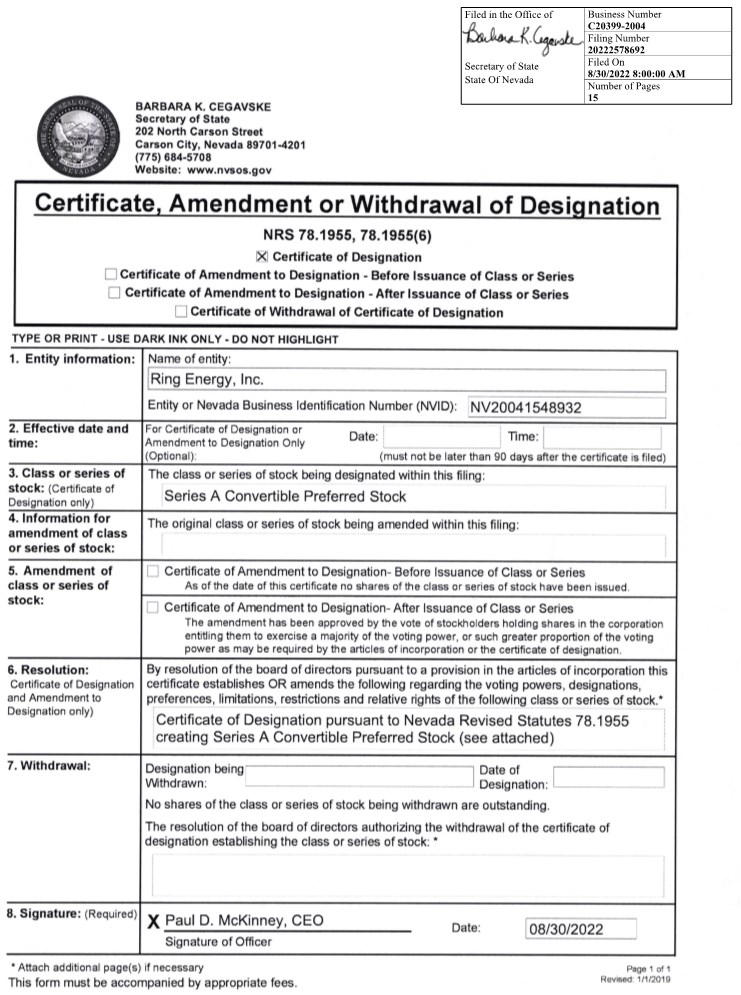

| Filed in the Office of

Secretary of State

State Of Nevada

Business Number

C20399-2004

Filing Number

20222578692

Filed On

8/30/2022 8:00:00 AM

Number of Pages

15

BARBARA K . CEGAVSKE

Secretary of State

202 North Carson Street

Carson City, Nevada 89701-4201

(775) 684-5708

Website: www.nvsos.gov

~{(__(.,, • .,Jo

()

Certificate, Amendment or Withdrawal of Designation

N RS 78.1955, 78.1955(6)

~ Certificate of Designation

D Certificate of Amendment to Designation - Before Issuance of Class or Series

D Certificate of Amendment to Designation -After Issuance of Class or Series

D Certificate of Withdrawal of Certificate of Designation

TYPE OR PRINT - USE DARK INK ONLY - DO NOT HIGHLIGHT

1. Entity information: Name of ent i ty :

! Ring Energy, Inc.

Entity or Nevada Business Identification Number (NVID) : I NV20041548932

2. Effective date and For Cert i ficate of Designation or Date: i J Time : I time: Amendment to Designation Only

I

I

I

(Optional): ( must not be l ater than 90 days after the certificate is filed )

3. Class or series of The class or series of stock being designated within this filing:

stock: (C ert i ficate of [ series A Convertible Preferred Stock

-

I Designation only)

4. Information for The original class or series of stock being amended within this filing : amendment of class

I or series of stock:

5. Amendment of D Certificate of Amendment to Designation- Before Issuance of Class or Series

class or series of As of the date of this certificate no shares of the c lass or series of stock have been issued .

stock: O Certificate of Amendment to Designation-After Issuance of Class or Series

The amendment has been approved by the vote of stockho l ders holding shares in the corporation

entitling them to e x ercise a majority of the voting po w er , or such greater proportion of the voting

power as may be required by the artic l es of incorporation or the certificate of designat i on .

6. Resolution: By resolution of the board of directors pursuant to a provision in the articles of incorporation this

Certificate of Designation certificate establishes OR amends the following regarding the voting powers, designations,

and Amendment to preferences, limitations, restrictions and relative rights of the following class or series of stock.*

Designation only) I" --···-- - - - --- ___ .. ____

1 Certificate of Designation pursuant to Nevada Revised Statutes 78.1955

1

creating Series A Convertible Preferred Stock (see attached)

7. Withdrawal: Designation being [ Date of [

Withdrawn : Designation:

No shares of the class or series of stock being withdrawn are outstanding.

The resolution of the board of directors authorizing the withdrawal of the certificate of

designation establishing the class or series of stock: •

I

I

I

8. Signature: ( Required ) X Paul D. McKinney, CEO Date: I 0813012022 I Signature of Officer

• Attach addit i onal page ( s) if necessary Page 1 of 1

Revis ed : 1/ 1 /2019 This form must be accompanied by appropriate fees. |

RING ENERGY, INC.

CERTIFICATE OF DESIGNATION

Pursuant to Nevada Revised Statutes 78.1955

SERIES A CONVERTIBLE

PREFERRED STOCK

(Par Value $0.001 Per Share)

Pursuant to the authority

expressly granted to and vested in the Board of Directors (the “Board”) of Ring Energy, Inc., a Nevada corporation

(the “Corporation”), and in accordance with the provisions of Section 78.1955 of the Nevada Revised Statutes (the

“NRS”), the Board duly adopted the following recitals and resolutions as of July 1, 2022:

WHEREAS,

the Articles of Incorporation of the Corporation (as so amended and as further amended from time to time in accordance with the NRS, the

“Articles of Incorporation”), authorizes the issuance of up to 50,000,000 shares of preferred stock, par value $0.001

per share (the “Preferred Stock”), and further authorizes the Board, by resolutions, to establish one or more series

of Preferred Stock, and to prescribe the voting powers, designations, preferences, limitations, restrictions and relative rights of each

such series; and

WHEREAS,

the Corporation has entered into that certain Purchase and Sale Agreement, dated as of July 1, 2022 (the “Purchase Agreement”),

by and between Stronghold Energy II Operating, LLC and Stronghold Energy II Royalties, LP, collectively as seller, and the Corporation,

as buyer, pursuant to which the Corporation has agreed to issue shares of a series of Preferred Stock that are convertible into shares

of the Corporation’s common stock, $0.001 par value per share of the Corporation (the “Common Stock”).

RESOLVED,

that pursuant to the authority granted to and vested in it, the Board hereby establishes a series of Preferred Stock designated Series A

Convertible Preferred Stock, consisting of 153,176 shares, and hereby fixes the voting powers, designations, preferences, limitations,

restrictions and relative rights of such series of Preferred Stock as set forth in this certificate of designation (this “Certificate

of Designation”):

Section 1. General;

Ranking.

(a) There

is hereby established from the 50,000,000 shares of Preferred Stock of the Corporation authorized to be issued pursuant to the Articles

of Incorporation, a series of Preferred Stock designated as “Series A Convertible Preferred Stock,” par value $0.001

per share (the “Series A Preferred Stock”), and the authorized number of shares of Series A Preferred Stock

is 153,176.

(b) Notwithstanding

anything to the contrary herein, the shares of Series A Preferred Stock and any shares of Common Stock issued upon conversion thereof

shall be in uncertificated, book-entry form or, if requested by any holder of Series A Preferred Stock, such holder’s shares

of Series A Preferred Stock shall be issued in certificated form, in each case as permitted by the Bylaws.

(c) With

respect to both the payment of distributions and the distribution of assets upon a Liquidation Event, the Series A Preferred Stock

shall rank: (i) senior to all Junior Securities, (ii) pari passu with all Parity Securities and (iii) junior to

all Senior Securities.

Section 2. Definitions.

Capitalized terms used herein without definition shall have the meanings given to them in the Purchase Agreement, except that the terms

set forth below are used herein as so defined:

“Affiliate”

shall have the meaning ascribed to it, on the date on which this Certificate of Designation first becomes effective, in Rule 405

under the Securities Act.

“Articles

of Incorporation” is defined in the recitals.

“As-Converted

Amount” has the meaning assigned to it in Section 4(a).

“Board”

is defined in the preamble.

“Business

Day” means any day other than a Saturday, Sunday or any other day on which commercial banks in the State of Nevada are authorized

or required by law or executive order to close.

“Bylaws”

means the Bylaws of the Corporation, as amended from time to time in accordance with the NRS.

“Certificate

of Designation” is defined in the recitals.

“Change

of Control” means (A) the acquisition at any time by a “person” or “group” (as such terms are used

in Sections 13(d) of the Exchange Act) of securities (excluding shares of Common Stock issuable upon conversion of the Series A

Preferred Stock) representing more than 50% of the combined voting power in the election of directors of the then-outstanding securities

of the Corporation or any successor of the Corporation (provided that the equityholders of any entity with a class of securities listed

on a national securities exchange shall constitute a “group” for purposes of this clause (A)); (B) approval by

the Corporation or any of its subsidiaries of any sale or disposition of substantially all of the assets of the Corporation and its subsidiaries,

taken as a whole; or (C) approval by the stockholders of the Corporation of any merger, consolidation or statutory share exchange

to which the Corporation is a party as a result of which the persons who were stockholders immediately prior to the effective date of

the merger, consolidation or share exchange shall have beneficial ownership of less than 50% of the combined voting power in the election

of directors of the surviving corporation.

“Common

Stock” is defined in the recitals.

“Common

Stock Price” means, as of any date of determination, the volume weighted average closing price of Common Stock (as reported

by the principal securities exchange on which Common Stock is then traded) for the 30 Trading Days immediately preceding such date of

determination.

“Conversion

Date” has the meaning assigned to it in Section 5(a).

“Conversion

Price” has the meaning assigned to it in Section 5(b).

“Conversion

Rate” has the meaning assigned to it in Section 5(a).

“Corporation”

is defined in the preamble.

“Directed

Opportunity” has the meaning assigned to it in Section 10(a).

“Distribution

Payment Date” has the meaning assigned to it in Section 3(a).

“Equity

Securities” means capital stock of the Corporation (including Common Stock and Preferred Stock) or any options, warrants or

other securities that are directly or indirectly convertible into, or exercisable or exchangeable for, any capital stock of the Corporation

(including Common Stock and Preferred Stock).

“Exchange

Act” shall mean the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.`

“Governmental

Body” means any (a) nation, state, county, city, town, village, district or other jurisdiction of any nature; (b) federal,

state, local, municipal, foreign or other government; (c) governmental or quasi-governmental authority of any nature (including any

governmental agency, branch, department, official or entity and any court or other tribunal); (d) multi-national organization or

body or (e) body exercising, or entitled to exercise, any administrative, executive, judicial, legislative, police, regulatory or

taxing authority or power of any nature.

“Grace

Period Expiration Date” has the meaning assigned to it in Section 3(a).

“Initial

Liquidation Preference” has the meaning assigned to it in Section 4(a).

“Issue

Date” has the meaning assigned to it in Section 3(a).

“Junior

Securities” means the Common Stock and any other class or series of stock issued by the Corporation ranking junior as to the

Series A Preferred Stock with respect to payment of distributions, or upon liquidation, dissolution or winding up of the Corporation.

“Liquidation

Event” means (i) any voluntary or involuntary liquidation, dissolution or winding-up of the Corporation or (ii) the

consummation of a Change of Control.

“Liquidation

Preference” has the meaning assigned to it in Section 4(a).

“Material

Transaction” means an acquisition, merger, consolidation, tender offer, exchange offer, business combination, reorganization,

share exchange, disposition, partnership, joint venture or other similar transaction that may be deemed “material,” as such

term is defined under Rule 405 under the Securities Act.

“NRS”

is defined in the preamble.

“Parity

Securities” means any class or series of securities issued by the Corporation expressly ranking on a parity with the Series A

Preferred Stock with respect to payment of distributions, and upon liquidation, dissolution or winding up of the Corporation.

“Person”

means any individual, firm, corporation (including any non-profit corporation), general or limited partnership, limited liability company,

joint venture, estate, trust, association, organization, labor union or other entity or Governmental Body.

“Preferred

Stock” is defined in the recitals.

“Purchase

Agreement” is defined in the recitals.

“Redemption

Date” has the meaning assigned to it in Section 7(b).

“Redemption

Event” has the meaning assigned to it in Section 7(a).

“Redemption

Notice” has the meaning assigned to it in Section 7(b).

“Repurchase”

has the meaning assigned to it in Section 9(b).

“SEC”

means the U.S. Securities and Exchange Commission.

“Securities

Act” shall mean the Securities Act of 1933, as amended.

“Senior

Securities” means any class or series of securities issued by the Corporation ranking senior to the Series A Preferred

Stock with respect to payment of distributions, or upon liquidation, dissolution or winding up of the Corporation.

“Series A

Preferred Stock” has the meaning assigned to it in Section 1(a).

“Specified

Party” has the meaning assigned to it in Section 10(a).

“Stockholder

Approval” means each requisite approval from holders of capital stock of the Corporation required at law or under the applicable

securities exchange rules of any securities exchange on which capital stock of the Corporation is listed with respect to authorizing

or effectuating the conversion of Series A Preferred Stock.

“Trading

Day” means a day on which (a) there is no VWAP Market Disruption Event; and (b) trading in the Common Stock generally

occurs on the principal U.S. national or regional securities exchange on which the Common Stock is then listed or, if the Common Stock

is not then listed on a U.S. national or regional securities exchange, on the principal other market on which the Common Stock is then

traded. If the Common Stock is not so listed or traded, then “Trading Day” means a Business Day.

“VWAP Market

Disruption Event” means, with respect to any date: (a) the failure by the principal U.S. national or regional securities

exchange on which the Common Stock is then listed, or, if the Common Stock is not then listed on a U.S. national or regional securities

exchange, the principal other market on which the Common Stock is then traded, to open for trading during its regular trading session

on such date; or (b) the occurrence or existence, for more than one half hour period in the aggregate, of any suspension or limitation

imposed on trading (by reason of movements in price exceeding limits permitted by the relevant exchange or otherwise) in the Common Stock

or in any options contracts or futures contracts relating to the Common Stock, and such suspension or limitation occurs or exists at any

time before 1:00 p.m., New York City time, on such date.

Section 3. Distributions.

(a) Commencing

immediately upon the earliest original issue date of any shares of the Series A Preferred Stock (the “Issue Date”),

the holders of the Series A Preferred Stock shall be entitled to receive out of any assets legally available therefor distributions

on each outstanding share of Series A Preferred Stock at the rate of 8.0% per annum of the Liquidation Preference per share of Series A

Preferred Stock, payable quarterly in cash, subject to Section 3(c), on March 31, June 30, September 30 and

December 31 of each year (each a “Distribution Payment Date”), beginning January 31, 2023 (the “Grace

Period Expiration Date”) with respect to the period from and including the Issue Date through the Grace Period Expiration Date,

when, as and if declared by the Board, in accordance with the preferences and priorities described in Section 1(c) with

respect to any payment of any distribution on the Common Stock or any other class or series of stock of the Corporation. Except as provided

below, such distributions shall accrue on a daily basis from the Issue Date, whether or not in any period the Corporation is legally permitted

to make the payment of such distributions and whether or not such distributions are declared. Neither conversion on or after the Grace

Period Expiration Date nor redemption of the Series A Preferred Stock on or after the Grace Period Expiration Date shall affect any

holder’s right to receive any accrued but unpaid distributions on such Series A Preferred Stock. Notwithstanding any other

provision herein, no distributions shall be payable or accrue on the Series A Preferred Stock if conversion, as described in Section 5,

occurs on or before the Grace Period Expiration Date. Except to the extent set forth in Section 3(c), distributions shall

not be cumulative.

(b) Distributions

shall be calculated on the basis of the time elapsed from but excluding the last preceding Distribution Payment Date (or from the Issue

Date in respect of the first distribution payable on the Grace Period Expiration Date) to and including the next following Distribution

Payment Date or any final distribution date relating to conversion or redemption or to a Liquidation Event. Distributions payable on the

shares of Series A Preferred Stock for any period of less than a full calendar year shall be prorated for the partial year on the

basis of a 360-day year of twelve, 30-day months.

(c) To

the extent any accrued distributions are not declared and paid in full in cash on a Distribution Payment Date, the Liquidation Preference

of each share of Series A Preferred Stock outstanding as of such Distribution Payment Date shall automatically be increased by an

amount equal to the unpaid amount of the distribution that shall have accrued on such share to and including the Distribution Payment

Date (including the period from the Issue Date to and including the Grace Period Expiration Date), effective as of the date immediately

following such Distribution Payment Date. The Liquidation Preference, as so adjusted, shall thereafter be used for all purposes hereunder,

including, without limitation, for purposes of the accrual of future distributions in accordance with Section 3(a), the determination

of the Liquidation Preference in accordance with Section 4(a) and the determination of the number of shares of Common

Stock into which the shares of Series A Preferred Stock are convertible in accordance with Section 4(a) and Section 5(a).

The adjustment of the Liquidation Preference as provided in this Section 3(c) shall satisfy in full the Corporation’s

obligation to pay distributions on the applicable Distribution Payment Date, and, following such adjustment, under no circumstance shall

distributions be deemed to be accrued or in arrears with respect to any period prior to and including such Distribution Payment Date.

(d) Distributions

payable on each Distribution Payment Date shall be paid to record holders of the shares of Series A Preferred Stock as they appear

on the Corporation’s books at the close of business on the tenth Business Day immediately preceding the respective Distribution

Payment Date or on such other record date as may be fixed by the Board in advance of a Distribution Payment Date, provided that no such

record date shall be less than 10 or more than 60 calendar days preceding such Distribution Payment Date. If a Distribution Payment Date

is not a Business Day, then any distribution declared in respect of such date shall be due and payable on the first Business Day following

such Distribution Payment Date. Distributions paid in cash on shares of Series A Preferred Stock in an amount less than the total

amount of such distributions at the time payable shall be allocated pro rata on a share by share basis among all shares of Series A

Preferred Stock outstanding.

(e) The

holders of the Series A Preferred Stock shall be entitled to receive, with respect to any distribution of cash or other property

made to holders of Common Stock, the amount that such holders of Series A Preferred Stock would have been entitled to receive if

the Series A Preferred Stock were fully converted (disregarding for such purpose any conversion limitations hereunder) to Common

Stock as provided in Section 5 on the record date for such distribution, which amounts shall be paid pari passu

with all holders of Common Stock.

Section 4. Liquidation.

(a) In

the event of any Liquidation Event, the holders of the Series A Preferred Stock shall be entitled to receive, in accordance with

the preference, ranking and priority described in Section 1(c) as to any distribution of any assets of the Corporation

to the holders of any other class or series of shares, the amount of $1,000.00 per share of Series A Preferred Stock (as the same

may be adjusted pursuant to Section 3(c), the “Initial Liquidation Preference”) plus any accrued but

unpaid distributions thereon (together with the Initial Liquidation Preference, and as may be further adjusted pursuant to Section 3(c) the

“Liquidation Preference”). To the extent the available assets are insufficient to fully satisfy the Liquidation Preference,

then the holders of the Series A Preferred Stock shall share ratably in such distribution in the proportion that each holder’s

shares bears to the total number of shares of Series A Preferred Stock outstanding. Notwithstanding anything in this Section 4(a) to

the contrary, if, in the event of any Liquidation Event (or deemed Liquidation Event), the aggregate amount that the holders of Series A

Preferred Stock would have been entitled to receive in respect of the Series A Preferred Stock if the Series A Preferred Stock

were fully converted (disregarding for such purpose any conversion limitations hereunder) to Common Stock immediately prior to such Liquidation

Event of the Corporation (or deemed Liquidation Event of the Corporation) (the “As-Converted Amount”) is greater than

the aggregate Liquidation Preference otherwise payable to such holders pursuant to Section 3(c) and this Section 4(a),

then the holders of Series A Preferred Stock shall, in lieu of receiving such aggregate Liquidation Preference, instead receive the

As-Converted Amount, which As-Converted Amount shall be paid according to the terms of preference, ranking and priority set forth in Section 1(c).

(b) No

payment on account of any such Liquidation Event (or deemed Liquidation Event) of the Corporation shall be paid to the holders of the

shares of Series A Preferred Stock or the holders of any Parity Securities unless there shall be paid at the same time to the holders

of the shares of Series A Preferred Stock and the holders of any Parity Securities amounts in proportion to the respective full preferential

amounts to which each is entitled with respect to such distribution.

(c) The

Corporation shall not have the power to effect a Change of Control or other deemed Liquidation Event unless the definitive agreement regarding

such Change of Control or deemed Liquidation Event provides that the consideration payable to the stockholders of the Corporation shall

be allocated among the holders of capital stock of the Corporation in accordance with Section 1(c) and this Section 4.

(d) Written

notice of any Liquidation Event (or deemed Liquidation Event) of the Corporation, stating the payment date or dates when and the place

or places where the amounts distributable in such circumstances shall be payable, shall be given not less than 10 Business Days prior

to any payment date stated therein, to the holders of record of the shares of Series A Preferred Stock.

(e) Any

distribution in connection with any Liquidation Event (or deemed Liquidation Event), shall be made in cash to the extent possible. Whenever

any such distribution shall be paid in property other than cash, the value of such distribution shall be the fair market value of such

property as determined in good faith by the Board.

Section 5. Conversion.

The Series A Preferred Stock shall be convertible into Common Stock in accordance with the following:

(a) Automatic

Conversion. Each share of Series A Preferred Stock shall automatically convert into such number of shares of Common Stock as

provided in this Section 5 upon the day (the “Conversion Date”) immediately following the receipt of Stockholder

Approval. Each share of Series A Preferred Stock shall be convertible into such number of fully paid and non-assessable shares of

Common Stock as is determined by dividing (i) the Liquidation Preference of the Series A Preferred Stock determined pursuant

to Section 4 as of the Conversion Date by (ii) the Conversion Price determined in Section 5(b) in effect

on the Conversion Date (such calculation, as so adjusted from time to time, the “Conversion Rate”). Each share of Series A

Preferred Stock shall thus, at the Issue Date, be convertible into 277.7778 shares of Common Stock, subject to adjustment as set forth

herein, and each fractional share of Series A Preferred Stock shall, at the Issue Date, be convertible into a proportionate number

of shares of Common Stock. Upon the automatic conversion of the Series A Preferred Stock, each holder shall be deemed to own the

number of shares of Common Stock into which the holder’s shares of Series A Preferred Stock are converted. On the Conversion

Date, the number of shares of Common Stock into which the shares of Series A Preferred Stock are converted shall be promptly issued

in uncertificated, book-entry form and evidence thereof shall be promptly delivered by the Corporation or its transfer agent to the holders

of Series A Preferred Stock. If requested by any holder of the Series A Preferred Stock, such shares of Common Stock shall be

issued in certificated form and such certificates shall be delivered to the holder of Series A Preferred Stock thereof or such holder’s

designee. At the close of business on the Conversion Date, each holder shall be deemed to be the beneficial owner of the shares of Common

Stock, and the Series A Preferred Stock theretofore held by such holder shall no longer be outstanding. For purposes of clarity,

to the extent the shares of Series A Preferred Stock are converted into Common Stock prior to the Grace Period Expiration Date, the

Liquidation Preference for purposes of calculating such conversion under clause (i) of the first sentence of this Section 5(a) shall

be the Initial Liquidation Preference and shall not include any accrued but unpaid distributions.

(b) Determination

of Conversion Price. For purposes hereof, the “Conversion Price” shall be $3.60, subject to adjustment as provided

in this Section 5(b). If the Corporation at any time or from time to time makes, issues, declares, pays or fixes a record

date for the determination of holders entitled to receive any distribution or other distribution payable on shares of Common Stock in

Common Stock or other securities of the Corporation or any of its subsidiaries or in rights to acquire Common Stock or other securities

of the Corporation or any of its subsidiaries, or shall effect any subdivision (by stock split, exchange, stock distribution, reclassification,

recapitalization or otherwise) or combination (by reverse stock split, exchange, reclassification, recapitalization or otherwise) or similar

reclassification or recapitalization of the Common Stock, then, in each such event, the Conversion Price shall be proportionately decreased

or increased, as appropriate, to give effect to such event, such that upon any conversion after any such event, a holder of Series A

Preferred Stock shall be entitled to receive the number and class of any securities of the Corporation or other assets which the holder

would have received had the Series A Preferred Stock been converted into Common Stock immediately before the event. The Conversion

Price, as so adjusted, shall be readjusted in the same manner upon the happening of any successive event or events described in this Section 5(b).

(c) Certificates

as to Adjustments. Upon the occurrence of any adjustment of the Liquidation Preference pursuant to Section 3(c), or the

occurrence of any adjustment or readjustment of the Conversion Price pursuant to Section 5(b), the Corporation at its expense

shall promptly compute such adjustment or readjustment in accordance with the terms hereof and the principal financial officer of the

Corporation shall verify such computation and prepare and furnish to each holder of Series A Preferred Stock a certificate setting

forth such adjustment or readjustment and showing in detail the facts upon which such adjustment or readjustment is based. The Corporation

shall, upon the written request at any time of any holder of Series A Preferred Stock, furnish or cause to be furnished to such holder

a like certificate prepared by the Corporation setting forth (i) such adjustments and readjustments and (ii) the number of shares

of Common Stock or other securities and the amount, if any, of other property which at the time would be received upon the conversion

of each share of Series A Preferred Stock.

(d) Notice

of Record Date. If the Corporation takes a record of the holders of any class of securities for the purpose of determining the holders

thereof who are entitled to receive any distribution (other than a cash distribution) or other distribution, any security or right convertible

into or entitling the holder thereof to receive additional shares of Common Stock, or any right to subscribe for, purchase or otherwise

acquire any shares of stock of any class or any other securities or property, or to receive any other right, the Corporation shall mail

to each holder of Series A Preferred Stock at least 10 Business Days prior to the date specified therein, a notice specifying the

date on which any such record is to be taken for the purpose of such distribution, distribution, security or right and the amount and

character of such distribution, distribution, security or right.

(e) Issue

Taxes. The Corporation shall pay any and all issue and other taxes, excluding any income, franchise or similar taxes, that may be

payable in respect of any issue or delivery of (i) shares of Series A Preferred Stock and (ii) shares of Common Stock on

conversion of shares of Series A Preferred Stock.

Section 6. Consolidation,

Merger, Etc. In case of any reorganization, reclassification of the capital stock of the Corporation, any consolidation or merger

of the Corporation with or into any other corporation or corporations, or a sale of all or substantially all of the assets of the Corporation

to any other person, if such transaction is not a Liquidation Event, then, as part of such reorganization, reclassification, consolidation,

merger or sale, provision shall be made so that each share of Series A Preferred Stock shall thereafter be convertible into the number

of shares of stock or other securities or property (including cash) to which a holder of the number of shares of Common Stock deliverable

upon conversion of such share of Series A Preferred Stock would have been entitled upon the record date of (or date of, if no record

date is fixed) such event and, in any case, appropriate adjustment (as determined reasonably and in good faith by the Board) shall be

made in the application of the provisions herein set forth with respect to the rights and interests thereafter of the holders of the Series A

Preferred Stock, to the end that the provisions set forth herein shall thereafter be applicable, as nearly as equivalent as is practicable,

in relation to any shares of stock or the securities or property (including cash) thereafter deliverable upon the conversion of the shares

of Series A Preferred Stock.

Section 7. Redemption

of Series A Preferred Stock.

(a) On

the date that is 61 months following the date of the closing of the transactions contemplated by the Purchase Agreement, a redemption

event (“Redemption Event”) shall be deemed to have occurred, and the Corporation shall, subject to applicable law,

be required to repurchase all of the outstanding shares of Series A Preferred Stock as provided in this Section 7.

(b) Within

5 Business Days after a Redemption Event, the Corporation shall deliver a written notice (the “Redemption Notice”)

to each holder of record of shares of Series A Preferred Stock at the address last shown on the records of the Corporation for such

holder, notifying such holder of the redemption which is to be effected, the date on which the redemption of the Series A Preferred

Stock shall occur (which day (the “Redemption Date”) must be within 15 Business Days after the Redemption Event), and

the amount to be paid to such holder in redemption of his, her or its shares of Series A Preferred Stock. On the Redemption Date,

the Corporation shall pay to each holder of Series A Preferred Stock then outstanding an amount equal to the greater of (i) the

Liquidation Preference per share of Series A Preferred Stock held by such holder or (ii) the Common Stock Price in respect of

each share of Common Stock that such holder would hold if the Series A Preferred Stock held by such holder were converted (disregarding

for such purpose any conversion limitations hereunder) into Common Stock on the Redemption Date at the then-applicable Conversion Rate,

in each case, by wire transfer of immediately available funds to an account specified by such holder to the Corporation at least one Business

Day prior to the Redemption Date and, upon such holder’s receipt of such amount, the Series A Preferred Stock theretofore held

by such holder shall no longer be outstanding.

Section 8. Other

Provisions.

(a) Best

Efforts. The Corporation shall use its best efforts to effect the automatic conversion as provided in Section 5(a) above

and in accordance with the applicable terms of the Purchase Agreement (including, without limitation, promptly calling and holding one

or more special meetings of the holders of the Common Stock and soliciting proxies from the holders of the Common Stock to obtain Stockholder

Approval, and to take all other actions necessary or advisable to obtain Stockholder Approval in one or more such special meetings).

(b) Record

Holders. The Corporation and its transfer agent, if any, for the Series A Preferred Stock may deem and treat the record holder

of any shares of Series A Preferred Stock as reflected on the books and records of the Corporation as the sole, true and lawful owner

thereof for all purposes, and neither the Corporation nor any such transfer agent shall be affected by any notice to the contrary.

(c) Reservation

and Authorization of Common Stock. So long as any shares of Series A Preferred Stock remain outstanding, the Corporation shall

at all times reserve and keep available, from its authorized and unissued shares of Common Stock solely for issuance and delivery upon

the conversion of the shares of Series A Preferred Stock and free of preemptive rights, such number of shares of Common Stock as

from time to time shall be issuable upon the conversion in full of all outstanding shares of Series A Preferred Stock. The Corporation

further shall, from time to time, take all steps necessary (including, without limitation, engaging in commercially reasonable efforts

to obtain the requisite stockholder approval) to increase the authorized number of shares of its Common Stock if at any time the authorized

number of shares of Common Stock remaining unissued would otherwise be insufficient to allow delivery of all of the shares of Common Stock

when deliverable upon the conversion in full of all outstanding shares of Series A Preferred Stock. The Corporation shall cause all

shares of Common Stock issuable upon conversion of the Series A Preferred Stock to be listed at all times on the securities exchange

or nationally recognized quotation system on which Common Stock is then traded generally.

(d) Fractional

Shares. No fractional shares of Common Stock or scrip shall be issued upon conversion of shares of the Series A Preferred Stock.

If such conversion would result in the issuance of a fraction of a share of Common Stock, in lieu of issuing any fractional share, the

Corporation shall instead make a cash payment to each holder that would otherwise be entitled to a fractional share (based on the Common

Stock Price on the date of such conversion).

(e) Severability.

In case any one or more of the provisions contained in this Certificate of Designation shall be invalid, illegal or unenforceable in any

respect, the validity, legality and enforceability of the remaining provisions contained herein shall not in any way be affected or impaired

thereby. Furthermore, in lieu of any such invalid, illegal or unenforceable provision, there shall be added automatically as a part of

this Certificate of Designation a provision as similar in terms to such invalid, illegal or unenforceable provision as may be possible

and be legal, valid and enforceable, unless the requisite parties separately agree to a replacement provision that is valid, legal and

enforceable.

Section 9. Restriction

and Limitations; Consent Rights. So long as any shares of Series A Preferred Stock remain outstanding, in addition to the voting

and consent rights provided in Section 12 and Section 17, unless a greater percentage shall then be required by

law, the Corporation shall not take (or, to the extent applicable, permit any of the Corporation’s controlled Affiliates to take)

any of the following actions, or enter into any arrangement or contract to do any of the following actions, without the affirmative vote

or consent of the holders of a majority of the shares of Series A Preferred Stock at the time outstanding and entitled to vote thereon

or consent thereto, voting or consenting, as the case may be, separately as a single class:

(a) create,

authorize (including by way of reclassification, merger, consolidation, subdivision or other similar reorganization) or issue any Equity

Securities (other than issuances of Junior Securities, to employees or other similar service providers, by the Corporation under the Corporation’s

employee incentive plans as in effect on the date on which this Certificate of Designation first becomes effective), including additional

shares of Series A Preferred Stock;

(b) redeem,

acquire, engage in a tender offer (other than responding to a third-party tender offer as required by applicable law) or otherwise purchase

any Equity Securities (a “Repurchase”), other than a Repurchase (i) from an employee or director in connection

with such employee’s or director’s termination or as provided for in the agreement with such employee or director pursuant

to which such Equity Securities were issued or (ii) of Junior Securities by the Corporation in satisfaction of tax withholding obligations

under the Corporation’s employee incentive plans;

(c) declare

or pay, set apart for payment in respect of or make any direct or indirect distribution or distribution (whether in cash, securities or

other property) in respect of any Equity Securities, other than pursuant to Section 3;

(d) amend,

repeal, modify or alter the Articles of Incorporation or Bylaws, whether by or in connection with a reorganization, recapitalization,

transfer of assets, merger, consolidation, dissolution, issue or sale of securities or any other voluntary action so as to affect adversely

the rights, preferences, privileges or voting or consent rights of the Series A Preferred Stock or the holders of the Series A

Preferred Stock;

(e) announce,

authorize or enter into any agreement related to or consummate a Material Transaction, including (but not limited to) any Change of Control;

or

(f) increase

or decrease the size of the Board other than as set forth in the Purchase Agreement or any ancillary documents thereto.

(g) Notwithstanding

the provisions of Section 9(a), nothing herein shall prevent the Company from creating, authorizing or issuing Junior Securities

for cash in an amount equal to the fair market value of such Junior Securities as of the date of their issuance, as determined in good

faith by the Board, if the Board determines, after consultation with its outside financial advisors and outside counsel, that the failure

of the Board to cause the Company to create, authorize or issue such Junior Securities in response to a material change, event or occurrence

that arises after the date of the Purchase Agreement and was not known or reasonably foreseeable to the Board as of such date, would be

inconsistent with the Board’s fiduciary duties under Nevada law.

Section 10. Business

Opportunities.

(a) To

the fullest extent permitted by applicable law, the Corporation, on behalf of itself and its subsidiaries, renounces any interest or expectancy

of the Corporation and its subsidiaries in, or in being offered an opportunity to participate in, business opportunities that are from

time to time presented to the holders of the Series A Preferred Stock or any of their Affiliates or any of their respective officers,

directors, agents, equityholders, members, partners, affiliates and subsidiaries (other than the Corporation and its subsidiaries) (each,

a “Specified Party”) or are business opportunities in which a Specified Party participates or desires to participate,

even if the opportunity is one that the Corporation or its subsidiaries might reasonably be deemed to have pursued or had the ability

or desire to pursue if granted the opportunity to do so, and each such Specified Party shall have no duty to communicate or offer such

business opportunity to the Corporation and, to the fullest extent permitted by applicable law, shall not be liable to the Corporation

or any of its subsidiaries or any stockholder, for breach of any fiduciary or other duty, as a director or officer or controlling stockholder

or otherwise, by reason of the fact that such Specified Party pursues or acquires such business opportunity, directs such business opportunity

to another Person or fails to present such business opportunity, or information regarding such business opportunity, to the Corporation

or its subsidiaries. Notwithstanding the foregoing, a Specified Party who is a director of the Corporation and who is offered a business

opportunity in his or her capacity as a director or officer of the Corporation (a “Directed Opportunity”) shall be

obligated to communicate such Directed Opportunity to the Corporation; provided, however, that all of the protections

of this Section 10 shall otherwise apply to other Specified Parties with respect to such Directed Opportunity, including,

without limitation, the ability of such Specified Parties to pursue or acquire such Directed Opportunity or to direct such Directed Opportunity

to another Person.

(b) Neither

the amendment nor repeal of this Section 10, nor the adoption of any provision of the Articles of Incorporation or the Bylaws,

nor, to the fullest extent permitted by Nevada law, any modification of law, shall eliminate, reduce or otherwise adversely affect any

right or protection of any Person granted pursuant hereto existing at, or arising out of or related to any event, act or omission that

occurred prior to, the time of such amendment, repeal, adoption or modification (regardless of when any proceeding (or part thereof) relating

to such event, act or omission arises or is first threatened, commenced or completed).

(c) If

any provision or provisions of this Section 10 shall be held to be invalid, illegal or unenforceable as applied to any circumstance

for any reason whatsoever, then the validity, legality and enforceability of such provisions in any other circumstance and of the remaining

provisions of this Section 10 (including, without limitation, each portion of any section of this Section 10 containing

any such provision held to be invalid, illegal or unenforceable that is not itself held to be invalid, illegal or unenforceable) shall

not in any way be affected or impaired thereby.

Section 11. Corporation’s

Dealings with Holders of Series A Preferred Stock. No payments shall be made to holders of Series A Preferred Stock, and

no redemptions of Series A Preferred Stock shall be made, unless the right to receive such payments or participate in such redemptions

are made available to all holders of Series A Preferred Stock on a pro rata basis based on the number of shares of Series A

Preferred Stock such holder holds.

Section 12. Meetings;

Action Without a Meeting.

(a) The

holders of not less than 20% of the shares of Series A Preferred Stock outstanding may request the calling of a special meeting of

the holders of Series A Preferred Stock, which meeting shall thereupon be called by the Chief Executive Officer, an Executive Vice

President or the Secretary of the Corporation. Notice of such meeting shall be given to each holder of record of Series A Preferred

Stock by mailing a copy of such notice to such holder at such holder’s last address as the same appears on the books of the Corporation.

Such meeting shall be called for a time not earlier than 10 days and not later than 60 calendar days after such request and shall be held

at such place as specified in such request. If such meeting shall not be called within 10 days after such request, then the holders of

not less than 10% of the shares of Series A Preferred Stock outstanding may designate in writing any holder of Series A Preferred

Stock to call such meeting on similar notice at the expense of the Corporation.

(b) With

respect to actions by the holders of Series A Preferred Stock upon those matters on which such holders are entitled to vote as a

separate class, such actions may be taken without a meeting by the written consent of such holders who would be entitled to vote at a

meeting having voting power to cast not less than the minimum number of votes that would be necessary to authorize or take such action

at a meeting at which all holders of the Series A Preferred Stock entitled to vote were present and voted.

(c) The

holders of the Series A Preferred Stock shall have no voting or consent rights, except as set forth in Section 9, this

Section 12, Section 17 or as required by law. With respect to any matter on which the holders of the Series A

Preferred Stock are entitled to vote or consent, each share of Series A Preferred Stock shall be entitled to one vote on such matter.

Section 13. Status

of Reacquired Shares of Series A Preferred Stock. Shares of outstanding Series A Preferred Stock reacquired by the Corporation

(including shares of Series A Preferred Stock that shall have been redeemed pursuant to the provisions hereof) or cancelled upon

conversion into Common Stock shall be restored to the status of authorized and unissued shares of Preferred Stock, undesignated as to

series, and subject to later designation and issuance by the Corporation in accordance with its Articles of Incorporation.

Section 14. Preemptive

Rights. Holders of Series A Preferred Stock shall not be entitled to any preemptive, subscription or similar rights in respect

of any securities of the Corporation, except as specifically set forth herein.

Section 15. No

Impairment. The Corporation will not, by amendment of the Articles of Incorporation or through any reorganization, recapitalization,

transfer of assets, merger, consolidation, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid

the observance or performance of any of the terms to be observed or performed hereunder by the Corporation but will at all times in good

faith assist in the carrying out of all the provisions of this Certificate of Designation and in the taking of all such action as may

be necessary or appropriate in order to protect the rights of the holders of the Series A Preferred Stock against impairment; provided

that, to the extent that the rights and obligations of the holders of the Series A Preferred Stock and the Corporation with respect

to any transaction, event or other matter are expressly addressed by one or more specific provisions of this Certificate of Designation,

such provision(s) shall govern and this Section 15 shall be inapplicable with respect thereto.

Section 16. Notices.

Any notice required by the provisions hereof shall be made in accordance with the applicable provisions of the Purchase Agreement.

Section 17. Amendments.

The affirmative vote or consent of holders of a majority of the Series A Preferred Stock then outstanding, voting as a separate class,

shall be required to approve any amendment, alteration or repeal of (a) any provision of the Articles of Incorporation that adversely

affects the rights, preferences, privileges or voting powers of the Series A Preferred Stock or the holders thereof or (b) any

provision of this Certificate of Designation.

[The Remainder of this Page Intentionally

Left Blank]