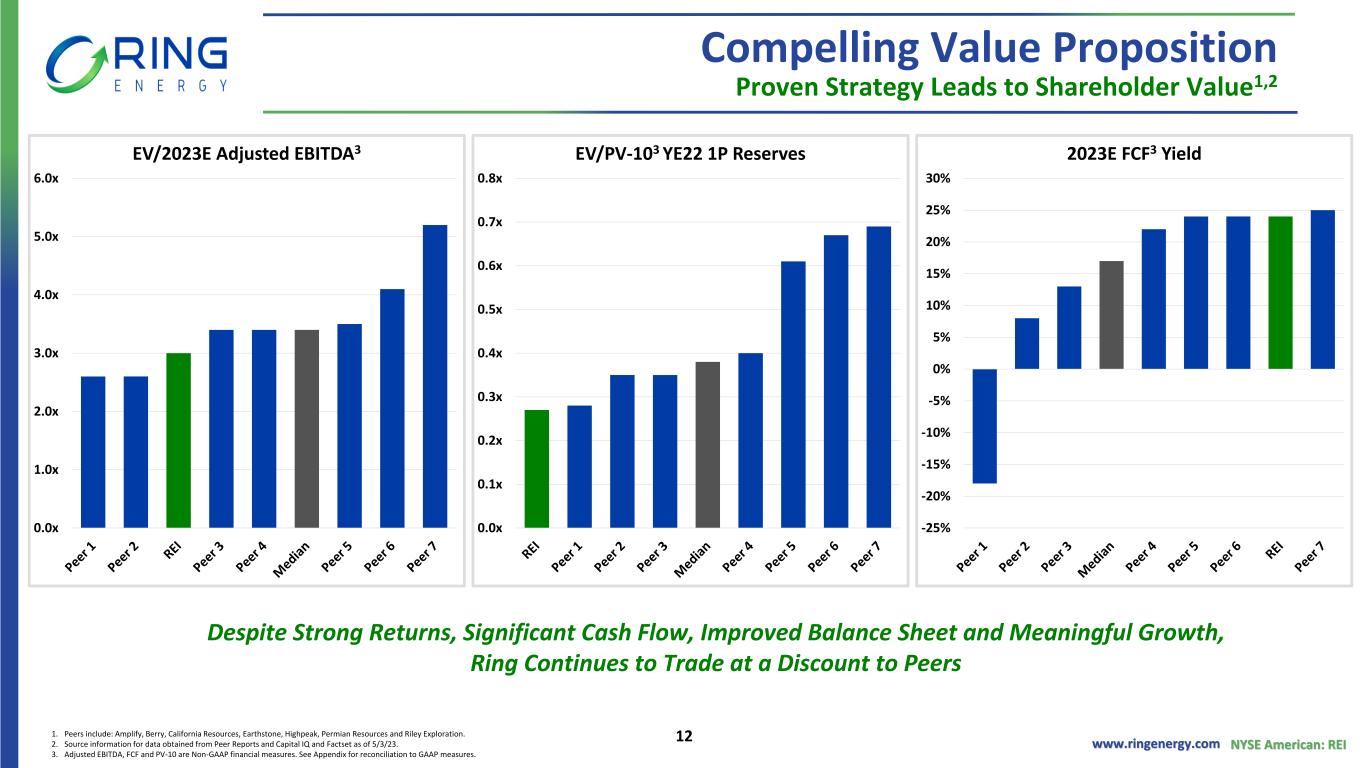

www.ringenergy.com NYSE American: REI Compelling Value Proposition Proven Strategy Leads to Shareholder Value1,2 1. Peers include: Amplify, Berry, California Resources, Earthstone, Highpeak, Permian Resources and Riley Exploration. 2. Source information for data obtained from Peer Reports and Capital IQ and Factset as of 5/3/23. 3. Adjusted EBITDA, FCF and PV-10 are Non-GAAP financial measures. See Appendix for reconciliation to GAAP measures. Despite Strong Returns, Significant Cash Flow, Improved Balance Sheet and Meaningful Growth, Ring Continues to Trade at a Discount to Peers -25% -20% -15% -10% -5% 0% 5% 10% 15% 20% 25% 30% 2023E FCF3 Yield 0.0x 1.0x 2.0x 3.0x 4.0x 5.0x 6.0x EV/2023E Adjusted EBITDA3 0.0x 0.1x 0.2x 0.3x 0.4x 0.5x 0.6x 0.7x 0.8x EV/PV-103 YE22 1P Reserves 12

www.ringenergy.com NYSE American: REI Value Proposition 2023 and Beyond ❖ Trading at a discount to peer average ❖ Delivering higher returns than peer average ❖ Value focused strategy is proven by record 2022 & Q1 2023 results ❖ Disciplined and capital efficient budget is focused on maintaining production levels, FCF generation and debt reduction ❖ Pursuing accretive, balance sheet enhancing acquisitions to further increase scale and lower break-even costs ❖ Goal and strategy designed to position Ring Energy to return capital to stockholders 13

Asset Overview

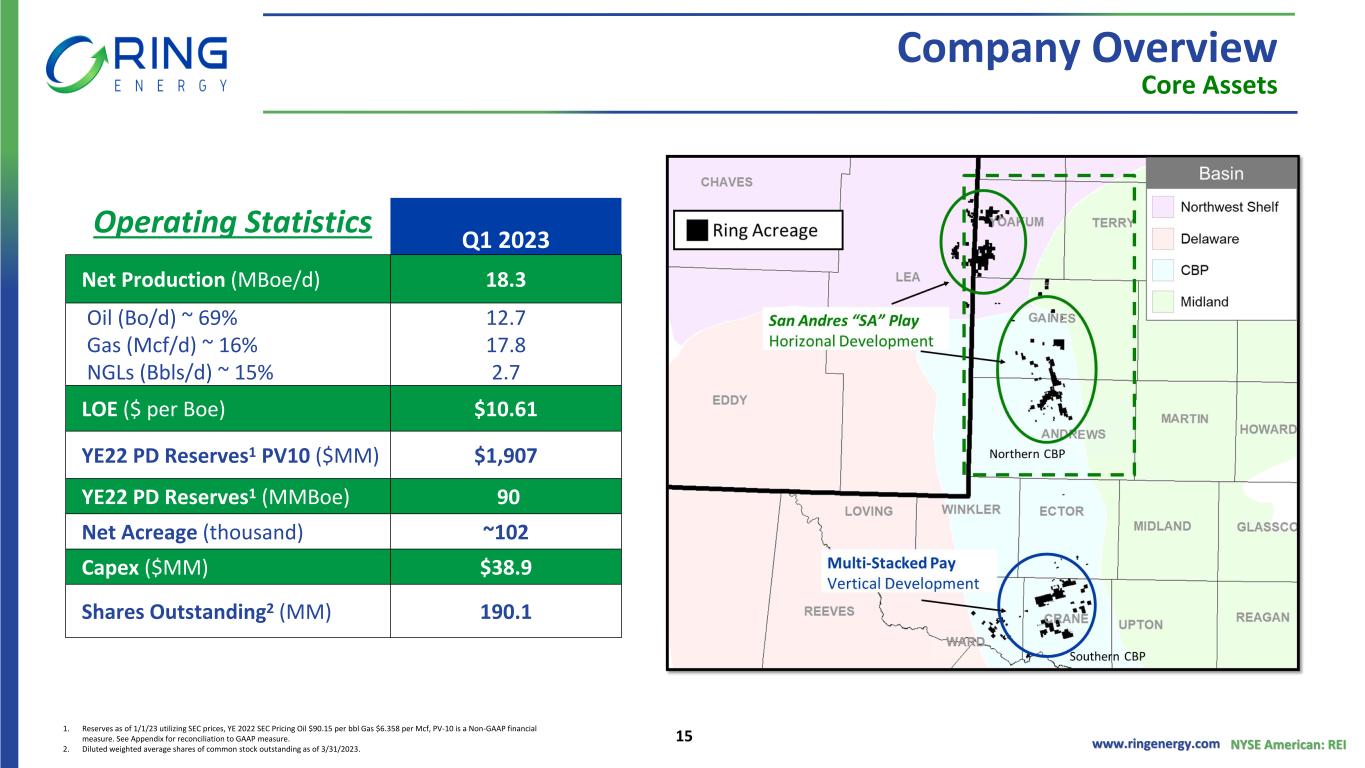

www.ringenergy.com NYSE American: REI Company Overview Operating Statistics Q1 2023 Net Production (MBoe/d) 18.3 Oil (Bo/d) ~ 69% Gas (Mcf/d) ~ 16% NGLs (Bbls/d) ~ 15% 12.7 17.8 2.7 LOE ($ per Boe) $10.61 YE22 PD Reserves1 PV10 ($MM) $1,907 YE22 PD Reserves1 (MMBoe) 90 Net Acreage (thousand) ~102 Capex ($MM) $38.9 Shares Outstanding2 (MM) 190.1 Core Assets 1. Reserves as of 1/1/23 utilizing SEC prices, YE 2022 SEC Pricing Oil $90.15 per bbl Gas $6.358 per Mcf, PV-10 is a Non-GAAP financial measure. See Appendix for reconciliation to GAAP measure. 2. Diluted weighted average shares of common stock outstanding as of 3/31/2023. 15

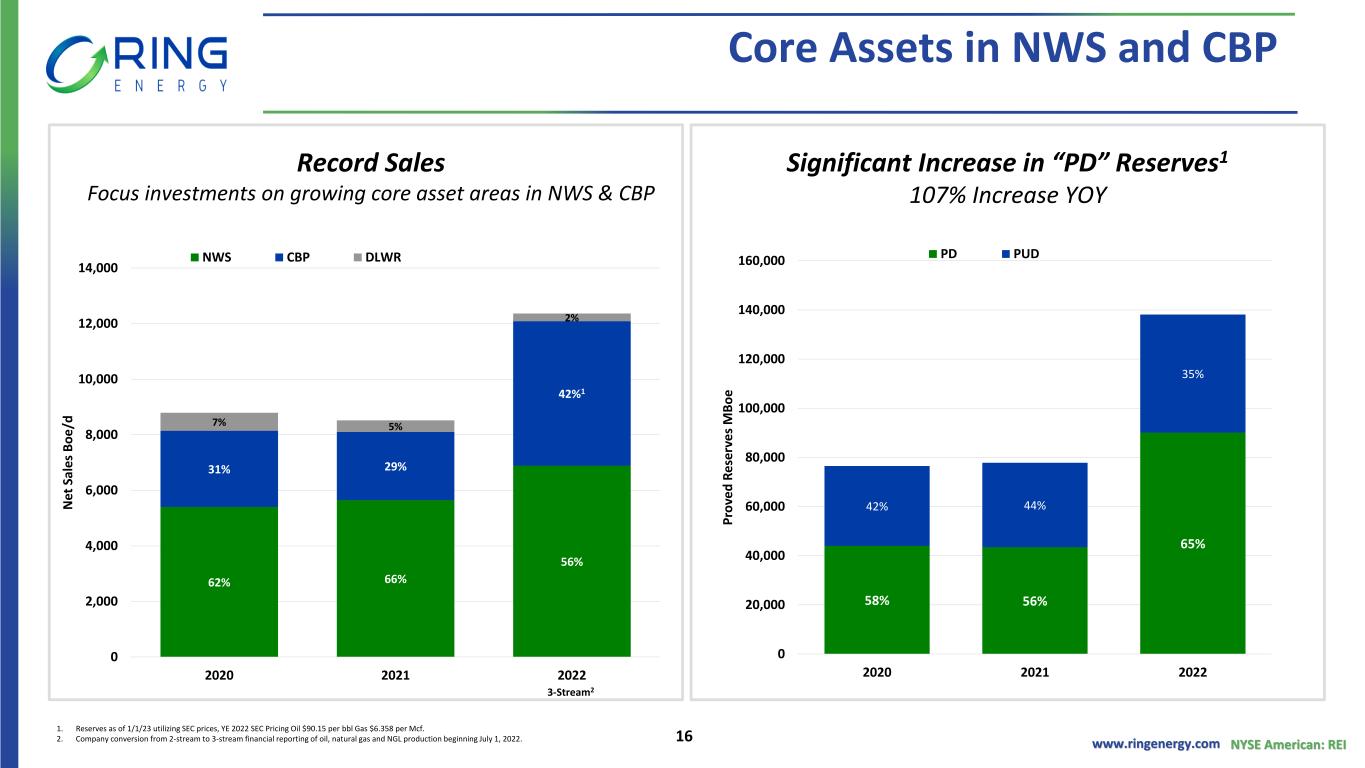

www.ringenergy.com NYSE American: REI Core Assets in NWS and CBP 62% 66% 56% 31% 29% 42%1 7% 5% 2% 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 2020 2021 2022 N et S al e s B o e /d NWS CBP DLWR Record Sales Focus investments on growing core asset areas in NWS & CBP 58% 56% 65% 42% 44% 35% 0 20,000 40,000 60,000 80,000 100,000 120,000 140,000 160,000 2020 2021 2022 P ro ve d R e se rv e s M B o e PD PUD Significant Increase in “PD” Reserves1 107% Increase YOY 1. Reserves as of 1/1/23 utilizing SEC prices, YE 2022 SEC Pricing Oil $90.15 per bbl Gas $6.358 per Mcf. 2. Company conversion from 2-stream to 3-stream financial reporting of oil, natural gas and NGL production beginning July 1, 2022. 3-Stream2 16

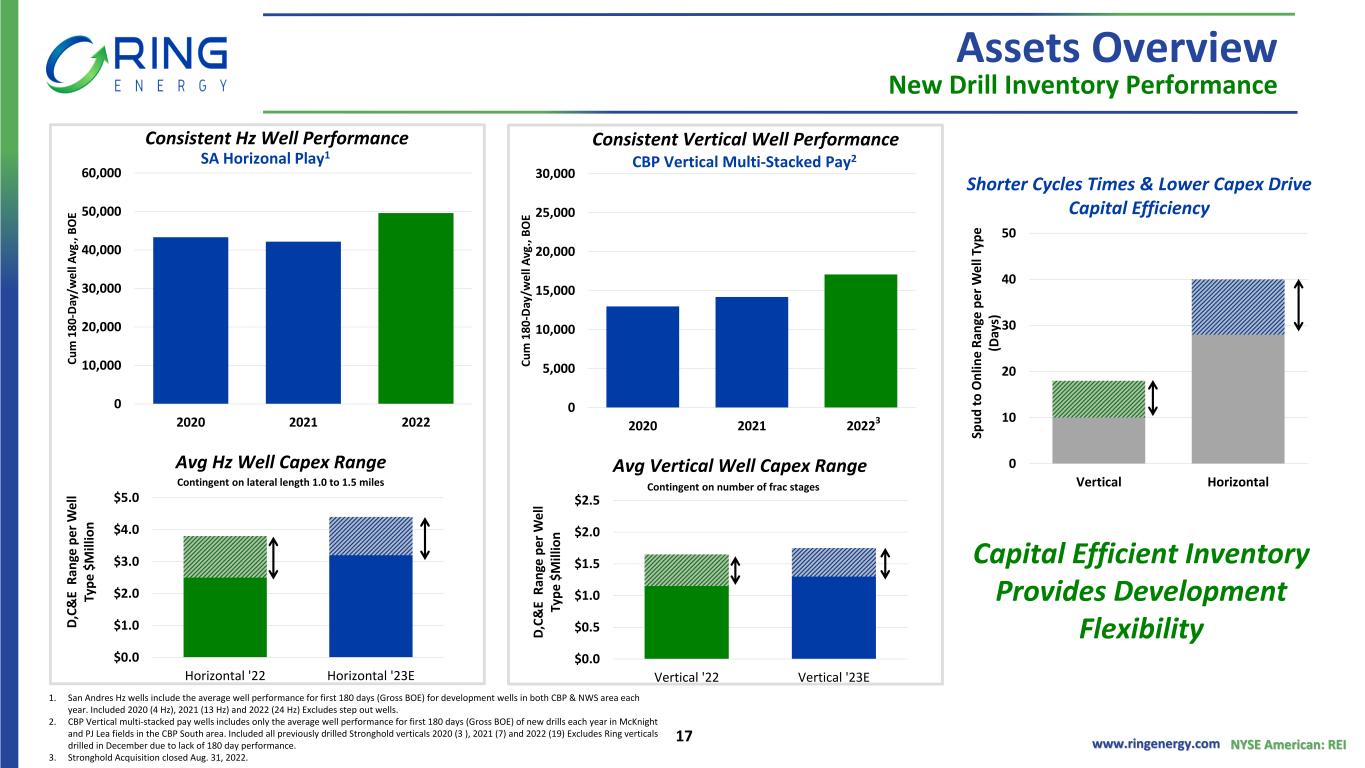

www.ringenergy.com NYSE American: REI 0 5,000 10,000 15,000 20,000 25,000 30,000 2020 2021 2022 C u m 1 8 0 -D ay /w e ll A vg ., B O E Assets Overview New Drill Inventory Performance 0 10 20 30 40 50 Vertical Horizontal Sp u d t o O n lin e R an ge p e r W e ll Ty p e (D ay s) Shorter Cycles Times & Lower Capex Drive Capital Efficiency Consistent Hz Well Performance SA Horizonal Play1 Oil 90% Oil 95% Oil 92% CBP Vertical Multi-Stacked Pay2 Avg Hz Well Capex Range Avg Vertical Well Capex Range Capital Efficient Inventory Provides Development Flexibility Consistent Vertical Well Performance 1. San Andres Hz wells include the average well performance for first 180 days (Gross BOE) for development wells in both CBP & NWS area each year. Included 2020 (4 Hz), 2021 (13 Hz) and 2022 (24 Hz) Excludes step out wells. 2. CBP Vertical multi-stacked pay wells includes only the average well performance for first 180 days (Gross BOE) of new drills each year in McKnight and PJ Lea fields in the CBP South area. Included all previously drilled Stronghold verticals 2020 (3 ), 2021 (7) and 2022 (19) Excludes Ring verticals drilled in December due to lack of 180 day performance. 3. Stronghold Acquisition closed Aug. 31, 2022. $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 Horizontal '22 Horizontal '23E D ,C & E R an ge p e r W e ll Ty p e $ M ill io n $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 Vertical '22 Vertical '23E D ,C & E R an ge p e r W e ll Ty p e $ M ill io n 0 10,000 20,000 30,000 40,000 50,000 60,000 2020 2021 2022 C u m 1 8 0 -D ay /w e ll A vg ., B O E Contingent on lateral length 1.0 to 1.5 miles 3 Contingent on number of frac stages 17

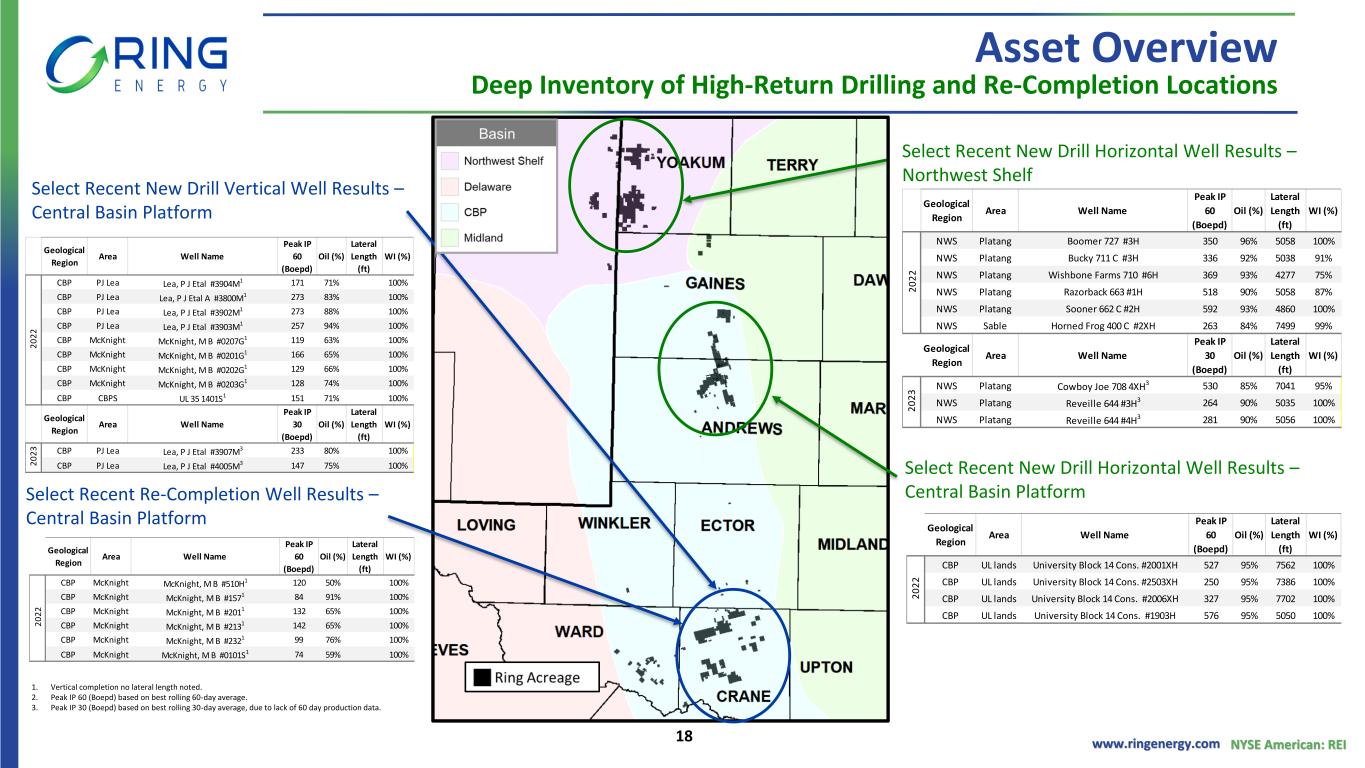

www.ringenergy.com NYSE American: REI Asset Overview Deep Inventory of High-Return Drilling and Re-Completion Locations Select Recent New Drill Horizontal Well Results – Northwest Shelf 1. Vertical completion no lateral length noted. 2. Peak IP 60 (Boepd) based on best rolling 60-day average. 3. Peak IP 30 (Boepd) based on best rolling 30-day average, due to lack of 60 day production data. Select Recent Re-Completion Well Results – Central Basin Platform Select Recent New Drill Horizontal Well Results – Central Basin Platform Select Recent New Drill Vertical Well Results – Central Basin Platform Geological Region Area Well Name Peak IP 60 (Boepd) Oil (%) Lateral Length (ft) WI (%) NWS Platang Boomer 727 #3H 350 96% 5058 100% NWS Platang Bucky 711 C #3H 336 92% 5038 91% NWS Platang Wishbone Farms 710 #6H 369 93% 4277 75% NWS Platang Razorback 663 #1H 518 90% 5058 87% NWS Platang Sooner 662 C #2H 592 93% 4860 100% NWS Sable Horned Frog 400 C #2XH 263 84% 7499 99% Geological Region Area Well Name Peak IP 30 (Boepd) Oil (%) Lateral Length (ft) WI (%) NWS Platang Cowboy Joe 708 4XH3 530 85% 7041 95% NWS Platang Reveille 644 #3H3 264 90% 5035 100% NWS Platang Reveille 644 #4H3 281 90% 5056 100% 2 0 2 2 2 0 2 3 Geological Region Area Well Name Peak IP 60 (Boepd) Oil (%) Lateral Length (ft) WI (%) CBP UL lands University Block 14 Cons. #2001XH 527 95% 7562 100% CBP UL lands University Block 14 Cons. #2503XH 250 95% 7386 100% CBP UL lands University Block 14 Cons. #2006XH 327 95% 7702 100% CBP UL lands University Block 14 Cons. #1903H 576 95% 5050 100% 2 0 2 2 Geological Region Area Well Name Peak IP 60 (Boepd) Oil (%) Lateral Length (ft) WI (%) CBP McKnight McKnight, M B #510H1 120 50% 100% CBP McKnight McKnight, M B #1571 84 91% 100% CBP McKnight McKnight, M B #2011 132 65% 100% CBP McKnight McKnight, M B #2131 142 65% 100% CBP McKnight McKnight, M B #2321 99 76% 100% CBP McKnight McKnight, M B #0101S1 74 59% 100% 2 0 2 2 Geological Region Area Well Name Peak IP 60 (Boepd) Oil (%) Lateral Length (ft) WI (%) CBP PJ Lea Lea, P J Etal #3904M1 171 71% 100% CBP PJ Lea Lea, P J Etal A #3800M1 273 83% 100% CBP PJ Lea Lea, P J Etal #3902M1 273 88% 100% CBP PJ Lea Lea, P J Etal #3903M1 257 94% 100% CBP McKnight McKnight, M B #0207G1 119 63% 100% CBP McKnight McKnight, M B #0201G1 166 65% 100% CBP McKnight McKnight, M B #0202G1 129 66% 100% CBP McKnight McKnight, M B #0203G1 128 74% 100% CBP CBPS UL 35 1401S1 151 71% 100% Geological Region Area Well Name Peak IP 30 (Boepd) Oil (%) Lateral Length (ft) WI (%) CBP PJ Lea Lea, P J Etal #3907M3 233 80% 100% CBP PJ Lea Lea, P J Etal #4005M3 147 75% 100% 2 0 2 2 2 0 2 3 18

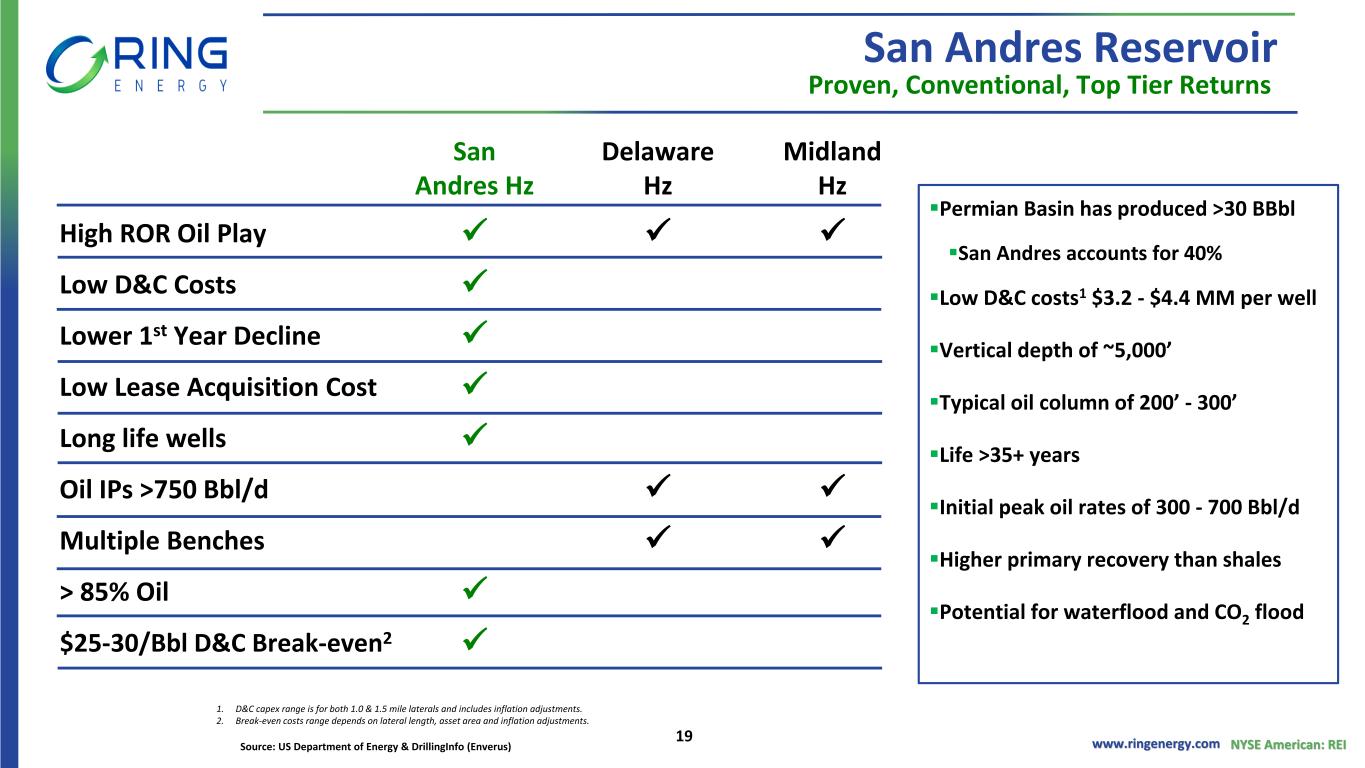

www.ringenergy.com NYSE American: REI San Andres Reservoir Proven, Conventional, Top Tier Returns San Andres Hz Delaware Hz Midland Hz High ROR Oil Play ✓ ✓ ✓ Low D&C Costs ✓ Lower 1st Year Decline ✓ Low Lease Acquisition Cost ✓ Long life wells ✓ Oil IPs >750 Bbl/d ✓ ✓ Multiple Benches ✓ ✓ > 85% Oil ✓ $25-30/Bbl D&C Break-even2 ✓ ▪Permian Basin has produced >30 BBbl ▪San Andres accounts for 40% ▪Low D&C costs1 $3.2 - $4.4 MM per well ▪Vertical depth of ~5,000’ ▪Typical oil column of 200’ - 300’ ▪Life >35+ years ▪Initial peak oil rates of 300 - 700 Bbl/d ▪Higher primary recovery than shales ▪Potential for waterflood and CO2 flood Source: US Department of Energy & DrillingInfo (Enverus) 1. D&C capex range is for both 1.0 & 1.5 mile laterals and includes inflation adjustments. 2. Break-even costs range depends on lateral length, asset area and inflation adjustments. 19

Financial Overview

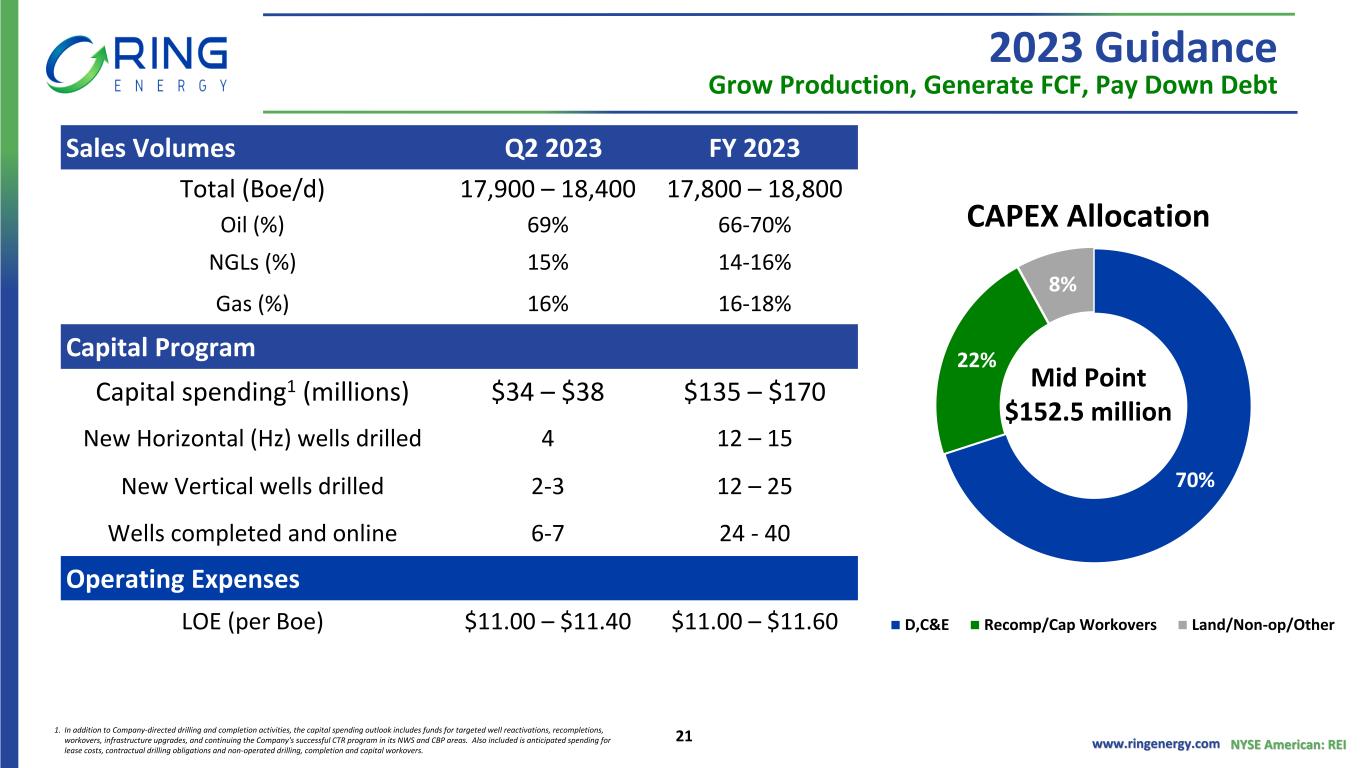

www.ringenergy.com NYSE American: REI 70% 22% 8% D,C&E Recomp/Cap Workovers Land/Non-op/Other CAPEX Allocation Mid Point $152.5 million 2023 Guidance Grow Production, Generate FCF, Pay Down Debt Sales Volumes Q2 2023 FY 2023 Total (Boe/d) 17,900 – 18,400 17,800 – 18,800 Oil (%) 69% 66-70% NGLs (%) 15% 14-16% Gas (%) 16% 16-18% Capital Program Capital spending1 (millions) $34 – $38 $135 – $170 New Horizontal (Hz) wells drilled 4 12 – 15 New Vertical wells drilled 2-3 12 – 25 Wells completed and online 6-7 24 - 40 Operating Expenses LOE (per Boe) $11.00 – $11.40 $11.00 – $11.60 1. In addition to Company-directed drilling and completion activities, the capital spending outlook includes funds for targeted well reactivations, recompletions, workovers, infrastructure upgrades, and continuing the Company's successful CTR program in its NWS and CBP areas. Also included is anticipated spending for lease costs, contractual drilling obligations and non-operated drilling, completion and capital workovers. 21

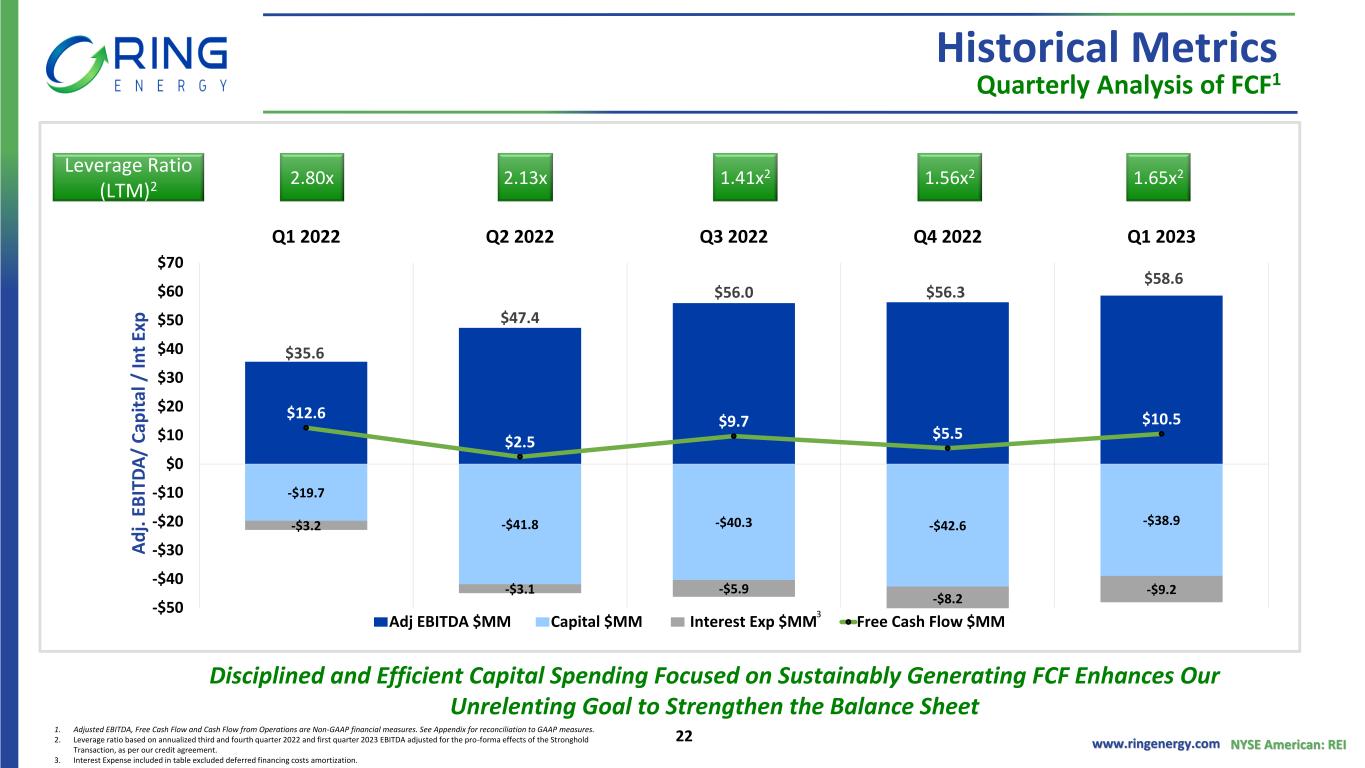

www.ringenergy.com NYSE American: REI Historical Metrics Quarterly Analysis of FCF1 $35.6 $47.4 $56.0 $56.3 $58.6 -$19.7 -$41.8 -$40.3 -$42.6 -$38.9-$3.2 -$3.1 -$5.9 -$8.2 -$9.2 $12.6 $2.5 $9.7 $5.5 $10.5 -$50 -$40 -$30 -$20 -$10 $0 $10 $20 $30 $40 $50 $60 $70 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 A d j. E B IT D A / C ap it al / In t Ex p Adj EBITDA $MM Capital $MM Interest Exp $MM Free Cash Flow $MM Leverage Ratio (LTM)2 2.13x2.80x 1.41x2 1.56x2 Disciplined and Efficient Capital Spending Focused on Sustainably Generating FCF Enhances Our Unrelenting Goal to Strengthen the Balance Sheet 1. Adjusted EBITDA, Free Cash Flow and Cash Flow from Operations are Non-GAAP financial measures. See Appendix for reconciliation to GAAP measures. 2. Leverage ratio based on annualized third and fourth quarter 2022 and first quarter 2023 EBITDA adjusted for the pro-forma effects of the Stronghold Transaction, as per our credit agreement. 3. Interest Expense included in table excluded deferred financing costs amortization. 1.65x2 3 22

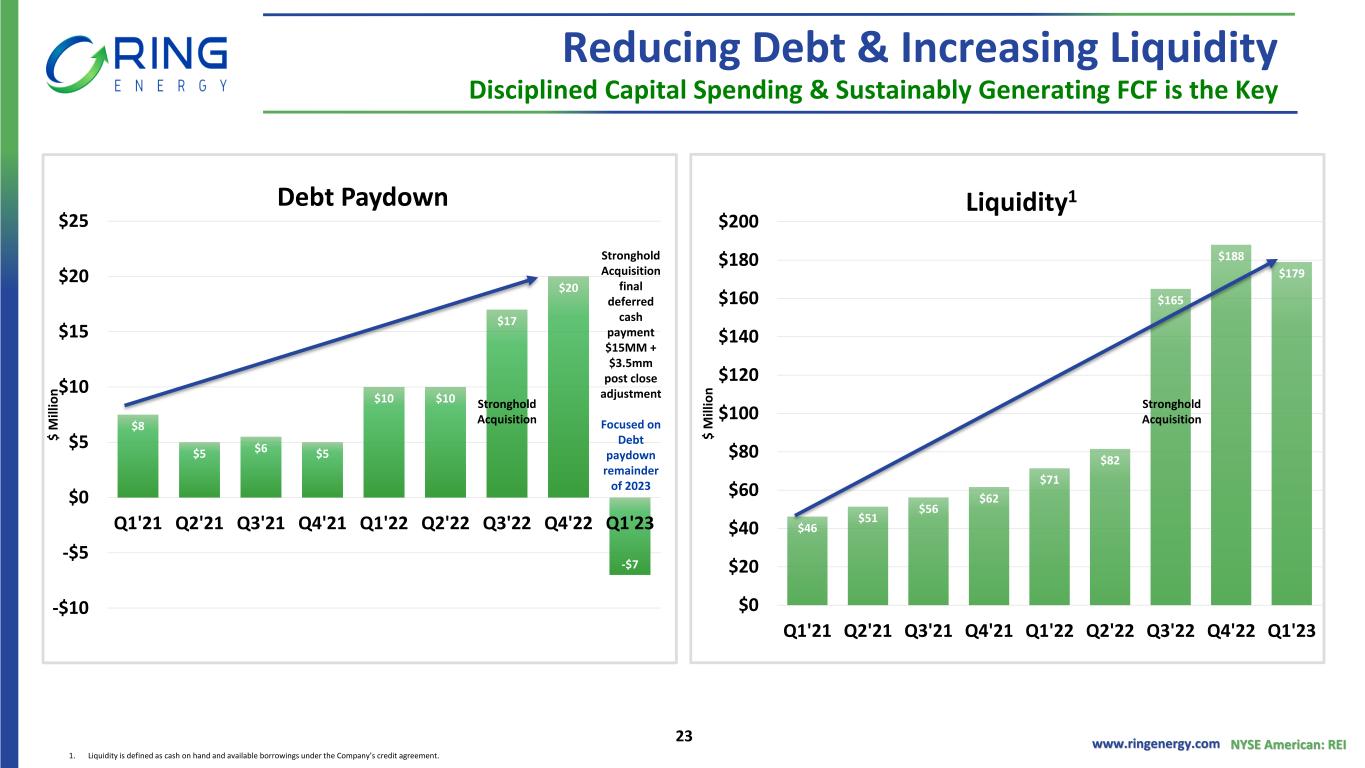

www.ringenergy.com NYSE American: REI Reducing Debt & Increasing Liquidity Disciplined Capital Spending & Sustainably Generating FCF is the Key $8 $5 $6 $5 $10 $10 $17 $20 -$7 -$10 -$5 $0 $5 $10 $15 $20 $25 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 $ M ill io n Debt Paydown Stronghold Acquisition $313 MM outstanding debt with $36 MM in Surplus Cash $46 $51 $56 $62 $71 $82 $165 $188 $179 $0 $20 $40 $60 $80 $100 $120 $140 $160 $180 $200 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 $ M ill io n Liquidity1 Stronghold Acquisition 1. Liquidity is defined as cash on hand and available borrowings under the Company’s credit agreement. Stronghold Acquisition final deferred cash payment $15MM + $3.5mm post close adjustment Focused on Debt paydown remainder of 2023 23

Appendix

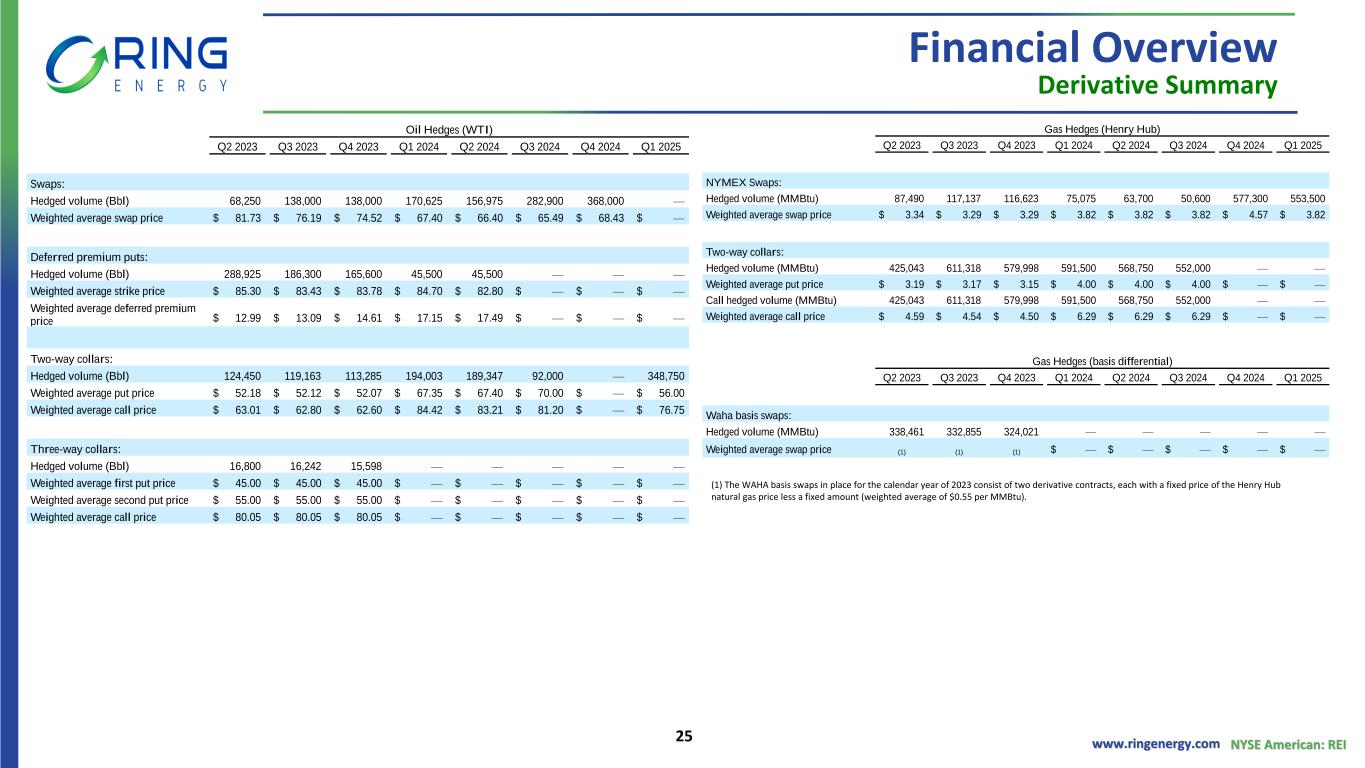

www.ringenergy.com NYSE American: REI Financial Overview Derivative Summary Oil Hedges (WTI) Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Swaps: Hedged volume (Bbl) 68,250 138,000 138,000 170,625 156,975 282,900 368,000 — Weighted average swap price $ 81.73 $ 76.19 $ 74.52 $ 67.40 $ 66.40 $ 65.49 $ 68.43 $ — Deferred premium puts: Hedged volume (Bbl) 288,925 186,300 165,600 45,500 45,500 — — — Weighted average strike price $ 85.30 $ 83.43 $ 83.78 $ 84.70 $ 82.80 $ — $ — $ — Weighted average deferred premium price $ 12.99 $ 13.09 $ 14.61 $ 17.15 $ 17.49 $ — $ — $ — Two-way collars: Hedged volume (Bbl) 124,450 119,163 113,285 194,003 189,347 92,000 — 348,750 Weighted average put price $ 52.18 $ 52.12 $ 52.07 $ 67.35 $ 67.40 $ 70.00 $ — $ 56.00 Weighted average call price $ 63.01 $ 62.80 $ 62.60 $ 84.42 $ 83.21 $ 81.20 $ — $ 76.75 Three-way collars: Hedged volume (Bbl) 16,800 16,242 15,598 — — — — — Weighted average first put price $ 45.00 $ 45.00 $ 45.00 $ — $ — $ — $ — $ — Weighted average second put price $ 55.00 $ 55.00 $ 55.00 $ — $ — $ — $ — $ — Weighted average call price $ 80.05 $ 80.05 $ 80.05 $ — $ — $ — $ — $ — Gas Hedges (Henry Hub) Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 NYMEX Swaps: Hedged volume (MMBtu) 87,490 117,137 116,623 75,075 63,700 50,600 577,300 553,500 Weighted average swap price $ 3.34 $ 3.29 $ 3.29 $ 3.82 $ 3.82 $ 3.82 $ 4.57 $ 3.82 Two-way collars: Hedged volume (MMBtu) 425,043 611,318 579,998 591,500 568,750 552,000 — — Weighted average put price $ 3.19 $ 3.17 $ 3.15 $ 4.00 $ 4.00 $ 4.00 $ — $ — Call hedged volume (MMBtu) 425,043 611,318 579,998 591,500 568,750 552,000 — — Weighted average call price $ 4.59 $ 4.54 $ 4.50 $ 6.29 $ 6.29 $ 6.29 $ — $ — Gas Hedges (basis differential) Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Waha basis swaps: Hedged volume (MMBtu) 338,461 332,855 324,021 — — — — — Weighted average swap price (1) (1) (1) $ — $ — $ — $ — $ — (1) The WAHA basis swaps in place for the calendar year of 2023 consist of two derivative contracts, each with a fixed price of the Henry Hub natural gas price less a fixed amount (weighted average of $0.55 per MMBtu). 25

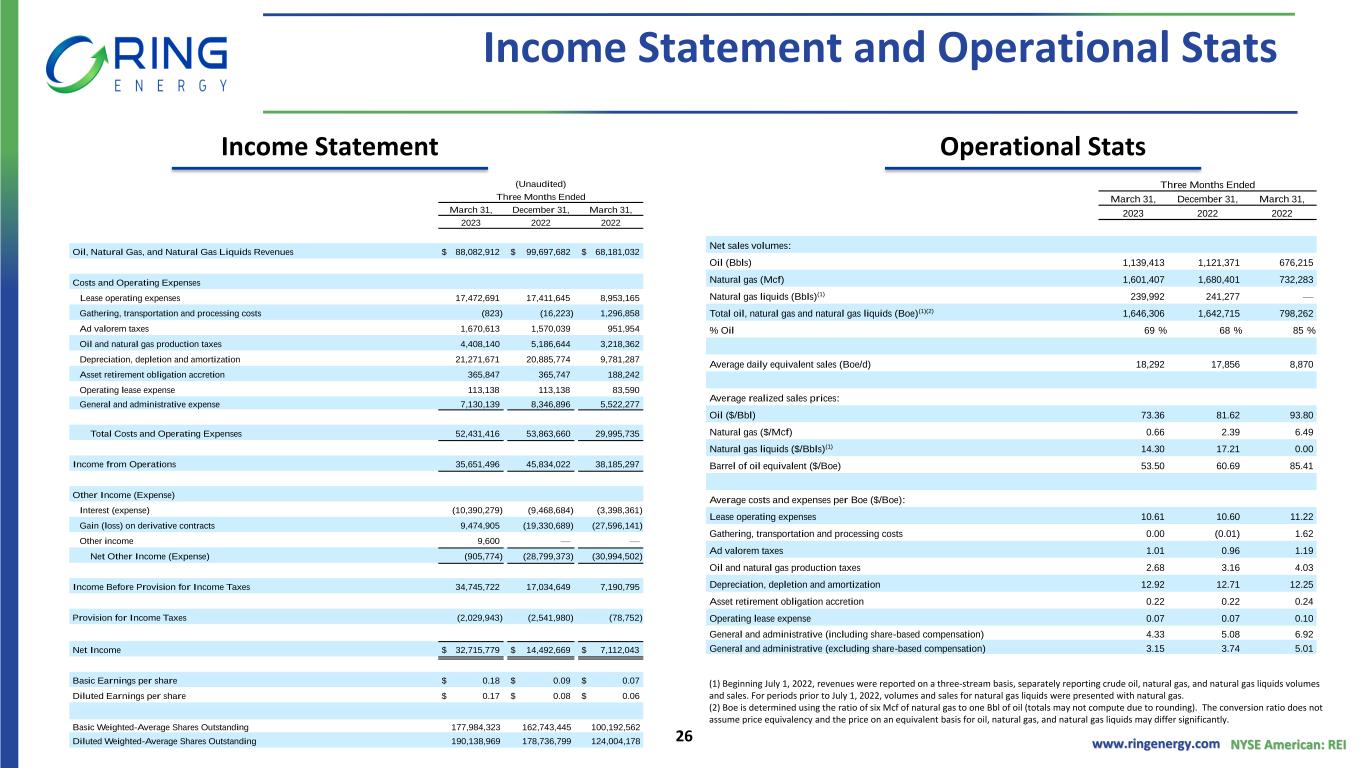

www.ringenergy.com NYSE American: REI Income Statement and Operational Stats Income Statement Operational Stats (1) Beginning July 1, 2022, revenues were reported on a three-stream basis, separately reporting crude oil, natural gas, and natural gas liquids volumes and sales. For periods prior to July 1, 2022, volumes and sales for natural gas liquids were presented with natural gas. (2) Boe is determined using the ratio of six Mcf of natural gas to one Bbl of oil (totals may not compute due to rounding). The conversion ratio does not assume price equivalency and the price on an equivalent basis for oil, natural gas, and natural gas liquids may differ significantly. Three Months Ended March 31, December 31, March 31, 2023 2022 2022 Net sales volumes: Oil (Bbls) 1,139,413 1,121,371 676,215 Natural gas (Mcf) 1,601,407 1,680,401 732,283 Natural gas liquids (Bbls)(1) 239,992 241,277 — Total oil, natural gas and natural gas liquids (Boe)(1)(2) 1,646,306 1,642,715 798,262 % Oil 69 % 68 % 85 % Average daily equivalent sales (Boe/d) 18,292 17,856 8,870 Average realized sales prices: Oil ($/Bbl) 73.36 81.62 93.80 Natural gas ($/Mcf) 0.66 2.39 6.49 Natural gas liquids ($/Bbls)(1) 14.30 17.21 0.00 Barrel of oil equivalent ($/Boe) 53.50 60.69 85.41 Average costs and expenses per Boe ($/Boe): Lease operating expenses 10.61 10.60 11.22 Gathering, transportation and processing costs 0.00 (0.01) 1.62 Ad valorem taxes 1.01 0.96 1.19 Oil and natural gas production taxes 2.68 3.16 4.03 Depreciation, depletion and amortization 12.92 12.71 12.25 Asset retirement obligation accretion 0.22 0.22 0.24 Operating lease expense 0.07 0.07 0.10 General and administrative (including share-based compensation) 4.33 5.08 6.92 General and administrative (excluding share-based compensation) 3.15 3.74 5.01 (Unaudited) Three Months Ended March 31, December 31, March 31, 2023 2022 2022 Oil, Natural Gas, and Natural Gas Liquids Revenues $ 88,082,912 $ 99,697,682 $ 68,181,032 Costs and Operating Expenses Lease operating expenses 17,472,691 17,411,645 8,953,165 Gathering, transportation and processing costs (823) (16,223) 1,296,858 Ad valorem taxes 1,670,613 1,570,039 951,954 Oil and natural gas production taxes 4,408,140 5,186,644 3,218,362 Depreciation, depletion and amortization 21,271,671 20,885,774 9,781,287 Asset retirement obligation accretion 365,847 365,747 188,242 Operating lease expense 113,138 113,138 83,590 General and administrative expense 7,130,139 8,346,896 5,522,277 Total Costs and Operating Expenses 52,431,416 53,863,660 29,995,735 Income from Operations 35,651,496 45,834,022 38,185,297 Other Income (Expense) Interest (expense) (10,390,279) (9,468,684) (3,398,361) Gain (loss) on derivative contracts 9,474,905 (19,330,689) (27,596,141) Other income 9,600 — — Net Other Income (Expense) (905,774) (28,799,373) (30,994,502) Income Before Provision for Income Taxes 34,745,722 17,034,649 7,190,795 Provision for Income Taxes (2,029,943) (2,541,980) (78,752) Net Income $ 32,715,779 $ 14,492,669 $ 7,112,043 Basic Earnings per share $ 0.18 $ 0.09 $ 0.07 Diluted Earnings per share $ 0.17 $ 0.08 $ 0.06 Basic Weighted-Average Shares Outstanding 177,984,323 162,743,445 100,192,562 Diluted Weighted-Average Shares Outstanding 190,138,969 178,736,799 124,004,178 26

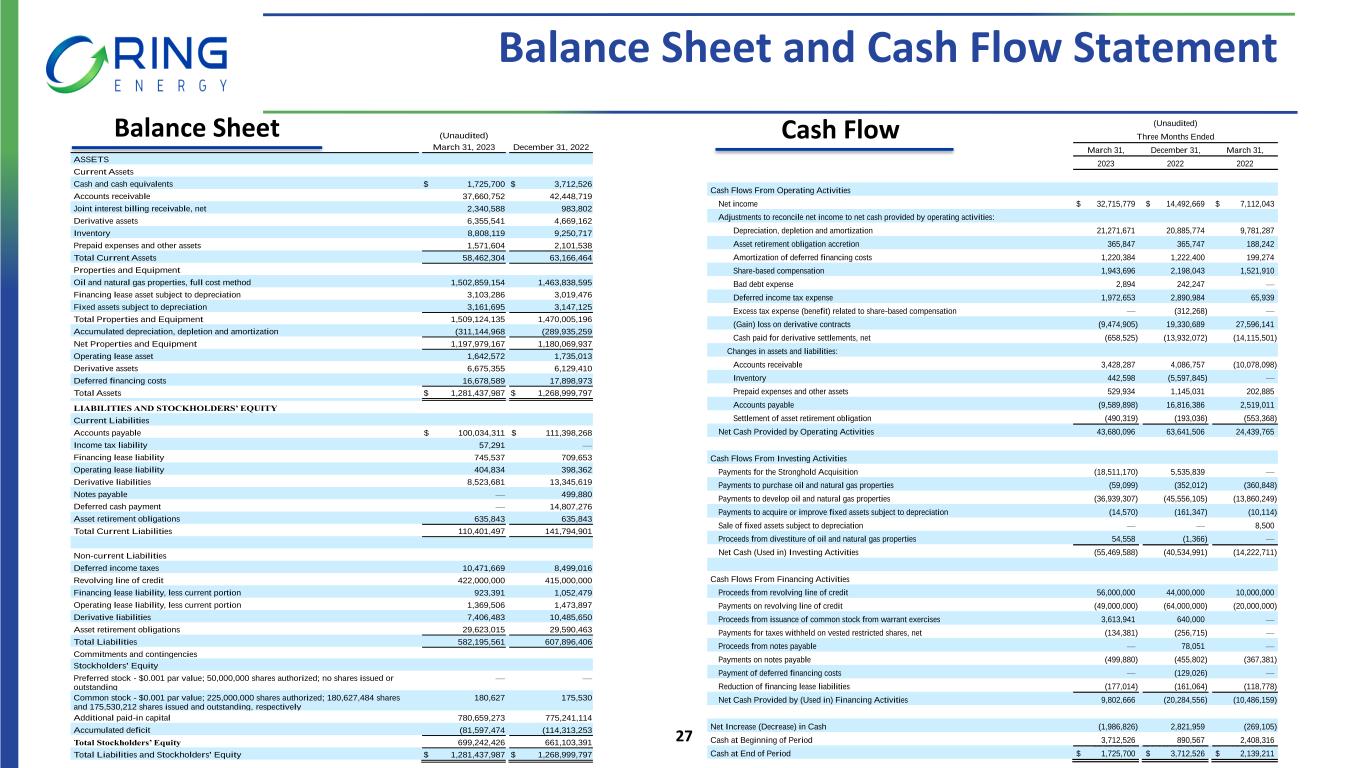

www.ringenergy.com NYSE American: REI (Unaudited) March 31, 2023 December 31, 2022 ASSETS Current Assets Cash and cash equivalents $ 1,725,700 $ 3,712,526 Accounts receivable 37,660,752 42,448,719 Joint interest billing receivable, net 2,340,588 983,802 Derivative assets 6,355,541 4,669,162 Inventory 8,808,119 9,250,717 Prepaid expenses and other assets 1,571,604 2,101,538 Total Current Assets 58,462,304 63,166,464 Properties and Equipment Oil and natural gas properties, full cost method 1,502,859,154 1,463,838,595 Financing lease asset subject to depreciation 3,103,286 3,019,476 Fixed assets subject to depreciation 3,161,695 3,147,125 Total Properties and Equipment 1,509,124,135 1,470,005,196 Accumulated depreciation, depletion and amortization (311,144,968 ) (289,935,259 ) Net Properties and Equipment 1,197,979,167 1,180,069,937 Operating lease asset 1,642,572 1,735,013 Derivative assets 6,675,355 6,129,410 Deferred financing costs 16,678,589 17,898,973 Total Assets $ 1,281,437,987 $ 1,268,999,797 LIABILITIES AND STOCKHOLDERS’ EQUITY Current Liabilities Accounts payable $ 100,034,311 $ 111,398,268 Income tax liability 57,291 — Financing lease liability 745,537 709,653 Operating lease liability 404,834 398,362 Derivative liabilities 8,523,681 13,345,619 Notes payable — 499,880 Deferred cash payment — 14,807,276 Asset retirement obligations 635,843 635,843 Total Current Liabilities 110,401,497 141,794,901 Non-current Liabilities Deferred income taxes 10,471,669 8,499,016 Revolving line of credit 422,000,000 415,000,000 Financing lease liability, less current portion 923,391 1,052,479 Operating lease liability, less current portion 1,369,506 1,473,897 Derivative liabilities 7,406,483 10,485,650 Asset retirement obligations 29,623,015 29,590,463 Total Liabilities 582,195,561 607,896,406 Commitments and contingencies Stockholders' Equity Preferred stock - $0.001 par value; 50,000,000 shares authorized; no shares issued or outstanding — — Common stock - $0.001 par value; 225,000,000 shares authorized; 180,627,484 shares and 175,530,212 shares issued and outstanding, respectively 180,627 175,530 Additional paid-in capital 780,659,273 775,241,114 Accumulated deficit (81,597,474 ) (114,313,253 ) Total Stockholders’ Equity 699,242,426 661,103,391 Total Liabilities and Stockholders' Equity $ 1,281,437,987 $ 1,268,999,797 (Unaudited) Three Months Ended March 31, December 31, March 31, 2023 2022 2022 Cash Flows From Operating Activities Net income $ 32,715,779 $ 14,492,669 $ 7,112,043 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation, depletion and amortization 21,271,671 20,885,774 9,781,287 Asset retirement obligation accretion 365,847 365,747 188,242 Amortization of deferred financing costs 1,220,384 1,222,400 199,274 Share-based compensation 1,943,696 2,198,043 1,521,910 Bad debt expense 2,894 242,247 — Deferred income tax expense 1,972,653 2,890,984 65,939 Excess tax expense (benefit) related to share-based compensation — (312,268) — (Gain) loss on derivative contracts (9,474,905) 19,330,689 27,596,141 Cash paid for derivative settlements, net (658,525) (13,932,072) (14,115,501) Changes in assets and liabilities: Accounts receivable 3,428,287 4,086,757 (10,078,098) Inventory 442,598 (5,597,845) — Prepaid expenses and other assets 529,934 1,145,031 202,885 Accounts payable (9,589,898) 16,816,386 2,519,011 Settlement of asset retirement obligation (490,319) (193,036) (553,368) Net Cash Provided by Operating Activities 43,680,096 63,641,506 24,439,765 Cash Flows From Investing Activities Payments for the Stronghold Acquisition (18,511,170) 5,535,839 — Payments to purchase oil and natural gas properties (59,099) (352,012) (360,848) Payments to develop oil and natural gas properties (36,939,307) (45,556,105) (13,860,249) Payments to acquire or improve fixed assets subject to depreciation (14,570) (161,347) (10,114) Sale of fixed assets subject to depreciation — — 8,500 Proceeds from divestiture of oil and natural gas properties 54,558 (1,366) — Net Cash (Used in) Investing Activities (55,469,588) (40,534,991) (14,222,711) Cash Flows From Financing Activities Proceeds from revolving line of credit 56,000,000 44,000,000 10,000,000 Payments on revolving line of credit (49,000,000) (64,000,000) (20,000,000) Proceeds from issuance of common stock from warrant exercises 3,613,941 640,000 — Payments for taxes withheld on vested restricted shares, net (134,381) (256,715) — Proceeds from notes payable — 78,051 — Payments on notes payable (499,880) (455,802) (367,381) Payment of deferred financing costs — (129,026) — Reduction of financing lease liabilities (177,014) (161,064) (118,778) Net Cash Provided by (Used in) Financing Activities 9,802,666 (20,284,556) (10,486,159) Net Increase (Decrease) in Cash (1,986,826) 2,821,959 (269,105) Cash at Beginning of Period 3,712,526 890,567 2,408,316 Cash at End of Period $ 1,725,700 $ 3,712,526 $ 2,139,211 Balance Sheet and Cash Flow Statement Balance Sheet Cash Flow 27

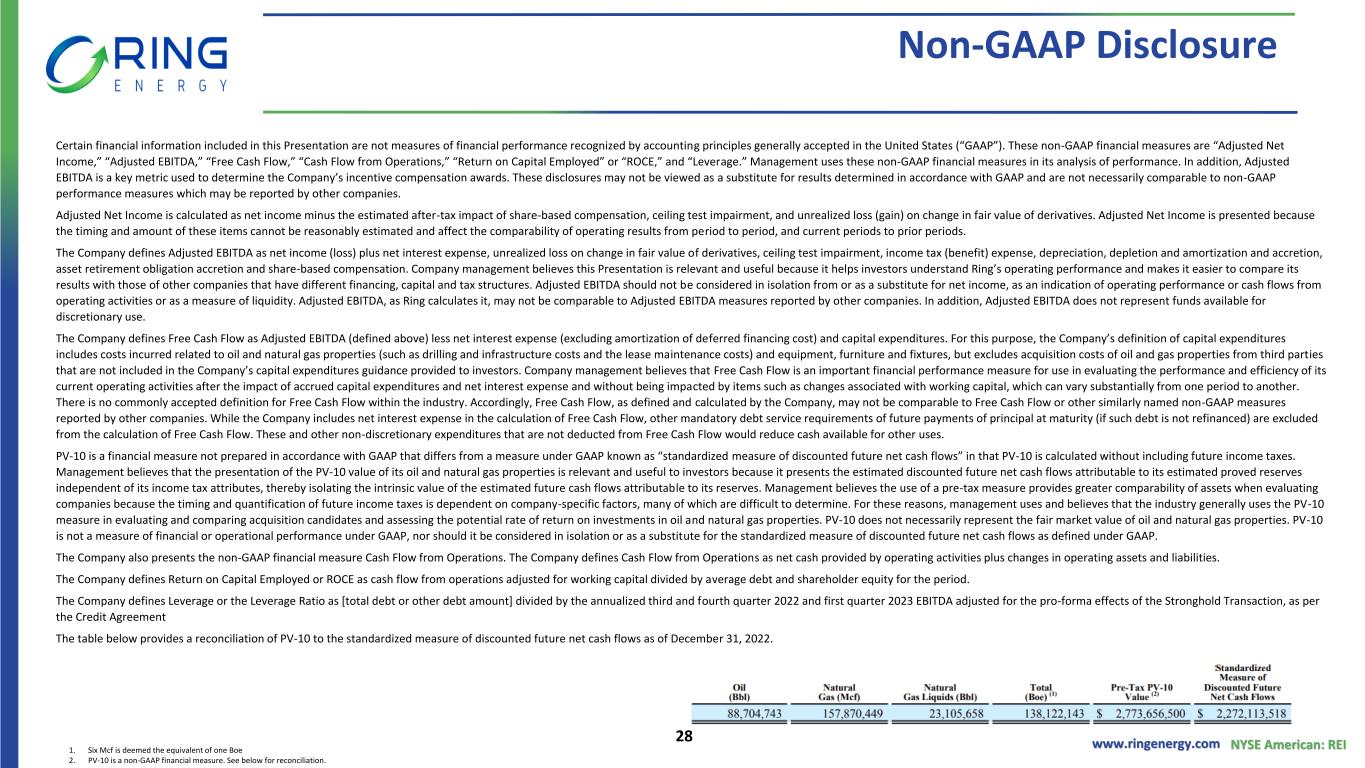

www.ringenergy.com NYSE American: REI Non-GAAP Disclosure Certain financial information included in this Presentation are not measures of financial performance recognized by accounting principles generally accepted in the United States (“GAAP”). These non-GAAP financial measures are “Adjusted Net Income,” “Adjusted EBITDA,” “Free Cash Flow,” “Cash Flow from Operations,” “Return on Capital Employed” or “ROCE,” and “Leverage.” Management uses these non-GAAP financial measures in its analysis of performance. In addition, Adjusted EBITDA is a key metric used to determine the Company’s incentive compensation awards. These disclosures may not be viewed as a substitute for results determined in accordance with GAAP and are not necessarily comparable to non-GAAP performance measures which may be reported by other companies. Adjusted Net Income is calculated as net income minus the estimated after-tax impact of share-based compensation, ceiling test impairment, and unrealized loss (gain) on change in fair value of derivatives. Adjusted Net Income is presented because the timing and amount of these items cannot be reasonably estimated and affect the comparability of operating results from period to period, and current periods to prior periods. The Company defines Adjusted EBITDA as net income (loss) plus net interest expense, unrealized loss on change in fair value of derivatives, ceiling test impairment, income tax (benefit) expense, depreciation, depletion and amortization and accretion, asset retirement obligation accretion and share-based compensation. Company management believes this Presentation is relevant and useful because it helps investors understand Ring’s operating performance and makes it easier to compare its results with those of other companies that have different financing, capital and tax structures. Adjusted EBITDA should not be considered in isolation from or as a substitute for net income, as an indication of operating performance or cash flows from operating activities or as a measure of liquidity. Adjusted EBITDA, as Ring calculates it, may not be comparable to Adjusted EBITDA measures reported by other companies. In addition, Adjusted EBITDA does not represent funds available for discretionary use. The Company defines Free Cash Flow as Adjusted EBITDA (defined above) less net interest expense (excluding amortization of deferred financing cost) and capital expenditures. For this purpose, the Company’s definition of capital expenditures includes costs incurred related to oil and natural gas properties (such as drilling and infrastructure costs and the lease maintenance costs) and equipment, furniture and fixtures, but excludes acquisition costs of oil and gas properties from third parties that are not included in the Company’s capital expenditures guidance provided to investors. Company management believes that Free Cash Flow is an important financial performance measure for use in evaluating the performance and efficiency of its current operating activities after the impact of accrued capital expenditures and net interest expense and without being impacted by items such as changes associated with working capital, which can vary substantially from one period to another. There is no commonly accepted definition for Free Cash Flow within the industry. Accordingly, Free Cash Flow, as defined and calculated by the Company, may not be comparable to Free Cash Flow or other similarly named non-GAAP measures reported by other companies. While the Company includes net interest expense in the calculation of Free Cash Flow, other mandatory debt service requirements of future payments of principal at maturity (if such debt is not refinanced) are excluded from the calculation of Free Cash Flow. These and other non-discretionary expenditures that are not deducted from Free Cash Flow would reduce cash available for other uses. PV-10 is a financial measure not prepared in accordance with GAAP that differs from a measure under GAAP known as “standardized measure of discounted future net cash flows” in that PV-10 is calculated without including future income taxes. Management believes that the presentation of the PV-10 value of its oil and natural gas properties is relevant and useful to investors because it presents the estimated discounted future net cash flows attributable to its estimated proved reserves independent of its income tax attributes, thereby isolating the intrinsic value of the estimated future cash flows attributable to its reserves. Management believes the use of a pre-tax measure provides greater comparability of assets when evaluating companies because the timing and quantification of future income taxes is dependent on company-specific factors, many of which are difficult to determine. For these reasons, management uses and believes that the industry generally uses the PV-10 measure in evaluating and comparing acquisition candidates and assessing the potential rate of return on investments in oil and natural gas properties. PV-10 does not necessarily represent the fair market value of oil and natural gas properties. PV-10 is not a measure of financial or operational performance under GAAP, nor should it be considered in isolation or as a substitute for the standardized measure of discounted future net cash flows as defined under GAAP. The Company also presents the non-GAAP financial measure Cash Flow from Operations. The Company defines Cash Flow from Operations as net cash provided by operating activities plus changes in operating assets and liabilities. The Company defines Return on Capital Employed or ROCE as cash flow from operations adjusted for working capital divided by average debt and shareholder equity for the period. The Company defines Leverage or the Leverage Ratio as [total debt or other debt amount] divided by the annualized third and fourth quarter 2022 and first quarter 2023 EBITDA adjusted for the pro-forma effects of the Stronghold Transaction, as per the Credit Agreement The table below provides a reconciliation of PV-10 to the standardized measure of discounted future net cash flows as of December 31, 2022. 1. Six Mcf is deemed the equivalent of one Boe 2. PV-10 is a non-GAAP financial measure. See below for reconciliation. 28

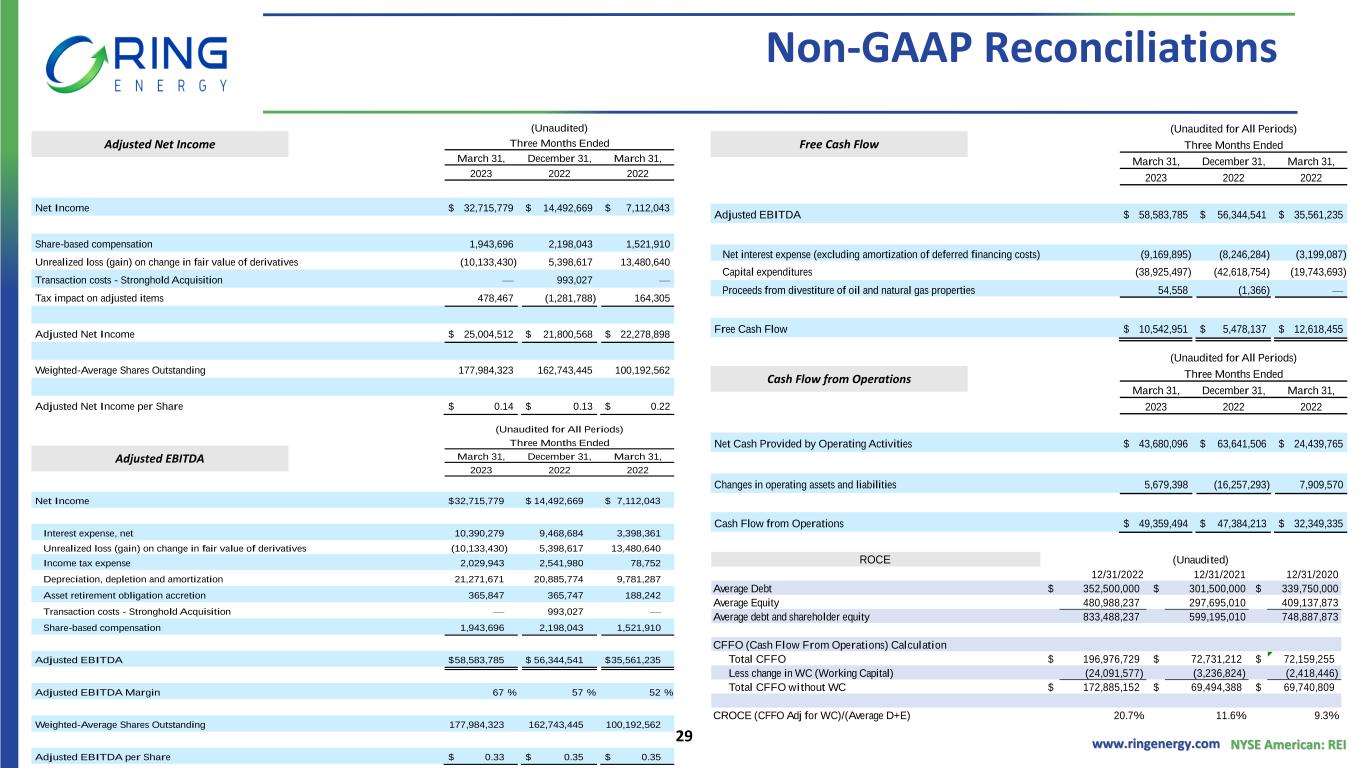

www.ringenergy.com NYSE American: REI (Unaudited for All Periods) Three Months Ended March 31, December 31, March 31, 2023 2022 2022 Net Cash Provided by Operating Activities $ 43,680,096 $ 63,641,506 $ 24,439,765 Changes in operating assets and liabilities 5,679,398 (16,257,293) 7,909,570 Cash Flow from Operations $ 49,359,494 $ 47,384,213 $ 32,349,335 (Unaudited) Three Months Ended March 31, December 31, March 31, 2023 2022 2022 Net Income $ 32,715,779 $ 14,492,669 $ 7,112,043 Share-based compensation 1,943,696 2,198,043 1,521,910 Unrealized loss (gain) on change in fair value of derivatives (10,133,430) 5,398,617 13,480,640 Transaction costs - Stronghold Acquisition — 993,027 — Tax impact on adjusted items 478,467 (1,281,788) 164,305 Adjusted Net Income $ 25,004,512 $ 21,800,568 $ 22,278,898 Weighted-Average Shares Outstanding 177,984,323 162,743,445 100,192,562 Adjusted Net Income per Share $ 0.14 $ 0.13 $ 0.22 Non-GAAP Reconciliations ROCE 12/31/2022 12/31/2021 12/31/2020 Average Debt $ 352,500,000 $ 301,500,000 $ 339,750,000 Average Equity 480,988,237 297,695,010 409,137,873 Average debt and shareholder equity 833,488,237 599,195,010 748,887,873 CFFO (Cash Flow From Operations) Calculation Total CFFO $ 196,976,729 $ 72,731,212 $ 72,159,255 Less change in WC (Working Capital) (24,091,577) (3,236,824) (2,418,446) Total CFFO without WC $ 172,885,152 $ 69,494,388 $ 69,740,809 CROCE (CFFO Adj for WC)/(Average D+E) 20.7% 11.6% 9.3% (Unaudited) Adjusted Net Income (Unaudited for All Periods) Three Months Ended March 31, December 31, March 31, 2023 2022 2022 Net Income $ 32,715,779 $ 14,492,669 $ 7,112,043 Interest expense, net 10,390,279 9,468,684 3,398,361 Unrealized loss (gain) on change in fair value of derivatives (10,133,430) 5,398,617 13,480,640 Income tax expense 2,029,943 2,541,980 78,752 Depreciation, depletion and amortization 21,271,671 20,885,774 9,781,287 Asset retirement obligation accretion 365,847 365,747 188,242 Transaction costs - Stronghold Acquisition — 993,027 — Share-based compensation 1,943,696 2,198,043 1,521,910 Adjusted EBITDA $ 58,583,785 $ 56,344,541 $ 35,561,235 Adjusted EBITDA Margin 67 % 57 % 52 % Weighted-Average Shares Outstanding 177,984,323 162,743,445 100,192,562 Adjusted EBITDA per Share $ 0.33 $ 0.35 $ 0.35 Adjusted EBITDA (Unaudited for All Periods) Three Months Ended March 31, December 31, March 31, 2023 2022 2022 Adjusted EBITDA $ 58,583,785 $ 56,344,541 $ 35,561,235 Net interest expense (excluding amortization of deferred financing costs) (9,169,895) (8,246,284) (3,199,087) Capital expenditures (38,925,497) (42,618,754) (19,743,693) Proceeds from divestiture of oil and natural gas properties 54,558 (1,366) — Free Cash Flow $ 10,542,951 $ 5,478,137 $ 12,618,455 Free Cash Flow Cash Flow from Operations 29

www.ringenergy.com NYSE American: REI Corporate Strategy Summary 2022 Value Focused for Sustainable Returns Attract and Retain Highly Qualified People Pursue Operational Excellence with a Sense of Urgency Invest in High-Margin, High RoR Projects Focus on FCF2 and Strengthen Balance Sheet Pursue Strategic A&D to Lower Breakeven Costs ✓Successfully attracting key personnel with <3% attrition rates while decreasing G&A per Boe ✓Safely set record production with increased efficiency and environmental stewardship ✓Increased ROCE1 to over 20% in 2022 ✓Multi-year generation of FCF while reducing leverage3 to ~1.56x and increasing liquidity4 205% ✓Closed transformational acquisition that led to improved metrics 1. We define ROCE as the return on capital employed. 2. ROCE and FCF are non-GAAP financial measures. See Appendix for reconciliation to GAAP measures. 3. Leverage ratio based on annualized third and fourth quarter 2022 and first quarter 2023 EBITDA adjusted for the pro-forma effects of the Stronghold Transaction, as per the Credit Agreement. 4. Liquidity is defined as cash on hand and available borrowings under the Company’s credit agreement. 30

www.ringenergy.com NYSE American: REI Add Photo Add Photo Add Photo Paul D. McKinney Chairman & Chief Executive Officer 39+ years of domestic & international oil & gas industry experience Executive & board roles include CEO, President, COO, Region VP and public & private board directorships Travis Thomas EVP & Chief Financial Officer 18+ years of oil & gas industry experience & accounting experience High level financial experience including CAO, VP Finance, Controller, Treasurer Alexander Dyes EVP of Engineering & Corporate Strategy 16+ years of oil & gas industry experience Multi-disciplined experience including VP A&D, VP Engineering, Director Strategy, multiple engineering & operational roles Marinos Baghdati EVP of Operations 19+ years of oil & gas industry experience Operational experience in drilling, completions and production including VP Operations, Operations manager, multiple engineering roles Stephen D. Brooks EVP of Land, Legal, HR & Marketing 45+ years of oil & gas industry experience Extensive career as landman including VP Land & Legal, VP HR VP Land and Land Manager Hollie Lamb VP of NonOP Reservoir Engineering / O&G Marketing 20+ years of oil & gas industry experience Previously Partner of HeLMS Oil & Gas, VP Engineering, Reservoir & Geologic Engineer Experienced Management Team Shared Vision with a Track Record of Success 31

www.ringenergy.com NYSE American: REI Paul D. McKinney Chairman & Chief Executive Officer 35+ years of domestic & international oil & gas industry experience Executive & board roles include CEO, President, COO, Region VP and public & private board directorships Anthony D. Petrelli Lead Independent Director 43+ years of banking, capital markets, governance & financial experience Executive and Board positions include CEO, President, multiple board chairs & directorships Refreshed Board of Directors Accomplished and Diversified Experience Roy I. Ben-Dor Director 14+ years of finance & capital markets experience Extensive financial and capital markets acumen and experience including Managing Director and numerous Board Director positions David S. Habachy Independent Director 24+ years of oil & gas industry, finance & capital markets experience Wide range of operations, engineering, financial and capital markets roles and experience including Managing Director and numerous Board Director positions John A. Crum Independent Director 45+ years of domestic & international oil & gas industry experience Extensive executive roles including CEO, President & COO, and multiple public & private board chairs & directorships Richard E. Harris Independent Director 40+ years of experience across multiple industries Executive positions in oil & gas, industrial equipment, and technology including CIO, Treasurer, Finance and Business Development Thomas L. Mitchell Independent Director 35+ years of domestic & international oil & gas industry experience Executive & board roles include CFO, VP Accounting, Controller and public & private board directorships Regina Roesener Independent Director 35+ years of banking, capital markets, governance & financial experience Executive and Board positions including COO, director and Board Director positions Clayton E. Woodrum Independent Director 50+ years of accounting, tax & finance experience Wide range of financial acumen including positions as CFO, Partner in Charge and Board Director positions 32

ANALYST COVERAGE Alliance Global Partners (A.G.P.) Jeff Grampp (713) 349-1067 jgrampp@allianceg.com ROTH Capital Partners John M. White (949) 720-7115 jwhite@roth.com Truist Financial Neal Dingmann (713) 247-9000 neal.dingmann@truist.com Tuohy Brothers Investment Noel Parks (215) 913-7320 nparks@tuohybrothers.com Water Tower Research Jeff Robertson (469) 343-9962 jeff@watertowerresearch.com COMPANY CONTACT Al Petrie (281) 975-2146 apetrie@ringenergy.com Chris Delange (281) 975-2146 cdelange@ringenergy.com