| {JK01385352.10 } Proxy Statement |

| {JK01385352.10 } Ring Energy, Inc. (NYSE American: REI) is a growth oriented independent oil and natural gas company headquartered in The Woodlands, Texas. It is focused on the acquisition, exploration and development of high-quality, oil and liquids rich assets in the Permian Basin of Texas and New Mexico which is recognized as the top producing oil basin in North America. Formed in 2012, Ring Energy has aggressively sought to acquire select low decline, long-life hydrocarbon producing properties with highly economic drilling opportunities that can be developed in future years. With over 100 years of combined industry experience in most of the oil and gas producing basins in the United States, coupled with the careful application of new and emerging geoscience, engineering, drilling and completion technologies, and long-established industry relationships, REI is poised for profitability and success. |

| {JK01385352.10 } A Special Meeting of Stockholders (the “Special Meeting”) of Ring Energy, Inc., a Nevada corporation (“Ring” or the “Company”), will be held on Tuesday, November 16, 2021, at 10:00 a.m., Central Time, in Ring’s office building, located at 1725 Hughes Landing Blvd., The Woodlands, TX 77380. You will be asked to consider and to approve the following proposal: This proxy statement and accompanying proxy card are being mailed to our stockholders on or about October [__], 2021. Only stockholders of record at the close of business on the Record Date are entitled to notice of and to vote at the Special Meeting. A list of stockholders entitled to vote at the Special Meeting will be available for examination at our offices during normal business hours for a period of ten (10) calendar days prior to the Special Meeting and will also be available during the Special Meeting for inspection by our stockholders. EVEN IF YOU PLAN TO ATTEND THE SPECIAL MEETING, PLEASE COMPLETE, SIGN, AND MAIL THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE IN THE ACCOMPANYING ENVELOPE, OR VOTE YOUR SHARES USING THE TELEPHONE OR INTERNET VOTING INSTRUCTIONS PROVIDED. We thank you for your continued support and look forward to seeing you at the Special Meeting. The Woodlands, Texas [_•_], 2021 By Order of the Board of Directors, Travis T. Thomas Executive Vice President, Chief Financial Officer, Corporate Secretary & Treasurer IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON N OVE MB E R 16, 2021 The Notice of Special Meeting, Proxy Statement, and Annual Report to Stockholders for the year ended December 31, 2020, are available on Ring Energy, Inc.’s website at www.ringenergy.com. PRELIMINARY PROXY STATEMENT – SUBJECT TO COMPLETION, DATED SEPTEMBER [_], 2021 Tuesday, November 16, 2021 |

| {JK01385352.10 } TABLE OF CONTENTS OVERVIEW Joint Letter to Stockholders Questions And Answers About the Special Meeting And Voting PROPOSAL 1: AMENDMENT OF THE ARTICLES OF INCORPORATION Background Text of the Proposed Amendment Reasons for the Proposed Amendment Possible Effects of the Proposed Amendment Interests of Directors and Executive Officers Vote Required Recommendation of the Board STOCKHOLDER PROPOSALS AND DIRECTOR NOMINATIONS FOR THE 2022 ANNUAL MEETING AND OTHER ITEMS Summary of Procedures For Submitting a Proposal or Nominating a Director Other Business Annual Report |

| Proxy Statement 1 {JK01385352.10 } On behalf of the Board of Directors of Ring Energy, Inc., we are pleased to invite you to our Special Meeting of Stockholders, which will take place on Tuesday, November 16, 2021 at 10:00 AM Central Time in meeting rooms A and B on the ground floor of our office building located at 1725 Hughes Landing Blvd., The Woodlands, Texas 77380. Commencing at the start of 2021, our leadership team has made significant progress improving our operational efficiencies, reducing expenses, reducing debt, and executing targeted capital development programs designed to help offset production declines and deliver significant return on investment for our stockholders. While our efforts to further enhance the effectiveness and profitability of our current asset base will continue, we recognize the need to be able to efficiently take advantage of emerging market-place opportunities that can develop long- term value for our stockholders. As such, we are asking our stockholders to approve an increase in our total authorized shares of common stock from 150,000,000 shares to 225,000,000 shares. We have no present plans regarding the issuance of any of the additional shares proposed to be authorized at the special meeting. However, we believe the current environment may provide opportunities that could. Our acquisition strategy at this time is to seek acquisitions that are accretive to existing stockholders and improve our balance sheet. Thank you for your time and consideration of our request. On behalf of the Board of Directors and the entire management team, thank you for your continued support. Your vote is very important to us, and we encourage you to review the enclosed proxy statement and to promptly vote so your shares are represented at the Special Meeting. Best regards, Paul D. McKinney Chairman of the Board of Directors & Chief Executive Officer Anthony B. Petrelli Lead Independent Director Paul D. McKinney |

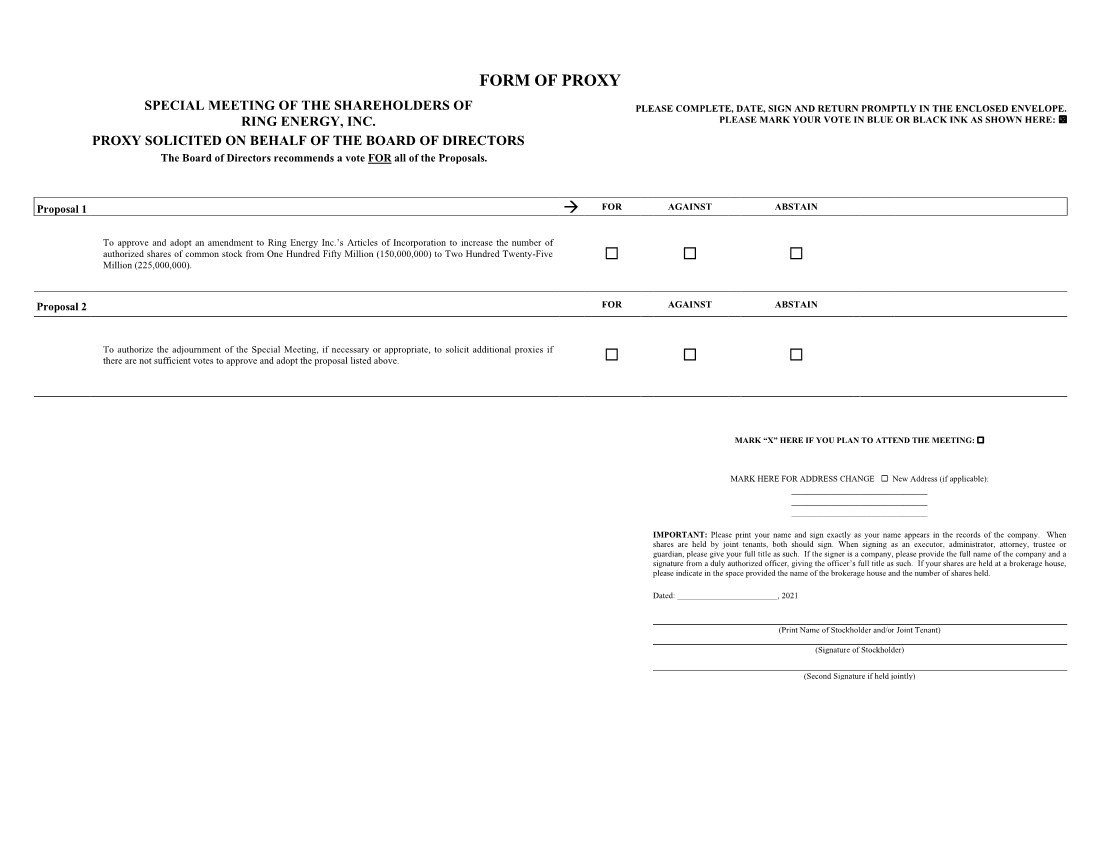

| 2 {JK01385352.10 } WHAT IS THE PURPOSE OF THE SPECIAL MEETING? At the Special Meeting, our stockholders will act upon the matters outlined in the Notice, including (1) an amendment (the “Articles Amendment”) to our Articles of Incorporation (as amended, the “Articles of Incorporation”) to increase the authorized shares of Common Stock from 150,000,000 to 225,000,000; and (2) the transaction of such other business as may arise that can properly be conducted at the Special Meeting or any adjournment or postponement thereof. WHY IS THE COMPANY REQUESTING THE INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK AT THIS TIME? Our Board of Directors considered it advisable and preferable to have a sufficient number of unissued and unreserved authorized shares of Common Stock to provide the Company with enhanced flexibility with respect to our authorized share capital as we consider strategic and financial alternatives that further promote the long-term sustainability of our business. This includes capital raising transactions and acquisitions of oil and gas assets, which may include public offerings for cash. WHAT IS A PROXY? A proxy is another person that you legally designate to vote your stock. If you designate a person or entity as your proxy in a written document, such document is also called a proxy or a proxy card. All duly executed proxies received prior to the Special Meeting will be voted in accordance with the choices specified thereon and, in connection with any other business that may properly come before the meeting, in the discretion of the persons named in the proxy. WHAT IS A PROXY STATEMENT? A proxy statement is a document that regulations of the United States Securities and Exchange Commission (the “SEC”) require that we make available to you when we ask you to sign a proxy card to vote your stock at the Special Meeting. This proxy statement describes matters on which we would like you, as a stockholder, to vote and provides you with information on such matters so that you can make an informed decision. WHAT IS “HOUSEHOLDING”? One copy of the Notice and this proxy statement (collectively, the “Proxy Materials”) will be sent to stockholders who share an address, unless they have notified us that they want to continue receiving multiple packages. This practice, known as “householding,” is designed to reduce duplicate mailings and save significant printing and postage costs. If you received a householded mailing this year and you would like to have additional copies of the Proxy Materials mailed to you or you would like to opt out of this practice for future mailings, we will promptly deliver such additional copies to you if you submit your request in writing to Ring Energy, Inc., Attention: Travis T. Thomas, Chief Financial Officer, 1725 Hughes Landing Blvd., Suite 900, The Woodlands, TX 77380, or by telephone by calling (281) 397-3699. You may also contact us in the same manner if you received multiple copies of the Proxy Materials and would prefer to receive a single copy in the future. The Proxy Materials are also available on our website: www.ringenergy.com. No other portion of the website is part of this proxy statement. |

| Proxy Statement 3 {JK01385352.10 } WHAT SHOULD I DO IF I RECEIVE MORE THAN ONE SET OF VOTING MATERIALS? Despite our efforts related to householding, you may receive more than one set of Proxy Materials, including multiple copies of the proxy statement and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. Similarly, if you are a stockholder of record and hold shares in a brokerage account, you will receive a proxy card and a voting instruction card. Please complete, sign, date, and return each proxy card and voting instruction card that you receive to ensure that all your shares are voted at the Special Meeting. You can also vote your shares over the phone or Internet. Please see “HOW DO I VOTE MY SHARES?” below for more information. WHO IS ENTITLED TO NOTICE OF THE SPECIAL MEETING? Governing laws as well as our governance documents require our Board to establish a record date in order to determine who is entitled to receive notice of, attend, and vote at the Special Meeting, and any continuations, adjournments, or postponements thereof. The record date for the determination of stockholders entitled to notice of and to vote at the Special Meeting is the close of business on September 27, 2021 (the “Record Date”). As of the Record Date, we had [•] shares of Common Stock outstanding. A list of all stockholders of record entitled to vote at our Special Meeting is on file at our principal office located at 1725 Hughes Landing Blvd, Suite 900, The Woodlands, TX 77380, and will be available for inspection at the Special Meeting. WHO IS ENTITLED TO VOTE AT THE SPECIAL MEETING? Subject to the limitations set forth below, stockholders at the close of business on the Record Date may vote at the Special Meeting. If you are a beneficial owner of shares of Common Stock, you must have a legal proxy from the stockholder of record to vote your shares at the Special Meeting. WHAT IS A QUORUM? A quorum is the presence at the Special Meeting, in person or by proxy, of the holders of at least one-third of the shares of our Common Stock outstanding and entitled to vote as of the Record Date. There must be a quorum for the Special Meeting to be held. If a quorum is not present, the Special Meeting may be adjourned until a quorum is reached. Proxies received but marked as abstentions or broker non-votes will be included in the calculation of votes considered to be present at the Special Meeting. WHAT ARE THE VOTING RIGHTS OF OUR STOCKHOLDERS? Each holder of Common Stock is entitled to one vote per share of Common Stock on all matters to be acted upon at the Special Meeting. WHAT IS THE DIFFERENCE BETWEEN A STOCKHOLDER OF RECORD AND A “STREET NAME” HOLDER? Most stockholders hold their shares through a broker, bank, or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned in street name. Stockholder of Record. If your shares are registered directly in your name with Standard Registrar and Transfer Company Inc., our transfer agent, you are considered the stockholder of record with respect to those shares. As the stockholder of record, you have the right to grant your voting proxy directly or to vote in person at the Special Meeting. Street Name Stockholder. If your shares are held in a stock brokerage account or by a bank, fiduciary, or other nominee, you are considered the beneficial owner of shares held in “street name.” In this case, such broker, fiduciary, or other nominee is considered the stockholder of record for purposes of voting at the Special Meeting. As the beneficial owner, you have the right to direct your broker, bank, or nominee how to vote and are also invited to attend the Special Meeting. If you hold your shares through a broker, bank, or other nominee, follow the voting directions provided by your broker, bank, or other nominee to vote your shares. Since you are not the stockholder of record, you may not vote these shares in person at the Special Meeting unless you obtain a signed proxy from the record holder giving you the right to vote the shares. HOW DO I VOTE MY SHARES? Stockholders of Record: Stockholders of record may vote their shares or submit a proxy to have their shares voted by one of the following methods: By Written Proxy. You may indicate your vote by completing, signing, and dating your proxy card and returning it in the enclosed reply envelope. In Person. You may vote in person at the Special Meeting by completing a ballot; however, attending the Special Meeting without completing a ballot will not count as a vote. |

| 4 {JK01385352.10 } By Phone. Use any touch-tone telephone to call 1-800-690-6903 to transmit your voting instructions up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you call and then follow the instructions. By Internet. Use the Internet to access www.proxyvote.com to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time the day before the meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. |

| Proxy Statement 5 {JK01385352.10 } Street Name Stockholders: Street name stockholders may generally vote their shares or submit a proxy to have their shares voted by one of the following methods: By Voting Instruction Card. If you hold your shares in street name, your broker, bank, or other nominee will explain how you can access a voting instruction card for you to use in directing the broker, bank, or other nominee how to vote your shares. In Person with a Proxy from the Record Holder. You may vote in person at the Special Meeting if you obtain a legal proxy from your broker, bank, or other nominee. Please consult the instruction card or other information sent to you by your broker, bank, or other nominee to determine how to obtain a legal proxy in order to vote in person at the Special Meeting. If you are a stockholder of record, your shares will be voted by the management proxy holder in accordance with the instructions on the proxy card you submit. For stockholders who have their shares voted by submitting a proxy, the management proxy holder will vote all shares represented by such valid proxies as our Board recommends, unless a stockholder appropriately specifies otherwise. CAN I REVOKE MY PROXY OR CHANGE MY VOTE? Yes. If you are a stockholder of record, you can revoke your proxy at any time before it is voted at the Special Meeting by doing one of the following: Submitting written notice of revocation stating that you would like to revoke your proxy to Ring Energy, Inc., Attention: Travis T. Thomas, Chief Financial Officer, 1725 Hughes Landing Blvd, Suite 900, The Woodlands, TX 77380, which must be received prior to the Special Meeting; Completing, signing, and dating another proxy card with new voting instructions and returning it by mail to Ring Energy, Inc., Attention: Travis T. Thomas, Chief Financial Officer, 1725 Hughes Landing Blvd, Suite 900, The Woodlands, TX 77380 in time to be received, in which case the later submitted proxy will be recorded and earlier proxy revoked; or Attending the Special Meeting, notifying the inspector of elections that you wish to revoke your proxy, and voting your shares in person at the Special Meeting. Attendance at the Special Meeting without submitting a ballot to vote your shares will not revoke or change your vote. If you are a beneficial or street name stockholder, you should follow the directions provided by your broker, bank, or other nominee to revoke your voting instructions or otherwise change your vote before the applicable deadline. You may also vote in person at the Special Meeting if you obtain a legal proxy from your broker, bank, or other nominee as described in “How do I vote my shares” above. WHAT ARE ABSTENTIONS AND BROKER NON-VOTES? An abstention occurs when the beneficial owner of shares, or a broker, bank, or other nominee holding shares for a beneficial owner, is present, in person or by proxy, and entitled to vote at the meeting, but fails to vote or voluntarily withholds its vote for any of the matters upon which the stockholders are voting. |

|