UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

| RING ENERGY, INC. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) |

Title of each class of securities to which transaction applies:

| |

| (2) |

Aggregate number of securities to which transaction applies:

| |

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |

| (4) |

Proposed maximum aggregate value of transaction:

| |

| (5) |

Total fee paid:

| |

| ¨ | Fee paid previously with preliminary materials. | |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 240.0-11 and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) |

Amount Previously Paid:

| |

| (2) |

Form, Schedule or Registration Statement No.:

| |

| (3) |

Filing Party:

| |

| (4) |

Date Filed:

| |

RING ENERGY, INC.

901 West Wall St., 3rd Floor

Midland, TX 79702

(432) 682-7464

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD DECEMBER 12, 2017

November 15, 2017

Dear Ring Energy Stockholder:

We are pleased to invite you to attend the 2017 Annual Meeting of Stockholders of Ring Energy, Inc. The Annual Meeting will be held on December 12, 2017, at 10:00 a.m., Central Standard Time, at the Hilton Garden Inn Midland, 1301 North Loop #250 West, Midland, TX 79706.

The enclosed Notice of Annual Meeting and the accompanying proxy statement describe the various matters to be acted upon during the Annual Meeting. In addition, there will be a report on the state of our business and an opportunity for you to ask questions of our management.

You may vote your shares by submitting a proxy by completing, signing, dating and returning the enclosed proxy card or by voting your shares in person at the Annual Meeting. The proxy card describes your voting options in more detail. Our report to the stockholders, including our Annual Report on Form 10-K for the year ended December 31, 2016 and our Quarterly Report on Form 10-Q for the period ended September 30, 2017, also accompany the proxy statement.

The Annual Meeting gives us an opportunity to review our business results and discuss the steps we have taken to position our company for the future. We appreciate your ownership of Ring Energy’s common stock, and we hope you can join us at the Annual Meeting.

Sincerely,

| /s/ Kelly Hoffman | |

| Kelly Hoffman | |

| Chief Executive Officer |

RING ENERGY, INC.

901 West Wall St., 3rd Floor

Midland, TX 79702

(432) 682-7464

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD DECEMBER 12, 2017

The 2017 Annual Meeting of Stockholders (the “Annual Meeting”) of Ring Energy, Inc., a Nevada corporation, will be held on December 12, 2017, at 10:00 a.m., Central Standard Time, at the Hilton Garden Inn Midland, 1301 North Loop #250 West, Midland, TX 79706, for the following purposes:

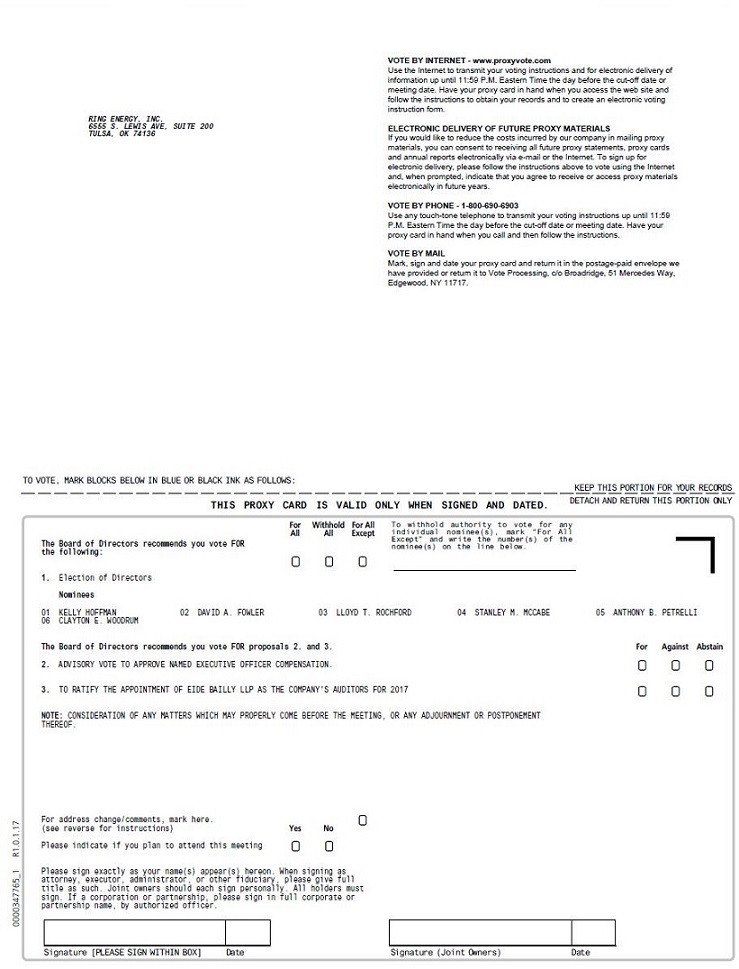

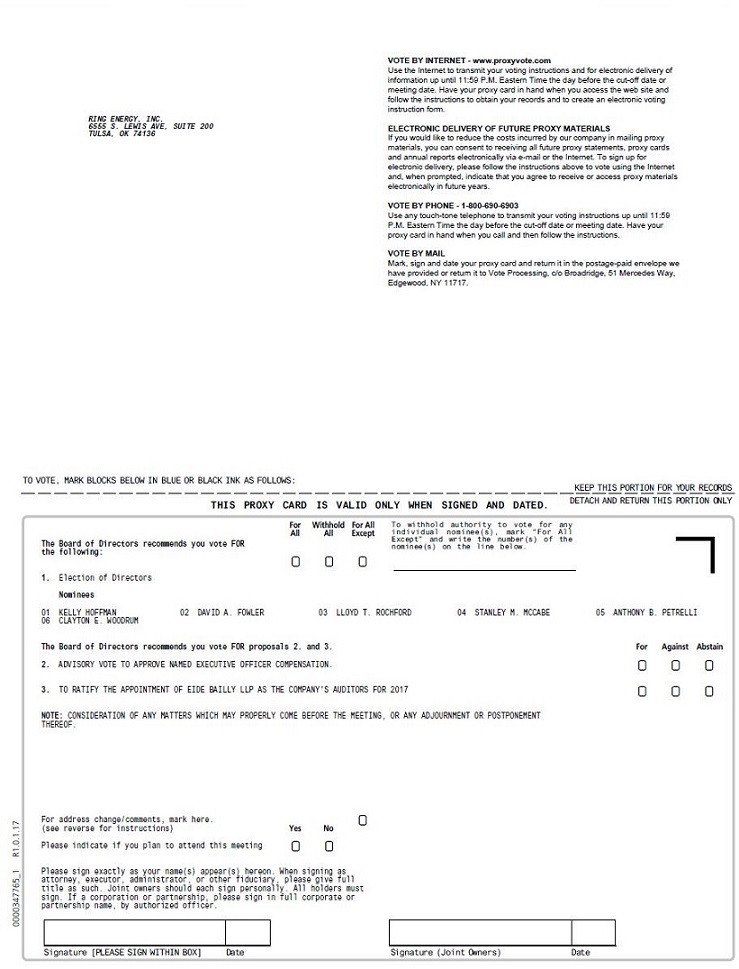

| (1) | to elect six directors to serve on our Board of Directors until the 2018 Annual Meeting of Stockholders or until their successors are duly elected and qualified; |

| (2) | to approve on a non-binding, advisory basis, the compensation of our Named Executive Officers; |

| (3) | to ratify the appointment of Eide Bailly LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017; and |

| (4) | to transact such other business as may arise that can properly be conducted at the Annual Meeting or any adjournment or postponement thereof. |

The Notice of Annual Meeting and Proxy Statement herein provide further information on the Company’s performance and corporate governance and describe the matters to be presented at the Annual Meeting. Our Board of Directors has fixed the close of business on November 17, 2017, as the record date (the “Record Date”) for the determination of stockholders entitled to notice of and to vote at the Annual Meeting or any adjournment or postponement thereof. Only stockholders of record at the close of business on the Record Date are entitled to notice of and to vote at the Annual Meeting. A list of stockholders entitled to vote at the Annual Meeting will be available for examination at our offices during normal business hours for a period of ten (10) calendar days prior to the Annual Meeting and will also be available during the Annual Meeting for inspection by stockholders.

EVEN IF YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, SIGN AND MAIL THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE IN THE ACCOMPANYING ENVELOPE.

We thank you for your continued support and look forward to seeing you at the Annual Meeting.

| By Order of the Board of Directors, | |

| /s/ William R. Broaddrick | |

| Midland, Texas | William R. Broaddrick |

| November 15, 2017 |

Chief Financial Officer, Corporate Secretary and Treasurer

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDER MEETING TO BE HELD ON DECEMBER 12, 2017

The Notice of Annual Meeting of Stockholders, the Proxy Statement for the 2017 Annual Meeting of Stockholders and the Annual Report to Stockholders for the year ended

December 31, 2016, are available on the Ring Energy, Inc.’s website,

www.ringenergy.com.

PROXY STATEMENT SUMMARY

This summary is included to provide an introduction and overview of the information contained in the Proxy Statement. This is a summary only and highlights information contained elsewhere in the Proxy Statement. This summary does not contain all of the information you should consider. You should read the Proxy Statement in its entirety carefully before voting. Additional information regarding the Company and its performance in 2016 can be found in the Company’s Annual report on Form 10-K.

2017 Annual Meeting of Stockholders

| Date and Time: | December 12, 2017, at 10:00 a.m., Central Standard Time |

| Location: | Hilton Garden Inn Midland, 1301 North Loop #250, Midland, TX 79706 |

| Record Date: | November 17, 2017 |

| Proxy Voting: | Stockholders as of the close of business on the Record Date are entitled to vote. Each share of Common Stock is entitled to one vote by proxy or at the Annual Meeting. |

Proposals and Recommendations

| Proposal | Board Recommendation | |||

| No. 1 | Election of 6 directors to serve on our Board of Directors until the 2018 Annual Meeting of Stockholders or until their successors are duly elected and qualified. | FOR each nominee | ||

| No. 2 | Advisory Vote to Approve Named Executive Officer Compensation. | FOR | ||

| No. 3 | Ratification of the appointment of Eide Bailly LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017. | FOR |

Performance Highlights as of the Third Quarter of 2017

| · | Significant Production Growth – We increased our production approximately 54% as of the end of the third quarter of 2017 as compared to the first three quarters of 2016, despite some weather related issues and delays. |

| · | Poised for Steady, Sustained Reserve and Production Growth – We drilled 33 wells as of September 30, 2017, which included 28 horizontal wells and 5 vertical wells on our Central Basin Platform and Delaware Basin acreage, of which 8 wells need to be completed. With the completion of wells not yet completed and our drilling inventory, we are poised for steady, sustained reserve and production growth. |

Performance Highlights for 2016

| · | Significant Production Growth – We created significant production growth in 2016, despite lower and more volatile commodity prices. Our production increased approximately 18% to 878,066 BOE in 2016, as compared to production of 743,363 BOE for the year ended December 31, 2015. |

| · | Reserve Growth – We increased our proved reserves 14% to 27.7 million BOE. As of December 31, 2016, our estimated proved reserves had a pre-tax “PV10” (present value of future net revenues before income taxes discounted at 10%) of approximately $217.3 million and a Standardized Measure of Discounted Future Net Cash Flows of approximately $159.8 million. |

| · | Improved Production Curves and Increase in Proved Undeveloped Reserves – Our PUD reserve estimate increased to 17.5 million BOE in 2016 from 15.8 million BOE in 2015, resulting from development, improved production curves and improved recovery and extension from the addition of new horizontal reserves proved up through development. |

| · | Improved Operational Efficiency – We improved our operational efficiency through employing technological advancements, which have provided a significant benefit in our continuous drilling program in the lower commodity price environment. As of result of our improved operational efficiency, as of December 31, 2016, we had drilled 195 wells, with 192 being vertical wells and 3 horizontal wells, and re-stimulated 35 existing wells on our Central Basin acreage and had drilled 6 wells and recompleted 6 existing wells on our Delaware Basin acreage. Our aggregate oil and gas production costs decreased on a BOE basis to $11.24 in 2016 from $13.40 in 2015. |

| · | Additional Financial Flexibility for Future Growth and Development – We increased our financial flexibility for future growth and development by paying down our credit facility and successfully raising additional capital in an underwritten public offering. We have a credit facility in place with a $60 million borrowing base for borrowings, and, as of December 31, 2016, we had paid all amounts outstanding on our credit facility. We successfully raised $139.6 million in underwritten public offerings in 2016. Our credit facility and capital raise provide us with additional operating flexibility. |

| · | Safety and Training – We continued our strong safety performance in 2016. |

RING ENERGY, INC.

PROXY STATEMENT

TABLE OF CONTENTS

RING ENERGY, INC.

901 West Wall St., 3rd Floor

Midland, TX 79702

(432) 682-7464

PROXY STATEMENT

FOR

THE 2017 ANNUAL MEETING OF STOCKHOLDERS

This proxy statement is furnished in connection with the solicitation by the Board of Directors (the “Board”) of Ring Energy, Inc. of proxies for use at its 2017 Annual Meeting of Stockholders to be held at the Hilton Garden Inn Midland, 1301 North Loop #250 West, Midland, TX 79706, on December 12, 2017, at 10:00 a.m., or any adjournment or postponement thereof (the “Annual Meeting”), for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders (the “Notice”).

Unless the context requires otherwise, references in this proxy statement to “Ring,” the “Company,” “we,” “us” and “our” are to Ring Energy, Inc., a Nevada corporation, and its consolidated subsidiaries. Unless the context otherwise requires, references to the “stockholders” are to the holders of shares of our common stock, par value $0.001 per share (“Common Stock”).

This proxy statement and accompanying form of proxy are being mailed to our stockholders on or about November 23, 2017. Our Annual Report on Form 10-K (the “Annual Report”) covering the year ended December 31, 2016 and our Quarterly Report on Form 10-Q covering the period ended September 30, 2017, are enclosed, but do not form any part of the materials for solicitation of proxies.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

What is the purpose of the Annual Meeting?

At the Annual Meeting, our stockholders will act upon the matters outlined in the Notice, including (1) the election of six directors to our Board, each for a term ending on the date of the 2018 Annual Meeting of Stockholders (this proposal is referred to as the “Election of Directors”); (2) a non-binding, advisory vote to approve Named Executive Officer compensation (this proposal is referred to as “Executive Compensation”); (3) the ratification of the appointment of Eide Bailly LLP as our independent registered public accounting firm for the fiscal year ended December 31, 2017 (this proposal is referred to as the “Ratification of Eide Bailly”); and (4) the transaction of such other business as may arise that can properly be conducted at the Annual Meeting or any adjournment or postponement thereof. Also, management will report on our performance during the last fiscal year and respond to questions from our stockholders.

What is a proxy?

A proxy is another person that you legally designate to vote your stock. If you designate a person or entity as your proxy in a written document, that document is also called a proxy or a proxy card.

What is a proxy statement?

It is a document that regulations of the Securities and Exchange Commission (the “SEC”) require that we give to you when we ask you to sign a proxy card to vote your stock at the Annual Meeting.

1

What is “householding” and how does it affect me?

One copy of the Notice, this proxy statement and the Annual Report (collectively, the “Proxy Materials”) will be sent to stockholders who share an address, unless they have notified us that they want to continue receiving multiple packages. This practice, known as “householding,” is designed to reduce duplicate mailings and save significant printing and postage costs. If you received a householded mailing this year and you would like to have additional copies of the Proxy Materials mailed to you or you would like to opt out of this practice for future mailings, we will promptly deliver such additional copies to you if you submit your request in writing to Ring Energy, Inc., Attention: William R. Broaddrick, Chief Financial Officer, 6555 Lewis Ave., Suite 200, Tulsa, OK, 74136 or by telephone at (918) 499-3880. You may also contact us in the same manner if you received multiple copies of the Proxy Materials and would prefer to receive a single copy in the future. The Proxy Materials are also available on our website: www.ringenergy.com.

What should I do if I receive more than one set of voting materials?

Despite our efforts related to householding, you may receive more than one set of Proxy Materials, including multiple copies of the proxy statement and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. Similarly, if you are a stockholder of record and hold shares in a brokerage account, you will receive a proxy card and a voting instruction card. Please complete, sign, date and return each proxy card and voting instruction card that you receive to ensure that all your shares are voted at the Annual Meeting.

What is the record date and what does it mean?

The record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting is the close of business on November 17, 2017 (the “Record Date”). The Record Date is established by our Board as required by Nevada law.

What is a quorum?

A quorum is the presence at the Annual Meeting, in person or by proxy, of the holders of at least one-third of the shares of our Common Stock outstanding and entitled to vote as of the Record Date. There must be a quorum for the Annual Meeting to be held. If a quorum is not present, the Annual Meeting may be adjourned until a quorum is reached. Proxies received but marked as abstentions or broker non-votes will be included in the calculation of votes considered to be present at the Annual Meeting.

Who is entitled to vote at the Annual Meeting?

Subject to the limitations set forth below, stockholders at the close of business on the Record Date may vote at the Annual Meeting.

What are the voting rights of the stockholders?

Each holder of Common Stock is entitled to one vote per share of Common Stock on all matters to be acted upon at the Annual Meeting. Neither our Articles of Incorporation, as amended, nor our Bylaws allow for cumulative voting rights.

What is the difference between a stockholder of record and a “street name” holder?

Most stockholders hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned in street name.

| · | Stockholder of Record. If your shares are registered directly in your name with Standard Registrar and Transfer Company Inc., our transfer agent, you are considered, with respect to those shares, the stockholder of record. As the stockholder of record, you have the right to grant your voting proxy directly or to vote in person at the Annual Meeting. |

2

| · | Street Name Stockholder. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name.” As the beneficial owner, you have the right to direct your broker or nominee how to vote and are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you obtain a signed proxy from the record holder giving you the right to vote the shares. |

How do I vote my shares?

Stockholders of Record: Stockholders of record may vote their shares or submit a proxy to have their shares voted by one of the following methods:

| · | By Mail. You may indicate your vote by completing, signing and dating your proxy card and returning it in the enclosed reply envelope. |

| · | In Person. You may vote in person at the Annual Meeting by completing a ballot; however, attending the Annual Meeting without completing a ballot will not count as a vote. |

Street Name Stockholders: Street name stockholders may generally vote their shares or submit a proxy to have their shares voted by one of the following methods:

| · | By Mail. You may indicate your vote by completing, signing and dating your proxy card or other information forwarded by your bank, broker or other holder of record and returning it in the enclosed reply envelope. |

| · | In Person with a Proxy from the Record Holder. You may vote in person at the Annual Meeting if you obtain a legal proxy from your bank, broker or other nominee. Please consult the voting form or other information sent to you by your bank, broker or other nominee to determine how to obtain a legal proxy in order to vote in person at the Annual Meeting. |

Can I revoke my proxy?

Yes. If you are a stockholder of record, you can revoke your proxy at any time before it is exercised by:

| · | submitting written notice of revocation to Ring Energy, Inc., Attention: William R. Broaddrick, Chief Financial Officer, 6555 Lewis Ave., Suite 200, Tulsa, OK, 74136, no later than December 11, 2017; |

| · | submitting another proxy with new voting instructions by mail; or |

| · | attending the Annual Meeting and voting your shares in person. |

If you are a street name stockholder and you vote by proxy, you may change your vote by submitting new voting instructions to your bank, broker or nominee in accordance with that entity’s procedures.

May I vote confidentially?

Yes. We treat all stockholder meeting proxies, ballots and voting tabulations confidentially if the stockholder has requested confidentiality on the proxy or ballot.

If you so request, your proxy will not be available for examination and your vote will not be disclosed prior to the tabulation of the final vote at the Annual Meeting except (1) to meet applicable legal requirements or (2) to allow the independent election inspectors to count and certify the results of the vote. The independent election inspectors may, however, at any time inform us whether or not a stockholder has voted.

3

What is the effect of broker non-votes and abstentions and what vote is required to approve each proposal?

If you hold your shares in “street name,” you will receive instructions from your broker or other nominee describing how to vote your shares. If you do not instruct your broker or nominee how to vote your shares, they may vote your shares as they decide as to each matter for which they have discretionary authority under the rules of the NYSE MKT LLC (the “NYSE MKT”).

There are also non-discretionary matters for which brokers and other nominees do not have discretionary authority to vote unless they receive timely instructions from you. When a broker or other nominee does not have discretion to vote on a particular matter, you have not given timely instructions on how the broker or other nominee should vote your shares and the broker or other nominee indicates it does not have authority to vote such shares on its proxy, a “broker non-vote” results. Although any broker non-vote would be counted as present at the Annual Meeting for purposes of determining a quorum, it would be treated as not entitled to vote with respect to non-discretionary matters.

Abstentions occur when stockholders are present at the Annual Meeting but fail to vote or voluntarily withhold their vote for any of the matters upon which the stockholders are voting.

If your shares are held in street name and you do not give voting instructions, the record holder will not be permitted to vote your shares with respect to Proposal 1 (Election of Directors) or Proposal 2 (Executive Compensation), and your shares will be considered broker non-votes with respect to these proposals. If your shares are held in street name and you do not give voting instructions, the record holder will nevertheless be entitled to vote your shares with respect to Proposal 3 (Ratification of Eide Bailly) in the discretion of the record holder.

| · | Proposal 1 (Election of Directors): To be elected, each nominee for election as a director must receive the affirmative vote of a plurality of the votes cast by the holders of our Common Stock, present in person or represented by proxy at the Annual Meeting and entitled to vote on the proposal. This means that director nominees who receive the most votes are elected. Votes may be cast in favor of or withheld from the election of each nominee. Votes that are withheld from a director’s election will be counted toward a quorum, but will not affect the outcome of the vote on the election of a director. Broker non-votes will not be counted as votes cast, and, accordingly, will have no effect on the outcome of the vote for directors. |

| · | Proposal 2 (Executive Compensation): To consider and vote upon, on a non-binding, advisory basis, a resolution to approve the compensation of the Named Executive Officers as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the compensation discussion and analysis, the compensation tables and any related material disclosed in this proxy statement. This vote is advisory, which means that the vote on executive compensation is not binding on the Company, its Board of Directors, or the Compensation Committee. |

| · | Proposal 3 (Ratification of Eide Bailly): Ratification of the appointment of Eide Bailly LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017, requires the affirmative vote of the holders of a majority of the votes cast by the holders of our Common Stock present in person or represented by proxy at the Annual Meeting and entitled to vote thereon. Abstentions and broker non-votes will not be counted as votes either for or against this proposal, and, accordingly, will have no effect on the outcome of this proposal. |

Our Board has appointed William R. Broaddrick as the management proxy holder for the Annual Meeting. If you are a stockholder of record, your shares will be voted by the management proxy holder in accordance with the instructions on the proxy card you submit by mail. For stockholders who have their shares voted by duly submitting a proxy by mail, the management proxy holder will vote all shares represented by such valid proxies as our Board recommends, unless a stockholder appropriately specifies otherwise.

4

Our Board recommends a vote:

| · | FOR each of the nominees for director; |

| · | FOR non-binding, advisory approval of Named Executive Officer compensation; and |

| · | FOR the ratification of the appointment of Eide Bailly LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017. |

What happens if additional proposals are presented at the Annual Meeting?

Other than the matters specified in the Notice, we do not expect any matters to be presented for a vote at the Annual Meeting. If you grant a proxy, the management proxy holder will have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting. Under our bylaws, the deadline for notifying us of any additional proposals to be presented at the Annual Meeting has passed and, accordingly, stockholders may not present proposals at the Annual Meeting.

Who will bear the cost of soliciting votes for the Annual Meeting?

We will bear all expenses of soliciting proxies. We have engaged Broadridge Financial Solutions, Inc. to aid in the distribution of proxy materials and to provide voting and tabulation services for the Annual Meeting. Directors, officers and employees will not be additionally compensated but may be reimbursed for reasonable out-of-pocket expenses in connection with any solicitation. In addition, we may reimburse brokerage firms, custodians, nominees, fiduciaries and other persons representing beneficial owners of our Common Stock for their reasonable expenses in forwarding solicitation material to such beneficial owners.

May I propose actions for consideration at the 2018 Annual Meeting of Stockholders or nominate individuals to serve as directors?

You may submit proposals for consideration at future stockholder meetings, including director nominations. Please read “Stockholder Proposals and Director Nominations for the 2018 Annual Meeting” for information regarding the submission of stockholder proposals and director nominations for consideration at next year’s annual meeting.

5

PROPOSAL 1: ELECTION OF DIRECTORS

At the Annual Meeting, the stockholders will elect six directors to serve on the Board until the 2018 Annual Meeting or until their successors are duly elected and qualified. Upon the recommendation of the Nominating and Corporate Governance Committee of the Board, our Board has nominated as directors the following six individuals, each of whom is presently serving as a director.

We neither paid any third-party fees to assist in the process of identifying or evaluating candidates nor did we receive any stockholder nominations for director. Each nominee is currently a director and was previously elected to our Board by our stockholders. Messrs. Rochford and McCabe joined the Board in June 2012, and Messrs. Hoffman, Fowler, Woodrum and Petrelli joined the Board in January 2013.

Each nominee has consented to being named as a nominee in this proxy statement and has indicated a willingness to serve if elected.

Stockholders may not cumulate their votes in the election of our directors. We have no reason to believe that the nominees will be unable or unwilling to serve if elected. However, if a nominee should become unable or unwilling to serve for any reason, proxies may be voted for another person nominated as a substitute by our Board.

EXECUTIVE OFFICERS AND DIRECTORS

The following table sets forth the names, ages and titles, as of November 2, 2017, of each of our current executive officers and directors.

| Name | Age | Position | ||

| Kelly Hoffman | 59 | Chief Executive Officer, Director | ||

| David A. Fowler | 59 | President, Director | ||

| Daniel D. Wilson | 56 | Executive Vice President | ||

| William R. Broaddrick | 40 | Chief Financial Officer | ||

| Lloyd T. Rochford | 71 | Chairman of the Board of Directors | ||

| Stanley M. McCabe | 85 | Director | ||

| Anthony B. Petrelli | 65 | Director | ||

| Clayton E. Woodrum | 77 | Director |

Below are summaries of the background and business experience, attributes, qualifications and skills of the current executive officers, directors, and director nominees of the Company.

Kelly Hoffman – Chief Executive Officer and Director. Mr. Hoffman, 59, has organized the funding, acquisition and development of many oil and gas properties. He began his career in the Permian Basin in 1975 with Amoco Production Company. His responsibilities included oilfield construction, crew management, and drilling and completion operations. In the early 1990s, Mr. Hoffman co-founded AOCO and began acquiring properties in West Texas. In 1996, he arranged financing and purchased 10,000 acres in the Fuhrman Mascho field in Andrews, Texas. In the first six months, he organized a 60 well drilling and completion program resulting in a 600% increase in revenue and approximately 18 months later sold the properties to Lomak (Range Resources). In 1999, Mr. Hoffman arranged financing and acquired 12,000 acres in Lubbock and Crosby counties. After drilling and completing 19 successful wells, unitizing the acreage, and instituting a secondary recovery project, he sold his interest in the property to Arrow Operating Company. From April 2009 until December 2011, Mr. Hoffman served as President of Victory Park Resources, a privately held exploration and production company focused on the acquisition of oil and gas producing properties in Oklahoma, Texas and New Mexico. Mr. Hoffman has served as Chief Executive Officer of the Company since January 2013. Mr. Hoffman currently serves as a director of Joes Jeans Inc. (NASDAQ: JOEZ), a reporting company.

6

David A. Fowler – President and Director. Mr. Fowler, 59, has served in several management positions for various companies in the insurance and financial services industries. In 1994, he joined Petroleum Listing Service as Vice President of Operations, overseeing oil and gas property listings, information packages, and marketing oil and gas properties to industry players. In late 1998, Mr. Fowler became the Corporate Development Coordinator for the Independent Producer Finance (“IPF”) group of Range Resources Corporation. Leaving IPF in April 2001, Mr. Fowler co-founded and became President of Simplex Energy Solutions, LLC (“Simplex”). Representing Permian Basin oil and gas independent operators, Simplex became known as the Permian Basin’s premier oil and gas divestiture firm, closing over 150 projects valued at approximately $675 million. Mr. Fowler has served as President of the Company since January 2013.

Daniel D. Wilson – Executive Vice President. Mr. Wilson, 56, has over 30 years of experience in operating, evaluating and exploiting oil and gas properties. He has experience in production, drilling and reservoir engineering. From September 1983 to December 2012, Mr. Wilson served as the Vice President and Manager of Operations for Breck Operating Corporation (“Breck”). He had the responsibility of overseeing the building, operating and divestiture of two companies during this time. At Breck’s peak, Mr. Wilson was responsible for over 750 wells in seven states and had an operating staff of 27 members, including engineers, foremen, pumpers and clerks. Mr. Wilson personally performed or oversaw all of the economic evaluations for both acquisition and banking purposes. Mr. Wilson has served as Executive Vice President of the Company since January 2013.

William R. Broaddrick – Chief Financial Officer. Mr. Broaddrick, 40, was employed from 1997 to 2000 with Amoco Production Company, performing lease revenue accounting and state production tax regulatory reporting functions. During 2000, Mr. Broaddrick was employed by Duke Energy Field Services, LLC, performing state production tax functions. From 2001 until 2010, Mr. Broaddrick was employed by Arena Resources, Inc. (“Arena”), as Vice President and Chief Financial Officer. During 2011, Mr. Broaddrick joined Stanford Energy, Inc. (“Stanford”) as Chief Financial Officer. As a result of the merger transaction between Stanford and Ring, Mr. Broaddrick became Chief Financial Officer of the Company as of July 2012.

In 1999, Mr. Broaddrick received a Bachelor’s Degree in Accounting from Langston University, through Oklahoma State University – Tulsa. Mr. Broaddrick is a Certified Public Accountant.

Lloyd T. (“Tim”) Rochford – Chairman of the Board of Directors. Mr. Rochford, 71, has been an active individual consultant and entrepreneur in the oil and gas industry since 1973. He has been an operator of wells in the mid-continent of the United States, evaluated leasehold drilling and production projects, and arranged and raised in excess of $500 million in private and public financing for oil and gas projects and development.

Mr. Rochford has successfully formed, developed and sold/merged four natural resource companies, two of which were listed on the New York Stock Exchange. The most recent, Arena, was founded by Mr. Rochford and his associate Stanley McCabe in August 2000. From inception until May 2008, Mr. Rochford served as President, Chief Executive Officer and as a director of Arena. During that time, Arena received numerous accolades from publications such as Business Week (2007 Hot Growth Companies), Entrepreneur (2007 Hot 500), Fortune (2007, 2008, 2009 Fastest Growing Companies), Fortune Small Business (2007, 2008 Fastest Growing Companies) and Forbes (Best Small Companies of 2009). In May 2008, Mr. Rochford resigned from the position of Chief Executive Officer at Arena and accepted the position of Chairman of the Board. In his role as Chairman, Mr. Rochford continued to pursue opportunities that would enhance the then-current, as well as long-term, value of Arena. Through his efforts, Arena entered into a merger agreement and was acquired by another New York Stock Exchange company for $1.6 billion in July 2010.

Stanley M. McCabe – Director. Mr. McCabe, 85, has been active in the oil and gas industry for over 30 years, primarily seeking individual oil and gas acquisition and development opportunities. In 1979, he founded and served as Chairman and Chief Executive Officer of Stanton Energy, Inc., a Tulsa, Oklahoma natural resource company specializing in contract drilling and operation of oil and gas wells. In 1990, Mr. McCabe co-founded with Mr. Rochford, Magnum Petroleum, Inc., serving as an officer and director. In 2000, Mr. McCabe co-founded Arena, with Mr. Rochford, and Mr. McCabe served as Chairman of the Board until 2008 and then as a director of Arena until 2010.

7

Anthony B. Petrelli – Director. Mr. Petrelli, 65, is President, Chairman, and Director of Investment Banking Services of NTB Financial Corporation, a Denver, Colorado based financial services firm founded in 1977. Beginning his career in 1972, Mr. Petrelli has extensive experience in the areas of operations, sales, trading, management of sales, underwriting and corporate finance. He has served on numerous regulatory and industry committees including service on the FINRA Corporate Finance Committee, the NASD Small Firm Advisory Board and as Chairman of the FINRA District Business Conduct Committee, District 3. Additionally, Mr. Petrelli has served on the Board of Directors of Sensus Healthcare, Inc. since July 2016. Mr. Petrelli received his Bachelors of Science in Business (Finance) and his Masters of Business Administration (MBA) from the University of Colorado and a Masters of Arts in Counseling from Denver Seminary.

Clayton E. Woodrum – Director. Mr. Woodrum, CPA, 77, is a founding partner of Woodrum, Tate & Associates, PLLC. His financial background encompasses over 40 years of experience from serving as a Partner In Charge of the Tax Department of a big eight accounting firm to Chief Financial Officer of BancOklahoma Corp. and Bank of Oklahoma. His areas of expertise include business valuation, litigation support (including financial analysis, damage reports, depositions and testimony), estate planning, financing techniques for businesses, asset protection vehicles, sale and liquidation of businesses, debt restructuring, debt discharge and CFO functions for private and public companies.

All directors and nominees for director of the Company are United States citizens. There are no family relationships between any of our directors or nominees for director and executive officers. In addition, there are no other arrangements or understandings between any of our directors or nominees for director and any other person pursuant to which any person was selected as a director or nominee for director.

During the past ten years, there have been no events under any bankruptcy act, no criminal proceedings and no judgments, injunctions, orders or decrees material to the evaluation of the ability and integrity of any of our directors or nominees for director, and none of our directors or nominees for director has been involved in any judicial or administrative proceedings resulting from involvement in mail or wire fraud or fraud in connection with any business entity, any judicial or administrative proceedings based on violations of federal or state securities, commodities, banking or insurance laws or regulations, and any disciplinary sanctions or orders imposed by a stock, commodities or derivatives exchange or other self-regulatory organization.

BOARD RECOMMENDATION ON PROPOSAL

The Board unanimously recommends a vote FOR the election of each of the director nominees named above. The management proxy holder will vote all properly submitted proxies FOR election unless properly instructed otherwise.

8

CORPORATE GOVERNANCE AND OUR BOARD

General

Our Board currently consists of six members. The Company’s Articles of Incorporation and Bylaws provide for the annual election of directors. At each annual meeting of stockholders, our directors will be elected for a one-year term and serve until their respective successors have been elected and qualified.

Our Board held six meetings during the fiscal year ending on December 31, 2016. During the fiscal year ending on December 31, 2016, no directors attended fewer than 75% of the total number of meetings of our Board and committees on which that director served.

We encourage, but do not require, our directors to attend annual meetings of stockholders. At our last Annual Meeting of Stockholders, all serving members of our Board attended.

Board Independence

As required under the listing standards of the NYSE MKT, a majority of the members of our Board must qualify as independent, as affirmatively determined by our Board. Our Nominating and Corporate Governance Committee evaluated all relevant transactions and relationships between each director, and any of his or her family members, and our Company, senior management and independent registered accounting firm. Based on this evaluation and the recommendation of our Nominating and Corporate Governance Committee, our Board has determined that Clayton E. Woodrum, Anthony B. Petrelli, Lloyd T. Rochford, and Stanley M. McCabe are independent directors, as that term is defined in the listing standards of the NYSE MKT.

Board Committees

Our Board of Directors has established an Audit Committee, a Compensation Committee, a Nominating and Corporate Governance Committee, and an Executive Committee, the composition and responsibilities of which are briefly described below. The charters for each of these committees shall be provided to any person without charge, upon request. The charters are also available on the Company’s website at www.ringenergy.com. Requests may be directed to Ring Energy, Inc., Attention: William R. Broaddrick, 6555 S. Lewis Ave., Suite 200, Tulsa, Oklahoma 74136, or by calling (918) 499-3880. The information on, or that can be accessed through our website, is not incorporated by reference into this proxy statement and should not be considered part of this proxy statement. Our Board, in its business judgment, has determined that the Compensation Committee, Audit Committee and Nominating and Corporate Governance Committee are comprised entirely of independent directors as currently required under the listing standards of the NYSE MKT and applicable rules and requirements of the SEC. The Board may also delegate certain duties and responsibilities to the committees it establishes; for example, the Board may delegate the duty of determining appropriate salaries for our executive officers from time to time.

Audit Committee

The Audit Committee’s principal functions are to assist the Board in monitoring the integrity of our financial statements, the independent auditor’s qualifications and independence, the performance of our independent auditors and our compliance with legal and regulatory requirements. The Audit Committee has the sole authority to retain and terminate our independent auditors and to approve the compensation paid to our independent auditors. The Audit Committee is also responsible for overseeing our internal audit function.

The Audit Committee is comprised of Messrs. Woodrum, Petrelli and McCabe, with Mr. Woodrum acting as the chairman. Our Board determined that Mr. Woodrum qualified as an “audit committee financial expert” as defined in Item 407 of Regulation S-K promulgated by the SEC. Each of Messrs. Woodrum, Petrelli and McCabe further qualified as “independent” in accordance with the applicable regulations of the NYSE MKT definition of independent director set forth in the Company Guide, Part 8, Section 803(A). The Audit Committee met four times during the fiscal year ending December 31, 2016.

9

Compensation Committee

The Compensation Committee’s principal function is to make recommendations regarding the compensation of the Company’s officers. In accordance with the rules of the NYSE MKT, the compensation of our chief executive officer is recommended by the Compensation Committee to the Board (in a proceeding in which the chief executive officer does not participate). Compensation for all other officers is also recommended to the Board for determination by the Compensation Committee. The Compensation Committee is comprised of Messrs. Rochford and McCabe, with Mr. Rochford acting as the chairman.

The Compensation Committee is delegated all authority of the Board as may be required or advisable to fulfill the purposes of the Compensation Committee. The Compensation Committee may form and delegate some or all of its authority to subcommittees when it deems appropriate. Meetings may, at the discretion of the Compensation Committee, include members of the Company’s management, other members of the Board, consultants or advisors, and such other persons as the Compensation Committee or its chairperson may determine.

The Compensation Committee has the sole authority to retain, amend the engagement with, and terminate any compensation consultant to be used to assist in the evaluation of director, chief executive officer or executive officer compensation, including employment contracts and change in control provisions. The Compensation Committee has sole authority to approve the consultant’s fees and other retention terms and has authority to cause the Company to pay the fees and expenses of such consultants. The Compensation Committee did not retain any compensation consultants for the fiscal year ending December 31, 2016.

Each member of the Compensation Committee during the fiscal year ending December 31, 2016, was an “outside director” as defined under section 162(m) of the Internal Revenue Code, as amended (the “Code”) and was “independent” as defined in the applicable rules of the NYSE MKT and the SEC. The Compensation Committee held two meetings during the fiscal year ending December 31, 2016.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee’s principal functions are to (a) identify and recommend qualified candidates to the Board of Directors for nomination as members of the Board and its committees, and (b) develop and recommend to the Board corporate governance principles and policies applicable to the Company. The Nominating and Corporate Governance Committee is comprised of Messrs. Rochford and McCabe, with Mr. Rochford acting as the chairman.

Each member of the Nominating and Corporate Governance Committee during the fiscal year ending December 31, 2016, was “independent” as defined in the applicable rules of the NYSE MKT and the SEC. The Nominating and Corporate Governance Committee met two times during the fiscal year ending December 31, 2016.

Director Nominations and Qualifications

Under its charter, the Nominating and Corporate Governance Committee identifies qualified candidates to serve as Board members as necessary to fill vacancies or the additional needs of the Board, and reviews and evaluates candidates recommended by stockholders of the Company. The Nominating and Corporate Governance Committee considers qualified candidates from several sources, including stockholders. The Nominating and Corporate Governance Committee may, but has not, retained an outside consultant to evaluate or assist in identifying or evaluating potential director candidates.

Any stockholders desiring to propose a nominee to the Board should submit such proposed nominee for consideration by the Nominating and Corporate Governance Committee, including the proposed nominee’s qualifications, to Ring Energy, Inc., Attention: Mr. William R. Broaddrick, 6555 Lewis Ave., Suite 200, Tulsa, OK, 74136. Stockholders who meet certain requirements specified in our by-laws may also nominate candidates for inclusion in our proxy materials for an annual meeting as described in “Stockholder Proposals and Director Nominations for the 2018 Annual Meeting.” There are no differences in the manner in which the Nominating and Corporate Governance Committee evaluates nominees for director based on whether the nominee is recommended by a stockholder or the incumbent directors.

10

Whether nominated by a stockholder or through the activities of the Nominating and Corporate Governance Committee, the Nominating and Corporate Governance Committee seeks to select candidates who have distinguished records of leadership and success in their area of activity and who will make substantial contributions to Board operations and effectively represent the interests of all stockholders.

The Nominating and Corporate Governance Committee’s assessment of candidates includes, but is not limited to, consideration of: (i) roles and contributions valuable to the business community; (ii) personal qualities of leadership, character, judgment, and whether the candidate possesses and maintains throughout service on the Board a reputation in the community at large of integrity, trust, respect, competence, and adherence to the highest ethical standards; (iii) relevant knowledge and diversity of background and experience in such things as the Company’s industry, and in general, business, manufacturing, technology, finance and accounting, marketing, international business, government, and the like; or (iv) whether the candidate is free of conflicts and has the time required for preparation, participation, and attendance at all meetings. A director’s qualifications in light of these criteria are considered at least each time the director is re-nominated for Board membership. The Committee also evaluates whether the candidate’s skills are complementary to the existing Board members’ skills, the Board’s needs for particular expertise in fields such as business, manufacturing, technology, financial, marketing, governmental, or other areas of expertise, and assess the candidate’s impact on Board dynamics and effectiveness. The Committee selects candidates that best suit the Board’s current needs and recommends one or more of such individuals to the Board. Our membership criteria and a rigorous selection process help ensure that candidates recommended to the Board will effectively represent the balanced best interests of all stockholders.

Board of Directors Diversity

The Board encourages a diversity of backgrounds among its members; however, it does not have a formal diversity policy with regard to the consideration of diversity in identifying director nominees. The Board considers candidates with significant direct or indirect energy industry experience that will provide the Board as a whole with the talents, skills, diversity and expertise to serve the long-term interests of the Company and its stockholders.

Executive Committee

The Executive Committee’s principal function is to exercise the powers and duties of the Board between Board meetings and while the Board is not in session, and implement the policy decisions of the Board. The Executive Committee is comprised of Messrs. Rochford and McCabe and met five times during the fiscal year ending December 31, 2016.

Code of Ethics and Code of Business Conduct

We have adopted a Code of Ethics that applies to our Chief Executive Officer, President, and Chief Financial Officer, as well as the principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions to ensure the highest standard of ethical conduct and fair dealing.

We have also adopted a Code of Business Conduct covering a wide range of business practices and procedures that applies to all of our officers, directors, and employees to help to promote honest and ethical conduct. The Code of Business Conduct covers standards for professional conduct, including, among others, conflicts of interest, insider trading, confidential information, protection and proper use of Company assets, and compliance with all laws and regulations applicable to the Company’s business.

These documents will be provided to any person without charge upon request to Ring Energy, Inc., Attention: Mr. William R. Broaddrick, 6555 Lewis Ave., Suite 200, Tulsa, OK, 74136, and are available on the Company’s website at www.ringenergy.com.

11

Board Leadership Structure

The Chairman of the Board is selected by the members of the Board. The positions of Chairman of the Board and Chief Executive Officer are separate. The Board has determined that the current structure is appropriate at this time because it enables Mr. Hoffman to focus on his role as Chief Executive Officer of the Company, while enabling Mr. Rochford, the Chairman of our Board, to continue providing leadership on policy at the Board level. Although the roles of Chief Executive Officer and Chairman are currently separated, the Board has not adopted a formal policy requiring such separation. The Board believes that the right leadership structure on the Board should, among other things, be determined by the needs and circumstances of the Company and the then current membership of the Board, and that the Board should remain adaptable to shaping the leadership structure as those needs and circumstances change.

Board Risk Assessment and Control

The Board considers risk oversight and management to be an integral part of its role. Our risk management program is overseen by our Board and its committees, with support from our management. Our Board utilizes an enterprise-wide approach to oil and gas industry risk management, designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and enhance stockholder value. A fundamental part of risk management is a thorough understanding of the risks the Company faces, understanding of the level of risk appropriate for our Company and the steps needed to manage those risks effectively. The involvement of all members of the Board in setting our business strategy is a key part of their overall responsibilities and, together with management, determines what constitutes an appropriate level of risk for our Company. Our Board believes that its practice of including all members of our management team in our risk assessments allows the Board to more directly and effectively evaluate management capabilities and performance, more effectively and efficiently communicate its concerns and wishes to the entire management team and provides all members of management with a direct communication avenue to the Board.

While our Board has the ultimate oversight responsibility for the risk management process, the committees of our Board also have responsibility for specific risk management activities. In particular, the Audit Committee focuses on financial risk management, including internal controls, and oversees compliance with regulatory requirements. In setting compensation, the Compensation Committee approves compensation programs for the officers and other key employees to encourage an appropriate level of risk-taking behavior consistent with our business strategy and performance.

More information about the Company’s corporate governance practices and procedures is available on the Company’s website at www.ringenergy.com.

Communications with our Board

Stockholders desiring to communicate with our Board, or any director in particular, may do so by mail addressed as follows: Attn: Board of Directors, Ring Energy, Inc., 901 West Wall St., 3rd Floor, Midland, TX 79702. Our Chief Executive Officer, Chief Financial Officer or Corporate Secretary review each such communication received from stockholders and other interested parties and will forward the communication, as expeditiously as reasonably practicable, to the Board (or individual director) if: (1) the communication complies with the requirements of any applicable policy adopted by us relating to the subject matter; or (2) the communication falls within the scope of matters generally considered by our Board.

12

COMPENSATION DISCUSSION & ANALYSIS

Our Compensation Committee, appointed by our Board, assists the Board in performing its responsibilities relating to the compensation of our Chief Executive Officer and other Named Executive Officers. The Compensation Committee is responsible for our incentive compensation programs, which include programs for our executive management team, including the Named Executive Officers listed below. (See “Setting Executive Compensation” below).

This Compensation Discussion and Analysis (1) provides an overview of our compensation policies and programs; (2) explains our compensation objectives, policies and practices with respect to our Named Executive Officers and our Compensation Committee’s rationale in structuring our executive compensation program, which is designed to align the interests of Named Executive Officers with our stockholders, as well as to provide our Named Executive Officers with incentives to achieve the Company’s goals and objectives that will ultimately enhance value to our stockholders; and (3) identifies the elements of compensation for each of the individuals identified in the following table, whom we refer to in this proxy statement as our “Named Executive Officers” for the fiscal year ending December 31, 2016.

| Name | Principal Position | |

| Kelly Hoffman | Chief Executive Officer, effective January 1, 2013 | |

| David A. Fowler | President, effective January 1, 2013 | |

| Daniel D. Wilson | Executive Vice President, effective January 1, 2013 | |

| William R. Broaddrick | Chief Financial Officer, effective July 1, 2012 |

This section contains a discussion of the material elements of compensation awarded to, earned by or paid to (i) all individuals serving as the Company’s principal executive officer or acting in a similar capacity during the last completed fiscal year (“PEO”), regardless of compensation level, and (ii) all individuals serving as the Company’s principal financial officer or acting in a similar capacity during the last completed fiscal year (“PFO”), regardless of compensation level. As of the end of the last completed fiscal year, the Company had two executive officers other than the PEO and PFO, and this discussion includes the material elements of compensation awarded to, earned by, or paid to such executive officers. This section omits tables and columns if there has been no compensation awarded to, earned by, or paid to any of the Named Executive Officers or directors required to be reported in such table or column in any fiscal year covered by such table.

Objectives and Philosophy of Our Executive Compensation Program

The Company strives to attract, motivate and retain high-quality executives who are willing to accept a lower base compensation in cash and be rewarded with stock options based on performance and the achievement of the goals and objectives of the Company, thereby allowing the Company to better align the interests of its executives with its stockholders. The Company competes for executive talent from a broad range of public companies and private companies primarily using its stock option grants, as its cash compensation relative to its peers is relatively low.

General

Our executive compensation programs are intended to achieve two objectives. The primary objective is to enhance stockholder value. The second objective is to attract, motivate, reward and retain employees, including executive personnel, who contribute to the long-term success of the Company and the enhancement of stockholder value. As described in more detail below, the material elements of our current executive compensation program for Named Executive Officers include three major elements: a base salary, discretionary annual bonuses and discretionary stock option grants.

The Company believes that each element of its executive compensation program helps to achieve one or both of the Company’s compensation objectives outlined above. Our executives’ compensation is based on individual and Company performance and designed to attract, retain and motivate highly qualified executives while creating a strong connection to financial and operational performance and stockholder value, which is exemplified in the mix of compensation that we provide to our Named Executive Officers. In furtherance of our objective to align executive compensation with stockholder value, a significant portion of our Named Executive Officers’ compensation in 2016 was in the form of grants of stock options.

13

Our executive compensation program is designed to do the following:

| · | Align the compensation of our Named Executive Officers and other managers with our stockholders’ interests and motivate our executive officers to meet the Company’s objectives; |

| · | Pay for performance, taking into consideration both the performance of the Company and the individual in determining executive compensation; |

| · | Promote Named Executive Officer accountability by compensating Named Executive Officers for their contributions to the achievement of the Company’s objectives (while discouraging excessive risk-taking not in the interest of long term value for our stockholders); |

| · | Attract and retain highly qualified executives with significant industry knowledge and experience by providing them with a fair compensation program that provides financial stability and incentivizes growth in stockholder value. |

Our Compensation Committee and Board believe that our executive compensation program provides our executive officers with incentives to meet the Company’s goals and objectives, while not encouraging excessive risk taking. Our executive compensation program is consistently aligned with creating value to our stockholders as we have with prior ventures by the founding stockholder.

The table below lists each material element of our executive compensation program and the compensation objective or objectives that it is designed to achieve.

| Compensation Element | Compensation Objectives | |

| Base Salary |

· Attract and retain qualified executives with significant industry knowledge, experience and expertise. · Provide stability in compensation through a fixed compensation element that takes into account the Named Executive Officer’s skills, experience, expertise, and tenure with the Company. | |

| Bonus Compensation |

· Motivate and reward executives’ performance. · Reward achievement of the Company’s goals and objectives. · Enhance profitability of the Company and stockholder value. | |

| Equity-Based Compensation – stock options and restricted stock grants |

· Enhance profitability of the Company and stockholder value by aligning long-term incentives with stockholders’ long-term interests. · Incentivize achievement of both strategic goals and objectives by providing Named Executive Officers with rewards for their contributions to achieving such goals and objectives. · Promote Named Executive Officer accountability by compensating Named Executive Officers for their contributions to the achievement of the Company’s objectives (while discouraging excessive risk-taking). · Promote pay-for-performance and allow our Named Executive Officers to acquire meaningful interests in the Company. · Encourage long-term value creation for stockholders and retention of talented executive officers. |

14

As illustrated by the table above, base salary is primarily intended to attract and retain qualified executives who have significant industry knowledge, experience, and expertise and who are willing to accept relatively low fixed cash compensation and participation in variable compensation fully aligned with the stockholders’ interests. This is the element of the Company’s current executive compensation program where the value of the benefit in any given year is not wholly dependent on performance. Base salaries are intended to attract and retain qualified executives as well as to provide stability in the Named Executive Officer’s compensation and discourage excessive risk-taking. Base salaries are reviewed annually and take into account: experience and retention considerations; past performance; improvement in historical performance; anticipated future potential performance; and other issues specific to the individual executive.

There are specific elements of the current executive compensation program that are designed to reward performance and enhance profitability and stockholder value, and, therefore, the value of these benefits is based on performance. The Company’s discretionary annual bonus plan is primarily intended to motivate and reward Named Executive Officers’ performance to achieve specific strategies and operating objectives, as well as improved financial performance. The Company also awards stock options and restricted stock grants to promote long-term value creation for stockholders and to retain talented executives for an extended period.

Peer Review, Benchmarking and Compensation Consultant

The Compensation Committee reviews, evaluates and benchmarks the compensation practices of peer companies on a regular basis and has determined that the Company is efficient and is generally more effective than its peer companies in aligning the compensation of its executive officers with the interests of stockholders. The Compensation Committee believes that bonuses and equity compensation should fluctuate with the Company’s success in achieving financial, operating and strategic goals. The Committee’s philosophy is that the Company should continue to use long-term compensation such as stock options to align stockholders’ and executives’ interests and should allocate a much greater portion of long-term compensation to the entire executive compensation package. Based on this belief, the Compensation Committee reviews the performance of the Company’s executive officers throughout the year to evaluate the performance of each executive officer relative to the performance of the Company and the progress in meeting the Company’s goals and objectives.

The Company has not deemed it necessary to hire an outside consultant to assist the Compensation Committee, as compensation paid by its peers is generally available.

Setting Executive Compensation and Evaluating Named Executive Officer Performance

Our executive compensation programs are determined and approved by our Compensation Committee based on a comprehensive evaluation of the Company and individual executive officer’s performance, as well as consideration of industry compensation data reviewed by the Compensation Committee. The Compensation Committee takes into consideration the recommendations by our Chairman of the Board and our Chief Executive Officer (as to the compensation of executive officers other than the Chief Executive Officer). None of the Named Executive Officers are members of the Compensation Committee. The Compensation Committee has the direct responsibility and authority to review and approve the Company’s goals and objectives relative to the compensation of the Named Executive Officers, and to determine and approve (either as a committee or with the other members of the Company’s Board of Directors who qualify as “independent” directors under applicable guidelines adopted by the NYSE MKT, LLC) the compensation of the Named Executive Officers.

For purposes of evaluating performance, our Compensation Committee, in consultation with our management and the Board, sets performance goals and objectives for the Company, regularly assesses progress towards meeting such goals and objectives, and determines the appropriate compensation for each of our Named Executive Officers. The Compensation Committee evaluates progress toward meeting the Company’s goals and objectives throughout the year. The Compensation Committee evaluates various factors in determining the appropriate compensation for each of our Named Executive Officers.

15

Our Compensation Committee considered the following 2016 goals and objectives, among other factors such as industry compensation data and the commodity pricing environment, in determining the compensation of our Named Executive Officers:

| PERFORMANCE OBJECTIVES AND GOALS | ||

| Objectives | Evaluation/Analysis for 2016 | |

| Increase Production | · Production increased 18%, from 878,066 BOE in 2016, as compared to production of 743,363 BOE for 2015. | |

| Increase Proved Reserves |

· Increased our proved reserves 14% to 27.7 million BOE. · PUD reserve estimates increased by 11% to 17.5 million BOE, resulting from development, improved production curves and improved recovery and extension from addition of new horizontal reserves proved up through development. | |

| Improve Operational Efficiency |

· Oil and gas production costs decreased 16%, on a BOE basis to $11.24 in 2016 from $13.40 in 2015. · Drilled 12 wells, including 3 horizontal wells. | |

| Maintain Financial Flexibility and Increase Capital |

· Maintained a credit facility with a $60 million borrowing base with no amounts outstanding under the credit facility as of December 31, 2016. · Raised $139.6 in successful underwritten public offerings of common stock. | |

| Continue focus on safety |

· Continued to maintain safe operations. · No safety incidents in 2016. | |

The Compensation Committee reviewed the performance of our Named Executive Officers in conjunction with the Company’s performance objectives and goals for 2016. The Compensation Committee also took into consideration other circumstances in determining executive compensation including, without limitation, changes in commodity prices, market conditions, supply and demand, weather conditions, governmental regulation, and other factors. The Compensation Committee determined that, despite volatile commodity prices, the Company exceeded the objectives and goals for 2016 and tied the compensation (as discussed below) to the Company’s performance.

Role of Stockholder Say-on-Pay Advisory Vote

In determining 2016 executive compensation, the Compensation Committee considered the outcome of the say-on-pay vote at the last annual meeting. Based on the results of the say-on-pay vote, the Company has continued to focus on ensuring our executive compensation program is designed primarily to align the interests of executives with stockholders and incentivize our management to achieve the Company’s objectives and goals. The Company is developing a plan to communicate regularly with its stockholders to gather feedback on the Company’s performance and executive compensation program.

In 2016, upon the recommendation of the Compensation Committee, Ring rescinded option awards granted as compensation to its executive officers, employees, and certain directors (other than Messrs. McCabe and Rochford, the members of the Compensation Committee) and re-issued the options due to a precipitous decline in Ring’s stock price shortly after the options were granted. The recommendation of the Compensation Committee to rescind and re-issue the options was based on Ring’s objective to provide reasonable compensation competitive with its peers and to enable Ring to continue to retain such executives and incentivize them to increase the value of the common stock of the Company. Concerns were raised regarding the rescission and re-issuance of options without stockholder approval, and, to address such concerns, our Board has implemented a policy prohibiting the rescission and re-issuance of options without stockholder approval.

Our Board and Compensation Committee utilizes the “say-on-pay” vote as an additional guide to ensure our executive compensation programs are aligned with the interests of our stockholders. Our Compensation Committee will continue to evaluate the Company’s compensation program to ensure competitiveness, the alignment of the Company’s executive compensation with stockholders’ interests and to meet other compensation objectives.

16

Executive Compensation Program Elements for 2016

Our Compensation Committee believes that our executive compensation program has played a significant role in our ability to enhance our stockholders with value based upon our continued growth in production and reserves, in addition to our continued commitment to meeting our objectives and goals.

In 2016, the Company continued to grow its production and reserves despite lower and more volatile commodity prices in the oil and gas industry by focusing on operational efficiency. The Company paid off all indebtedness under its credit facility, successfully raised additional capital through underwritten public offerings, and continued its focus on safety in its operations.

| · | Significant Production Growth – We created significant production growth in 2016, despite lower and more volatile commodity prices. Our production increased approximately 18% to 878,066 BOE in 2016, as compared to production of 743,363 BOE for the year ended December 31, 2015. |

| · | Reserve Growth – We increased our proved reserves 14% to 27.7 million BOE. As of December 31, 2016, our estimated proved reserves had a pre-tax “PV10” (present value of future net revenues before income taxes discounted at 10%) of approximately $217.3 million and a Standardized Measure of Discounted Future Net Cash Flows of approximately $159.8 million. |

| · | Improved Production Curves and Increase in Proved Undeveloped Reserves (PUDS) – Our PUD reserve estimate increased to 17.5 million BOE in 2016 from 15.8 million BOE in 2015, resulting from development, improved production curves and improved recovery and extension from the addition of new horizontal reserves proved up through development. |

| · | Improved Operational Efficiency – We have improved our operational efficiency through employing technological advancements, which have provided a significant benefit in our continuous drilling program in the lower commodity price environment. As of result of our improved operational efficiency, as of December 31, 2016, we had drilled 195 wells, with 192 being vertical wells and 3 horizontal wells, and re-stimulated 35 existing wells on our Central Basin acreage and had drilled 6 wells and recompleted 6 existing wells on our Delaware Basin acreage. Our aggregate oil and gas production costs decreased on a BOE basis to $11.24 in 2016 from $13.40 in 2015. |

| · | Additional Financial Flexibility for Future Growth and Development – We increased our financial flexibility for future growth and development by paying down our credit facility and successfully raising additional capital in an underwritten public offering. We have a credit facility in place with a $60 million borrowing base for borrowings, and, as of December 31, 2016, we had paid all amounts outstanding on our credit facility. We successfully raised $139.6 million in underwritten public offerings in 2016. Our credit facility and capital raise provide us with additional operating flexibility. |

| · | Safety and Training – We continued our strong safety performance in 2016. We had no incidents resulting from our operations in 2016. |

Our Compensation Committee assessed each of our executive officers’ performance and contribution to the Company meeting its objectives for 2016. Below is a discussion of each element of the Company’s compensation program, which should be read in conjunction with the “Summary Compensation Table.”

Base Salaries

The Compensation Committee believes base salary is an integral element of executive compensation to provide executive officers with a base level of monthly income. We provide all of our employees, including our Named Executive Officers, with an annual base salary to compensate them for their services to the Company. Similar to most companies within the industry, our policy is to pay Named Executive Officers’ base salaries in cash. Base salary is reviewed annually by the Compensation Committee.

17

The base salary of each Named Executive Officer is reviewed annually, with the salary of the Chief Executive Officer being established by the Compensation Committee and the salaries of the other executive officers being determined and approved by the Compensation Committee after consideration of recommendations by the Chairman of the Board and Chief Executive Officer. The Compensation Committee analyzes many factors in its evaluation of our Named Executive Officers’ base salary, including the experience, skills, contributions and tenure of such officer with the Company and such executive officers’ current and future roles, responsibilities and contributions to the Company.

Effective July 1, 2012, the Compensation Committee designated a salary of $100,000 for Mr. Broaddrick. Effective September 1, 2012, the Compensation Committee recommended an increase of $25,000 for Mr. Broaddrick.

Mr. Hoffman joined the Company effective January 1, 2013, and the Compensation Committee designated a salary of $175,000.

Mr. Fowler joined the Company effective January 1, 2013, and the Compensation Committee designated a salary of $150,000.

Mr. Wilson joined the Company effective January 1, 2013, and the Compensation Committee designated a salary of $150,000.

The salary of each of our Named Executive Officers is reported in the “Salary” column of the “Summary Compensation Table” for each Named Executive Officer.

Annual Bonuses

The Company’s payment of bonuses has been discretionary and is largely based on the recommendations of the Compensation Committee. Cash incentive bonuses are designed to provide our executive officers with an incentive to achieve the Company’s business goals and objectives and are tied to the performance of the Company. Cash bonuses have not been, and are not expected to be, a significant portion of the Company’s executive compensation package. Cash bonuses are determined for Named Executive Officers based on the Company’s performance for the year, the officer’s individual performance in the prior year, the officer’s expected future contribution to the performance of the Company, and other competitive data on grant values of peer companies.

Cash bonuses were granted to all employees in December 2013. The annual discretionary bonus is reported in the “Bonus” column of the “Summary Compensation Table” for each Named Executive Officer.

Equity-Based Compensation – Options and Restricted Stock Grants

A significant component of our executive compensation program is equity-based compensation, which is determined by our Compensation Committee. It is our policy that the Named Executive Officers’ long-term compensation should be directly linked to enhancing stockholders’ value. Accordingly, the Compensation Committee grants to the Company’s Named Executive Officers equity awards under the Company’s long term incentive plan designed to link an increase in stockholder value to compensation. The purpose of granting equity-based compensation is to incentivize and reward the Company’s executive officers for the Company’s achievement of the objectives and goals and the individual’s contribution to meeting such goals and objectives and to encourage continued dedication to the Company by providing executives with meaningful ownership interests in the Company.

The Compensation Committee evaluates the performance of the Company’s Named Executive Officers throughout the year and retains discretion on the amount of equity-based compensation granted.