Exhibit 99.2

www. ringenergy.com NYSE American: REI VALUE FOCUSED PROVEN STRATEGY

www.ringenergy.com NYSE American: REI Forward - Looking Statements and Cautionary Note Regarding Hydrocarbon Disclosures 2 Forward – Looking Statements This Presentation includes "forward - looking statements" within the meaning of the Private Securities Litigation Reform Act of 19 95, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of strictly historical facts included in this Presentation constitute forward - loo king statements and may often, but not always, be identified by the use of such words as “may,” “will,” “should,” “could,” “intends,” “estimates,” “expects,” “anticipates,” “plans,” “project,” “guidance,” “target,” “potential,” “possible,” “probabl y,” and “believes” or the negative variations thereof or comparable terminology. These forward - looking statements include statements regarding the Company's financial position, future revenues, net income, potential evaluations, business strategy and plans and objectives for future operations. The forward - looking statements include statements about the expected benefits to the Company and to its stockholders from the proposed acquisition of certain assets (the “Stronghold Assets”) fro m S tronghold Energy II Operating, LLC (“Stronghold OpCo ”) and Stronghold Energy II Royalties, LP (“Stronghold RoyaltyCo ”, together with Stronghold OpCo , collectively, “Stronghold”); Forward - looking statements are subject to numerous assumptions, risks and uncertainties that may cause actual results to be mate rially different than any future results expressed or implied in those statements. However, whether actual results and developments will conform to expectations is subject to a nu mbe r of material risks and uncertainties, including but not limited to: the Company’s ability to close the acquisition of the Stronghold Assets; the Company’s ability to integrate the Stronghold Assets and achieve the anticipated benefits therefrom; r isk s relating to any unforeseen liability of the Company or the Stronghold Assets; declines in oil, natural gas liquids or natural gas prices; the level of success in exploration, development and production activities; the timing of exploration and de velopment expenditures; inaccuracies of reserve estimates or assumptions underlying them; revisions to reserve estimates as a result of changes in commodity prices or production history; impacts to financial statements as a result of impairment w rit e - downs; risks related to level of indebtedness and periodic redeterminations of the borrowing base under the Company’s credit facility; the ability of the Company to obtain substantial additional debt financing to close the acquisition of the Stronghold Assets; the impacts of hedging on results of operations; the Company’s ability to replace oil and natural gas reserves; any loss of senior management or technical personnel; and the direct and indirect impact on most or all of the foregoing due to the COVID - 19 pandemic. Some of the factors that could cause actual results to differ materially from expected results are described under “Risk Factors” in our 2021 annual report on Form 10 - K filed with the U.S. Securities and Exchange Commission (“S EC”) on March 16, 2022, and in our subsequent quarterly reports on Form 10 - Q and current reports on Form 8 - K. Although the Company believes that the assumptions upon which such forward - looking statements are based are reasonable, it can g ive no assurance that such assumptions will prove to be correct. All forward - looking statements in this Presentation are expressly qualified by the cautionary statements and by reference to the underlying assumptions that may prove to be inco rre ct. The Company undertakes no obligation to publicly revise these forward - looking statements to reflect events or circumstances that arise after the date hereof, except as required by applicable law. The financial and operating estimates contained in this presentation represent our reasonable estimates as of the date of this Presentation. Neither our independent auditors no r a ny other third party has examined, reviewed or compiled the projections and, accordingly, none of the foregoing expresses an opinion or other form of assurance with respect thereto. The assumptions upon which the projections are based ar e d escribed in more detail herein. Some of these assumptions inevitably will not materialize, and unanticipated events may occur that could affect our results. Therefore, our actual results achieved during the periods covered by the estimates w ill vary from the projected results. Prospective investors are cautioned not to place undue reliance on the estimates included herein. Cautionary Note regarding Hydrocarbon Disclosures The SEC has generally permitted oil and natural gas companies, in their filings with the SEC, to disclose proved reserves, wh ich are reserve estimates that geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions, and certain probable and possible reserv es that meet the SEC’s definitions for such terms. We use the terms “estimated ultimate recovery,” or “EURs,” “probable,” “possible,” and “non - proven” reserves, reserve “potential” or “upside” or other descriptions of volumes of reserves potentially recoverable through additional drilling or recovery techniques that the SEC’s guidelines prohibit us from including in filings with the SEC. Reference to EURs of natural gas and oil includes amounts that are not yet classified as p rov ed reserves under SEC definitions, but that we believe should ultimately be produced and are based on previous operating experience in a given area and publicly available information relating to the operations of producers who are conducting oper ati ons in these areas. These estimates are by their nature more speculative than estimates of proved reserves and accordingly are subject to substantially greater risk of being actually realized by us. Factors affecting the ultimate recove ry of reserves that may be recovered include the scope of our drilling programs, which will be directly affected by capital availability, drilling and production costs, commodity prices, availability of services and equipment, permit expirations, tr ans portation constraints, regulatory approvals and other factors, and actual drilling results, including geological and mechanic al factors affecting recovery rates. Accordingly, actual quantities that may be recovered from our interests will differ from ou r e stimates and could be significantly less than our targeted recovery rate. In addition, our estimates may change significantly as we receive additional data. Supplemental Non - GAAP Financial Measures This Presentation includes financial measures that are not in accordance with accounting principles generally accepted in the Un ited States (“GAAP”), such as “Adjusted Net Income,” “Adjusted EBITDA,” “PV - 10,” “Free Cash Flow,” or “FCF,” and “Cash Flow from Operations.” While management believes that such measures are useful for investors, they should not be used as a re pla cement for financial measures that are in accordance with GAAP. For definitions of such non - GAAP financial measures and their reconciliations to GAAP measures, please see the Appendix.

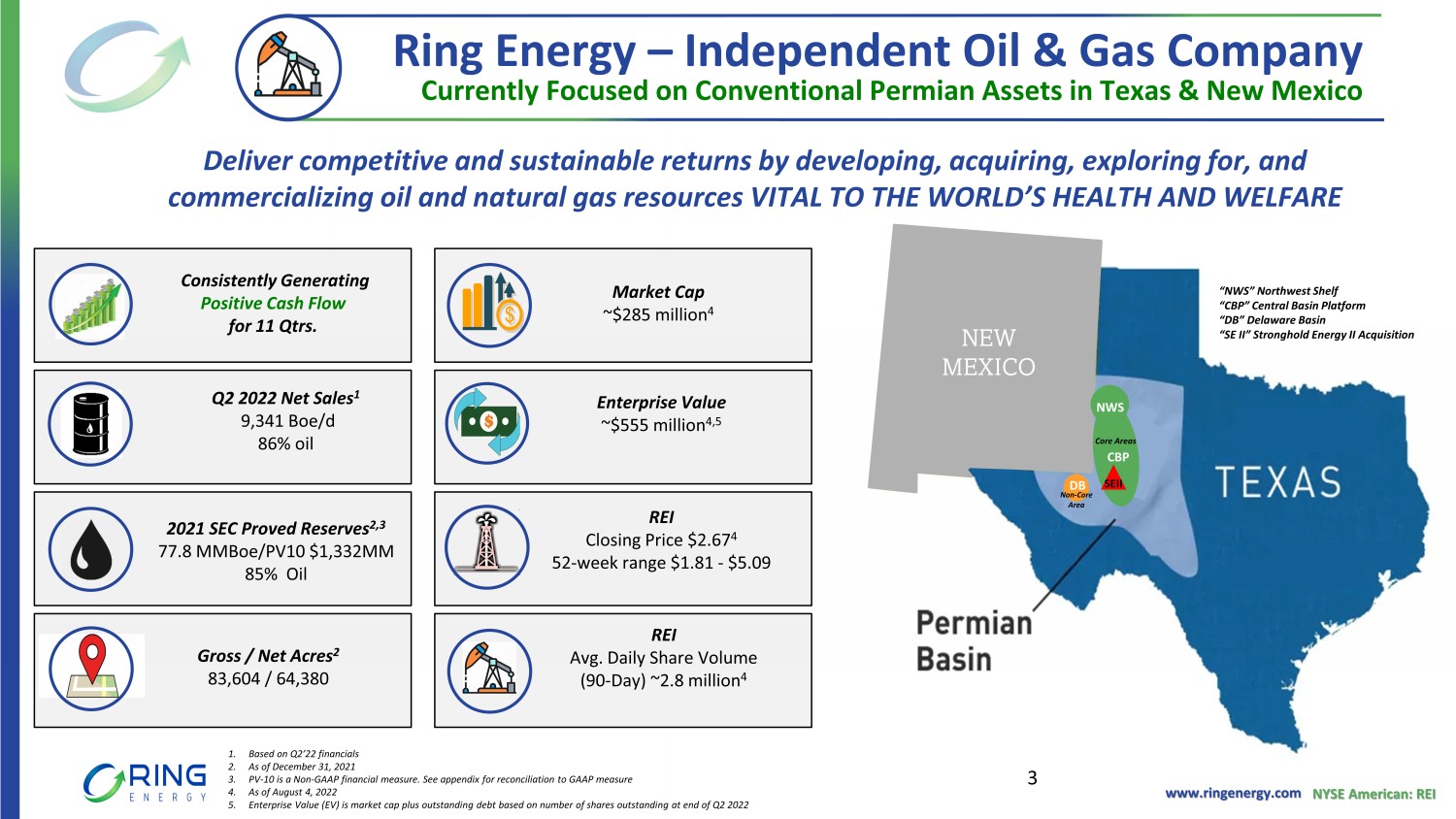

www.ringenergy.com NYSE American: REI Ring Energy – Independent Oil & Gas Company Currently Focused on Conventional Permian Assets in Texas & New Mexico 3 2021 SEC Proved Reserves 2,3 77.8 MMBoe/PV10 $1,332MM 85% Oil Gross / Net Acres 2 83,604 / 64,380 1. Based on Q2’22 financials 2. As of December 31, 2021 3. PV - 10 is a Non - GAAP financial measure. See appendix for reconciliation to GAAP measure 4. As of August 4, 2022 5. Enterprise Value (EV) is market cap plus outstanding debt based on number of shares outstanding at end of Q2 2022 Market Cap ~$285 million 4 Consistently Generating Positive Cash Flow for 11 Qtrs. NEW MEXICO “NWS” Northwest Shelf “CBP” Central Basin Platform “DB” Delaware Basin “SE II” Stronghold Energy II Acquisition Enterprise Value ~$555 million 4,5 REI Closing Price $2.67 4 52 - week range $1.81 - $5.09 REI Avg. Daily Share Volume (90 - Day) ~2.8 million 4 Non - Core Area DB CBP NWS Core Areas Q2 2022 Net Sales 1 9,341 Boe/d 86% oil SEII Deliver competitive and sustainable returns by developing, acquiring, exploring for, and commercializing oil and natural gas resources VITAL TO THE WORLD’S HEALTH AND WELFARE

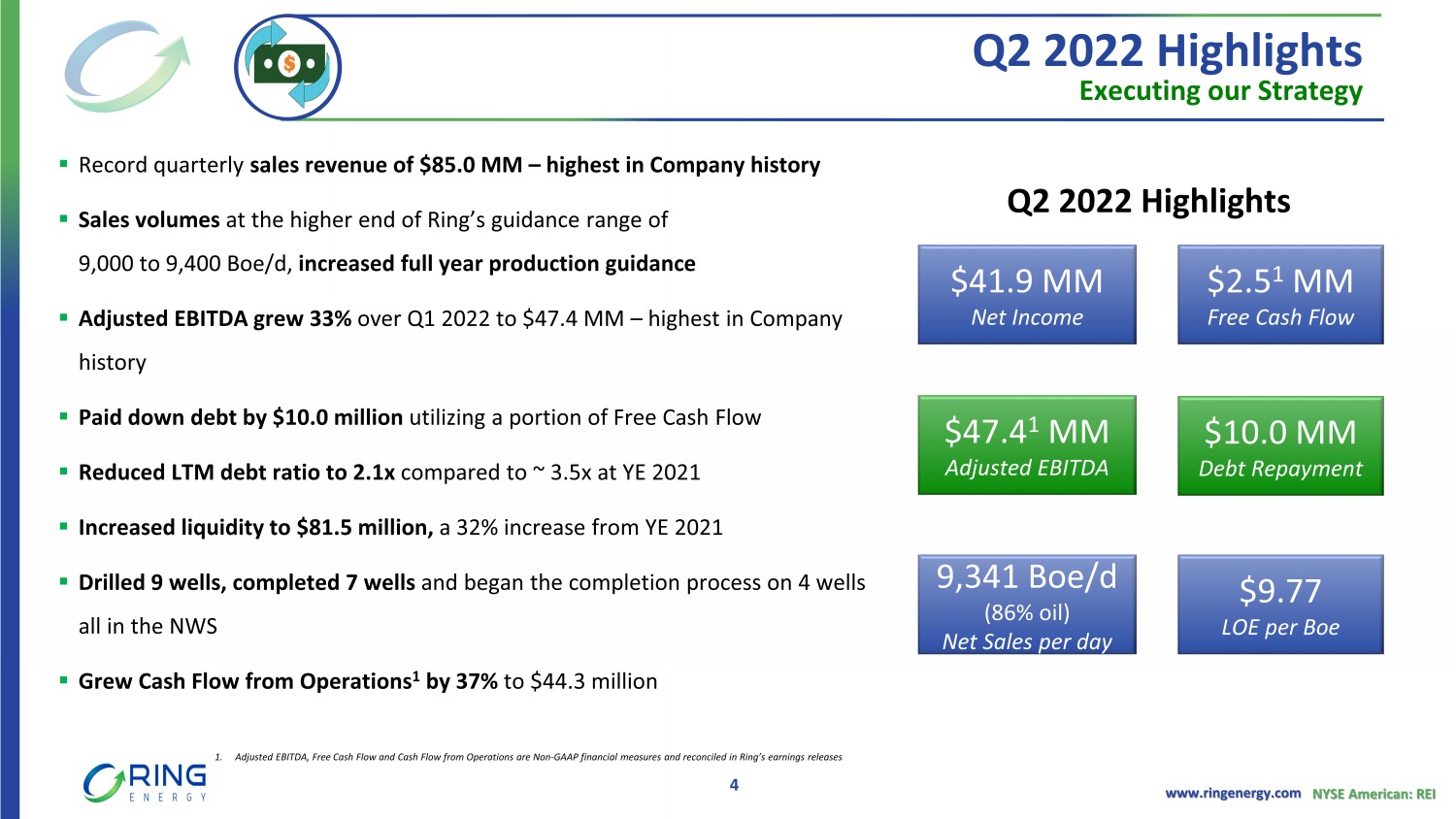

www.ringenergy.com NYSE American: REI Q2 2022 Highlights Executing our Strategy 4 ▪ Record quarterly sales revenue of $85.0 MM – highest in Company history ▪ Sales volumes at the higher end of Ring’s guidance range of 9,000 to 9,400 Boe /d, increased full year production guidance ▪ Adjusted EBITDA grew 33% over Q1 2022 to $47.4 MM – highest in Company history ▪ Paid down debt by $10.0 million utilizing a portion of Free Cash Flow ▪ Reduced LTM debt ratio to 2.1x compared to ~ 3.5x at YE 2021 ▪ Increased liquidity to $81.5 million, a 32% increase from YE 2021 ▪ Drilled 9 wells, completed 7 wells and began the completion process on 4 wells all in the NWS ▪ Grew Cash Flow from Operations 1 by 37% to $44.3 million $2.5 1 MM Free Cash Flow $47.4 1 MM Adjusted EBITDA $41.9 MM Net Income $10.0 MM Debt Repayment 9 ,341 Boe /d (86% oil) Net Sales per day $9.77 LOE per Boe 1. Adjusted EBITDA, Free Cash Flow and Cash Flow from Operations are Non - GAAP financial measures and reconciled in Ring’s earnings releases Q2 2022 Highlights

www.ringenergy.com NYSE American: REI Committed to ESG Issued Inaugural ESG Report in Q4 2021 5

www.ringenergy.com NYSE American: REI 1 Rig Continuous to Drill 25 - 33 Wells YTD Placed on production 16 Hz’s wells 3 compared to 13 in FY21 Significant Increase in Adjusted EBITDA 1H22 EBITDA ~ $82.9 million nearly matches FY21 1 Target Growth 9,300 - 9,700 Boepd (86% oil) 9 - 14% growth over FY21 increasing exposure to higher commodity prices Reduce Leverage Ratio to less than 2.0x by YE21 LTM leverage ratio as Q2 2022 already at 2.1x Focus on Maximizing Free Cash Flow 1H22 Generated over $15 million FCF 1 6 Proven Strategy Leads to Shareholder Value 2022 Value Focused Proposition 1. $83.3 million in adjusted EBITDA for FY 2021. Adjusted EBITDA & Free Cash Flow are Non - GAAP financial measures and reconciled in the appendix 2. REI 2022 capital guidance of $120 - 140 million with mid point at $130 million (mid point used for percent calculation versus 2021 ) 3. 16 Horizontal wells completed as of July 2022 Focus on FCF and Strengthening the Balance Sheet Invest in High ROR Projects Pursue Operational Excellence Enhance Scale & Improve Metrics Increased capital budget by over 150% 1 vs. FY21

Asset Areas

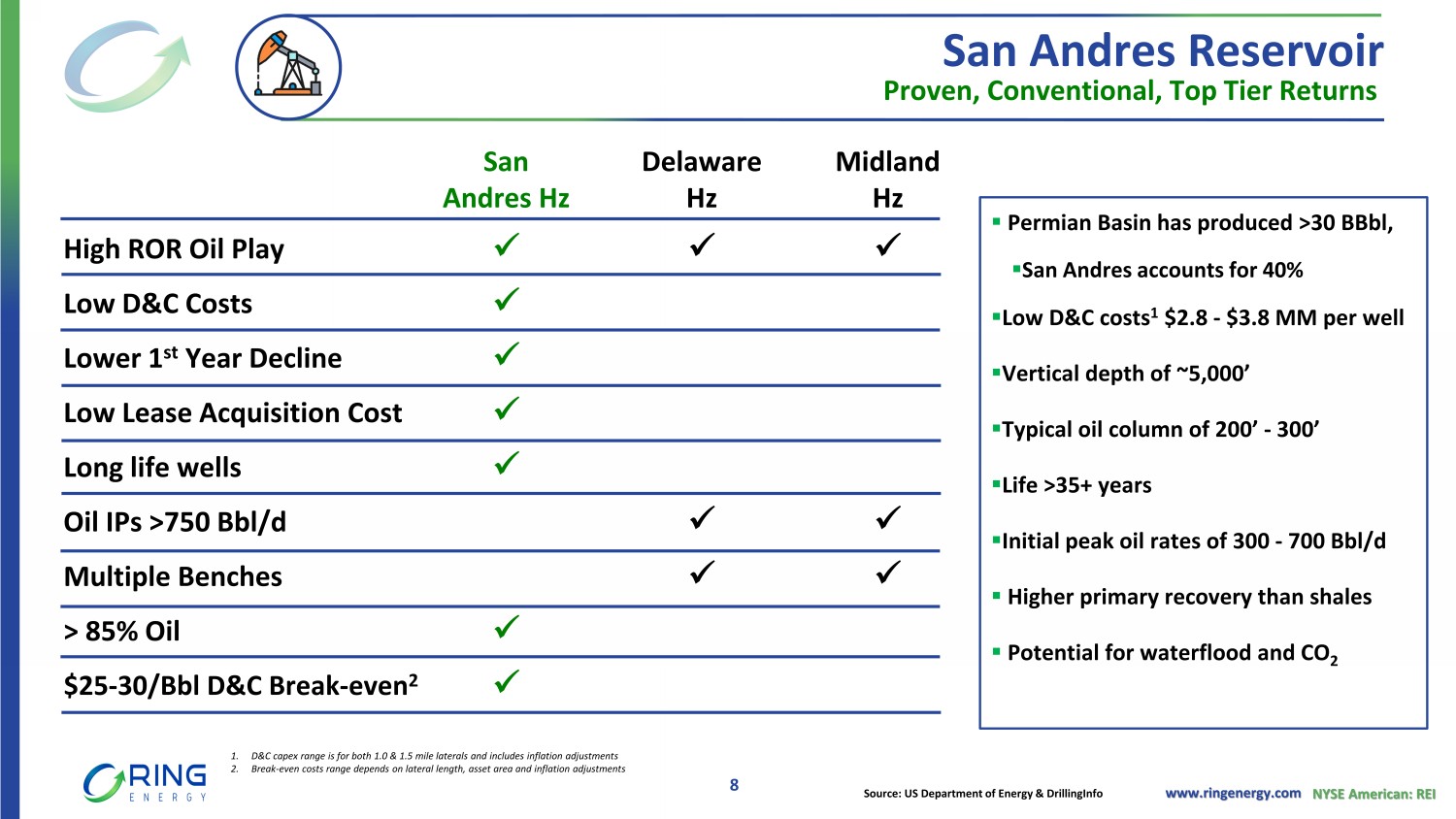

www.ringenergy.com NYSE American: REI Proven, Conventional, Top Tier Returns San Andres Hz Delaware Hz Midland Hz High ROR Oil Play x x x Low D&C Costs x Lower 1 st Year Decline x Low Lease Acquisition Cost x Long life wells x Oil IPs >750 Bbl /d x x Multiple Benches x x > 85% Oil x $25 - 30/ Bbl D&C Break - even 2 x ▪ Permian Basin has produced >30 BBbl , ▪ San Andres accounts for 40% ▪ Low D&C costs 1 $2.8 - $3.8 MM per well ▪ Vertical depth of ~5,000’ ▪ Typical oil column of 200’ - 300’ ▪ Life >35+ years ▪ Initial peak oil rates of 300 - 700 Bbl/d ▪ Higher primary recovery than shales ▪ Potential for waterflood and CO 2 Source: US Department of Energy & DrillingInfo 8 San Andres Reservoir 1. D&C capex range is for both 1.0 & 1.5 mile laterals and includes inflation adjustments 2. Break - even costs range depends on lateral length, asset area and inflation adjustments

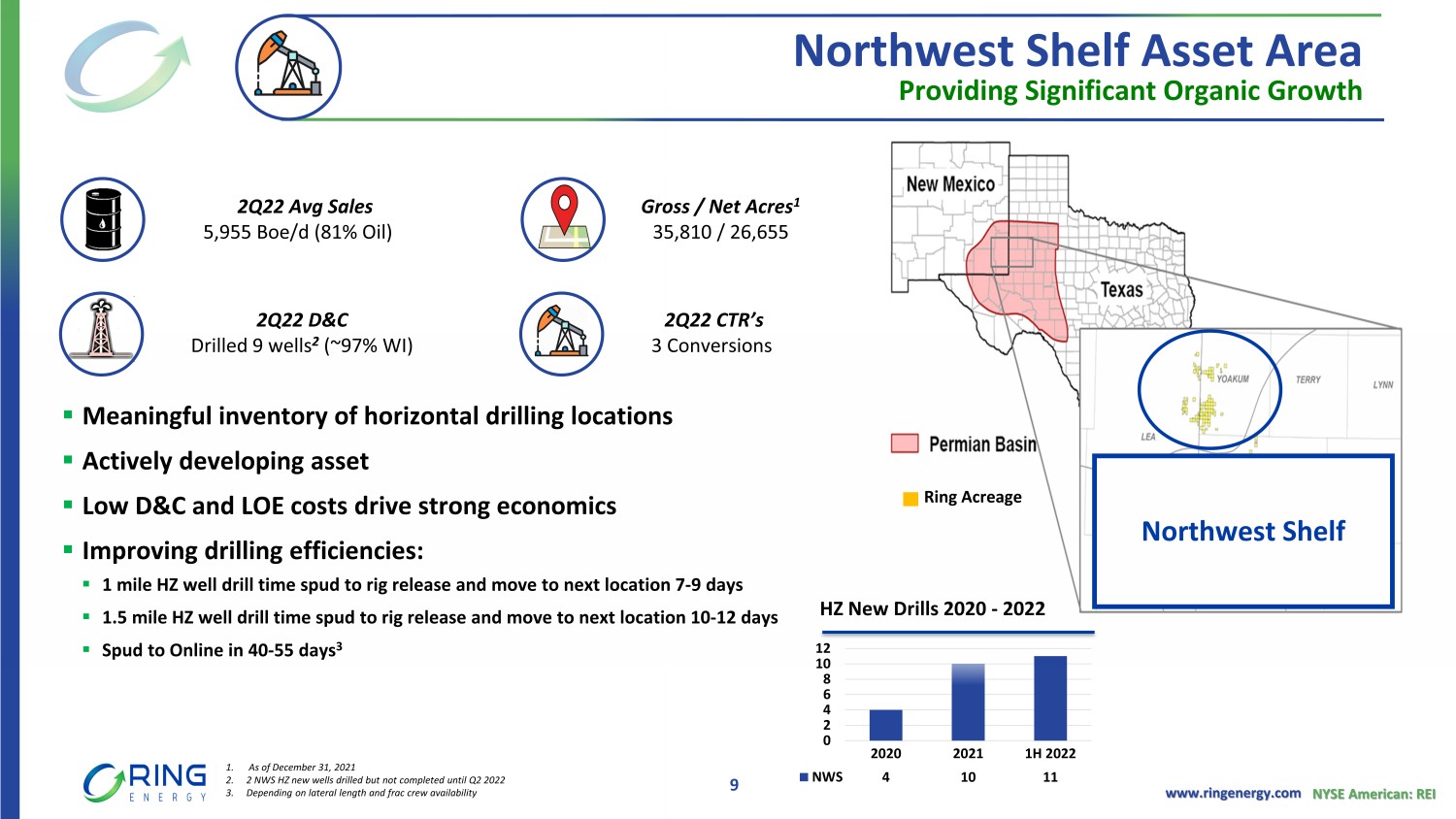

www.ringenergy.com NYSE American: REI ▪ Meaningful inventory of horizontal drilling locations ▪ Actively developing asset ▪ Low D&C and LOE costs drive strong economics ▪ Improving drilling efficiencies: ▪ 1 mile HZ well drill time spud to rig release and move to next location 7 - 9 days ▪ 1.5 mile HZ well drill time spud to rig release and move to next location 10 - 12 days ▪ Spud to Online in 40 - 55 days 3 Providing Significant Organic Growth 2Q22 Avg Sales 5,955 Boe /d (81% Oil) 2Q22 D&C Drilled 9 wells 2 (~97% WI) Gross / Net Acres 1 35,810 / 26,655 Northwest Shelf Asset Area 9 2Q22 CTR’s 3 Conversions 1. As of December 31, 2021 2. 2 NWS HZ new wells drilled but not completed until Q2 2022 3. Depending on lateral length and frac crew availability Ring Acreage Northwest Shelf 2020 2021 1H 2022 NWS 4 10 11 0 2 4 6 8 10 12 HZ New Drills 2020 - 2022

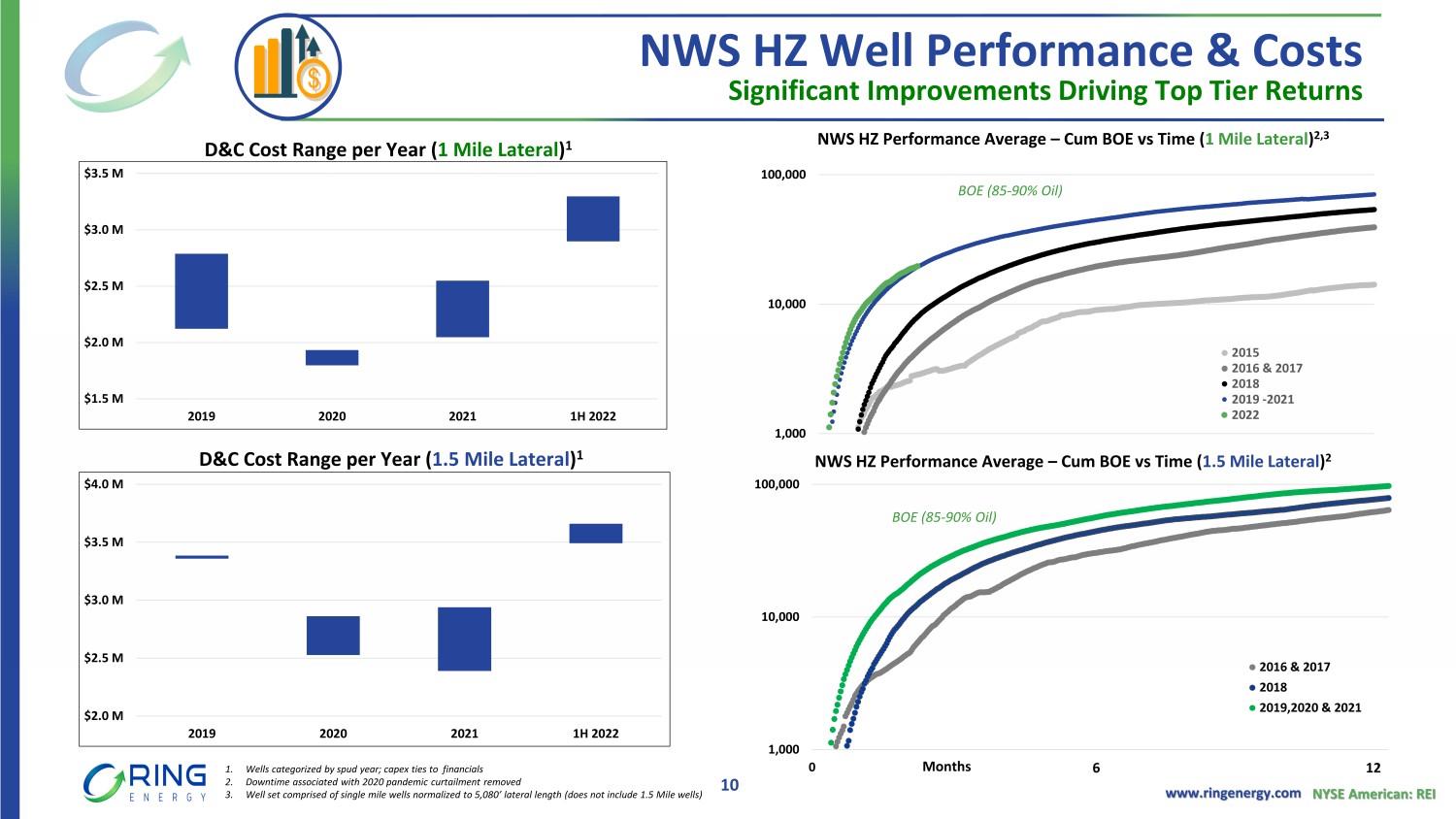

www.ringenergy.com NYSE American: REI 1,000 10,000 100,000 0 180 360 2016 & 2017 2018 2019,2020 & 2021 Months 6 12 BOE (85 - 90% Oil) NWS HZ Well Performance & Costs Significant Improvements Driving Top Tier Returns 10 D&C Cost Range per Year ( 1 Mile Lateral ) 1 NWS HZ Performance Average – Cum BOE vs Time ( 1 Mile Lateral ) 2,3 1. Wells categorized by spud year; capex ties to financials 2. Downtime associated with 2020 pandemic curtailment removed 3. Well set comprised of single mile wells normalized to 5,080’ lateral length (does not include 1.5 Mile wells) ~530 Avg ~410 Avg ~420 Avg D&C Cost Range per Year ( 1.5 Mile Lateral ) 1 BOE (85 - 90% Oil) NWS HZ Performance Average – Cum BOE vs Time ( 1.5 Mile Lateral ) 2 $1.5 M $2.0 M $2.5 M $3.0 M $3.5 M 2019 2020 2021 1H 2022 $2.0 M $2.5 M $3.0 M $3.5 M $4.0 M 2019 2020 2021 1H 2022 1,000 10,000 100,000 2015 2016 & 2017 2018 2019 -2021 2022

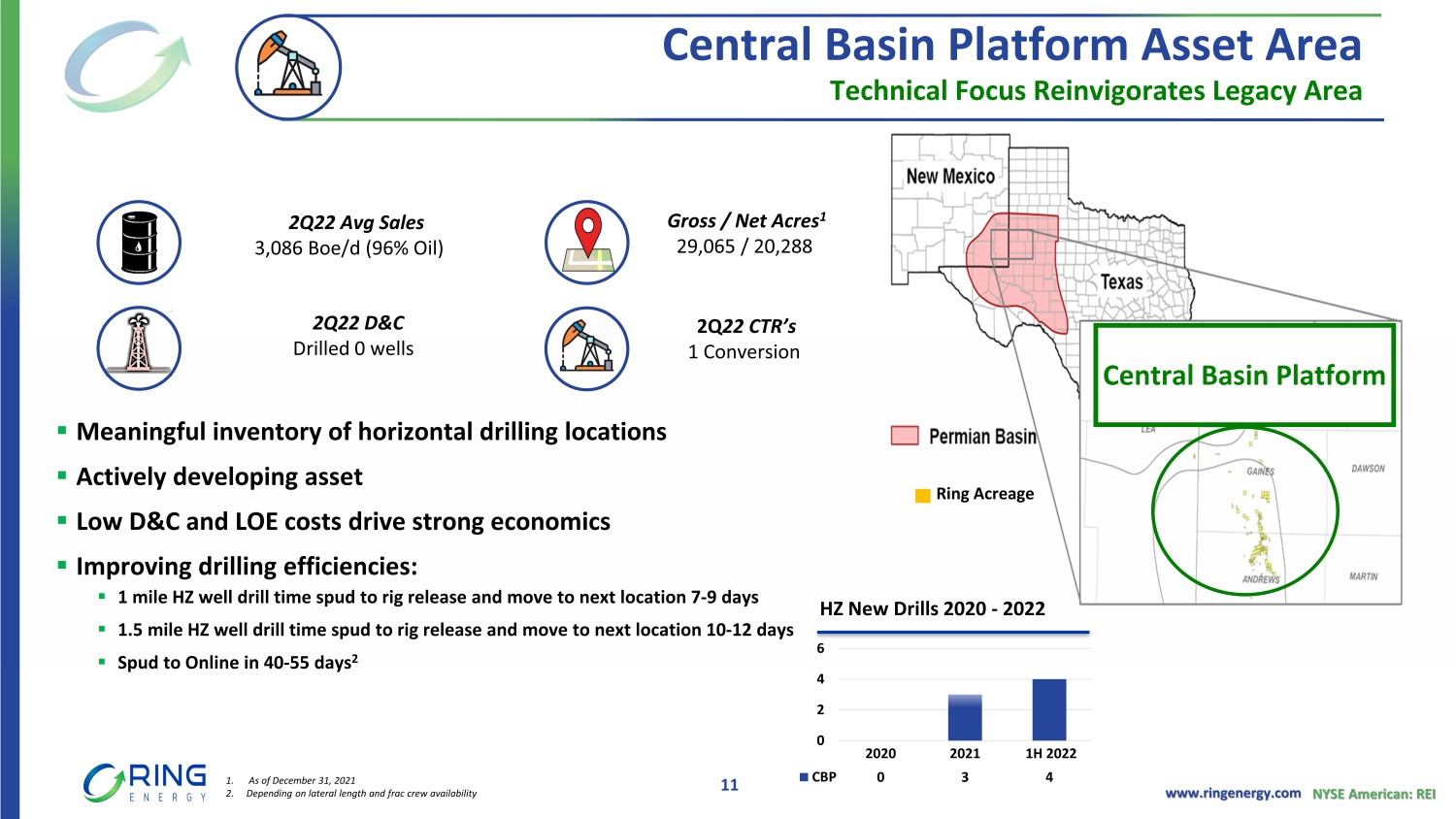

www.ringenergy.com NYSE American: REI 2Q22 Avg Sales 3,086 Boe /d (96% Oil) 2Q 22 CTR’s 1 Conversion 2Q22 D&C Drilled 0 wells Gross / Net Acres 1 29,065 / 20,288 Technical Focus Reinvigorates Legacy Area Central Basin Platform Asset Area 11 Ring Acreage Central Basin Platform 1. As of December 31, 2021 2. Depending on lateral length and frac crew availability ▪ Meaningful inventory of horizontal drilling locations ▪ Actively developing asset ▪ Low D&C and LOE costs drive strong economics ▪ Improving drilling efficiencies: ▪ 1 mile HZ well drill time spud to rig release and move to next location 7 - 9 days ▪ 1.5 mile HZ well drill time spud to rig release and move to next location 10 - 12 days ▪ Spud to Online in 40 - 55 days 2 2020 2021 1H 2022 CBP 0 3 4 0 2 4 6 HZ New Drills 2020 - 2022

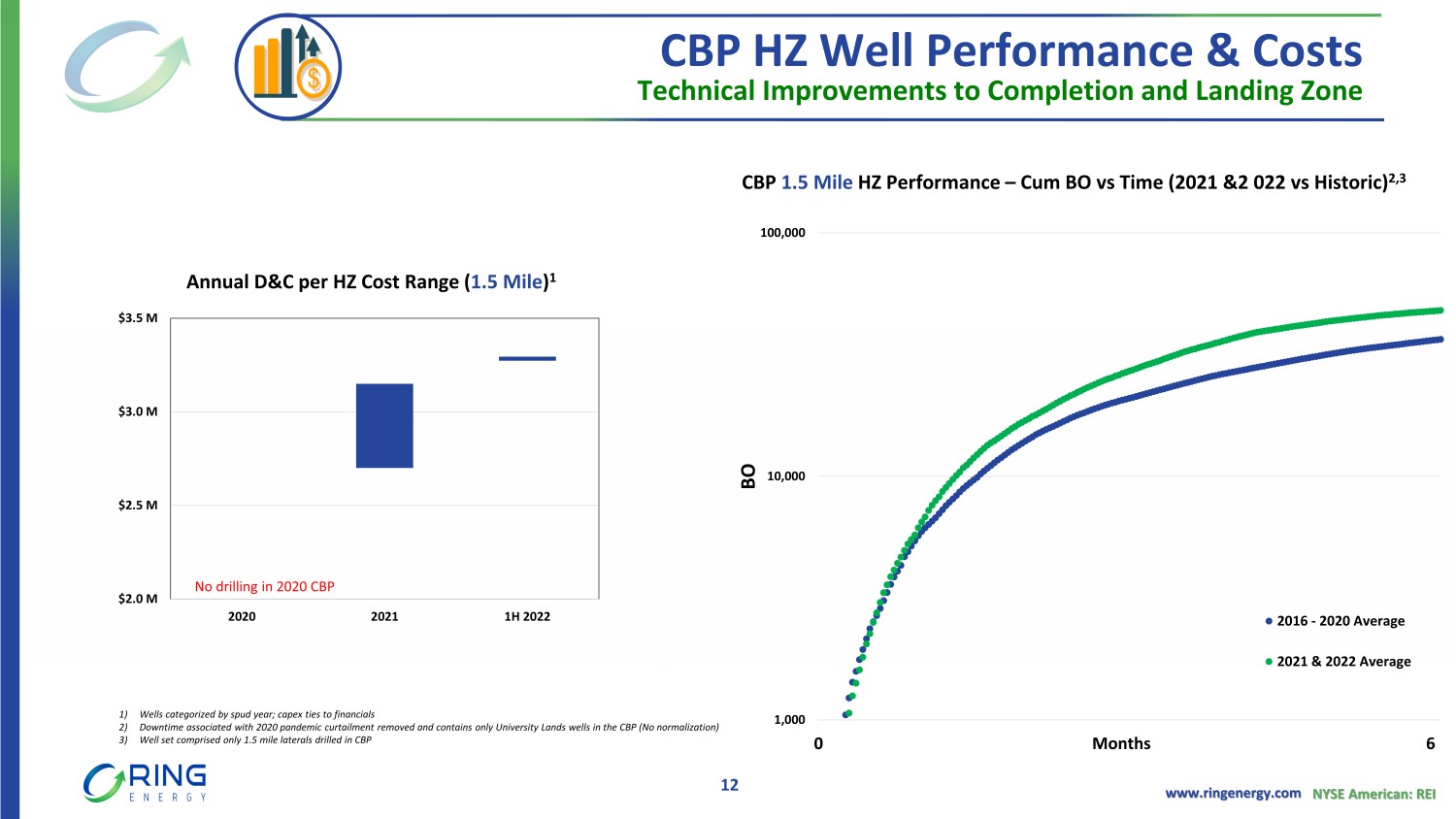

www.ringenergy.com NYSE American: REI 1,000 10,000 100,000 BO 2016 - 2020 Average 2021 & 2022 Average 0 Months 6 CBP HZ Well Performance & Costs Technical Improvements to Completion and Landing Zone 12 Annual D&C per HZ Cost Range ( 1.5 Mile ) 1 ~530 Avg ~410 Avg ~420 Avg CBP 1.5 Mile HZ Performance – Cum BO vs Time (2021 &2 022 vs Historic) 2,3 1) Wells categorized by spud year; capex ties to financials 2) Downtime associated with 2020 pandemic curtailment removed and contains only University Lands wells in the CBP (No normalizat ion ) 3) Well set comprised only 1.5 mile laterals drilled in CBP $2.0 M $2.5 M $3.0 M $3.5 M 2020 2021 1H 2022 No drilling in 2020 CBP

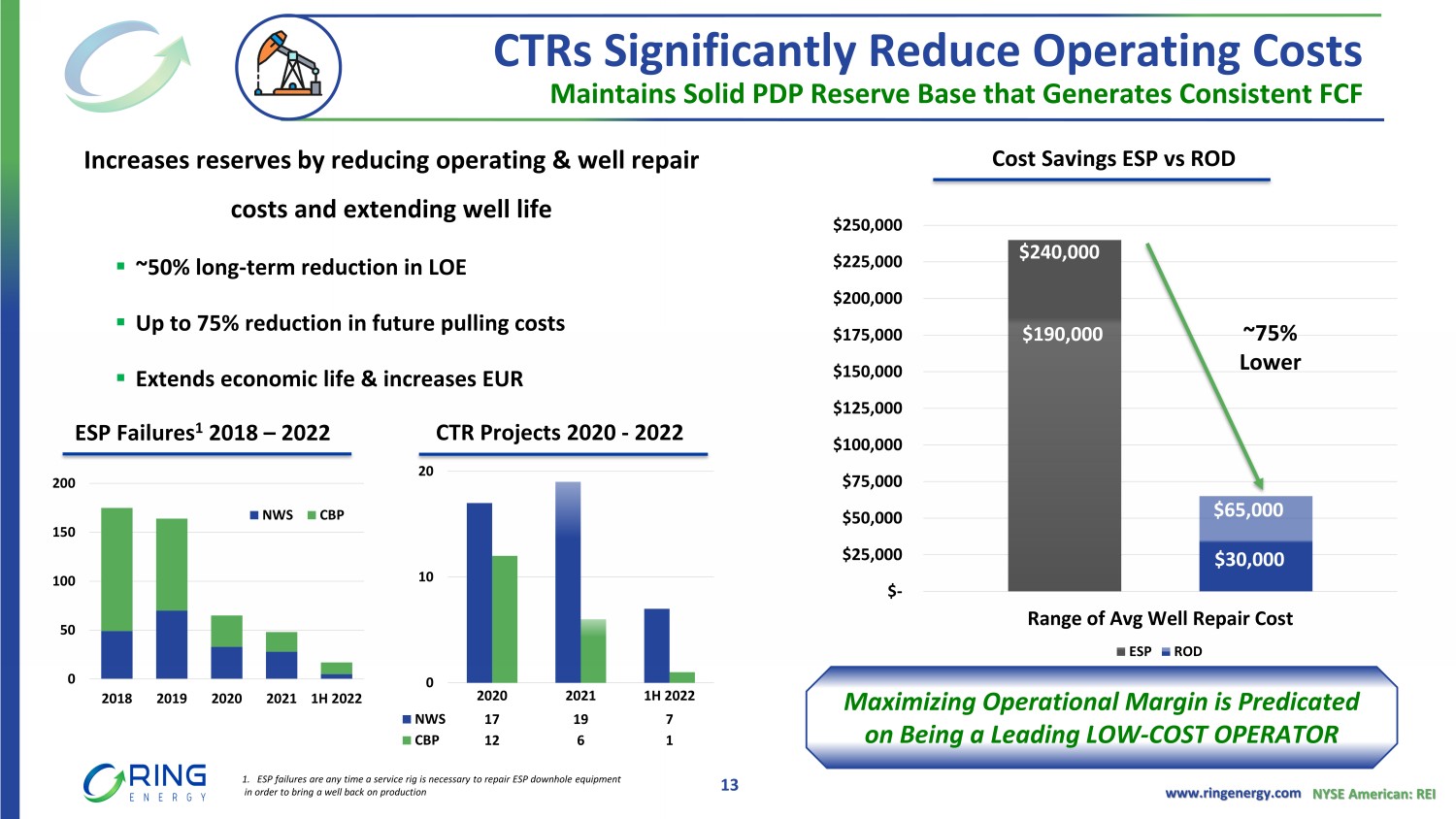

www.ringenergy.com NYSE American: REI 0 50 100 150 200 2018 2019 2020 2021 1H 2022 NWS CBP Maintains Solid PDP Reserve Base that Generates Consistent FCF Increases reserves by reducing operating & well repair costs and extending well life ▪ ~50% long - term reduction in LOE ▪ Up to 75% reduction in future pulling costs ▪ Extends economic life & increases EUR CTRs Significantly Reduce Operating Costs 2020 2021 1H 2022 NWS 17 19 7 CBP 12 6 1 0 10 20 13 $- $25,000 $50,000 $75,000 $100,000 $125,000 $150,000 $175,000 $200,000 $225,000 $250,000 Range of Avg Well Repair Cost ESP ROD $190,000 $65,000 $30,000 Cost Savings ESP vs ROD Maximizing Operational Margin is Predicated on Being a Leading LOW - COST OPERATOR ~75% Lower $240,000 CTR Projects 2020 - 2022 ESP Failures 1 2018 – 2022 1. ESP failures are any time a service rig is necessary to repair ESP downhole equipment in order to bring a well back on production

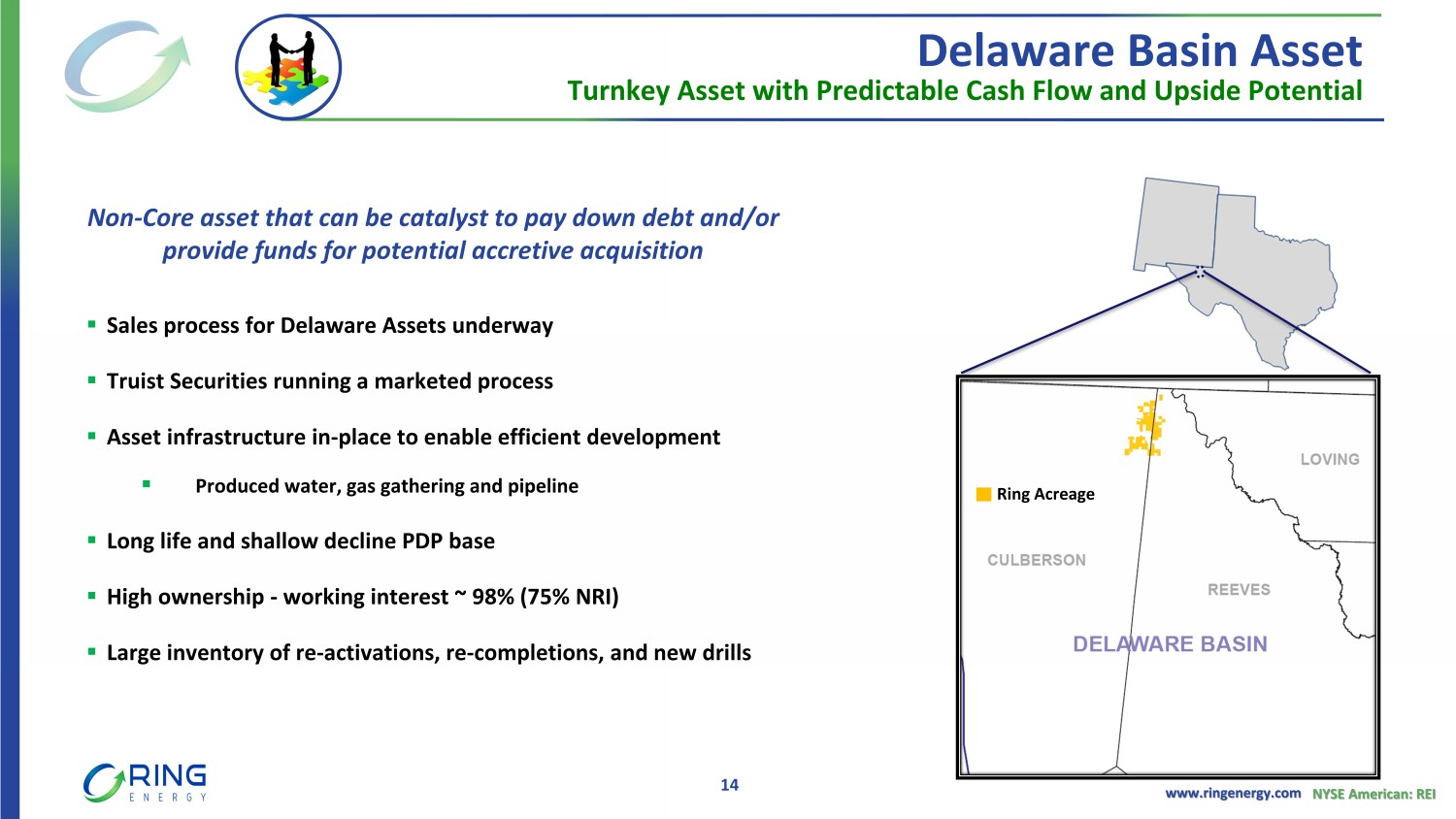

www.ringenergy.com NYSE American: REI Turnkey Asset with Predictable Cash Flow and Upside Potential Delaware Basin Asset 14 ▪ Sales process for Delaware Assets underway ▪ Truist Securities running a marketed process ▪ Asset infrastructure in - place to enable efficient development ▪ Produced water, gas gathering and pipeline ▪ Long life and shallow decline PDP base ▪ High ownership - working interest ~ 98% (75% NRI) ▪ Large inventory of re - activations, re - completions, and new drills Ring Acreage Non - Core asset that can be catalyst to pay down debt and/or provide funds for potential accretive acquisition

Financials

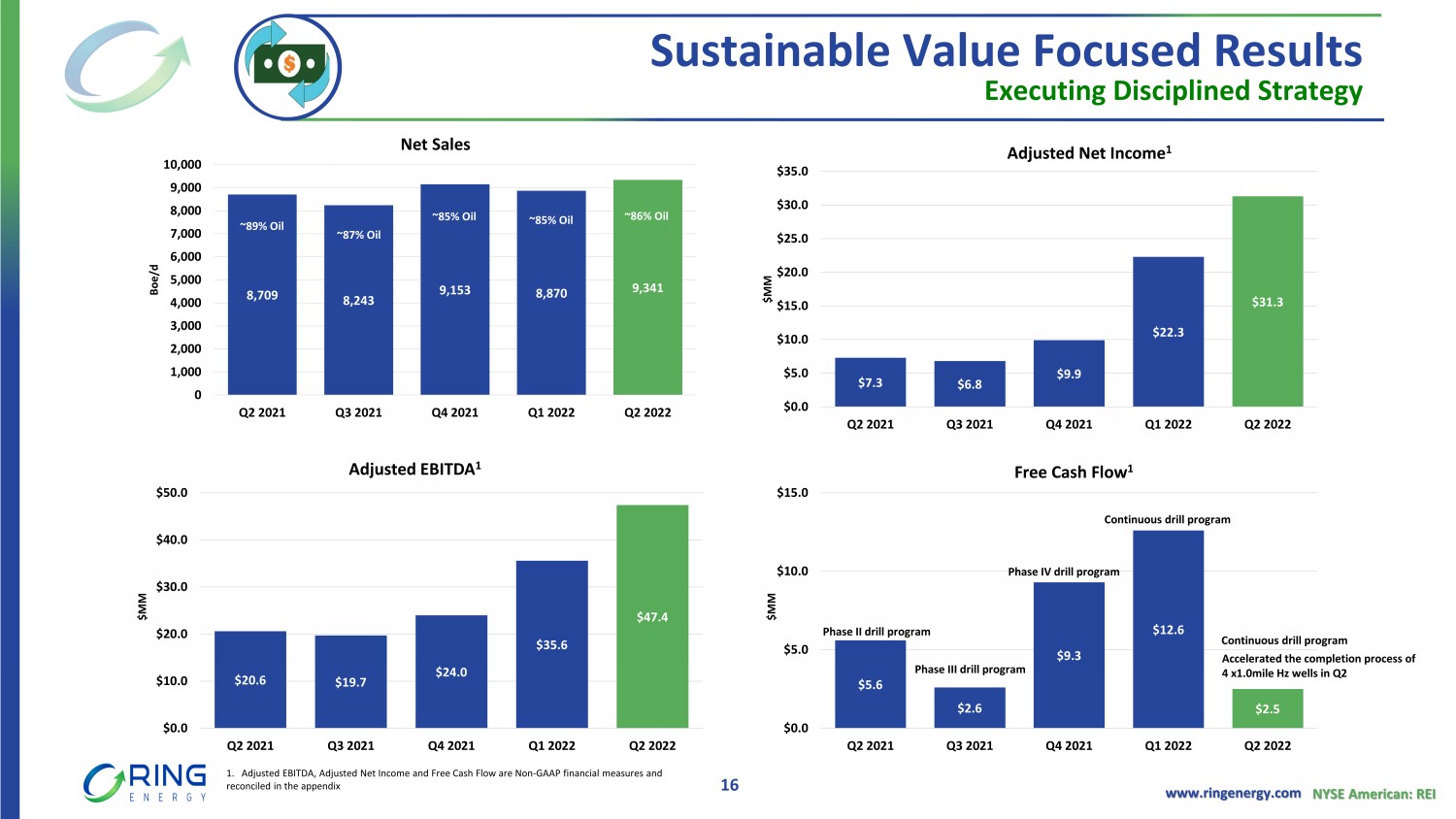

www.ringenergy.com NYSE American: REI Sustainable Value Focused Results 8,709 8,243 9,153 8,870 9,341 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 10,000 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Boe /d Net Sales $7.3 $6.8 $9.9 $22.3 $31.3 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 $MM Adjusted Net Income 1 $20.6 $19.7 $24.0 $35.6 $47.4 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 $MM Adjusted EBITDA 1 $5.6 $2.6 $9.3 $12.6 $2.5 $0.0 $5.0 $10.0 $15.0 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 $MM Free Cash Flow 1 Executing Disciplined Strategy 16 1. Adjusted EBITDA, Adjusted Net Income and Free Cash Flow are Non - GAAP financial measures and reconciled in the appendix Phase II drill program ~85% Oil ~87% Oil ~89% Oil ~86% Oil Phase III drill program ~85% Oil Phase IV drill program Continuous drill program Continuous drill program Accelerated the completion process of 4 x1.0mile Hz wells in Q2

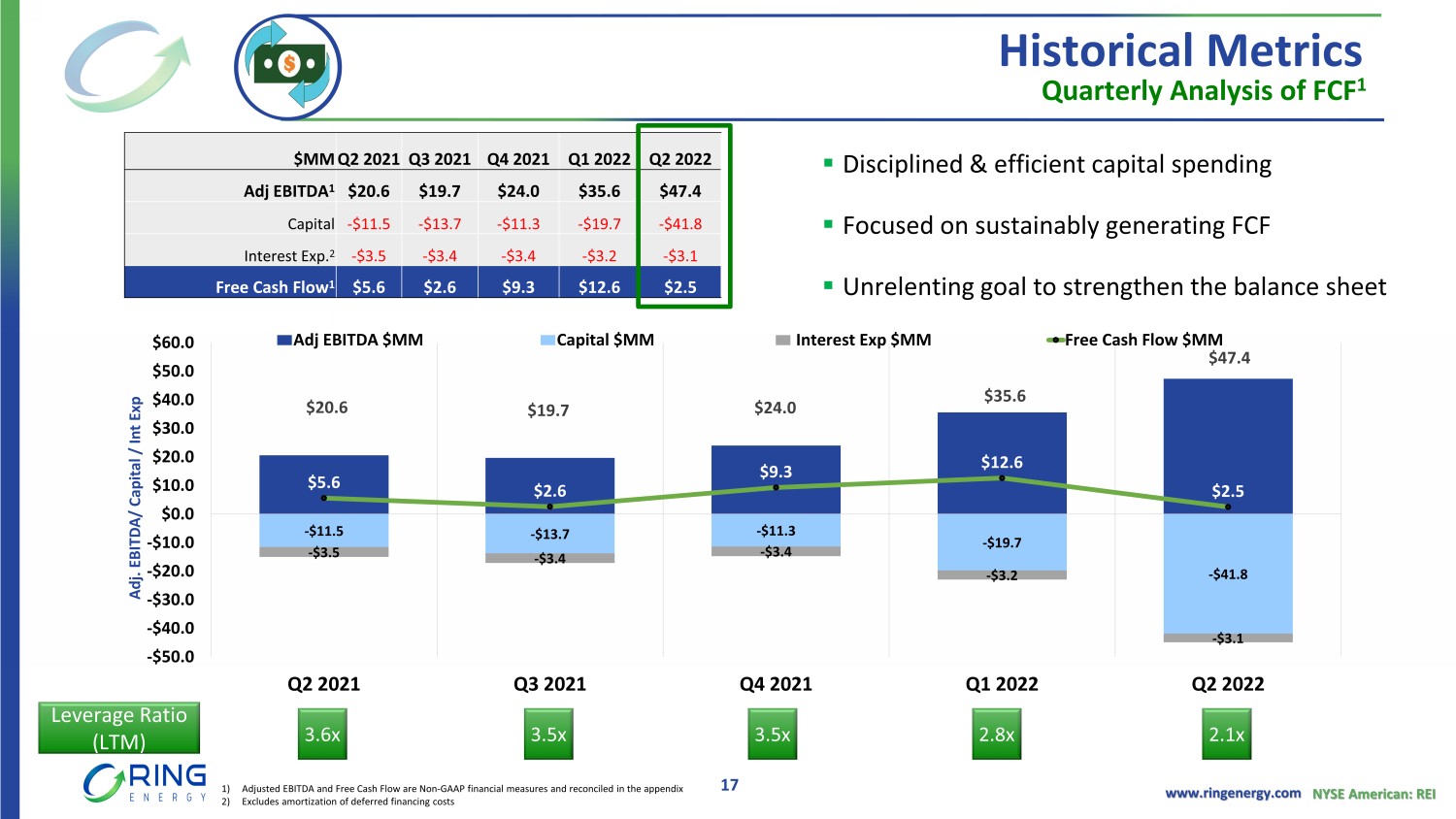

www.ringenergy.com NYSE American: REI Historical Metrics Quarterly Analysis of FCF 1 $MM Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Adj EBITDA 1 $20.6 $19.7 $24.0 $35.6 $47.4 Capital - $11.5 - $13.7 - $11.3 - $19.7 - $41.8 Interest Exp. 2 - $3.5 - $3.4 - $3.4 - $3.2 - $3.1 Free Cash Flow 1 $5.6 $2.6 $9.3 $12.6 $2.5 17 $20.6 $19.7 $24.0 $35.6 $47.4 - $11.5 - $13.7 - $11.3 - $19.7 - $41.8 - $3.5 - $3.4 - $3.4 - $3.2 - $3.1 $5.6 $2.6 $9.3 $12.6 $2.5 -$50.0 -$40.0 -$30.0 -$20.0 -$10.0 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Adj. EBITDA/ Capital / Int Exp Adj EBITDA $MM Capital $MM Interest Exp $MM Free Cash Flow $MM ▪ Disciplined & efficient capital spending ▪ Focused on sustainably generating FCF ▪ Unrelenting goal to strengthen the balance sheet 1) Adjusted EBITDA and Free Cash Flow are Non - GAAP financial measures and reconciled in the appendix 2) Excludes amortization of deferred financing costs Leverage Ratio (LTM) 3.5x 3.5x 3.6x 2.8x 2.1x

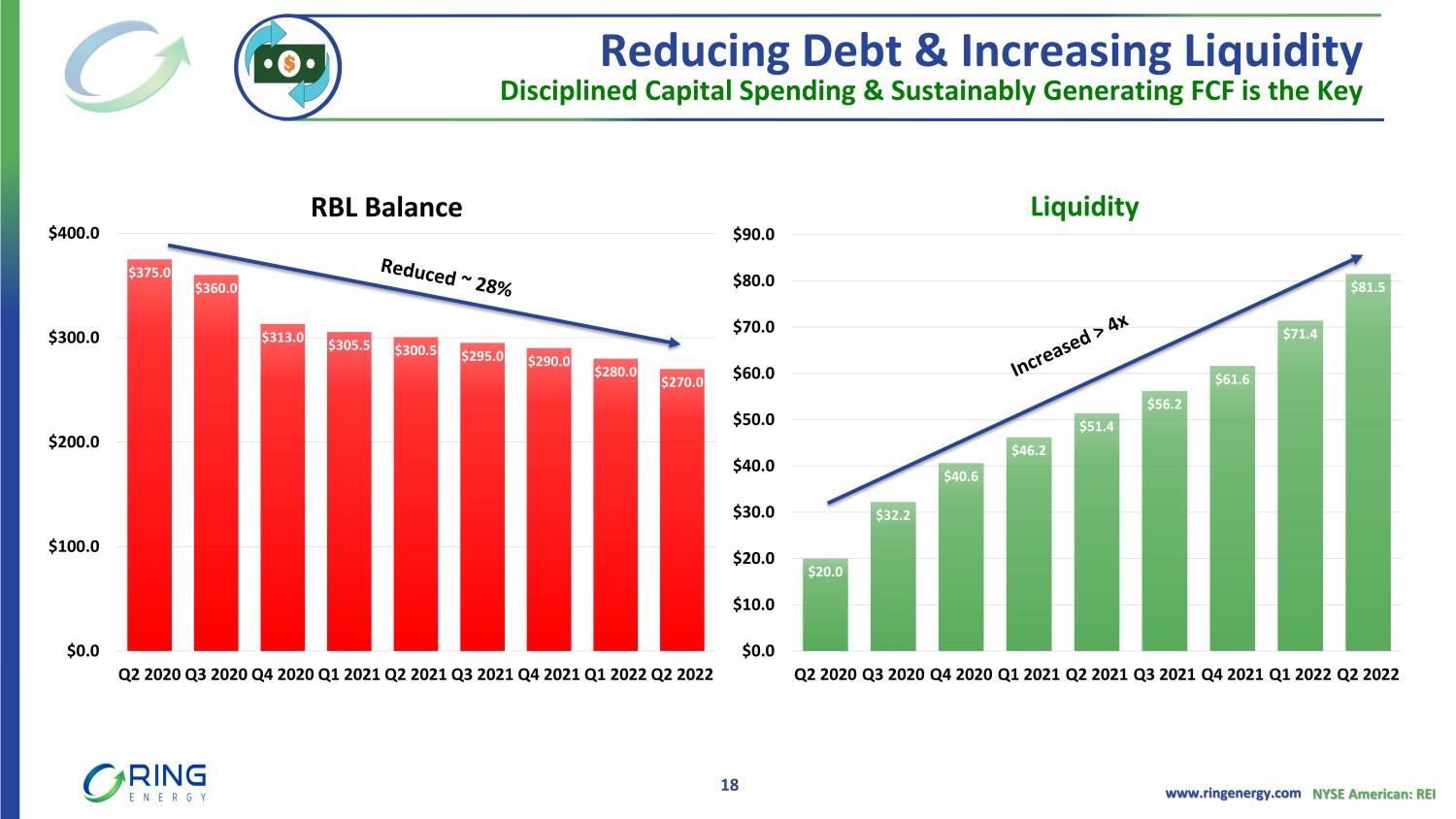

www.ringenergy.com NYSE American: REI $375.0 $360.0 $313.0 $305.5 $300.5 $295.0 $290.0 $280.0 $270.0 $0.0 $100.0 $200.0 $300.0 $400.0 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 RBL Balance $313 MM outstanding debt with $36 MM in Surplus Cash Reducing Debt & Increasing Liquidity Disciplined Capital Spending & Sustainably Generating FCF is the Key 18 $20.0 $32.2 $40.6 $46.2 $51.4 $56.2 $61.6 $71.4 $81.5 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 $80.0 $90.0 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Liquidity

www.ringenergy.com NYSE American: REI Value Proposition 2022 and Beyond 19 Positioned for Substantial Increase in Revenue and FCF Achieving High - Return Organic Growth Pursuing Acquisition Opportunities to Further Increase Scale and Lower Break - Even Costs

Stronghold Energy II Acquisition Overview

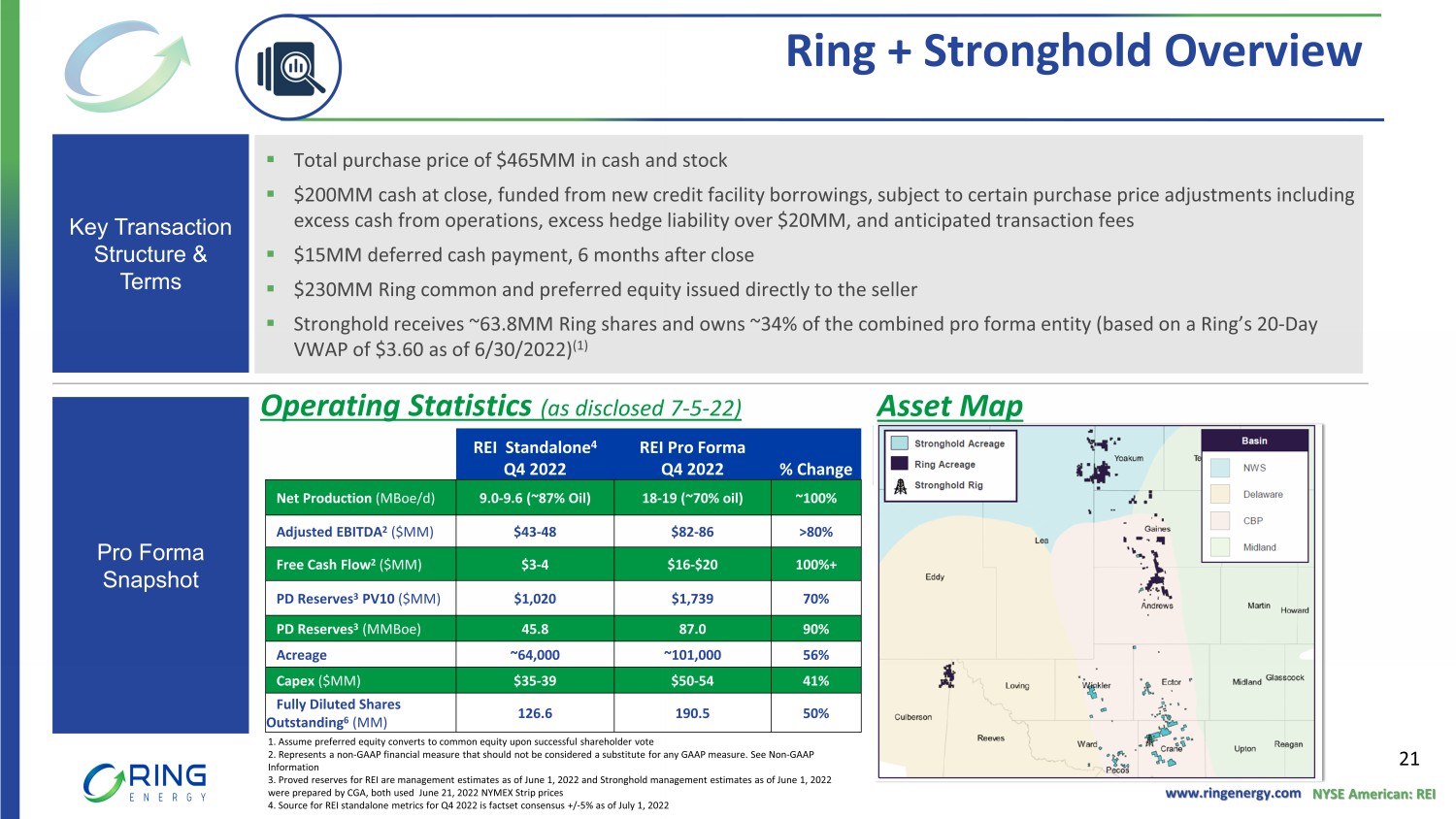

www.ringenergy.com NYSE American: REI Ring + Stronghold Overview 21 1. Assume preferred equity converts to common equity upon successful shareholder vote 2. Represents a non - GAAP financial measure that should not be considered a substitute for any GAAP measure. See Non - GAAP Information 3. Proved reserves for REI are management estimates as of June 1, 2022 and Stronghold management estimates as of June 1, 2022 were prepared by CGA, both used June 21, 2022 NYMEX Strip prices 4. Source for REI standalone metrics for Q4 2022 is factset consensus +/ - 5% as of July 1, 2022 ▪ Total purchase price of $465MM in cash and stock ▪ $200MM cash at close, funded from new credit facility borrowings, subject to certain purchase price adjustments including excess cash from operations, excess hedge liability over $20MM, and anticipated transaction fees ▪ $15MM deferred cash payment, 6 months after close ▪ $230MM Ring common and preferred equity issued directly to the seller ▪ Stronghold receives ~63.8MM Ring shares and owns ~34% of the combined pro forma entity (based on a Ring’s 20 - Day VWAP of $3.60 as of 6/30/2022) (1) Stronghold Acreage Ring Acreage Northwest Shelf Delaware Basin CBP Midland Operating Statistics (as disclosed 7 - 5 - 22) Asset Map Key Transaction Structure & Terms Pro Forma Snapshot REI Standalone 4 Q4 2022 REI Pro Forma Q4 2022 % Change Net Production ( MBoe /d) 9.0 - 9.6 (~87% Oil) 18 - 19 (~70% oil) ~100% Adjusted EBITDA 2 ($MM) $43 - 48 $82 - 86 >80% Free Cash Flow 2 ($MM) $3 - 4 $16 - $20 100%+ PD Reserves 3 PV10 ($MM) $1,020 $1,739 70% PD Reserves 3 ( MMBoe ) 45.8 87.0 90% Acreage ~64,000 ~101,000 56% Capex ($MM) $35 - 39 $50 - 54 41% Fully Diluted Shares Outstanding 6 (MM) 126.6 190.5 50%

www.ringenergy.com NYSE American: REI Transformational Transaction 22 High - quality , conventional , Proved Developed Producing asset base with high margins and low decline rates Attractive cash flow profile with low breakeven drilling economics and low operating costs Significant asset development flexibility and upside potential , including future development and operational improvements Premium de - risked inventory in most active county in the CBP Selected Stronghold Investment Highlights Selected Transaction Benefits Should substantially enhance financial position by increasing free cash flow generation and lowering operating costs Expected to strengthen balance sheet by immediately lower leverage ratio and accelerate ability to pay down debt Significantly increases size and scale , almost doubling Ring’s operational footprint Materially grows inventory of high rate - of - return projects, further enhancing the company’s cash flow profile Highly aligned management team partnering with a leading global private equity firm

www.ringenergy.com NYSE American: REI Transaction Logistics & Governance 23 Approvals and Timing ▪ Unanimously approved by Ring Board of Directors ▪ Subject to customary closing conditions, including regulatory approvals ▪ Transaction effective date is June 1, 2022 ▪ Anticipated closing targeted for the third quarter of 2022 ▪ Hold Special Stockholders Meeting to approve conversion of preferred stock to common stock Leadership & Governance ▪ Ring to expand existing board of directors ▪ Two additional Warburg directors to be appointed to existing Ring Board at closing ▪ Paul McKinney to remain Chairman & CEO ▪ Ring Management to remain in existing executive roles ▪ Company headquarters remains in The Woodlands, TX with increased Midland, TX presence for foreseeable future

Appendix

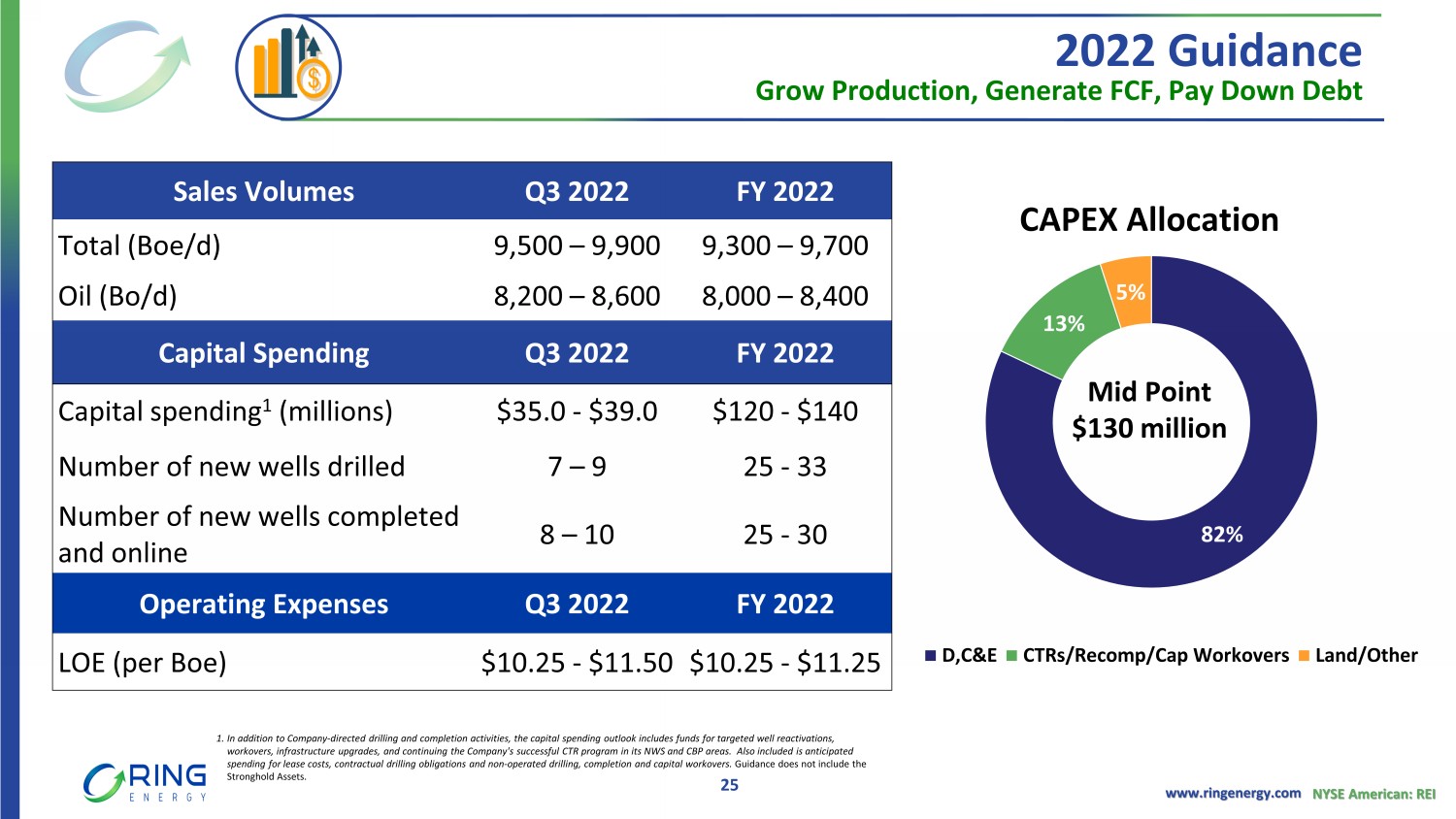

www.ringenergy.com NYSE American: REI 82% 13% 5% D,C&E CTRs/Recomp/Cap Workovers Land/Other CAPEX Allocation Mid Point $130 million 2022 Guidance Grow Production, Generate FCF, Pay Down Debt 25 Sales Volumes Q3 2022 FY 2022 Total ( Boe /d) 9,500 – 9,900 9,300 – 9,700 Oil (Bo/d) 8,200 – 8,600 8,000 – 8,400 Capital Spending Q3 2022 FY 2022 Capital spending 1 (millions) $35.0 - $39.0 $120 - $140 Number of new wells drilled 7 – 9 25 - 33 Number of new wells completed and online 8 – 10 25 - 30 Operating Expenses Q3 2022 FY 2022 LOE (per Boe ) $10.25 - $11.50 $10.25 - $11.25 1. In addition to Company - directed drilling and completion activities, the capital spending outlook includes funds for targeted wel l reactivations, workovers, infrastructure upgrades, and continuing the Company's successful CTR program in its NWS and CBP areas. Also inclu ded is anticipated spending for lease costs, contractual drilling obligations and non - operated drilling, completion and capital workovers. Guidance does not include the Stronghold Assets.

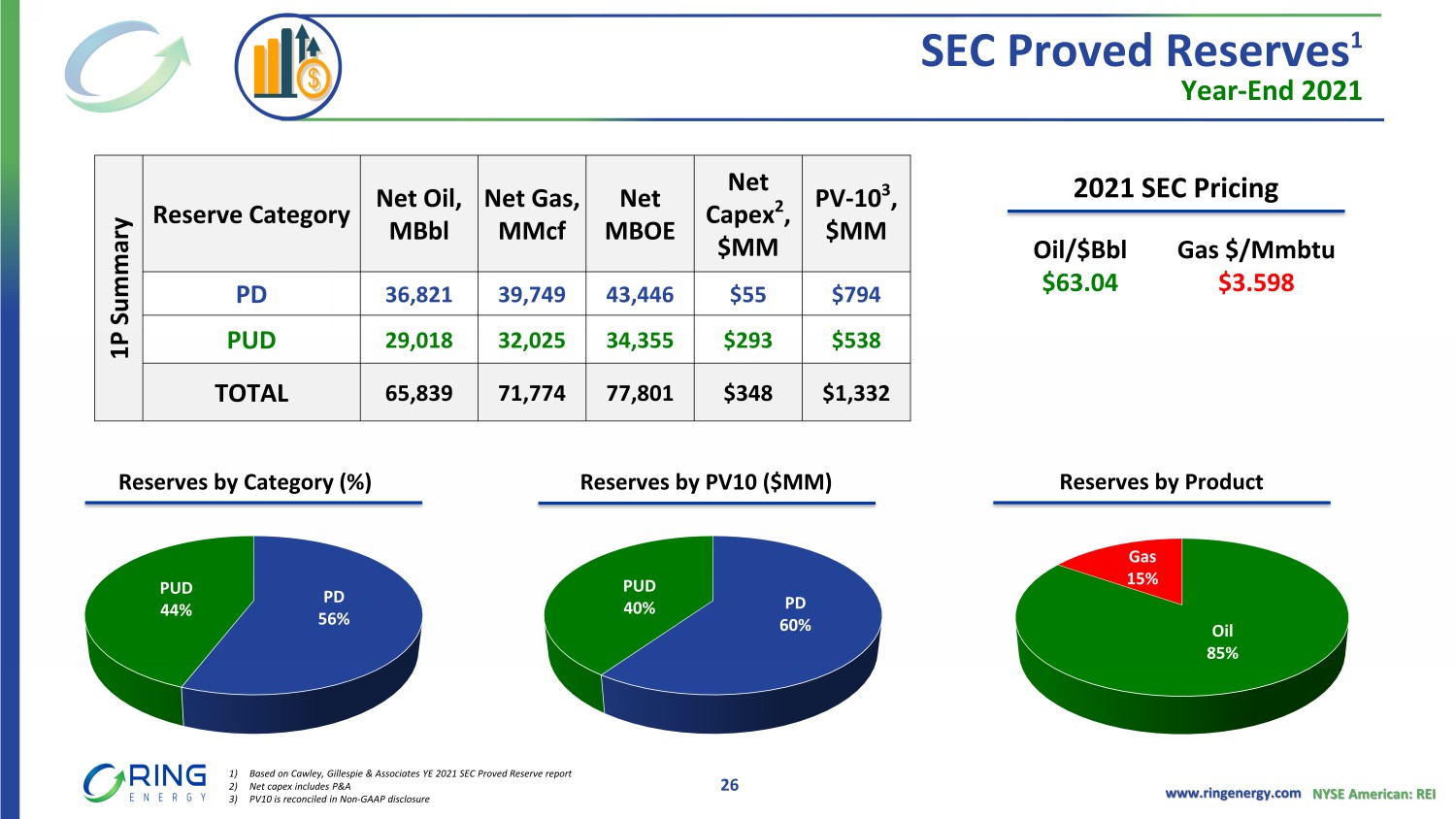

www.ringenergy.com NYSE American: REI PD 60% PUD 40% 1P Summary Reserve Category Net Oil, MBbl Net Gas, MMcf Net MBOE Net Capex 2 , $MM PV - 10 3 , $MM PD 36,821 39,749 43,446 $55 $794 PUD 29,018 32,025 34,355 $293 $538 TOTAL 65,839 71,774 77,801 $348 $1,332 SEC Proved Reserves 1 Year - End 2021 2021 SEC Pricing Reserves by Category ( % ) Reserves by PV 10 ( $ MM) Reserves by Product Oil/$ Bbl $63.04 Gas $/ Mmbtu $3.598 Oil 85% Gas 15% PD 56% PUD 44% 1) Based on Cawley, Gillespie & Associates YE 2021 SEC Proved Reserve report 2) Net capex includes P&A 3) PV10 is reconciled in Non - GAAP disclosure 26

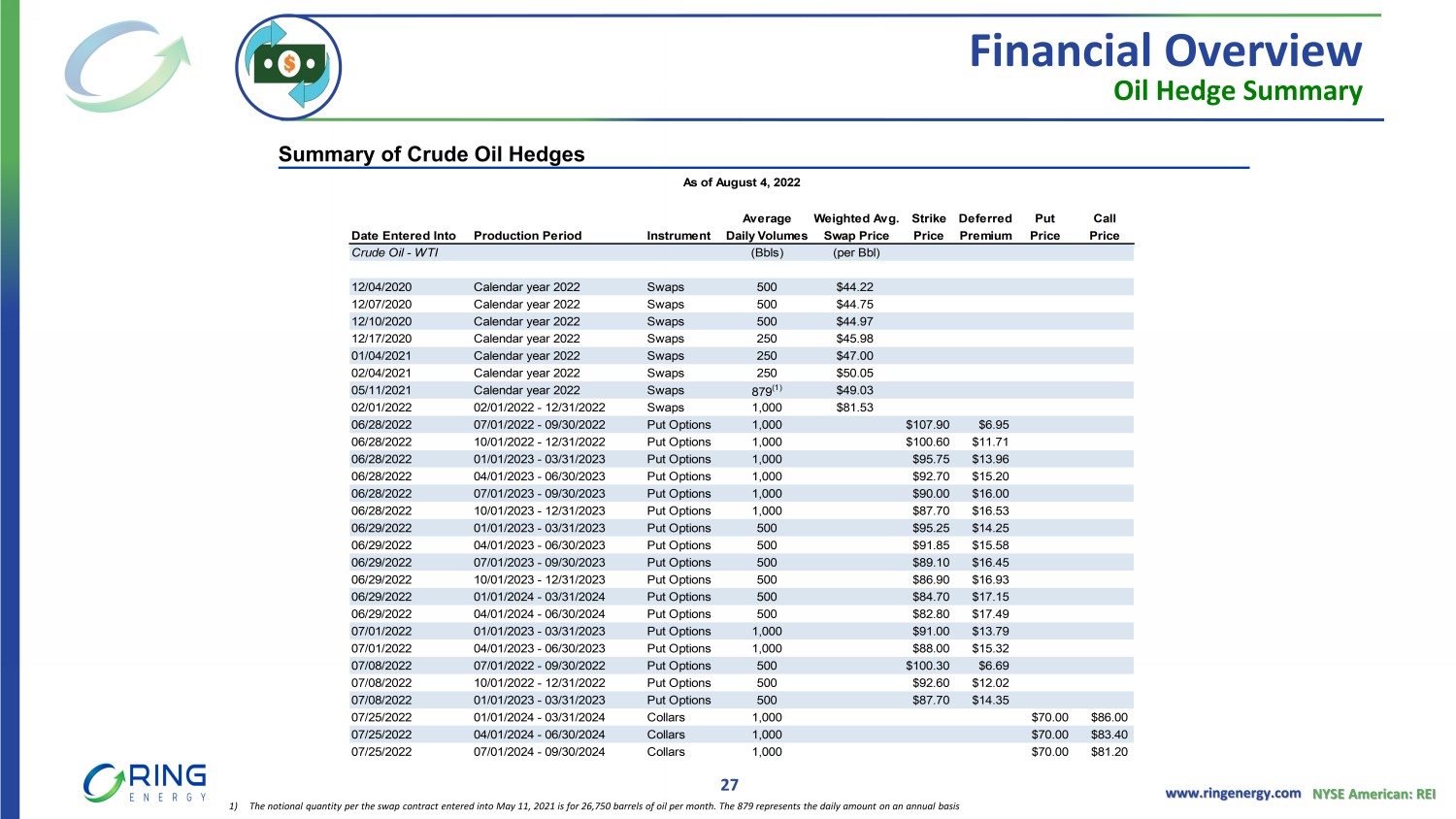

www.ringenergy.com NYSE American: REI Financial Overview Oil Hedge Summary Summary of Crude Oil Hedges 27 1) The notional quantity per the swap contract entered into May 11, 2021 is for 26,750 barrels of oil per month. The 879 represe nts the daily amount on an annual basis Average Weighted Avg. Strike Deferred Put Call Date Entered Into Production Period Instrument Daily Volumes Swap Price Price Premium Price Price Crude Oil - WTI (Bbls) (per Bbl) 12/04/2020 Calendar year 2022 Swaps 500 $44.22 12/07/2020 Calendar year 2022 Swaps 500 $44.75 12/10/2020 Calendar year 2022 Swaps 500 $44.97 12/17/2020 Calendar year 2022 Swaps 250 $45.98 01/04/2021 Calendar year 2022 Swaps 250 $47.00 02/04/2021 Calendar year 2022 Swaps 250 $50.05 05/11/2021 Calendar year 2022 Swaps 879 (1) $49.03 02/01/2022 02/01/2022 - 12/31/2022 Swaps 1,000 $81.53 06/28/2022 07/01/2022 - 09/30/2022 Put Options 1,000 $107.90 $6.95 06/28/2022 10/01/2022 - 12/31/2022 Put Options 1,000 $100.60 $11.71 06/28/2022 01/01/2023 - 03/31/2023 Put Options 1,000 $95.75 $13.96 06/28/2022 04/01/2023 - 06/30/2023 Put Options 1,000 $92.70 $15.20 06/28/2022 07/01/2023 - 09/30/2023 Put Options 1,000 $90.00 $16.00 06/28/2022 10/01/2023 - 12/31/2023 Put Options 1,000 $87.70 $16.53 06/29/2022 01/01/2023 - 03/31/2023 Put Options 500 $95.25 $14.25 06/29/2022 04/01/2023 - 06/30/2023 Put Options 500 $91.85 $15.58 06/29/2022 07/01/2023 - 09/30/2023 Put Options 500 $89.10 $16.45 06/29/2022 10/01/2023 - 12/31/2023 Put Options 500 $86.90 $16.93 06/29/2022 01/01/2024 - 03/31/2024 Put Options 500 $84.70 $17.15 06/29/2022 04/01/2024 - 06/30/2024 Put Options 500 $82.80 $17.49 07/01/2022 01/01/2023 - 03/31/2023 Put Options 1,000 $91.00 $13.79 07/01/2022 04/01/2023 - 06/30/2023 Put Options 1,000 $88.00 $15.32 07/08/2022 07/01/2022 - 09/30/2022 Put Options 500 $100.30 $6.69 07/08/2022 10/01/2022 - 12/31/2022 Put Options 500 $92.60 $12.02 07/08/2022 01/01/2023 - 03/31/2023 Put Options 500 $87.70 $14.35 07/25/2022 01/01/2024 - 03/31/2024 Collars 1,000 $70.00 $86.00 07/25/2022 04/01/2024 - 06/30/2024 Collars 1,000 $70.00 $83.40 07/25/2022 07/01/2024 - 09/30/2024 Collars 1,000 $70.00 $81.20 As of August 4, 2022

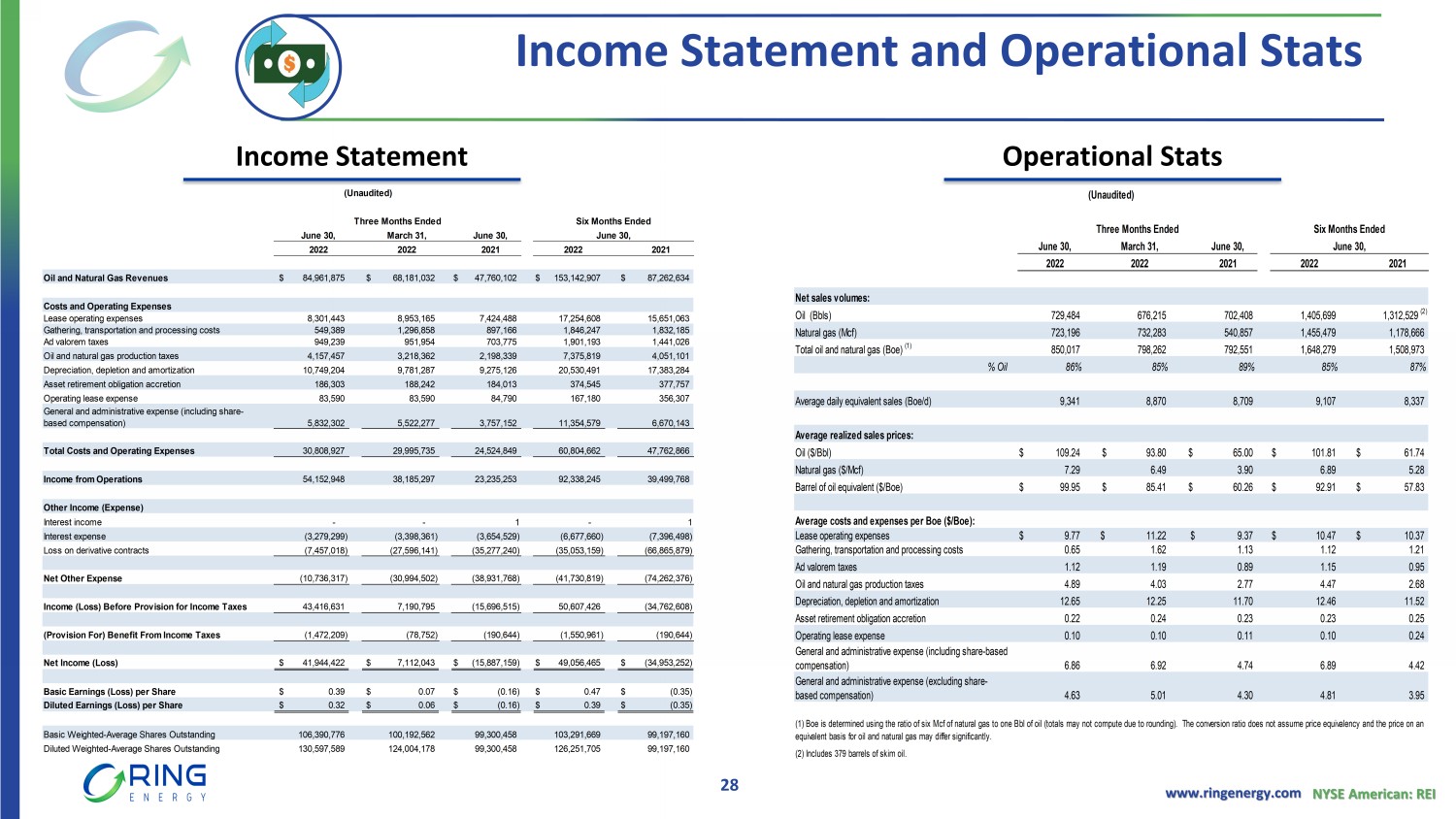

www.ringenergy.com NYSE American: REI Income Statement and Operational Stats Income Statement Operational Stats 28 June 30, March 31, June 30, 2022 2022 2021 2022 2021 Oil and Natural Gas Revenues $ 84,961,875 $ 68,181,032 $ 47,760,102 $ 153,142,907 $ 87,262,634 Costs and Operating Expenses Lease operating expenses 8,301,443 8,953,165 7,424,488 17,254,608 15,651,063 Gathering, transportation and processing costs 549,389 1,296,858 897,166 1,846,247 1,832,185 Ad valorem taxes 949,239 951,954 703,775 1,901,193 1,441,026 Oil and natural gas production taxes 4,157,457 3,218,362 2,198,339 7,375,819 4,051,101 Depreciation, depletion and amortization 10,749,204 9,781,287 9,275,126 20,530,491 17,383,284 Asset retirement obligation accretion 186,303 188,242 184,013 374,545 377,757 Operating lease expense 83,590 83,590 84,790 167,180 356,307 General and administrative expense (including share- based compensation) 5,832,302 5,522,277 3,757,152 11,354,579 6,670,143 Total Costs and Operating Expenses 30,808,927 29,995,735 24,524,849 60,804,662 47,762,866 Income from Operations 54,152,948 38,185,297 23,235,253 92,338,245 39,499,768 Other Income (Expense) Interest income - - 1 - 1 Interest expense (3,279,299) (3,398,361) (3,654,529) (6,677,660) (7,396,498) Loss on derivative contracts (7,457,018) (27,596,141) (35,277,240) (35,053,159) (66,865,879) Net Other Expense (10,736,317) (30,994,502) (38,931,768) (41,730,819) (74,262,376) Income (Loss) Before Provision for Income Taxes 43,416,631 7,190,795 (15,696,515) 50,607,426 (34,762,608) (Provision For) Benefit From Income Taxes (1,472,209) (78,752) (190,644) (1,550,961) (190,644) Net Income (Loss) $ 41,944,422 $ 7,112,043 $ (15,887,159) $ 49,056,465 $ (34,953,252) Basic Earnings (Loss) per Share $ 0.39 $ 0.07 $ (0.16) $ 0.47 $ (0.35) Diluted Earnings (Loss) per Share $ 0.32 $ 0.06 $ (0.16) $ 0.39 $ (0.35) Basic Weighted-Average Shares Outstanding 106,390,776 100,192,562 99,300,458 103,291,669 99,197,160 Diluted Weighted-Average Shares Outstanding 130,597,589 124,004,178 99,300,458 126,251,705 99,197,160 June 30, (Unaudited) Three Months Ended Six Months Ended

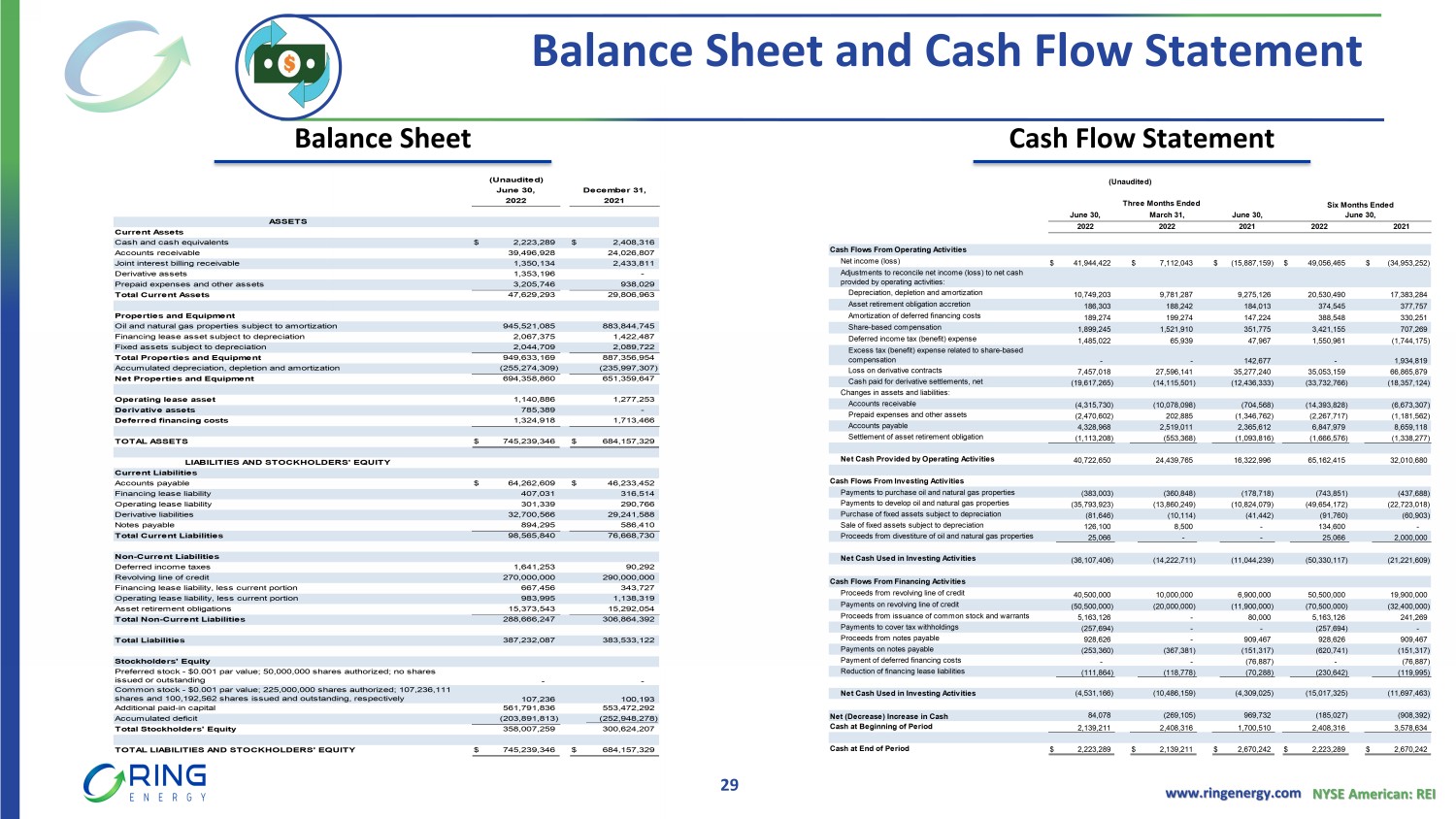

www.ringenergy.com NYSE American: REI Balance Sheet and Cash Flow Statement Balance Sheet Cash Flow Statement 29 ASSETS Current Assets Cash and cash equivalents $ 2,223,289 $ 2,408,316 Accounts receivable 39,496,928 24,026,807 Joint interest billing receivable 1,350,134 2,433,811 Derivative assets 1,353,196 - Prepaid expenses and other assets 3,205,746 938,029 Total Current Assets 47,629,293 29,806,963 Properties and Equipment Oil and natural gas properties subject to amortization 945,521,085 883,844,745 Financing lease asset subject to depreciation 2,067,375 1,422,487 Fixed assets subject to depreciation 2,044,709 2,089,722 Total Properties and Equipment 949,633,169 887,356,954 Accumulated depreciation, depletion and amortization (255,274,309) (235,997,307) Net Properties and Equipment 694,358,860 651,359,647 Operating lease asset 1,140,886 1,277,253 Derivative assets 785,389 - Deferred financing costs 1,324,918 1,713,466 TOTAL ASSETS $ 745,239,346 $ 684,157,329 LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities Accounts payable $ 64,262,609 $ 46,233,452 Financing lease liability 407,031 316,514 Operating lease liability 301,339 290,766 Derivative liabilities 32,700,566 29,241,588 Notes payable 894,295 586,410 Total Current Liabilities 98,565,840 76,668,730 Non-Current Liabilities Deferred income taxes 1,641,253 90,292 Revolving line of credit 270,000,000 290,000,000 Financing lease liability, less current portion 667,456 343,727 Operating lease liability, less current portion 983,995 1,138,319 Asset retirement obligations 15,373,543 15,292,054 Total Non-Current Liabilities 288,666,247 306,864,392 Total Liabilities 387,232,087 383,533,122 Stockholders' Equity Preferred stock - $0.001 par value; 50,000,000 shares authorized; no shares issued or outstanding - - Common stock - $0.001 par value; 225,000,000 shares authorized; 107,236,111 shares and 100,192,562 shares issued and outstanding, respectively 107,236 100,193 Additional paid-in capital 561,791,836 553,472,292 Accumulated deficit (203,891,813) (252,948,278) Total Stockholders' Equity 358,007,259 300,624,207 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $ 745,239,346 $ 684,157,329 June 30, December 31, 2022 2021 (Unaudited)

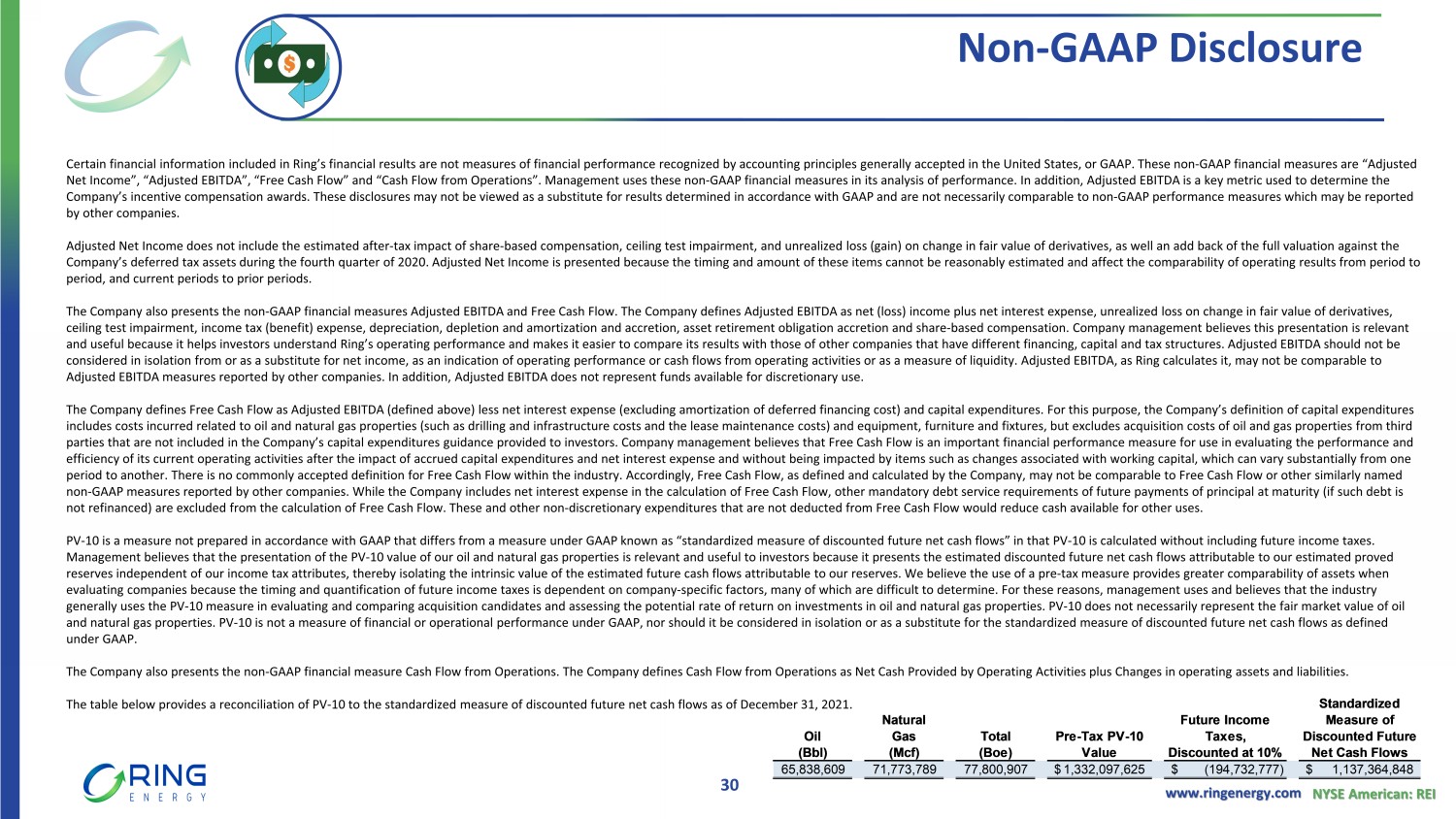

www.ringenergy.com NYSE American: REI Non - GAAP Disclosure Certain financial information included in Ring’s financial results are not measures of financial performance recognized by ac cou nting principles generally accepted in the United States, or GAAP. These non - GAAP financial measures are “Adjusted Net Income”, “Adjusted EBITDA”, “Free Cash Flow” and “Cash Flow from Operations”. Management uses these non - GAAP financial measu res in its analysis of performance. In addition, Adjusted EBITDA is a key metric used to determine the Company’s incentive compensation awards. These disclosures may not be viewed as a substitute for results determined in accord anc e with GAAP and are not necessarily comparable to non - GAAP performance measures which may be reported by other companies. Adjusted Net Income does not include the estimated after - tax impact of share - based compensation, ceiling test impairment, and un realized loss (gain) on change in fair value of derivatives, as well an add back of the full valuation against the Company’s deferred tax assets during the fourth quarter of 2020. Adjusted Net Income is presented because the timing and amou nt of these items cannot be reasonably estimated and affect the comparability of operating results from period to period, and current periods to prior periods. The Company also presents the non - GAAP financial measures Adjusted EBITDA and Free Cash Flow. The Company defines Adjusted EBITD A as net (loss) income plus net interest expense, unrealized loss on change in fair value of derivatives, ceiling test impairment, income tax (benefit) expense, depreciation, depletion and amortization and accretion, asset retireme nt obligation accretion and share - based compensation. Company management believes this presentation is relevant and useful because it helps investors understand Ring’s operating performance and makes it easier to compare its results with th ose of other companies that have different financing, capital and tax structures. Adjusted EBITDA should not be considered in isolation from or as a substitute for net income, as an indication of operating performance or cash flows from ope rating activities or as a measure of liquidity. Adjusted EBITDA, as Ring calculates it, may not be comparable to Adjusted EBITDA measures reported by other companies. In addition, Adjusted EBITDA does not represent funds available for dis cre tionary use. The Company defines Free Cash Flow as Adjusted EBITDA (defined above) less net interest expense (excluding amortization of de fer red financing cost) and capital expenditures. For this purpose, the Company’s definition of capital expenditures includes costs incurred related to oil and natural gas properties (such as drilling and infrastructure costs and the lease ma int enance costs) and equipment, furniture and fixtures, but excludes acquisition costs of oil and gas properties from third parties that are not included in the Company’s capital expenditures guidance provided to investors. Company management believ es that Free Cash Flow is an important financial performance measure for use in evaluating the performance and efficiency of its current operating activities after the impact of accrued capital expenditures and net interest expense and wit hout being impacted by items such as changes associated with working capital, which can vary substantially from one period to another. There is no commonly accepted definition for Free Cash Flow within the industry. Accordingly, Free Cash Fl ow, as defined and calculated by the Company, may not be comparable to Free Cash Flow or other similarly named non - GAAP measures reported by other companies. While the Company includes net interest expense in the calculation of Free Cash F low, other mandatory debt service requirements of future payments of principal at maturity (if such debt is not refinanced) are excluded from the calculation of Free Cash Flow. These and other non - discretionary expenditures that are not deducted from Free Cash Flow would reduce cash available for other uses. PV - 10 is a measure not prepared in accordance with GAAP that differs from a measure under GAAP known as “standardized measure of discounted future net cash flows” in that PV - 10 is calculated without including future income taxes. Management believes that the presentation of the PV - 10 value of our oil and natural gas properties is relevant and useful to inv estors because it presents the estimated discounted future net cash flows attributable to our estimated proved reserves independent of our income tax attributes, thereby isolating the intrinsic value of the estimated future cash flows a ttr ibutable to our reserves. We believe the use of a pre - tax measure provides greater comparability of assets when evaluating companies because the timing and quantification of future income taxes is dependent on company - specific factors, many of which are difficult to determine. For these reasons, management uses and believes that the industry generally uses the PV - 10 measure in evaluating and comparing acquisition candidates and assessing the potential rate of return o n investments in oil and natural gas properties. PV - 10 does not necessarily represent the fair market value of oil and natural gas properties. PV - 10 is not a measure of financial or operational performance under GAAP, nor should it be consider ed in isolation or as a substitute for the standardized measure of discounted future net cash flows as defined under GAAP. The Company also presents the non - GAAP financial measure Cash Flow from Operations. The Company defines Cash Flow from Operation s as Net Cash Provided by Operating Activities plus Changes in operating assets and liabilities. The table below provides a reconciliation of PV - 10 to the standardized measure of discounted future net cash flows as of Decembe r 31, 2021. 30

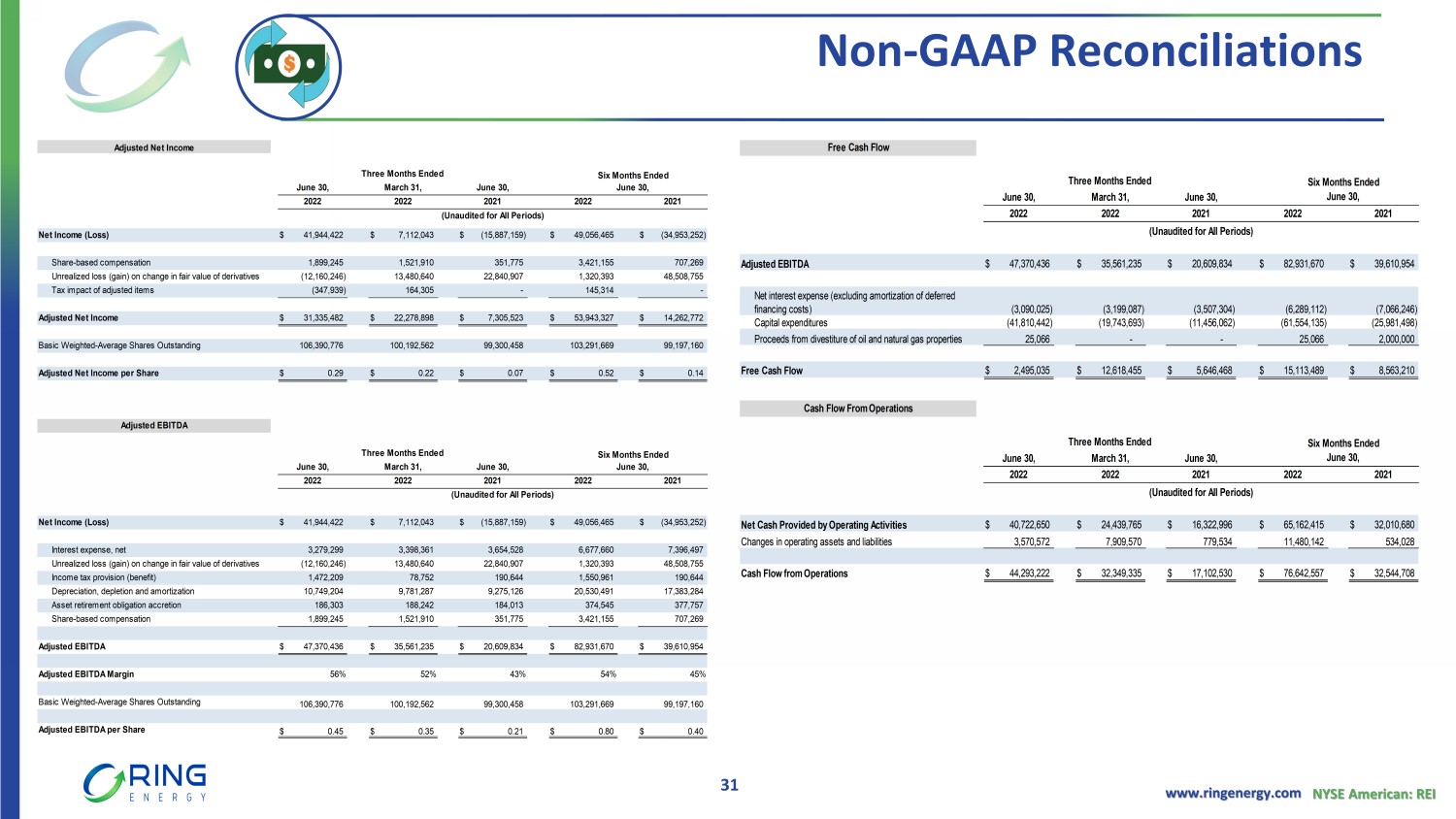

www.ringenergy.com NYSE American: REI Non - GAAP Reconciliations 31 Net Income (Loss) $ 41,944,422 $ 7,112,043 $ (15,887,159) $ 49,056,465 $ (34,953,252) Share-based compensation 1,899,245 1,521,910 351,775 3,421,155 707,269 Unrealized loss (gain) on change in fair value of derivatives (12,160,246) 13,480,640 22,840,907 1,320,393 48,508,755 Tax impact of adjusted items (347,939) 164,305 - 145,314 - Adjusted Net Income $ 31,335,482 $ 22,278,898 $ 7,305,523 $ 53,943,327 $ 14,262,772 Basic Weighted-Average Shares Outstanding 106,390,776 100,192,562 99,300,458 103,291,669 99,197,160 Adjusted Net Income per Share $ 0.29 $ 0.22 $ 0.07 $ 0.52 $ 0.14 Net Income (Loss) $ 41,944,422 $ 7,112,043 $ (15,887,159) $ 49,056,465 $ (34,953,252) Interest expense, net 3,279,299 3,398,361 3,654,528 6,677,660 7,396,497 Unrealized loss (gain) on change in fair value of derivatives (12,160,246) 13,480,640 22,840,907 1,320,393 48,508,755 Income tax provision (benefit) 1,472,209 78,752 190,644 1,550,961 190,644 Depreciation, depletion and amortization 10,749,204 9,781,287 9,275,126 20,530,491 17,383,284 Asset retirement obligation accretion 186,303 188,242 184,013 374,545 377,757 Share-based compensation 1,899,245 1,521,910 351,775 3,421,155 707,269 Adjusted EBITDA $ 47,370,436 $ 35,561,235 $ 20,609,834 $ 82,931,670 $ 39,610,954 Adjusted EBITDA Margin 56% 52% 43% 54% 45% Basic Weighted-Average Shares Outstanding 106,390,776 100,192,562 99,300,458 103,291,669 99,197,160 Adjusted EBITDA per Share $ 0.45 $ 0.35 $ 0.21 $ 0.80 $ 0.40 Adjusted Net Income Three Months Ended June 30, March 31, June 30, 2022 2021 Adjusted EBITDA Three Months Ended June 30, March 31, June 30, 2022 2022 2021 2022 2022 2021 Six Months Ended (Unaudited for All Periods) (Unaudited for All Periods) Six Months Ended June 30, June 30, 2022 2021

www.ringenergy.com NYSE American: REI Corporate Strategy Value Focused for Sustainable Success 32 Attract and Retain Highly Qualified People Pursue Operational Excellence with a Sense of Urgency Invest in High - Margin, High RoR Projects Focus on FCF and Strengthen Balance Sheet Pursue Strategic A&D to Lower Breakeven Costs

www.ringenergy.com NYSE American: REI Add Photo Add Photo Add Photo Add Photo Add Photo Paul D. McKinney Chairman & Chief Executive Officer 35+ years of domestic & international oil & gas industry experience Executive & board roles include CEO, President, COO, Region VP and public & private board directorships Travis Thomas EVP & Chief Financial Officer 17+ years of oil & gas industry experience & accounting experience High level financial experience including CAO, VP Finance, Controller, Treasurer Alexander Dyes EVP of Engineering & Corporate Strategy 15+ years of oil & gas industry experience Multi - disciplined experience including VP A&D, VP Engineering, Director Strategy, multiple engineering & operational roles Marinos Baghdati EVP of Operations 19+ years of oil & gas industry experience Operational experience in drilling, completions and production including VP Operations, Operations manager, multiple engineering roles Stephen D. Brooks EVP of Land, Legal, HR & Marketing 40+ years of oil & gas industry experience Extensive career as landman including VP Land & Legal, VP HR VP Land and Land Manager Hollie Lamb VP of Compliance & GM of Midland Office 20+ years of oil & gas industry experience Previously Partner of HeLMS Oil & Gas, VP Engineering, Reservoir & Geologic Engineer Experienced Management Team Shared Vision with a Track Record of Success 33

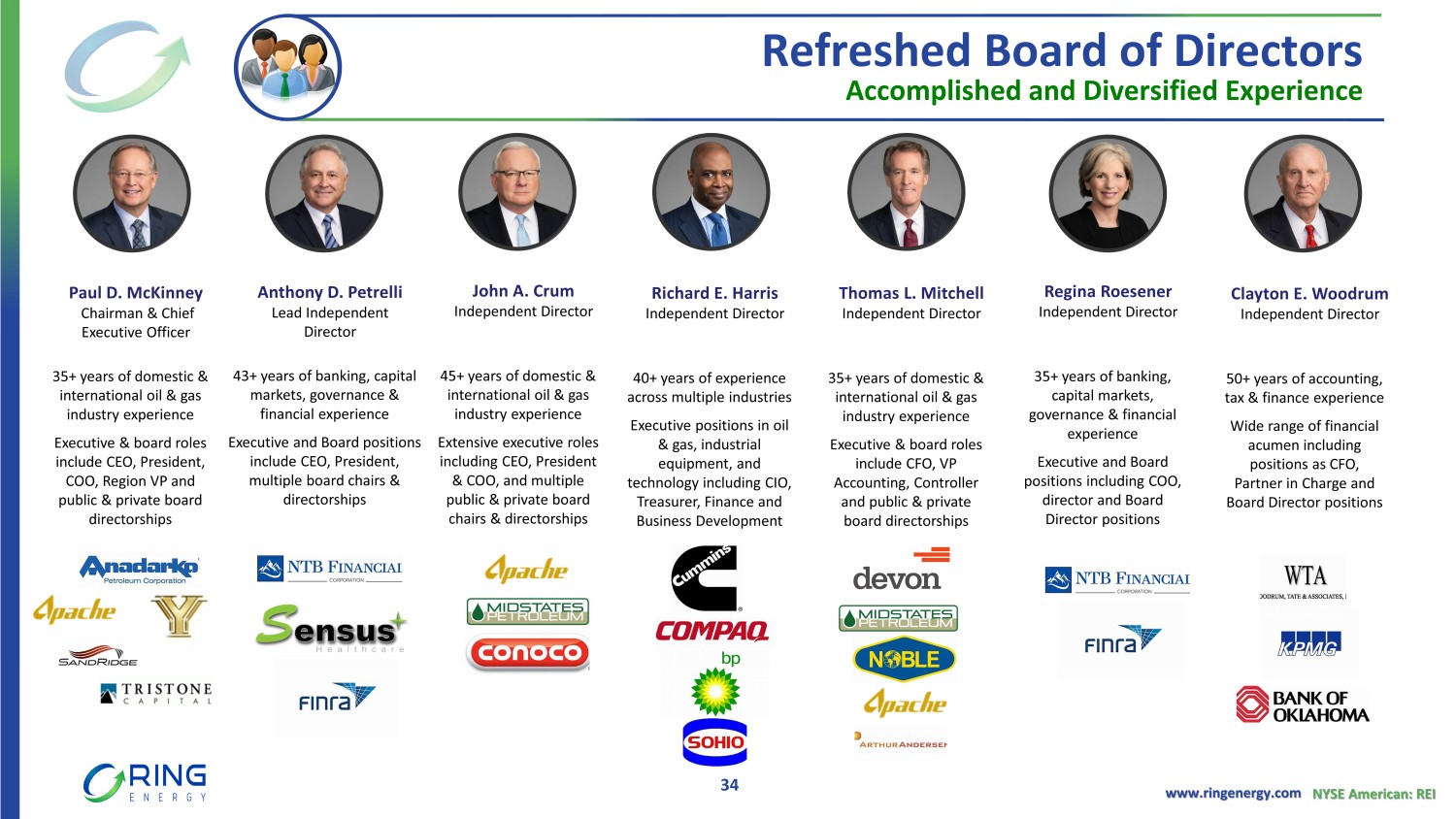

www.ringenergy.com NYSE American: REI 34 Add Photo Paul D. McKinney Chairman & Chief Executive Officer 35+ years of domestic & international oil & gas industry experience Executive & board roles include CEO, President, COO, Region VP and public & private board directorships Anthony D. Petrelli Lead Independent Director 43+ years of banking, capital markets, governance & financial experience Executive and Board positions include CEO, President, multiple board chairs & directorships John A. Crum Independent Director 45+ years of domestic & international oil & gas industry experience Extensive executive roles including CEO, President & COO, and multiple public & private board chairs & directorships Richard E. Harris Independent Director 40+ years of experience across multiple industries Executive positions in oil & gas, industrial equipment, and technology including CIO, Treasurer, Finance and Business Development Thomas L. Mitchell Independent Director 35+ years of domestic & international oil & gas industry experience Executive & board roles include CFO, VP Accounting, Controller and public & private board directorships Regina Roesener Independent Director 35+ years of banking, capital markets, governance & financial experience Executive and Board positions including COO, director and Board Director positions Refreshed Board of Directors Accomplished and Diversified Experience Clayton E. Woodrum Independent Director 50+ years of accounting, tax & finance experience Wide range of financial acumen including positions as CFO, Partner in Charge and Board Director positions

ANALYST COVERAGE Alliance Global Partners (A.G.P.) Jeff Campbell (203) 577 - 5427 jcampbell@allianceg.com Tuohy Brothers Investment Noel Parks (215) 913 - 7320 nparks@tuohybrothers.com ROTH Capital Partners John M. White (949) 720 - 7115 jwhite@roth.com Truist Financial Neal Dingmann (713) 247 - 9000 neal.dingmann@truist.com COMPANY CONTACT Al Petrie (281) 975 - 2146 apetrie@ringenergy.com Chris Delange (281) 975 - 2146 cdelange @ringenergy.com