Exhibit 99.2

www. ringenergy.com NYSE American: REI FRESH PERSPECTIVE PR OVEN S TRATEGY Q3 2021 Earnings Presentation

www.ringenergy.com NYSE American: REI Forward - Looking Statements and Cautionary Note Regarding Hydrocarbon Disclosures 2 Forward – Looking Statements This Presentation includes "forward - looking statements" within the meaning of the Private Securities Litigation Reform Act of 19 95, the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. All statements, other than statements of strictly historical facts included in this Presentation constitute forward - looking statements and may o ften, but not always, be identified by the use of such words as “may,” “will,” “should,” “could,” “intends,” “estimates,” “expects,” “anticipates,” “plans,” “guidance,” “target,” “potential,” “possible,” “probably,” and “believes” or the negative variations thereof or comparable terminology. These forward - looking statements include statements regarding the Company's financial position, future revenues, net income, potential evaluations, business strategy and plans a nd objectives for future operations. Forward - looking statements are subject to numerous assumptions, risks and uncertainties that may cause actual results to be materially different than any future results expressed or implied in those sta tements. However, whether actual results and developments will conform to expectations is subject to a number of material risks and uncertainties, including but not limited to: declines in oil, natural gas liquids or natural gas prices; t he level of success in exploration, development and production activities; the timing of exploration and development expenditures; inaccuracies of reserve estimates or assumptions underlying them; revisions to reserve estimates as a result of ch anges in commodity prices; impacts to financial statements as a result of impairment write - downs; risks related to level of indebtedness and periodic redeterminations of the borrowing base under the Company’s credit facility; the impacts of he dging on results of operations; the Company’s ability to replace oil and natural gas reserves; any loss of senior management or technical personnel; and the direct and indirect impact on most or all of the foregoing on the evolving COVID - 19 p andemic. Some of the factors that could cause actual results to differ materially from expected results are described under “Risk Factors” in our 2020 annual report on Form 10 - K filed with the U.S. Securities and Exchange Commission (“S EC”) on March 16, 2021, and in our subsequent quarterly reports on Form 10 - Q and current reports on Form 8 - K. Although the Company believes that the assumptions upon which such forward - looking statements are based are reasonable, it can g ive no assurance that such assumptions will prove to be correct. All forward - looking statements in this Presentation are expressly qualified by the cautionary statements and by reference to the underlying assumptions that may pro ve to be incorrect. The Company undertakes no obligation to publicly revise these forward - looking statements to reflect events or circumstances that arise after the date hereof, except as required by applicable law. The financial and operating projections contained in this presentation represent our reasonable estimates as of the date of this presentation. Neither our auditors n or any other third party has examined, reviewed or compiled the projections and, accordingly, none of the foregoing expresses an opinion or other form of assurance with respect thereto. The assumptions upon which the projections are based ar e d escribed in more detail herein. Some of these assumptions inevitably will not materialize, and unanticipated events may occur that could affect our results. Therefore, our actual results achieved during the periods covered by the proj ect ions will vary from the projected results. Prospective investors are cautioned not to place undue reliance on the projections included herein. Cautionary Note regarding Hydrocarbon Disclosures The SEC has generally permitted oil and natural gas companies, in their filings with the SEC, to disclose proved reserves, wh ich are reserve estimates that geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions, and certain probable and possible res erv es that meet the SEC’s definitions for such terms. We use the terms “estimated ultimate recovery,” or “EURs,” “probable,” “possible,” and “non - proven” reserves, reserve “potential” or “upside” or other descriptions of volumes of reserves potentially recoverable through additional drilling or recovery techniques that the SEC’s guidelines prohibit us from including in filings with the SEC. Reference to EURs (estimated ultimate recovery) of natural gas and oil includes amoun ts that are not yet classified as proved reserves under SEC definitions, but that we believe will ultimately be produced and are based on previous operating experience in a given area and publicly available information relating to the operations of producers who are conducting operations in these areas. These estimates are by their nature more speculative than estimates of proved reserves and accordingly are subject to substantially greater risk of being actually realized by us. Fact ors affecting the ultimate recovery of reserves that may be recovered include the scope of our drilling program, which will be directly affected by capital availability, drilling and production costs, commodity prices, availability of services and equipment, permit expirations, transportation constraints, regulatory approvals and other factors, and actual drilling results, including geological and mechanical factors affecting recovery rates. Accordingly, actual quantities that may be rec ove red from our interests will differ from our estimates and could be significantly less than our targeted recovery rate. In addition, our estimates may change significantly as we receive additional data. Supplemental Non - GAAP Financial Measures This Presentation includes financial measures that are not in accordance with generally accepted accounting principles (“GAAP ”), such as “Adjusted Net Income,” “Adjusted EBITDA,” “PV - 10,” “Free Cash Flow,” or “FCF,” and “Cash Flow from Operations.” While management believes that such measures are useful for investors, they should not be used as a replacement for financial measures that are in accordance with GAAP. For definitions of such non - GAAP financial measures, please see the Appendix.

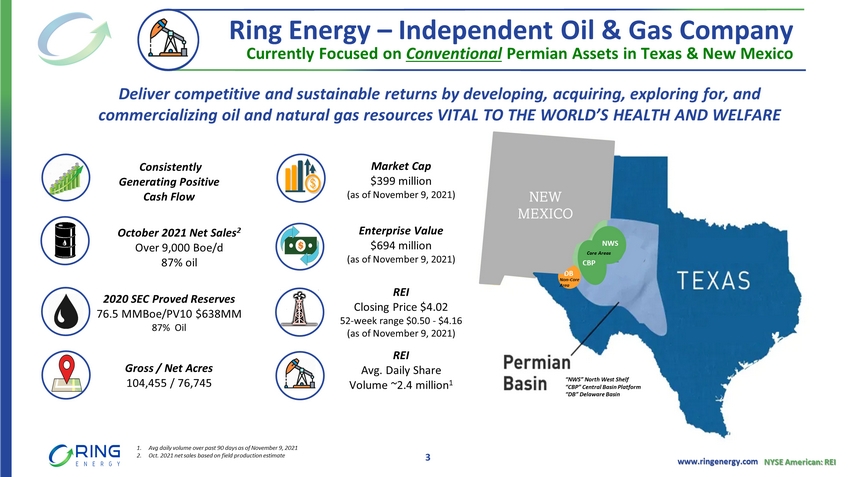

www.ringenergy.com NYSE American: REI Currently Focused on Conventional Permian Assets in Texas & New Mexico 2020 SEC Proved Reserves 76.5 MMBoe /PV10 $638MM 87% Oil October 2021 Net Sales 2 Over 9,000 Boe /d 87% oil Gross / Net Acres 104,455 / 76,745 Ring Energy – Independent Oil & Gas Company Deliver competitive and sustainable returns by developing, acquiring, exploring for, and commercializing oil and natural gas resources VITAL TO THE WORLD’S HEALTH AND WELFARE 1. Avg daily volume over past 90 days as of November 9, 2021 2. Oct. 2021 net sales based on field production estimate 3 Market Cap $399 million (as of November 9, 2021) Consistently Generating Positive Cash Flow NWS CBP DB NEW MEXICO “NWS” North West Shelf “CBP” Central Basin Platform “DB” Delaware Basin Core Areas Non - Core Area Enterprise Value $694 million (as of November 9, 2021) REI Closing Price $4.02 52 - week range $0.50 - $4.16 (as of November 9, 2021) REI Avg. Daily Share Volume ~2.4 million 1

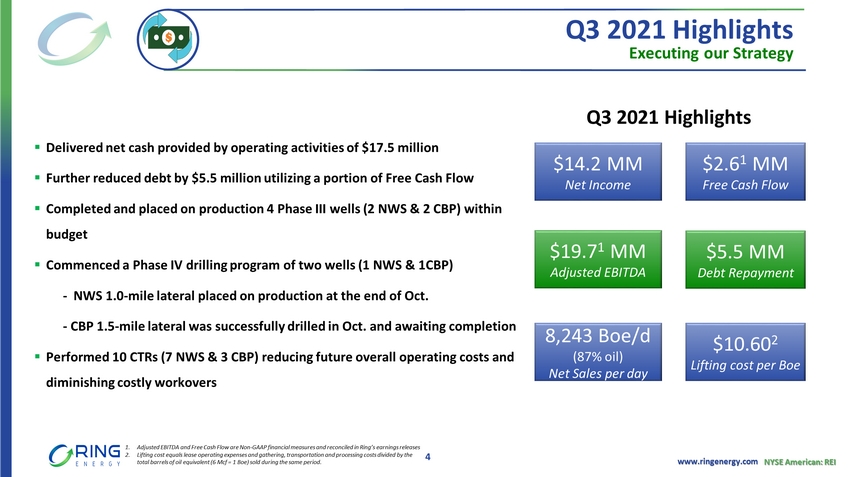

www.ringenergy.com NYSE American: REI Q3 2021 Highlights Executing our Strategy 4 ▪ Delivered net cash provided by operating activities of $17.5 million ▪ Further reduced debt by $5.5 million utilizing a portion of Free Cash Flow ▪ Completed and placed on production 4 Phase III wells (2 NWS & 2 CBP) within budget ▪ Commenced a Phase IV drilling program of two wells (1 NWS & 1CBP) - NWS 1.0 - mile lateral placed on production at the end of Oct. - CBP 1.5 - mile lateral was successfully drilled in Oct. and awaiting completion ▪ Performed 10 CTRs (7 NWS & 3 CBP) reducing future overall operating costs and diminishing costly workovers $2.6 1 MM Free Cash Flow $19.7 1 MM Adjusted EBITDA $14.2 MM Net Income $5.5 MM Debt Repayment 8,243 Boe /d (87% oil) Net Sales per day $10.60 2 Lifting cost per Boe 1. Adjusted EBITDA and Free Cash Flow are Non - GAAP financial measures and reconciled in Ring’s earnings releases 2. Lifting cost equals lease operating expenses and gathering, transportation and processing costs divided by the total barrels of oil equivalent (6 Mcf = 1 Boe ) sold during the same period. Q3 2021 Highlights

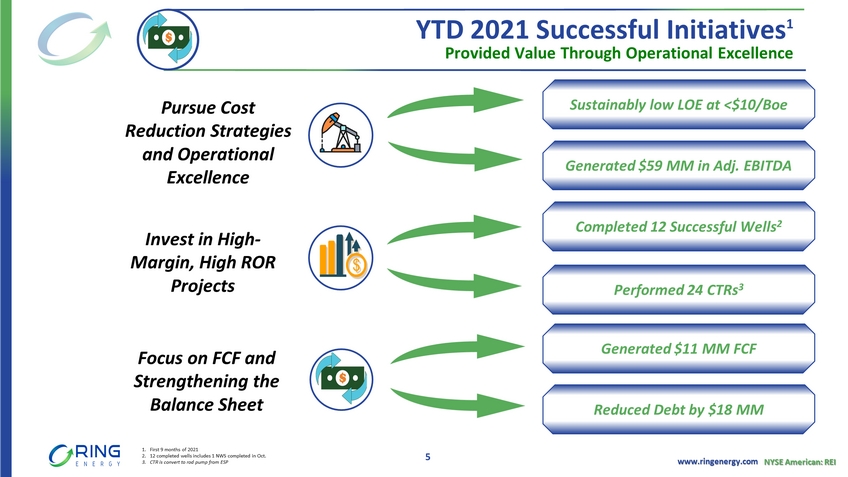

www.ringenergy.com NYSE American: REI Focus on FCF and Strengthening the Balance Sheet Invest in High - Margin, High ROR Projects Completed 12 Successful Wells 2 Generated $59 MM in Adj. EBITDA Sustainably low LOE at <$10/ Boe Generated $11 MM FCF Reduced Debt by $18 MM 5 Performed 24 CTRs 3 Provided Value Through Operational Excellence YTD 2021 Successful Initiatives 1 1. First 9 months of 2021 2. 12 completed wells includes 1 NWS completed in Oct. 3. CTR is convert to rod pump from ESP Pursue Cost Reduction Strategies and Operational Excellence

Asset Areas

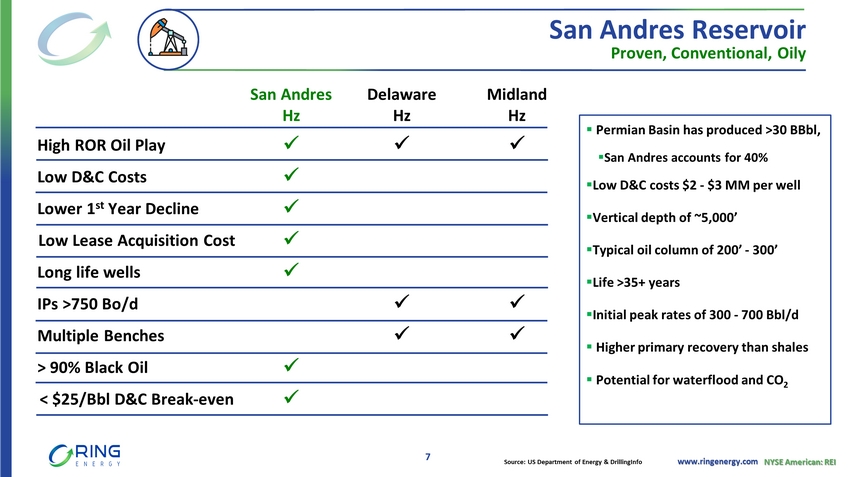

www.ringenergy.com NYSE American: REI Proven, Conventional, Oily San Andres Hz Delaware Hz Midland Hz High ROR Oil Play x x x Low D&C Costs x Lower 1 st Year Decline x Low Lease Acquisition Cost x Long life wells x IPs >750 Bo/d x x Multiple Benches x x > 90% Black Oil x < $25/ Bbl D&C Break - even x ▪ Permian Basin has produced >30 BBbl , ▪ San Andres accounts for 40% ▪ Low D&C costs $2 - $3 MM per well ▪ Vertical depth of ~5,000’ ▪ Typical oil column of 200’ - 300’ ▪ Life >35+ years ▪ Initial peak rates of 300 - 700 Bbl/d ▪ Higher primary recovery than shales ▪ Potential for waterflood and CO 2 Source: US Department of Energy & DrillingInfo 7 San Andres Reservoir

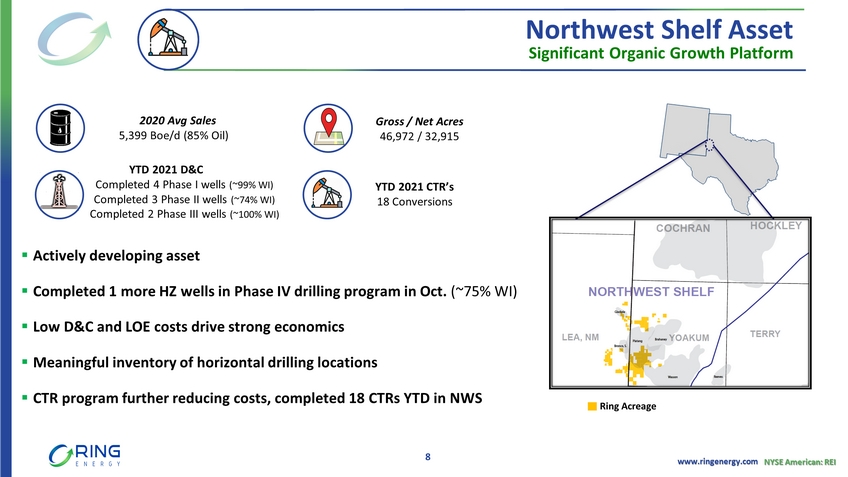

www.ringenergy.com NYSE American: REI Significant Organic Growth Platform 2020 Avg Sales 5,399 Boe /d (85% Oil) YTD 2021 D&C Completed 4 Phase I wells (~99% WI) Completed 3 Phase II wells (~74% WI) Completed 2 Phase III wells (~100% WI) Gross / Net Acres 46,972 / 32,915 ▪ Actively developing asset ▪ Completed 1 more HZ wells in Phase IV drilling program in Oct. (~75% WI) ▪ Low D&C and LOE costs drive strong economics ▪ Meaningful inventory of horizontal drilling locations ▪ CTR program further reducing costs, completed 18 CTRs YTD in NWS Northwest Shelf Asset 8 YTD 2021 CTR’s 18 Conversions Ring Acreage

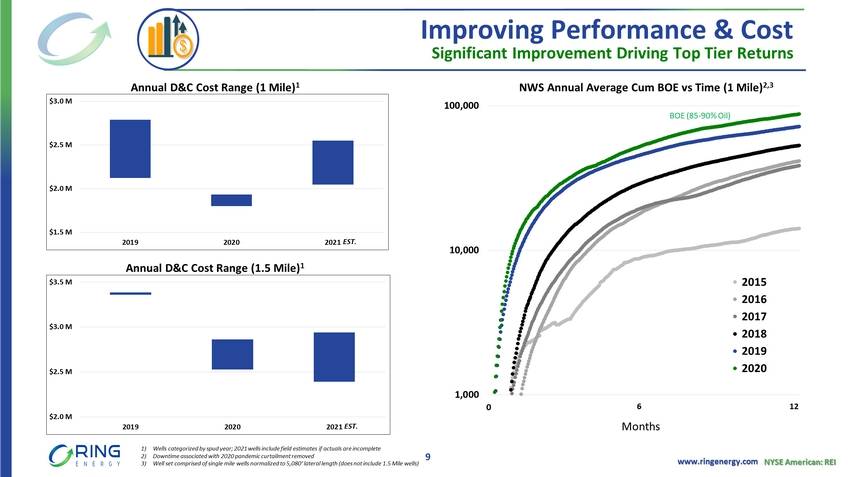

www.ringenergy.com NYSE American: REI $2.0 M $2.5 M $3.0 M $3.5 M 2019 2020 2021 1,000 10,000 100,000 0 365 2015 2016 2017 2018 2019 2020 Improving Performance & Cost Significant Improvement Driving Top Tier Returns 9 Annual D&C Cost Range (1 Mile) 1 NWS Annual Average Cum BOE vs Time (1 Mile) 2,3 1) Wells categorized by spud year; 2021 wells include field estimates if actuals are incomplete 2) Downtime associated with 2020 pandemic curtailment removed 3) Well set comprised of single mile wells normalized to 5,080’ lateral length (does not include 1.5 Mile wells) Months 12 6 ~530 Avg ~410 Avg ~420 Avg BOE (85 - 90% Oil) $1.5 M $2.0 M $2.5 M $3.0 M 2019 2020 2021 Annual D&C Cost Range (1.5 Mile) 1 EST. EST.

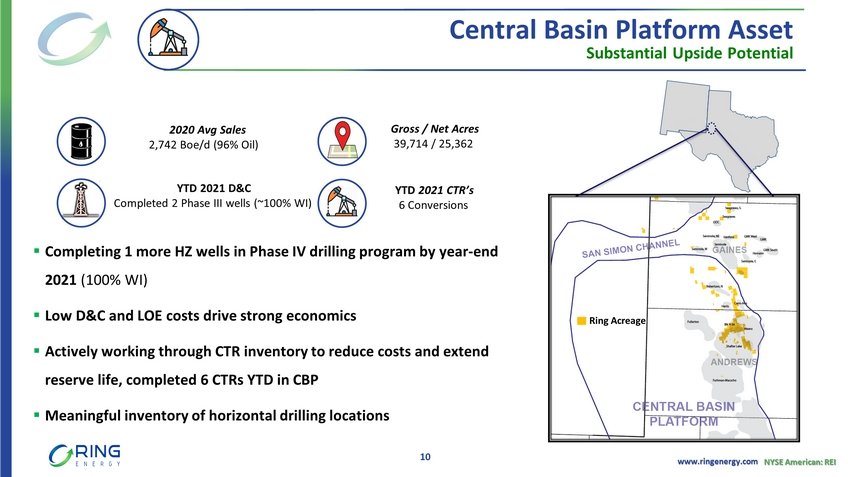

www.ringenergy.com NYSE American: REI ▪ Completing 1 more HZ wells in Phase IV drilling program by year - end 2021 (100% WI) ▪ Low D&C and LOE costs drive strong economics ▪ Actively working through CTR inventory to reduce costs and extend reserve life, completed 6 CTRs YTD in CBP ▪ Meaningful inventory of horizontal drilling locations 2020 Avg Sales 2,742 Boe /d (96% Oil) YTD 2021 CTR’s 6 Conversions YTD 2021 D&C Completed 2 Phase III wells (~100% WI) Gross / Net Acres 39,714 / 25,362 Substantial Upside Potential Central Basin Platform Asset 10 Ring Acreage

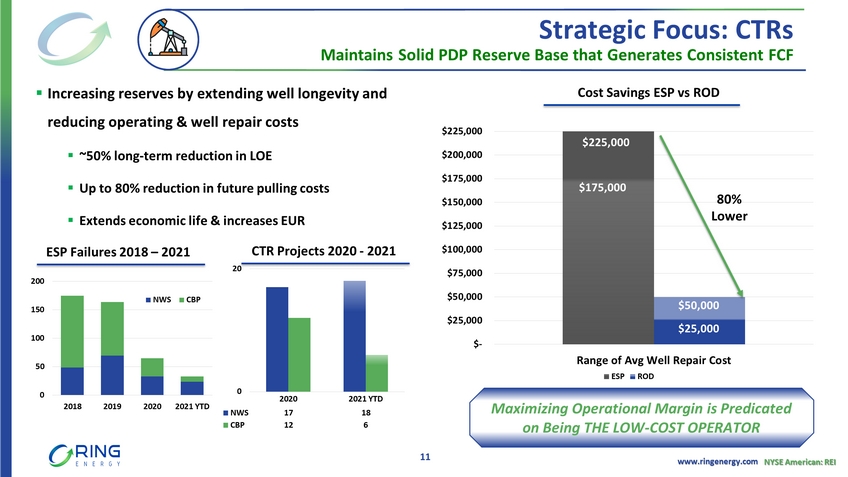

www.ringenergy.com NYSE American: REI 0 50 100 150 200 2018 2019 2020 2021 YTD NWS CBP Maintains Solid PDP Reserve Base that Generates Consistent FCF ▪ Increasing reserves by extending well longevity and reducing operating & well repair costs ▪ ~50% long - term reduction in LOE ▪ Up to 80% reduction in future pulling costs ▪ Extends economic life & increases EUR Strategic Focus: CTRs 2020 2021 YTD NWS 17 18 CBP 12 6 0 20 11 $- $25,000 $50,000 $75,000 $100,000 $125,000 $150,000 $175,000 $200,000 $225,000 Range of Avg Well Repair Cost ESP ROD $175,000 $50,000 $25,000 Cost Savings ESP vs ROD Maximizing Operational Margin is Predicated on Being THE LOW - COST OPERATOR 80% Lower $225,000 CTR Projects 2020 - 2021 ESP Failures 2018 – 2021

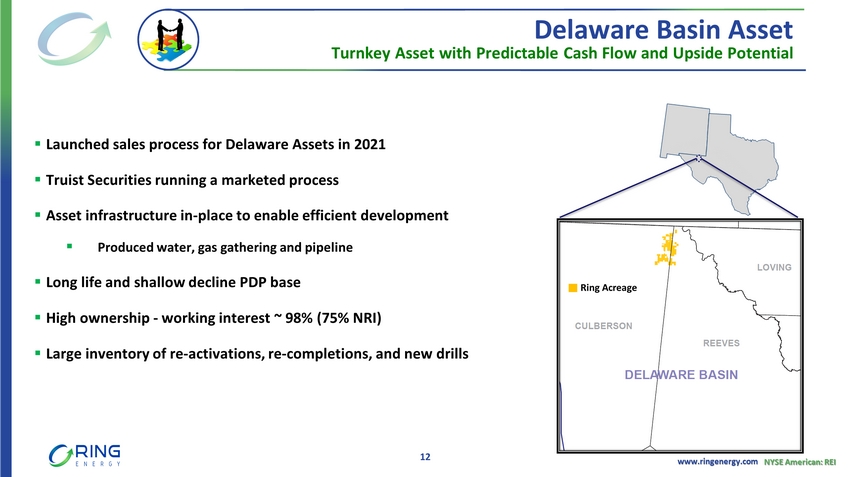

www.ringenergy.com NYSE American: REI Turnkey Asset with Predictable Cash Flow and Upside Potential Delaware Basin Asset 12 ▪ Launched sales process for Delaware Assets in 2021 ▪ Truist Securities running a marketed process ▪ Asset infrastructure in - place to enable efficient development ▪ Produced water, gas gathering and pipeline ▪ Long life and shallow decline PDP base ▪ High ownership - working interest ~ 98% (75% NRI) ▪ Large inventory of re - activations, re - completions, and new drills Ring Acreage

Financials

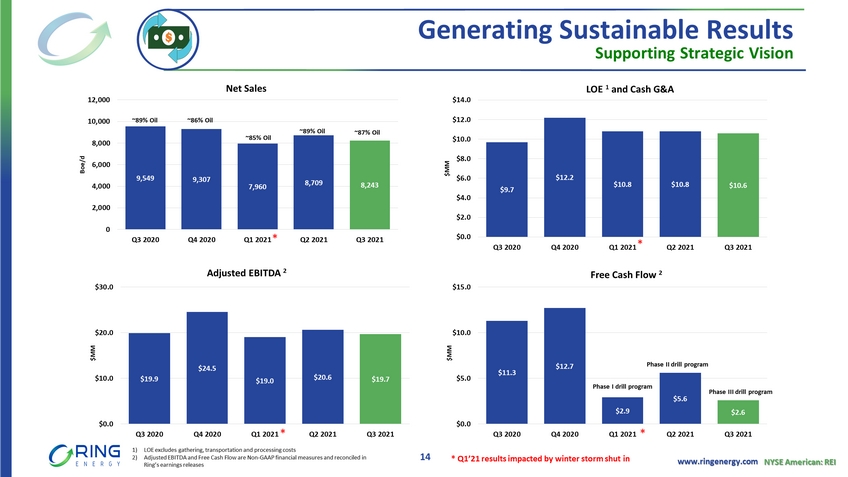

www.ringenergy.com NYSE American: REI Generating Sustainable Results 9,549 9,307 7,960 8,709 8,243 0 2,000 4,000 6,000 8,000 10,000 12,000 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Boe /d Net Sales $9.7 $12.2 $10.8 $10.8 $10.6 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 $MM LOE 1 and Cash G&A $19.9 $24.5 $19.0 $20.6 $19.7 $0.0 $10.0 $20.0 $30.0 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 $MM Adjusted EBITDA 2 $11.3 $12.7 $2.9 $5.6 $2.6 $0.0 $5.0 $10.0 $15.0 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 $MM Free Cash Flow 2 Supporting Strategic Vision 14 1) LOE excludes gathering, transportation and processing costs 2) Adjusted EBITDA and Free Cash Flow are Non - GAAP financial measures and reconciled in Ring’s earnings releases * Q1’21 results impacted by winter storm shut in Phase I drill program * * * * Phase II drill program ~87% Oil ~89% Oil ~85% Oil ~86% Oil ~89% Oil Phase III drill program

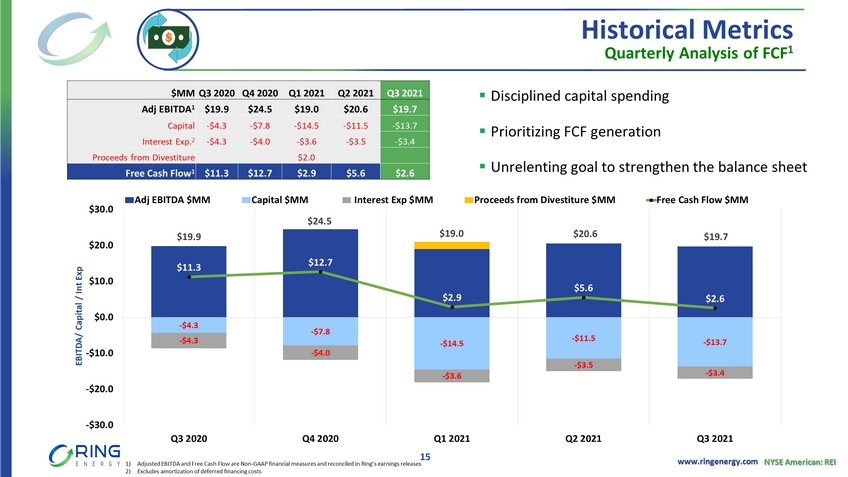

www.ringenergy.com NYSE American: REI Historical Metrics Quarterly Analysis of FCF 1 $MM Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Adj EBITDA 1 $19.9 $24.5 $19.0 $20.6 $19.7 Capital - $4.3 - $7.8 - $14.5 - $11.5 - $13.7 Interest Exp. 2 - $4.3 - $4.0 - $3.6 - $3.5 - $3.4 Proceeds from Divestiture $2.0 Free Cash Flow 1 $11.3 $12.7 $2.9 $5.6 $2.6 15 $19.9 $24.5 $19.0 $20.6 $19.7 - $4.3 - $7.8 - $14.5 - $11.5 - $13.7 - $4.3 - $4.0 - $3.6 - $3.5 - $3.4 $11.3 $12.7 $2.9 $5.6 $2.6 -$30.0 -$20.0 -$10.0 $0.0 $10.0 $20.0 $30.0 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 EBITDA/ Capital / Int Exp Adj EBITDA $MM Capital $MM Interest Exp $MM Proceeds from Divestiture $MM Free Cash Flow $MM ▪ Disciplined capital spending ▪ Prioritizing FCF generation ▪ Unrelenting goal to strengthen the balance sheet 1) Adjusted EBITDA and Free Cash Flow are Non - GAAP financial measures and reconciled in Ring’s earnings releases 2) Excludes amortization of deferred financing costs

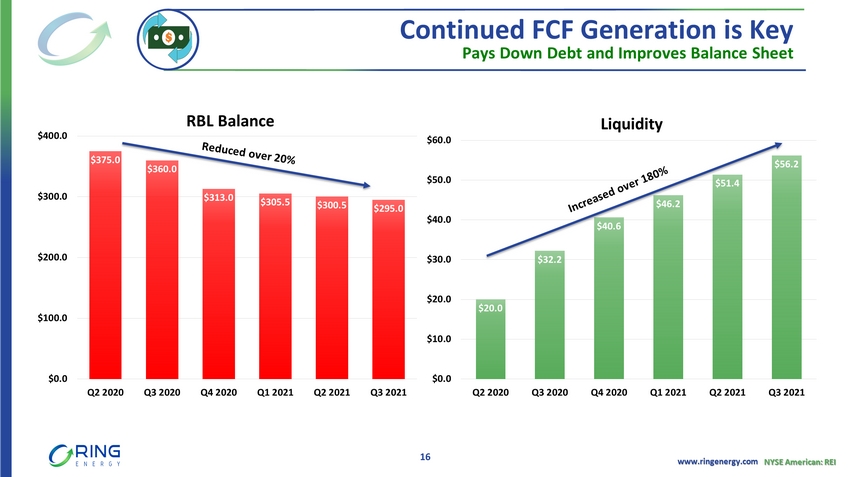

www.ringenergy.com NYSE American: REI $375.0 $360.0 $313.0 $305.5 $300.5 $295.0 $0.0 $100.0 $200.0 $300.0 $400.0 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 RBL Balance $313 MM outstanding debt with $36 MM in Surplus Cash Continued FCF Generation is Key Pays Down Debt and Improves Balance Sheet 16 $20.0 $32.2 $40.6 $46.2 $51.4 $56.2 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Liquidity

www.ringenergy.com NYSE American: REI Committed to ESG Foundational Cornerstone of Our Culture 17 Providing a safe work environment and corporate culture that promotes the health and well - being of all employees Investing in our workforce, the communities in which we operate, and future generations through social responsibility Committed to practicing sound corporate governance We recognize the importance of providing transparency on ESG - related matters Significantly improved ISS governance rating in 2021 Reducing our environmental impact, including GHG emissions, flaring and water management Sustainably extracting value by evaluating the economic and environmental aspects of each development opportunity Conducting a Robust Review Process to Deliver Ring’s 1 st ESG Report in 2021

www.ringenergy.com NYSE American: REI Building a Sustainable Corporate Culture Operate Efficiently and Effectively Highly Profitable Development Drilling Generate FCF and Strengthen Balance Sheet Evaluate Accretive Acquisition Opportunities Fresh Prospective Proven Strategy 18

Appendix

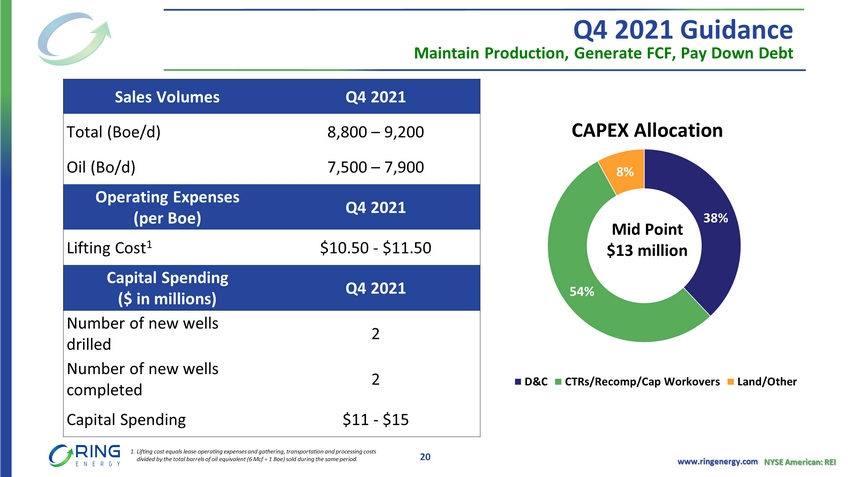

www.ringenergy.com NYSE American: REI 38% 54% 8% D&C CTRs/Recomp/Cap Workovers Land/Other CAPEX Allocation Mid Point $13 million Q4 2021 Guidance Maintain Production, Generate FCF, Pay Down Debt 20 Sales Volumes Q4 2021 Total ( Boe /d) 8,800 – 9,200 Oil (Bo/d) 7,500 – 7,900 Operating Expenses (per Boe ) Q4 2021 Lifting Cost 1 $10.50 - $11.50 Capital Spending ($ in millions) Q4 2021 Number of new wells drilled 2 Number of new wells completed 2 Capital Spending $11 - $15 1. Lifting cost equals lease operating expenses and gathering, transportation and processing costs divided by the total barrels of oil equivalent (6 Mcf = 1 Boe ) sold during the same period.

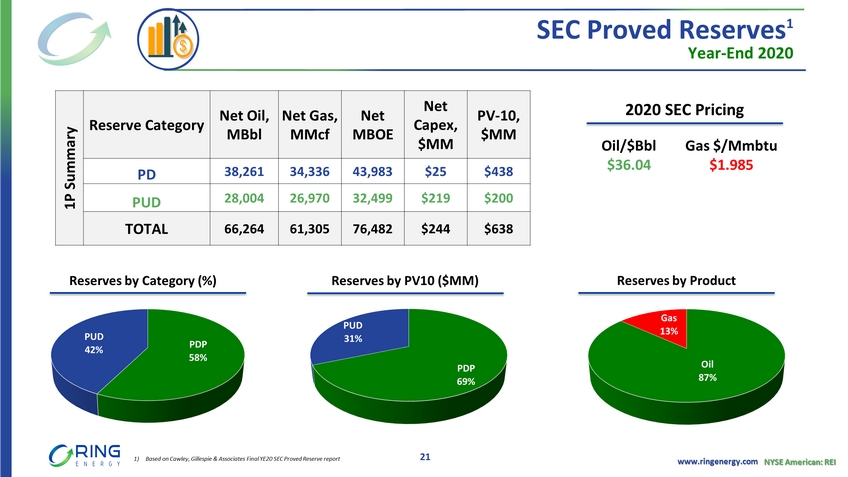

www.ringenergy.com NYSE American: REI PDP 69% PUD 31% PDP 58% PUD 42% 1P Summary Reserve Category Net Oil, MBbl Net Gas, MMcf Net MBOE Net Capex, $MM PV - 10, $MM PD 38,261 34,336 43,983 $25 $438 PUD 28,004 26,970 32,499 $219 $200 TOTAL 66,264 61,305 76,482 $244 $638 SEC Proved Reserves 1 Year - End 2020 21 2020 SEC Pricing Reserves by Category ( % ) Reserves by PV 10 ( $ MM) Reserves by Product Oil/$ Bbl $36.04 Gas $/ Mmbtu $1.985 Oil 87% Gas 13% 1) Based on Cawley, Gillespie & Associates Final YE20 SEC Proved Reserve report

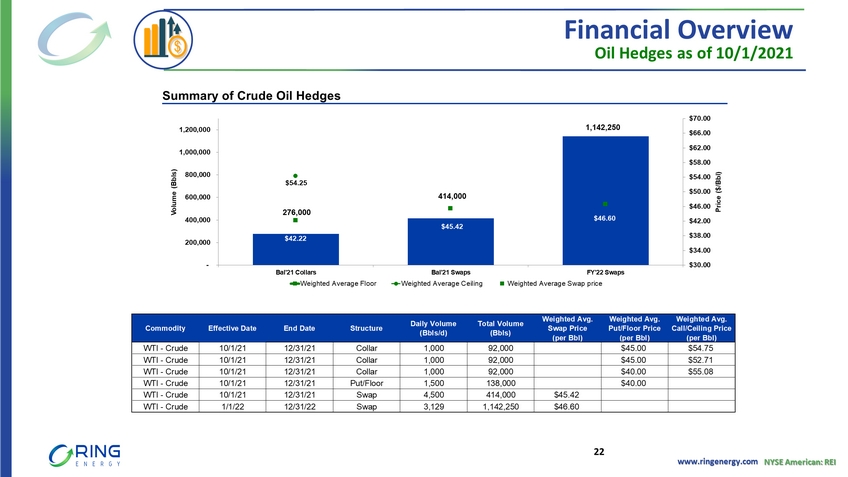

www.ringenergy.com NYSE American: REI Commodity Effective Date End Date Structure Daily Volume (Bbls/d) Total Volume (Bbls) Weighted Avg. Swap Price (per Bbl) Weighted Avg. Put/Floor Price (per Bbl) Weighted Avg. Call/Ceiling Price (per Bbl) WTI - Crude 10/1/21 12/31/21 Collar 1,000 92,000 $45.00 $54.75 WTI - Crude 10/1/21 12/31/21 Collar 1,000 92,000 $45.00 $52.71 WTI - Crude 10/1/21 12/31/21 Collar 1,000 92,000 $40.00 $55.08 WTI - Crude 10/1/21 12/31/21 Put/Floor 1,500 138,000 $40.00 WTI - Crude 10/1/21 12/31/21 Swap 4,500 414,000 $45.42 WTI - Crude 1/1/22 12/31/22 Swap 3,129 1,142,250 $46.60 Financial Overview Oil Hedges as of 10/1/2021 Summary of Crude Oil Hedges 276,000 414,000 1,142,250 $42.22 $54.25 $45.42 $46.60 $30.00 $34.00 $38.00 $42.00 $46.00 $50.00 $54.00 $58.00 $62.00 $66.00 $70.00 - 200,000 400,000 600,000 800,000 1,000,000 1,200,000 Bal'21 Collars Bal'21 Swaps FY'22 Swaps Price ($/Bbl) Volume (Bbls) Weighted Average Floor Weighted Average Ceiling Weighted Average Swap price 22

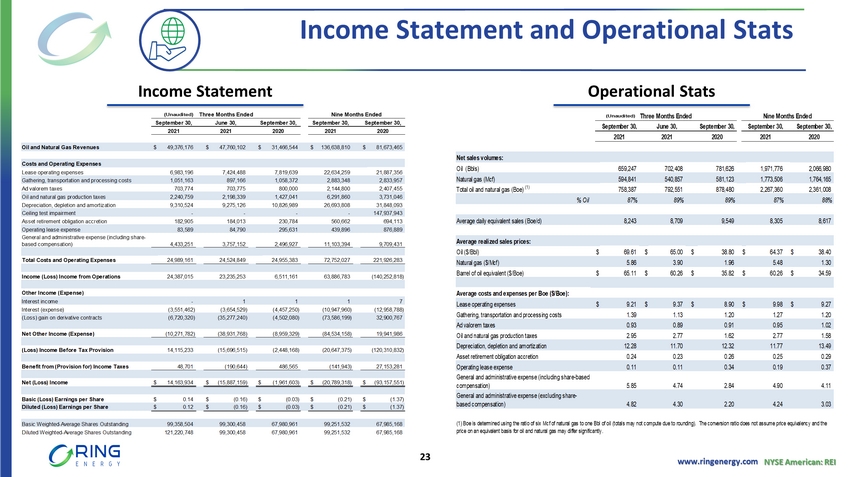

www.ringenergy.com NYSE American: REI Income Statement and Operational Stats 23 Income Statement Operational Stats Oil and Natural Gas Revenues $ 49,376,176 $ 47,760,102 $ 31,466,544 $ 136,638,810 $ 81,673,465 Costs and Operating Expenses Lease operating expenses 6,983,196 7,424,488 7,819,639 22,634,259 21,887,356 Gathering, transportation and processing costs 1,051,163 897,166 1,058,372 2,883,348 2,833,957 Ad valorem taxes 703,774 703,775 800,000 2,144,800 2,407,455 Oil and natural gas production taxes 2,240,759 2,198,339 1,427,041 6,291,860 3,731,046 Depreciation, depletion and amortization 9,310,524 9,275,126 10,826,989 26,693,808 31,848,093 Ceiling test impairment - - - - 147,937,943 Asset retirement obligation accretion 182,905 184,013 230,784 560,662 694,113 Operating lease expense 83,589 84,790 295,631 439,896 876,889 General and administrative expense (including share- based compensation) 4,433,251 3,757,152 2,496,927 11,103,394 9,709,431 Total Costs and Operating Expenses 24,989,161 24,524,849 24,955,383 72,752,027 221,926,283 Income (Loss) Income from Operations 24,387,015 23,235,253 6,511,161 63,886,783 (140,252,818) Other Income (Expense) Interest income - 1 1 1 7 Interest (expense) (3,551,462) (3,654,529) (4,457,250) (10,947,960) (12,958,788) (Loss) gain on derivative contracts (6,720,320) (35,277,240) (4,502,080) (73,586,199) 32,900,767 Net Other Income (Expense) (10,271,782) (38,931,768) (8,959,329) (84,534,158) 19,941,986 (Loss) Income Before Tax Provision 14,115,233 (15,696,515) (2,448,168) (20,647,375) (120,310,832) Benefit from (Provision for) Income Taxes 48,701 (190,644) 486,565 (141,943) 27,153,281 Net (Loss) Income $ 14,163,934 $ (15,887,159) $ (1,961,603) $ (20,789,318) $ (93,157,551) Basic (Loss) Earnings per Share $ 0.14 $ (0.16) $ (0.03) $ (0.21) $ (1.37) Diluted (Loss) Earnings per Share $ 0.12 $ (0.16) $ (0.03) $ (0.21) $ (1.37) Basic Weighted-Average Shares Outstanding 99,358,504 99,300,458 67,980,961 99,251,532 67,985,168 Diluted Weighted-Average Shares Outstanding 121,220,748 99,300,458 67,980,961 99,251,532 67,985,168 2021 2021 2020 2021 2020 Three Months Ended Nine Months Ended September 30, September 30,September 30, June 30, September 30, ASSETS Current Assets Cash and cash equivalents $ 2,046,946 $ 3,578,634 Accounts receivable 20,306,264 14,997,979 Joint interest billing receivable 1,672,334 1,327,262 Derivative receivable - 499,906 Prepaid expenses and retainers 1,298,801 396,109 Total Current Assets 25,324,345 20,799,890 Properties and Equipment Oil and natural gas properties, full cost method 872,258,987 836,514,815 Financing lease asset subject to depreciation 1,422,487 858,513 Fixed assets subject to depreciation 2,130,523 1,520,890 Total Properties and Equipment 875,811,997 838,894,218 Accumulated depreciation, depletion and amortization (225,744,692) (200,111,658) Net Properties and Equipment 650,067,305 638,782,560 Operating lease asset 1,344,378 1,494,399 Deferred financing costs 1,882,815 2,379,348 TOTAL ASSETS $ 678,618,843 $ 663,456,197 LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities Accounts payable $ 45,259,500 $ 32,500,081 Financing lease liability 385,866 295,311 Operating lease liability 268,512 859,017 Derivative liabilities 38,402,944 3,287,328 Notes payable 857,151 - Total Current Liabilities 85,173,973 36,941,737 Deferred income taxes 141,943 - Revolving line of credit 295,000,000 313,000,000 Financing lease liability, less current portion 393,340 126,857 Operating lease liability, less current portion 1,212,239 635,382 Derivative liabilities 6,061,724 869,273 Asset retirement obligations 14,998,130 17,117,135 Total Liabilities 402,981,349 368,690,384 Stockholders' Equity Preferred stock - $0.001 par value; 50,000,000 shares authorized; no shares issued or outstanding - - Common stock - $0.001 par value; 150,000,000 shares authorized; 99,359,938 shares and 85,568,287 shares issued and outstanding, respectively 99,360 85,568 Additional paid-in capital 552,598,622 550,951,415 Accumulated deficit (277,060,488) (256,271,170) Total Stockholders' Equity 275,637,494 294,765,813 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $ 678,618,843 $ 663,456,197 September 30, December 31, (Unaudited) 2021 2020

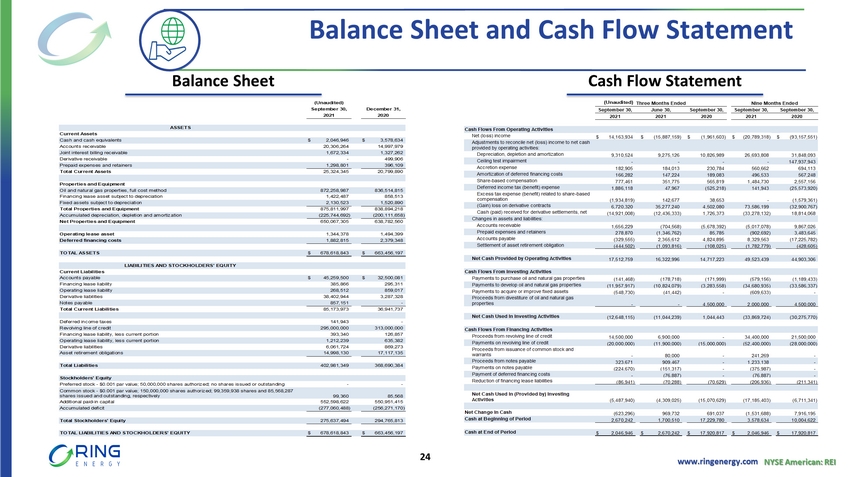

www.ringenergy.com NYSE American: REI Balance Sheet and Cash Flow Statement 24 Balance Sheet Cash Flow Statement ASSETS Current Assets Cash and cash equivalents $ 2,046,946 $ 3,578,634 Accounts receivable 20,306,264 14,997,979 Joint interest billing receivable 1,672,334 1,327,262 Derivative receivable - 499,906 Prepaid expenses and retainers 1,298,801 396,109 Total Current Assets 25,324,345 20,799,890 Properties and Equipment Oil and natural gas properties, full cost method 872,258,987 836,514,815 Financing lease asset subject to depreciation 1,422,487 858,513 Fixed assets subject to depreciation 2,130,523 1,520,890 Total Properties and Equipment 875,811,997 838,894,218 Accumulated depreciation, depletion and amortization (225,744,692) (200,111,658) Net Properties and Equipment 650,067,305 638,782,560 Operating lease asset 1,344,378 1,494,399 Deferred financing costs 1,882,815 2,379,348 TOTAL ASSETS $ 678,618,843 $ 663,456,197 LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities Accounts payable $ 45,259,500 $ 32,500,081 Financing lease liability 385,866 295,311 Operating lease liability 268,512 859,017 Derivative liabilities 38,402,944 3,287,328 Notes payable 857,151 - Total Current Liabilities 85,173,973 36,941,737 Deferred income taxes 141,943 - Revolving line of credit 295,000,000 313,000,000 Financing lease liability, less current portion 393,340 126,857 Operating lease liability, less current portion 1,212,239 635,382 Derivative liabilities 6,061,724 869,273 Asset retirement obligations 14,998,130 17,117,135 Total Liabilities 402,981,349 368,690,384 Stockholders' Equity Preferred stock - $0.001 par value; 50,000,000 shares authorized; no shares issued or outstanding - - Common stock - $0.001 par value; 150,000,000 shares authorized; 99,359,938 shares and 85,568,287 shares issued and outstanding, respectively 99,360 85,568 Additional paid-in capital 552,598,622 550,951,415 Accumulated deficit (277,060,488) (256,271,170) Total Stockholders' Equity 275,637,494 294,765,813 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $ 678,618,843 $ 663,456,197 September 30, December 31, (Unaudited) 2021 2020

www.ringenergy.com NYSE American: REI Non - GAAP Disclosure 25 Non - GAAP Information Certain financial information included in Ring’s financial results are not measures of financial performance recognized by ac cou nting principles generally accepted in the United States, or GAAP. These non - GAAP financial measures are “Adjusted Net Income”, “Adjusted EBITDA”, “Free Ca sh Flow” and “Cash Flow from Operations”. Management uses these non - GAAP financial measures in its analysis of performance. In addition, Adjusted EBITDA is a key metric used to determine the Company’s incentive compensation awards. These disclosures may not be viewed as a substitute for results determ ine d in accordance with GAAP and are not necessarily comparable to non - GAAP performance measures which may be reported by other companies. Adjusted Net Income does not include the estimated after - tax impact of share - based compensation, ceiling test impairment, and un realized loss (gain) on change in fair value of derivatives, as well an add back of the full valuation against the Company’s deferred tax assets duri ng the fourth quarter of 2020. Adjusted Net Income is presented because the timing and amount of these items cannot be reasonably estimated and affect the c omp arability of operating results from period to period, and current periods to prior periods. The Company also presents the non - GAAP financial measures Adjusted EBITDA and Free Cash Flow. The Company defines Adjusted EBITD A as net (loss) income plus net interest expense, unrealized loss on change in fair value of derivatives, ceiling test impairment, income tax (b enefit) expense, depreciation, depletion and amortization and accretion, asset retirement obligation accretion and share - based compensation. Company management believes this presentation is relevant and useful because it helps investors understand Ring’s operating performance and makes it easier to co mpare its results with those of other companies that have different financing, capital and tax structures. Adjusted EBITDA should not be considered in iso lat ion from or as a substitute for net income, as an indication of operating performance or cash flows from operating activities or as a measure of liquidity. A dju sted EBITDA, as Ring calculates it, may not be comparable to Adjusted EBITDA measures reported by other companies. In addition, Adjusted EBITDA does not repr ese nt funds available for discretionary use. The Company defines Free Cash Flow as Adjusted EBITDA (defined above) less net interest expense (excluding amortization of de fer red financing cost) and capital expenditures. For this purpose, the Company’s definition of capital expenditures includes costs incurred related to o il and natural gas properties (such as drilling and infrastructure costs and the lease maintenance costs) and equipment, furniture and fixtures, but excludes acq uis ition costs of oil and gas properties from third parties that are not included in the Company’s capital expenditures guidance provided to investors. Com pan y management believes that Free Cash Flow is an important financial performance measure for use in evaluating the performance and efficiency of its cu rrent operating activities after the impact of accrued capital expenditures and net interest expense and without being impacted by items such as changes as sociated with working capital, which can vary substantially from one period to another. There is no commonly accepted definition Free Cash Flow wit hin the industry. Accordingly, Free Cash Flow, as defined and calculated by the Company, may not be comparable to Free Cash Flow or other similarly named no n - G AAP measures reported by other companies. While the Company includes net interest expense in the calculation of Free Cash Flow, other mandatory deb t s ervice requirements of future payments of principal at maturity (if such debt is not refinanced) are excluded from the calculation of Free Cash Flow . T hese and other non - discretionary expenditures that are not deducted from Free Cash Flow would reduce cash available for other uses.

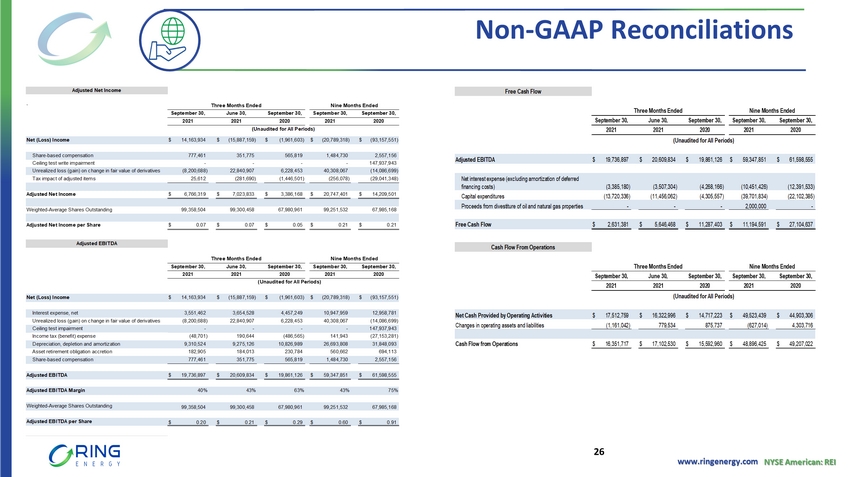

www.ringenergy.com NYSE American: REI Non - GAAP Reconciliations 26 ` Net (Loss) Income $ 14,163,934 $ (15,887,159) $ (1,961,603) $ (20,789,318) $ (93,157,551) Share-based compensation 777,461 351,775 565,819 1,484,730 2,557,156 Ceiling test write impairment - - - - 147,937,943 Unrealized loss (gain) on change in fair value of derivatives (8,200,688) 22,840,907 6,228,453 40,308,067 (14,086,699) Tax impact of adjusted items 25,612 (281,690) (1,446,501) (256,078) (29,041,348) Adjusted Net Income $ 6,766,319 $ 7,023,833 $ 3,386,168 $ 20,747,401 $ 14,209,501 Weighted-Average Shares Outstanding 99,358,504 99,300,458 67,980,961 99,251,532 67,985,168 Adjusted Net Income per Share $ 0.07 $ 0.07 $ 0.05 $ 0.21 $ 0.21 Net (Loss) Income $ 14,163,934 $ (15,887,159) $ (1,961,603) $ (20,789,318) $ (93,157,551) Interest expense, net 3,551,462 3,654,528 4,457,249 10,947,959 12,958,781 Unrealized loss (gain) on change in fair value of derivatives (8,200,688) 22,840,907 6,228,453 40,308,067 (14,086,699) Ceiling test impairment - - - - 147,937,943 Income tax (benefit) expense (48,701) 190,644 (486,565) 141,943 (27,153,281) Depreciation, depletion and amortization 9,310,524 9,275,126 10,826,989 26,693,808 31,848,093 Asset retirement obligation accretion 182,905 184,013 230,784 560,662 694,113 Share-based compensation 777,461 351,775 565,819 1,484,730 2,557,156 Adjusted EBITDA $ 19,736,897 $ 20,609,834 $ 19,861,126 $ 59,347,851 $ 61,598,555 Adjusted EBITDA Margin 40% 43% 63% 43% 75% Weighted-Average Shares Outstanding 99,358,504 99,300,458 67,980,961 99,251,532 67,985,168 Adjusted EBITDA per Share $ 0.20 $ 0.21 $ 0.29 $ 0.60 $ 0.91 (Unaudited for All Periods) (Unaudited for All Periods) 2020 Three Months Ended September 30, 20202021 2021 2020 June 30, Three Months Ended June 30, September 30,September 30, 2021 Adjusted Net Income Adjusted EBITDA 2021 September 30, September 30, September 30, 2021 2020 Nine Months Ended September 30, September 30, 2021 Nine Months Ended

www.ringenergy.com NYSE American: REI Add Photo Add Photo Add Photo Add Photo Add Photo Paul D. McKinney Chairman & Chief Executive Officer 35+ years of domestic & international oil & gas industry experience Executive & board roles include CEO, President, COO, Region VP and public & private board directorships Travis Thomas EVP & Chief Financial Officer 16+ years of oil & gas industry experience & accounting experience High level financial experience including CAO, VP Finance, Controller, Treasurer Alexander Dyes EVP of Engineering & Corporate Strategy 14+ years of oil & gas industry experience Multi - disciplined experience including VP A&D, VP Engineering, Director Strategy, multiple engineering & operational roles Marinos Baghdati EVP of Operations 18+ years of oil & gas industry experience Operational experience in drilling, completions and production including VP Operations, Operations manager, multiple engineering roles Stephen D. Brooks EVP of Land, Legal, HR & Marketing 40+ years of oil & gas industry experience Extensive career as landman including VP Land & Legal, VP HR VP Land and Land Manager Hollie Lamb VP of Compliance & GM of Midland Office 20+ years of oil & gas industry experience Previously Partner of HeLMS Oil & Gas, VP Engineering, Reservoir & Geologic Engineer Experienced Management Team Shared Vision with a Track Record of Success 27

www.ringenergy.com NYSE American: REI 28 Add Photo Paul D. McKinney Chairman & Chief Executive Officer 35+ years of domestic & international oil & gas industry experience Executive & board roles include CEO, President, COO, Region VP and public & private board directorships Anthony D. Petrelli Lead Independent Director 43+ years of banking, capital markets, governance & financial experience Executive and Board positions include CEO, President, multiple board chairs & directorships John A. Crum Independent Director 45+ years of domestic & international oil & gas industry experience Extensive executive roles including CEO, President & COO, and multiple public & private board chairs & directorships Richard E. Harris Independent Director 40+ years of experience across multiple industries Executive positions in oil & gas, industrial equipment, and technology including CIO, Treasurer, Finance and Business Development Thomas L. Mitchell Independent Director 35+ years of domestic & international oil & gas industry experience Executive & board roles include CFO, VP Accounting, Controller and public & private board directorships Regina Roesener Independent Director 35+ years of banking, capital markets, governance & financial experience Executive and Board positions including COO, director and Board Director positions Refreshed Board of Directors Accomplished and Diversified Experience Clayton E. Woodrum Independent Director 50+ years of accounting, tax & finance experience Wide range of financial acumen including positions as CFO, Partner in Charge and Board Director positions

ANALYST COVERAGE Alliance Global Partners (A.G.P.) Jeff Campbell (203) 577 - 5427 jcampbell@allianceg.com Tuohy Brothers Investment Noel Parks (215) 913 - 7320 nparks@tuohybrothers.com ROTH Capital Partners John M. White (949) 720 - 7115 jwhite@roth.com Truist Financial Neal Dingmann (713) 247 - 9000 neal.dingmann@truist.com COMPANY CONTACT Al Petrie (281) 975 - 2146 apetrie@ringenergy.com Chris Delange (281) 975 - 2146 cdelange @ringenergy.com